Author: Coinshift, Crypto KOL

Compiled by: Felix, PANews

The DeFi yield market is rapidly growing—Pendle and Spectra are key players driving growth in this field, each adopting different approaches.

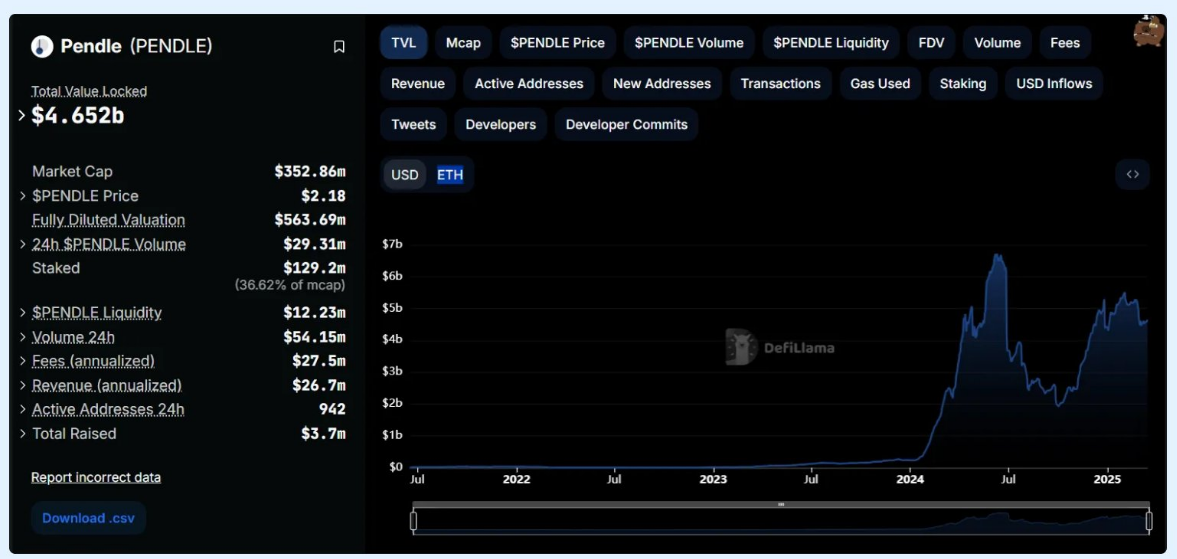

Pendle is set for a breakthrough year in 2024, benefiting from the integration of staking/re-staking ETH derivatives (LST and LRT), an active community, and strong airdrop momentum. Pendle's TVL surged from $20 million to $4.6 billion.

