追踪币圈实时热点、把握最佳成交机会,今天是2025年4月1日星期二,我是王毅博!各位币友早上好☀️铁粉打卡👍点赞发大财🍗🍗🌹🌹

==================================

==================================

🔥🔥🔥今天是2025年的第二个季度的开端——四月一号,进入四月份的加密市场的上旬将是一个跌宕起伏的过程而后做出方向性的选择,比特币和以太坊虽然大幅度波动,但是始终维持在各自的支撑位置而拒绝深度回调,明天就是“4.2”川普所谓的对等关税实施日期,接下来的操作还是要关注消息面的变化、关注毅博及时把握实时动态。

==================================

==================================

🔥🔥🔥隔夜美股三大指数收盘涨跌不一,道指涨1%,3月份累跌4.2%,一季度累跌1.28%;标普500指数涨0.55%,3月份累跌5.75%,创2022年10月以来最大单月跌幅;一季度累跌4.59%,创2022年四季度以来最大季度跌幅;道指跌0.14%,3月份累跌8.21%,创2023年以来最大单月跌幅;一季度累跌10.42%,创2022年三季度以来最大季度跌幅。纳斯达克100指数第一季度下跌8.3%,创2022年第二季度来最差季度表现。大型科技股多数下跌,亚马逊、特斯拉、英伟达跌超1%,微软、奈飞、Meta小幅下跌;苹果涨近2%,谷歌小幅上涨。据CME“美联储观察”: 美联储5月维持利率不变的概率为86.4%,降息25个基点的概率为13.6%。美联储到6月维持利率不变的概率为24%,累计降息25个基点的概率为66.2%,累计降息50个基点的概率为9.8%。

==================================

💎

💎

==================================

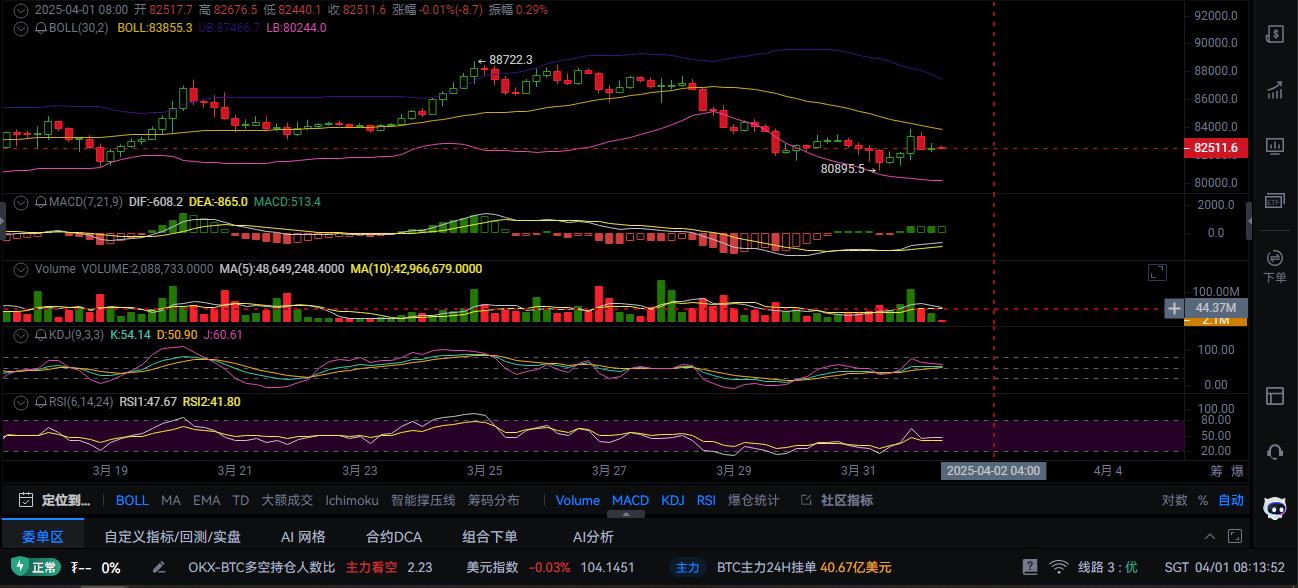

🔥🔥🔥比特币隔夜反弹至 83870 附近后,随即承压回落,上方压力显著,阻力极为强劲。从当前盘面分析,比特币日线收十字星阳线,且前两日连续收阴,上探动力匮乏,在缺乏宏观消息面刺激的情况下,难以攀升至 85000 附近。4 小时图显示,行情虽经历一波小幅单阳拉升,但未能持续拓展涨幅,在触及区间高点后便开始回落,上方压制明显。当前盘面多头虽有一定涨势,但反弹力度尚不足以改变整体盘面趋势,无法有效突破压力位区间。日内多次回调后出现快速反弹,但上方频繁出现长影线,表明行情处于明显承压状态。短期内若无法实现突破企稳,行情仍存在回撤风险。因此,操作上不建议盲目追涨,上方重点关注 84000 的突破与企稳情况,下方支撑则看向 81200 一线。

==================================

==================================

🔥🔥🔥以太坊自底部测试 1870 一线后反弹,在 1850 处承压,随后回落至 1820 附近进入区间震荡。日线连续收阴后,币价回踩态势有所缓和,1750 一线未再次触及,但上方抛压同样显著,阻力位依旧在 1920 一线。4 小时图中,币价反弹至中轨 1850 附近便受到压制,尽管短线有反弹迹象,但力度较弱,回调风险犹存。操作策略上,可参考在该位置反弹不破时尝试做空,下方继续关注 1750 一线支撑,若回踩不破则可反手做多。在未形成明显破位前,可参考 1750 - 1920 区域进行高抛低吸操作,待行情实现突破后再顺势跟进。

==================================

==================================

如果你正处于迷茫之中——不懂技术、不会看盘、不知何时进场、不会止损、不懂止盈、胡乱加仓、抄底被套、守不住利润、错过行情……这些都是散户常见的问题。但没关系,我可以帮助你建立正确的交易思维。千言万语不如一次盈利,屡战屡败不如找到正确的方向。与其频繁操作,不如精准出击,让每一单都更有价值。如果你需要实盘指导,可以扫描文章下方的二维码,关注我的公众号。行情瞬息万变,受审核时效性影响,后续走势以实盘实时布局为准。期待与你一起在市场中稳步前行。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。