原文作者:0xSketon,DeFi研究员

编译|Odaily星球日报(@OdailyChina)

译者|CryptoLeo(@LeoAndCrypto)

经历了“黑色星期一”和“CNBC乌龙事件”后,市场再次转冷。BTC保持在8万美元水平左右,大部分山寨币相较一年前腰斩,二级市场一片哀嚎,打狗的朋友或许还能遇见一两个金狗。

总体来说,关税的发展和特朗普的“大嘴巴”特性,导致现在的市场完全由消息面驱动,炒币赚钱难度再次上升。DeFi研究员 0xSketon撰写了近期Solana上面值得参与的11个赚取收益的DeFi协议,其中借贷、稳定币存款较多,Odaily星球日报编译如下:

本文将介绍Solana 上赚取被动收入的 11 大 DeFi 策略,寻找通过借贷、Vault和Farming获得 15–50% 的年利率。以下是一份精选的赚取稳定收益的协议列表:

借出USDC,提供13.94%的APY;

提供SOL(Solayer)参与流动性再质押,APY为9.7%。

将SOL存入GMS 借贷池(APR 16.68%),通过与 Fragmetric 合作“赚取收益 + 双倍积分获取”。

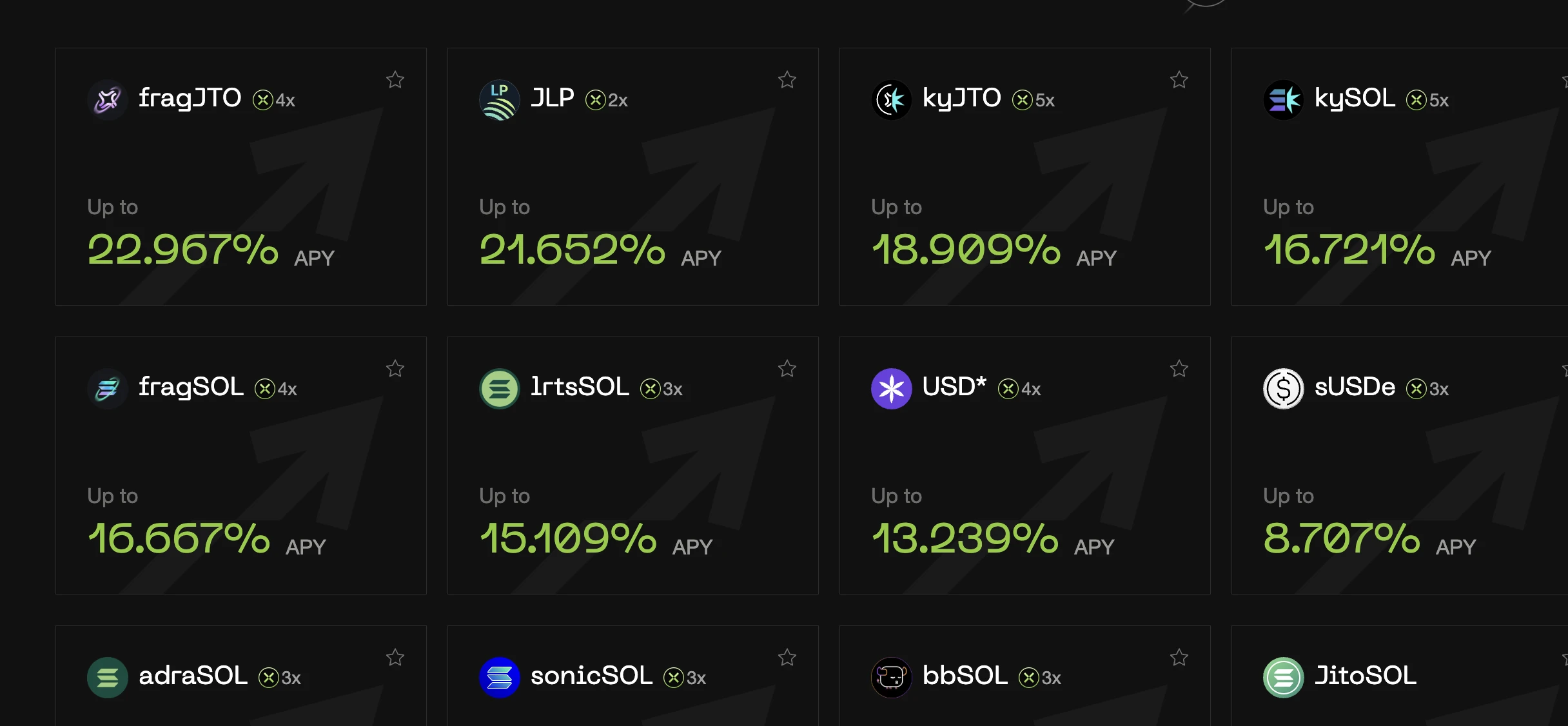

3、Vaultka

JLP挖矿(15%-20%),V1版本借出SOL(APY 16.65%)、USDC(10.27%)、USDT(12.65%);

此外,还可以借入JLP、SOL进行杠杆挖矿(保持借贷健康度),合作方为:Jupiter、Solayer、Jito。

4、RateX(人称小Pendle)

选择高APY池子存入质押版代币,赚取 Fragmetric + 原生积分。

5、DeFituna

将代币借入协议池子,目前APY较高的池子包括SOL、Fartcoin、USDS。

6、Pluto

存钱借入USDC、SOL和PYUSD,并通过其JLP和INF循环复利获得更高APY。

7、Exponent

Solana上的Pendle风格DeFi协议,通过Jupiter兑换相应代币并存入匹配池,该协议还具有Farm和存入流动性金库奖励(包括质押代币协议的Points奖励加成:Fragmetric、Fyros)。