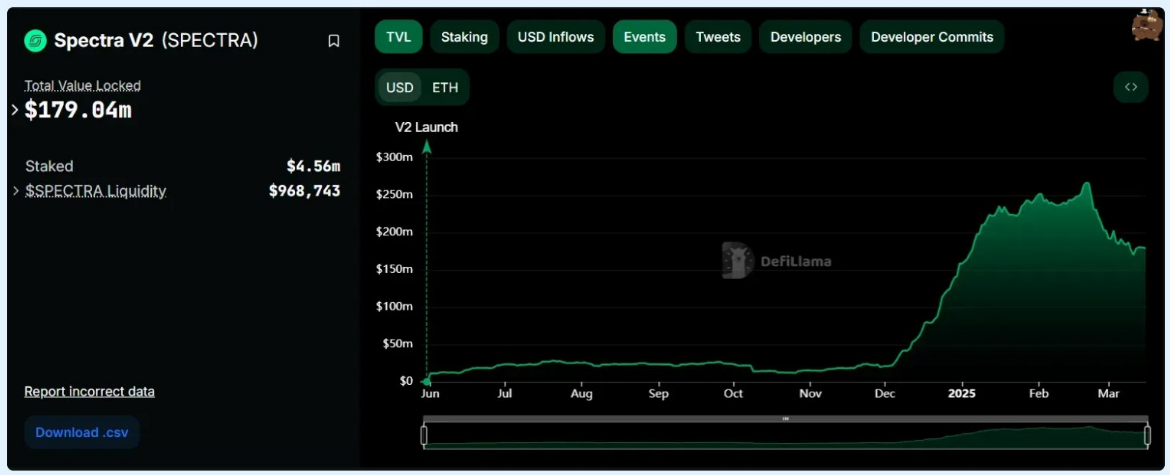

In June 2024, APWine rebranded to Spectra, focusing on permissionless pool creation and integration with stable, real yield assets like csUSDL (Coinshift) and USR (Resolv). By early 2025, its TVL grew from $20 million to around $190 million. While its growth rate is slower than Pendle's, it maintains ongoing appeal in Base and other L2s. Spectra is also developing MetaVaults features aimed at enhancing capital efficiency in the yield market.

This article aims to review the development trajectories of the two protocols, interpret their differences, and analyze how their growth strategies impact the future yields of DeFi.

Note: This article is for reference only and does not constitute financial advice. All data related to token prices, market capitalization, and protocol TVL is based on publicly available sources such as DeFiLlama.

Spectra vs Pendle: Development Trajectories

Pendle's Explosive Growth: First-Mover Advantage

Pendle gained a first-mover advantage in the yield derivatives space by transforming future yields into tradable assets. Thanks to the liquidity staking craze and early integration with staking ETH derivatives like Lido's wstETH and Renzo's ezETH, its TVL skyrocketed to $5.2 billion by mid-2024.

Key drivers of Pendle's growth include:

- Early support for popular yield tokens

- The vePENDLE model directing issuance to high-demand pools, encouraging deep liquidity

- A bribery-driven governance system that incentivizes active participation and enhances token utility

As TVL climbed, protocol revenue and user engagement also increased, creating a flywheel effect. Fueled by narratives around yield innovation and fee accumulation, Pendle's native token surged 20-fold in 2024.

Pendle's TVL Growth

Spectra's Low-Key Relaunch and Breakthrough Moment

Spectra took a different approach—strategic, phased rollouts rather than high-profile launches. After its planned relaunch of the yield market in June 2024, initial adoption was low. However, this changed in December 2024, when Spectra's TVL jumped from $20 million to over $190 million in just a few weeks.

What was the catalyst? The rapid rise of Resolv Labs' USR, a stablecoin, sparked a wave of demand for fixed-income options.

