Stablecoins are currently the largest application in the Crypto market or blockchain.

Written by: Blockchain Knight

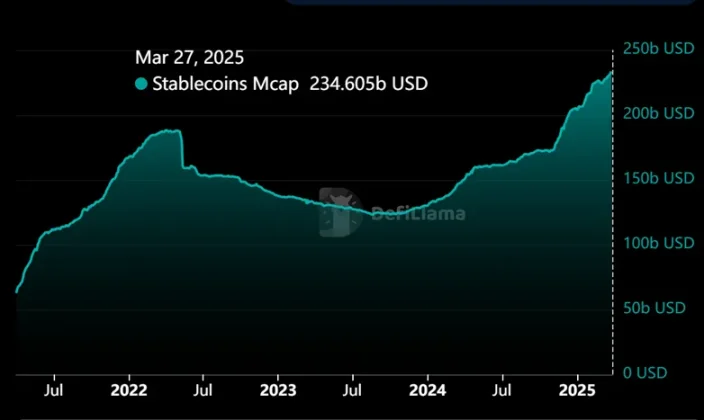

According to data from DefiLlama, the market capitalization of stablecoins reached a historic high last week, exceeding $234.6 billion. Compared to the low of $124 billion in August 2023, this represents nearly a doubling in growth. Currently, USDT still leads the stablecoin market, with a market share of over 62%.

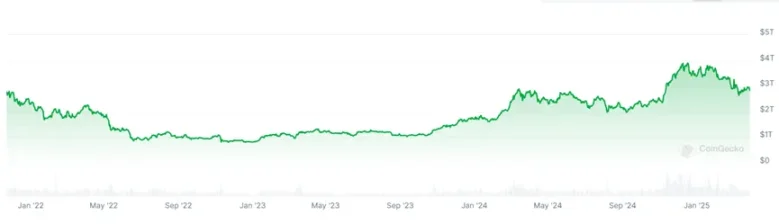

At the same time, the total market capitalization of Crypto has experienced a similar trend to that of stablecoins over the past two years. It doubled from about $2 trillion in mid-2023 to around $4 trillion, but the peak occurred in December last year, and it has since fallen back to around $2.8 trillion, a decline of about 30%, diverging from the growth in stablecoin market capitalization.

This raises an interesting question: why has the market capitalization of stablecoins continued to grow while the total market capitalization of the Crypto market continues to decline?

From the chart showing the changes in total market capitalization of stablecoins and BTC, it can be seen that before December last year, the trends of the two were almost identical. The rise of BTC was often accompanied by an increase in stablecoin market capitalization, while the decline of BTC would also affect the market capitalization of stablecoins, albeit with different amplitudes.

Statistics show that during the bull market from 2020 to 2021, the issuance of USDT was strongly positively correlated with BTC prices, with a correlation coefficient exceeding 0.85, confirming this trend.

The current trend seems to align with the early 2022 period when stablecoins and BTC also experienced a period of stablecoin market capitalization expansion, while BTC saw a pullback. However, I believe that this time the changes in stablecoins may differ from that instance.

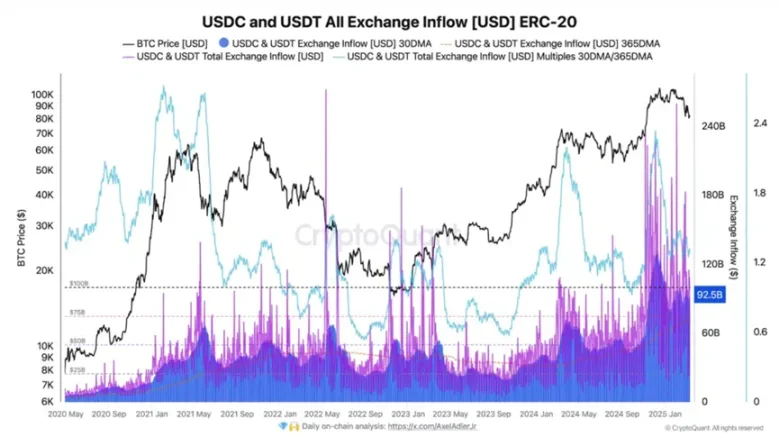

First, regarding the separation of stablecoin and BTC price changes, the new funds in this cycle have not directly flowed into the BTC spot market on a large scale. Data shows that the open interest in derivatives as of March 2025 remains at a high of $54 billion, while the net inflow of stablecoins into exchanges is relatively weak. This indicates that a large amount of stablecoins is being used for leveraged trading (such as futures and perpetual contracts), rather than actual holding demand, and even more so as a hedging tool.

Secondly, compared to a few years ago when the use of stablecoins was mainly concentrated in the single market of Crypto, stablecoins have now expanded beyond the Crypto industry itself, beginning to "move from virtual to real."

According to a survey by Visa, in emerging markets, about 47% of users use stablecoins for dollar savings, 43% for better currency exchange, and nearly 40% use stablecoins for actual payments (goods, cross-border remittances, or salary payments). In countries like Turkey and Egypt, where inflation rates exceed 50%, the number of stablecoin holders has increased by 400% year-on-year, becoming a core choice for residents to preserve their assets.

Electronic payment giants like PayPal have integrated their stablecoin PYUSD with over 1 million merchants, including eBay and Shopify, with transaction volumes exceeding $1.2 billion in the first quarter of 2025. According to BlackRock's predictions, the stablecoin market size will reach $2.8 trillion by 2028, penetrating 5% of global cross-border payments and 15% of the gig economy.

Therefore, the current expansion of the stablecoin market is not only limited to the growth of market capitalization in the Crypto market but also due to the expansion of its application scale itself, which has led to a weakening of the previous correlation. So, based on the current market situation, what data should we focus on regarding stablecoins?

I believe we should pay more attention to the changes in stablecoin inflows to large exchanges. Historically, surges in stablecoin inflows have coincided with local tops or bottoms, usually indicating an increase in volatility. The most recent surge exceeded $92.5 billion, marking one of the highest inflow levels ever recorded.

Although the Crypto market has experienced significant volatility, the ups and downs of the market are bringing about more changes, which are also driving the industry forward, even if not perfectly aligned with price changes.

As reported in an interesting news piece last week, according to the Financial Times citing informed sources, asset management giant Fidelity Investments is advancing the issuance of its own stablecoin, currently in the late testing phase, indicating that more traditional financial giants are joining the stablecoin race.

We must acknowledge that stablecoins are indeed the largest application in the Crypto market or blockchain at present, but the value changes and burdens brought by this underlying application may quietly alter something, as it also represents an expansion of Web3 users, albeit without bringing about a true qualitative change.

As for whether the Crypto market will ultimately benefit from the expansion of stablecoin market capitalization, there is an old saying: since we are here, let’s not be polite? The geese leave their call, and the wind leaves its trace; some feathers will surely be plucked.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。