来源: Cointelegraph原文: 《{title}》

美国总统唐纳德·特朗普于4月2日推出了一系列关税,使市场陷入混乱,并使加密货币观察家对其可能的长期影响产生分歧。

在白宫的一次特别活动中,特朗普签署了一项行政命令,并声称拥有紧急权力,对所有对美国商品征收关税的国家征收互惠关税,最低税率为10%。

这一系列新税可能对全球市场产生的长期影响尚不清楚。特朗普政府在确定关税税率时使用的模糊方法加剧了这种不确定性。

一些人认为,随着投资者寻求传统投资的替代品,加密市场将迎来繁荣。其他人则指出,关税可能会对采矿设备产生影响,阻碍盈利能力。更多的人仍然担心关税的更广泛影响和可能的经济衰退。

特朗普的关税为市场“提供了确定性”

关税消息一出,金融市场立即崩盘,加密市场也不例外。

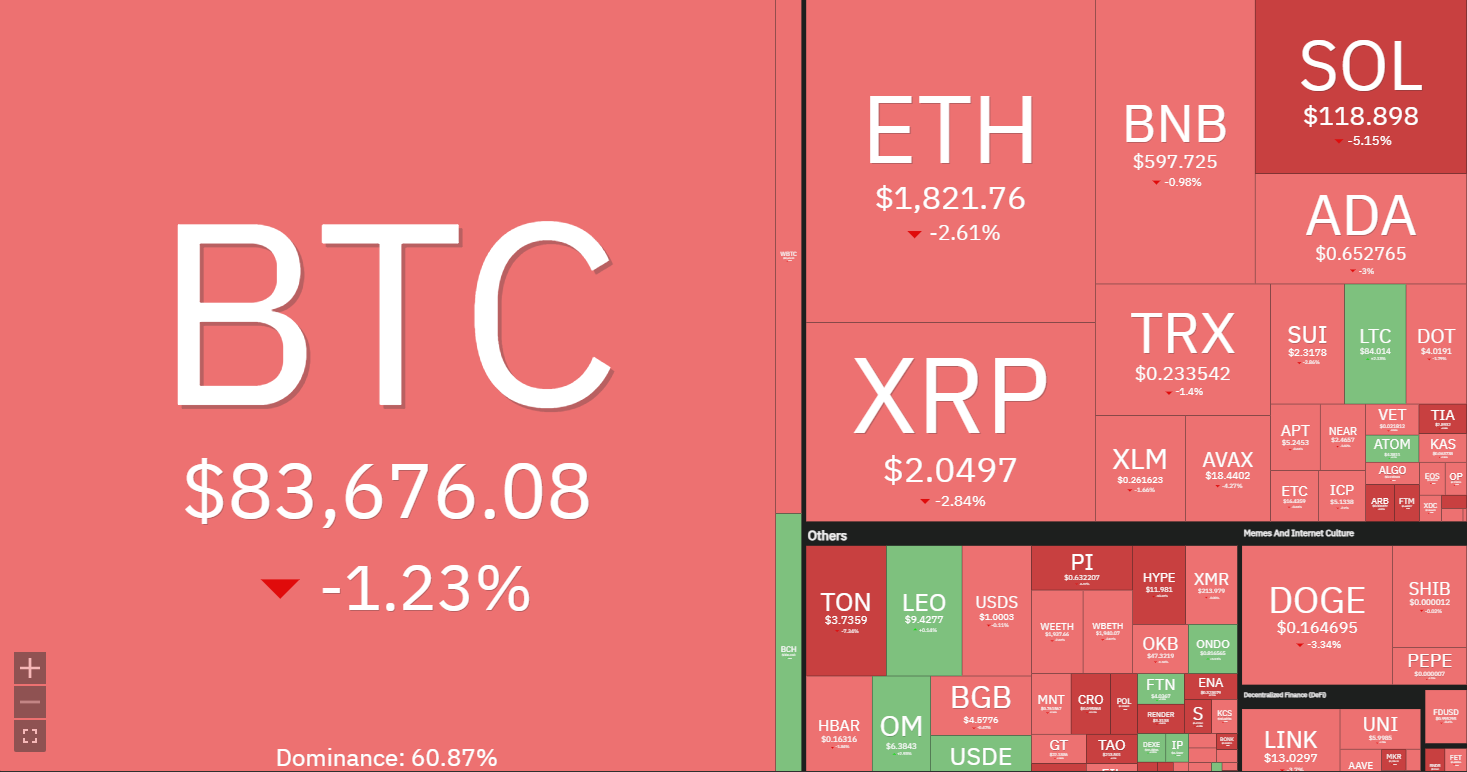

比特币(BTC)几乎达到了88,500美元的盘中高点,但下跌了2.6%,回落至83,000美元左右。关税宣布后,以太币(ETH)立即从1934美元跌至1797美元,加密货币总市值下降5.3%,至2.7万亿美元。

在特朗普的关税命令后,加密货币全面显示红色 来源:Coin360

一些市场分析师并未动摇。交易员Michaël van de Poppe写道,关税“不会像所有人预期的那么糟糕”。

“不确定性消失了。金价将下跌。‘买入谣言,卖出新闻,’”他说。“山寨币和比特币上涨。‘卖谣言,买新闻。’”

BitMEX创始人Arthur Hayes表示,虽然关税可能会减少贸易逆差,但出口减少可能会限制对美国国债的需求,这需要美联储进行国内干预,以稳定市场。

他表示:“美联储和银行体系必须加大力度,确保国债市场运转良好,这意味着‘降准’。”

“Brrrr”——指的是美联储印更多的钱——是Hayes此前提出的一个理论,随着流动性的增加进入市场,这可能对比特币的价格有利。

那么加密货币矿工呢?