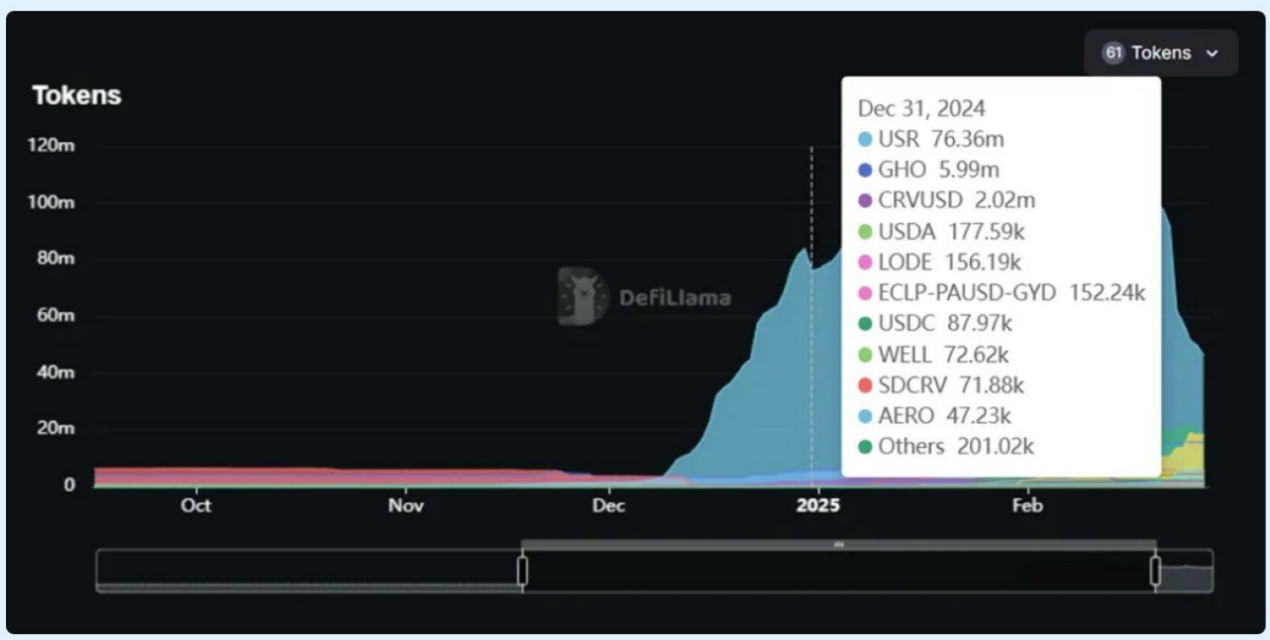

Spectra quickly became the primary venue for USR deployment, especially for users seeking predictable fixed-rate returns. By the end of the year, USR accounted for over 80% of Spectra's TVL.

Spectra's TVL Growth

USR and Spectra: DeFi Flywheel

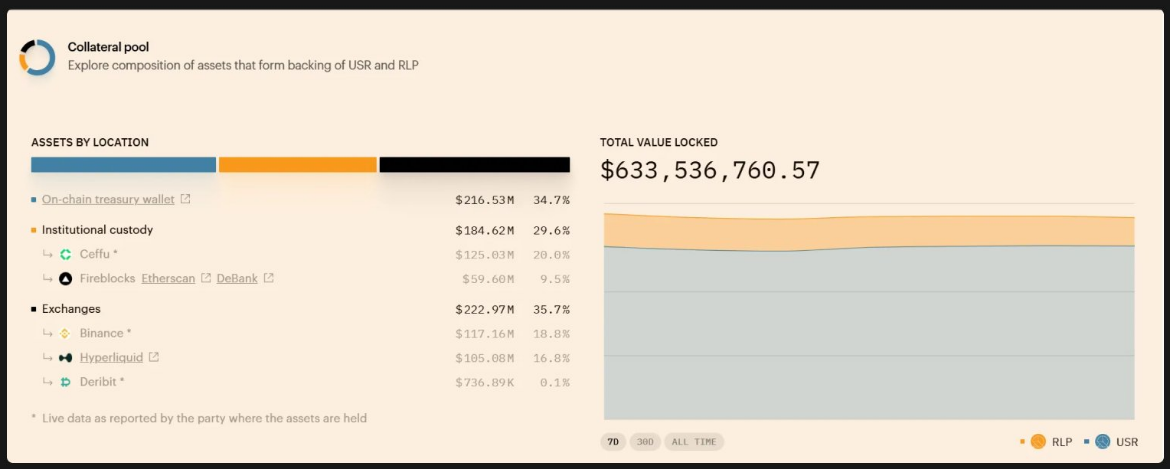

USR experienced a breakthrough moment at the end of 2024, with its TVL soaring from $36 million to nearly $400 million in less than a month. Spectra became the preferred platform for users looking to lock in USR fixed income.

Several key factors initiated the flywheel:

- Spectra was one of the first platforms to offer fixed income for USR holders

- Incentive pools funded by SPECTRA issuance and Resolv's yield mechanism quickly attracted liquidity

- As liquidity flowed in, more users turned to USR-Spectra strategies, chasing competitive fixed income and potential airdrops

Resolv's TVL closely followed the same growth curve as Spectra's. Particularly, yield miners were drawn to Spectra's incentives and Resolv's stablecoin returns.

Resolv Lab's TVL Growth Trajectory

This formed a self-reinforcing growth cycle. By December 2024, Spectra's TVL climbed from around $20-25 million to $143 million, while the USR pool just exceeded $300 million. Spectra was one of the first platforms where users could deploy USR for fixed income, leading most of the new USR supply directly into its market.

The effects were clear:

More USR in circulation → Increased demand for fixed income → More TVL flowing into Spectra → Growing user confidence → Repeat cycle.