借贷聚合器,选择JLP池子存款,APY为5–20%。

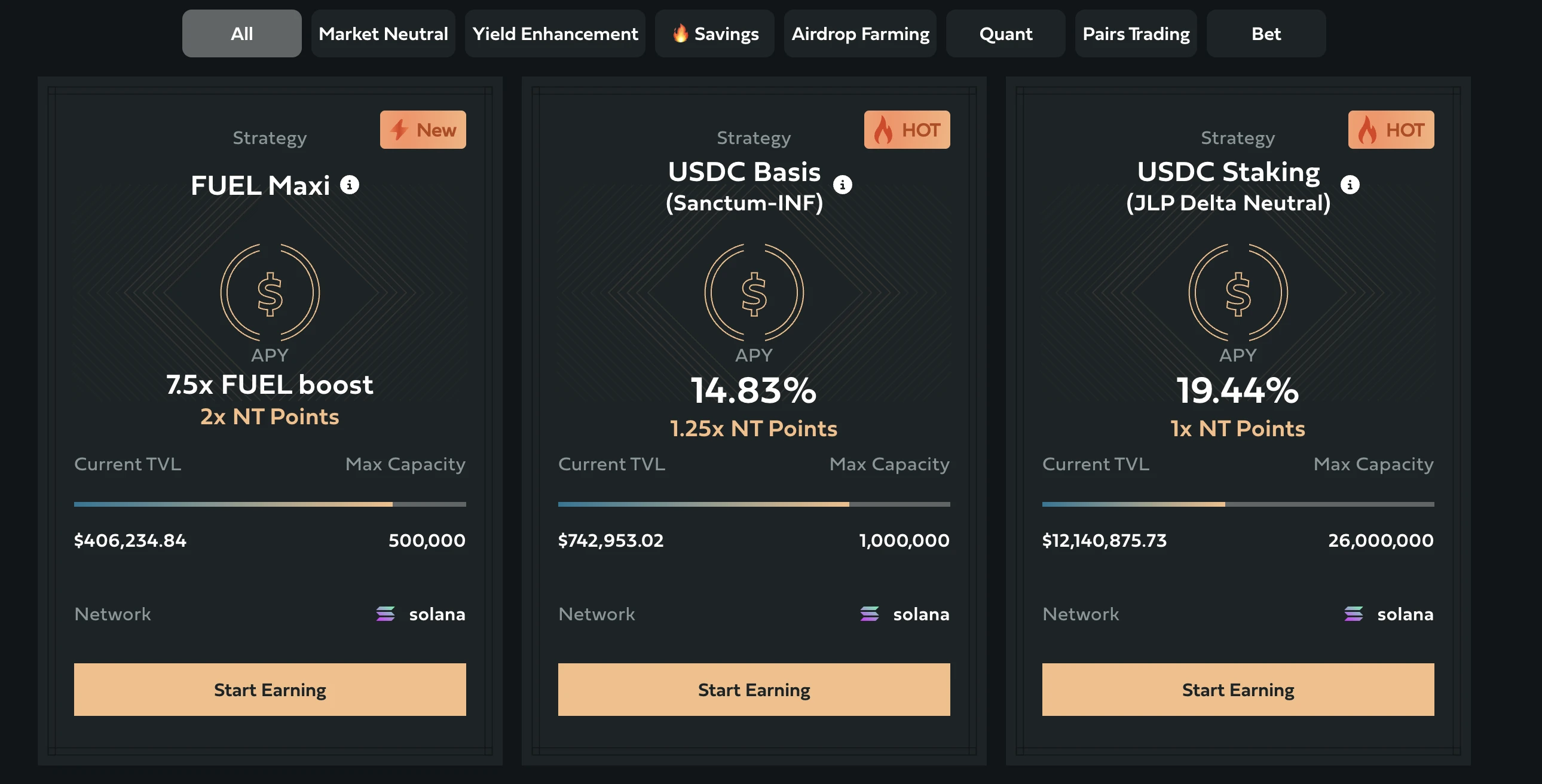

Delta 中性策略,选择一个金库存入USDC,获得6–25%的稳定币APY。

由前高盛团队领导;

选择一种收益策略并存入资金,赚取 1-2 倍 NT积分(空投)。

11、synatra

合成再质押协议,将SOL兑换为ySOL,赚取31–38% APY。

以上为今日分享的借贷和存款赚取APY协议,本人建议重点关注以下项目:

Neutral Trade:高盛、巴克莱和全球三大对冲基金的量化分析师、交易员以及经验丰富的Web3 开发人员创建,也是Solana Radar黑客松获奖项目之一;

RateX:种子轮融资由GSR、Animoca Ventures等参投,Solana基金会资助,也是Solana 2024 Renaissance 黑客松 MCM 一等奖获奖项目,机制清晰;

Exponent:2024年宣布完成210 万美元融资,由RockawayX 领投,存款质押代币可获多个项目积分加成;

DeFituna:创始人Dhirk此前发文表示,正在打造V2版本,也同时在开发一个独立的产品,届时将公布代币TGE消息,但DeFituna的代币首先是一个收益共享代币,治理功能将在未来添加。Dhirk此前也揭露了M3M3平台2亿美元市场操纵计划,涉及LIBRA、MELANIA等代币(当时名为Moty);

NX Finance:与Solana上多个DeFi协议达成合作,虽TVL不高,但其积分系统有空投预期。

最后,包括推荐关注的项目在内,大部分均为早期项目,存在一定风险,谨慎参与,DYOR!

若有必要,未来将挑选几个重点项目进行详细介绍。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。