美国的加密货币矿工可能没有理由对关税感到乐观,因为他们直接受到从亚洲进口的商品(即加密货币挖矿设备)加价的影响。

采矿即服务公司Blockware Solutions首席分析师Mitchell Askew表示:“关税对比特币矿工有巨大影响。预计离岸供应将受到挤压,从而增加对本土矿商的需求。如果这与比特币的运行相结合,我们可能会看到ASIC(采矿设备)价格像2021年那样飙升5到10倍。”

Blockware首席执行官Mason Jappa表示,关税将对比特币采矿业产生“重大影响”。“目前大部分比特币挖矿服务器进口来自马来西亚/泰国/印度尼西亚。已经登陆美国的钻机将变得更有价值,”他写道。

一些矿业公司已经急于在关税生效前将采矿设备运出出口国。4月3日,比特币挖矿软件公司Luxor Technology的硬件主管Lauren Lin告诉Bloomberg,她的公司正处于“手忙脚乱”当中。

她说:“理想情况下,我们可以租一架飞机,把机器运过去——只是想尽可能地发挥创意,把这些机器运出去。”

关税政策疑云:"荒谬计算"与经济衰退隐忧

在白宫签署仪式上展示的方便的关税百分比图表让许多人质疑特朗普政府究竟是如何得出这些数字的,以及为什么会选择某些国家。

Yale Review编辑James Surowiecki写道,政府实际上并没有计算关税税率加上非关税壁垒来确定它们的税率,而是“只是用我们对那个国家的贸易逆差除以该国对我们的出口”。

“这是多么荒唐的事啊。”

一些人甚至提出一种理论,认为政府使用ChatGPT来计算国家和数字。NFT收集者DCinvestor表示,他能够通过生成式人工智能上的提示几乎完全复制该列表。

“我能够在ChatGPT中复制它。它还告诉我,这个想法以前在任何地方都没有正式的形式,这是它想到的东西。“特朗普政府正在利用ChatGPT来决定贸易政策,”他说。

同样值得注意的是:白宫名单上的一些较小的国家和地区。据Forbes报道,这份完整的名单对赫德群岛和麦克唐纳群岛征收10%的关税,以回应它们对美国征收10%的关税。

赫德群岛和麦克唐纳群岛无人居住,贫瘠,是地球上最偏远的地方之一,距离南极洲1600公里。没有人住在那里;不存在贸易。

赫德岛,一个冰雪覆盖的岩石 来源:维基百科

这份关税清单中存疑的数学计算与内容构成,令多方质疑美国政府的经济决策逻辑。

全球金融咨询巨头deVere集团的首席执行官Nigel Green告诉Cointelegraph,总统“在经济错觉中兜售”。

“这是全球贸易的地震日。特朗普正在摧毁使美国和世界更加繁荣的战后体系,而且他是带着鲁莽的自信这样做的,”他说。

Cinneamhain Ventures的合伙人Adam Cochrane表示,当关税针对那些也有现有生产以抵消进口商品成本增加的行业时,关税“对大多数这些行业都很有效”。

“美国没有这些,也没有工厂,没有劳动力来抵消它,也没有原材料。所以你最终只会为同样的商品支付更多的钱。”

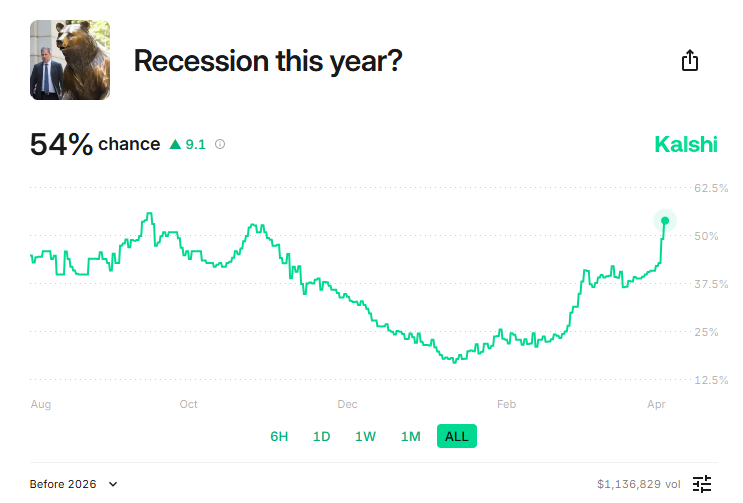

3月底,Goldman Sachs已经预测美国经济衰退的可能性为35%。特朗普签署命令后,对Kalshi的投注市场增加到50%以上。

博彩市场并不看好美国经济 来源:Kalshi

特朗普则认为,关税将“让美国再次伟大”,并使美国经济在与前盟友和贸易伙伴的竞争中具有优势。他在签字致辞中辩称,如果维持关税,上世纪30年代的大萧条就不会发生。

在大萧条期间提高关税的《斯穆特-霍利关税法》(Smoot-Hawley Tariff Act)被广泛认为是导致大萧条恶化的一个因素,并已成为灾难性经济政策制定的代名词。

相关文章:矿企高管:特朗普关税可能降低美国以外比特币矿机价格

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。