Spectra's Discord and social channels quickly caught up with this trend. Some even described it as a "Pendle-like moment," as Spectra showed signs of catching up in terms of TVL.

As more yield assets were added, the composition of Spectra's pools also changed.

Morpho Loop: Pendle's Flywheel, Spectra's Opportunity

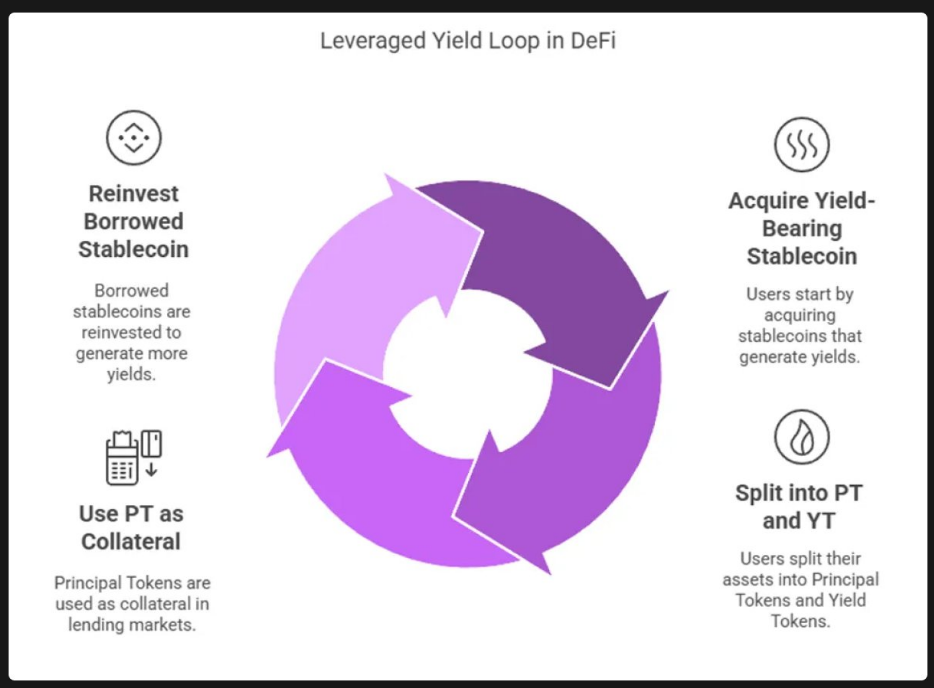

One of the strategies behind Pendle's recent stablecoin TVL growth is the leveraged yield loop. This is a recursive strategy where users borrow and lend principal tokens (PT) to expand their fixed income exposure.

This strategy is often referred to as the "Morpho Loop" or stablecoin arbitrage, exemplifying the practical application of DeFi composability. Taking PT-USR on Pendle as an example, here’s how it works:

(i) Acquire Yield-Generating Stablecoins

Users start with base stablecoins like USDC or DAI and convert them into yield-bearing tokens like wstUSR.

(ii) Split into PT and YT on Spectra

Users deposit wstUSR into Pendle, generating PT (Principal Token) and YT (Yield Token).

Most strategies involve holding PT, as its value remains relatively stable and accumulates to its full face value at maturity. Users can sell YT for immediate yield or use it elsewhere.

(iii) Use PT as Collateral on Morpho

Users acquire PT (e.g., PT-wstUSR) and provide it to Morpho as collateral.

For example, the PT-wstUSR/USR market on Morpho allows users to borrow USR against their PT collateral.

(iv) Reinvest Borrowed Stablecoins

The borrowed USR is converted back to wstUSR, deposited again into Pendle to mint more PT and YT, and the process is repeated.

The result of the Morpho loop is a leveraged fixed-rate position:

The amount of PT users ultimately hold exceeds what their original capital would allow, meaning they receive more stablecoins at maturity.

Why is this important?

The PT-USR loop is a classic example of DeFi composability—combining stablecoin issuers, yield protocols, and lending markets into a self-reinforcing flywheel.

The strategy is as follows:

Mint stablecoins → Split into PT / YT → Use PT as collateral → Borrow → Repeat cycle.

This stablecoin yield strategy has become a key factor in Pendle's TVL growth, as it allows users to expand their fixed income exposure while putting idle stablecoins to work.

What does this mean for Spectra?

Currently, this loop exists on Pendle rather than Spectra. However, Spectra is actively collaborating with Morpho and ecosystem managers to bring the Spectra-PT market to Morpho. Once launched, the same strategy could open a new round of growth for Spectra, especially considering its deep focus on native stablecoin yield markets and permissionless pool creation.

In other words: Pendle's flywheel is now in motion. Spectra's version is still loading—but if it replicates its mechanisms, the upside potential could be significant.

The leveraged yield loop strategy is in effect.

TVL Growth and Token Price Correlation

The cases of Spectra and Pendle illustrate that protocol TVL growth is often correlated with token price performance, especially when tokens derive value through fees, issuance, or governance.

Pendle

Pendle's TVL experienced explosive growth in 2024, directly translating into strong token performance:

- TVL surged from $230 million to $6.7 billion, significantly increasing market share.

- PENDLE rose from around $1 to a historical high of $6.67, an increase of nearly 590%.

This is not just speculation. Pendle's vePENDLE model introduces fee sharing and governance weight, meaning more TVL translates to more protocol revenue—and more incentives to lock PENDLE for voting rights and bribes.

At its peak, Pendle's TVL reached $4.6 billion, with a market capitalization of $644 million, resulting in a TVL to market cap ratio of about 14%. This "undervalued" perception helped drive continued buying. Ultimately, after peaking in April, the token price retreated from around $7 to the $2-4 range as some TVL declined with the expiration of popular yield pools.

Nevertheless, the overall trend remains: as Pendle's TVL grows, demand for the token also increases. Strong fundamentals (TVL, revenue, and token utility) drive narratives and investor interest.

Even by early 2025, when Pendle's TVL fluctuated between $3.5 billion and $5 billion, the token remained in the few dollars range. This indicates that the market is still pricing in future upside potential, rather than just the current TVL.

Comparison of PENDLE Token Price and TVL

Spectra

Spectra's token history is recent, but early data shows a clear correlation between TVL growth and token price movements.

In December 2024 alone, TVL grew from $20 million to $143 million, primarily due to USR integration and demand for stablecoin yields.

At the beginning of December last year, SPECTRA was issued at $0.07 and climbed to a historical high of $0.23 within weeks, an increase of about 310%.

After peaking in early January, SPECTRA's price began to decline, stabilizing around $0.04-$0.05 by March, while TVL remained stable above $150 million. This suggests that the initial price surge may have outpaced the rate of usage and fee generation, leading the market to adjust expectations accordingly.

At a peak price of $0.236, Spectra's circulating market cap was approximately $8 million, accounting for over 50% of its $143 million TVL—an MC/TVL ratio far higher than Pendle's at a similar growth stage. Once this imbalance became apparent, the premium disappeared.

By March 2025, Spectra's TVL was $190 million, with a market cap of $14 million, representing only about 7% of its TVL—arguably undervalued compared to Pendle at a similar point in its growth curve.

If Spectra continues to expand and activates governance mechanisms like veSPECTRA, token demand may follow suit. Assuming strong fee generation and sustained adoption, a leap to over $1 billion in TVL could lead to a repricing of the token.

Comparison of SPECTRA Token Price and TVL

Can Spectra Catch Up to Pendle?

Pendle has demonstrated strong market demand for tokenized yields, boasting billions in liquidity and a clear product-market fit. Spectra is building on this foundation—focusing on native stablecoin strategies, composable lending integration through Morpho, and permissionless designs to encourage broader participation.

As the yield landscape continues to evolve, Spectra's development path appears increasingly solid. If it can maintain growth, activate long-term token incentives through veSPECTRA, and continue attracting real users, it is likely to become the next major player in the space.

Related reading: Yield-Generating Stablecoins Are Thriving, How to Earn from Them?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。