编译:深潮TechFlow

稳定币令人振奋!

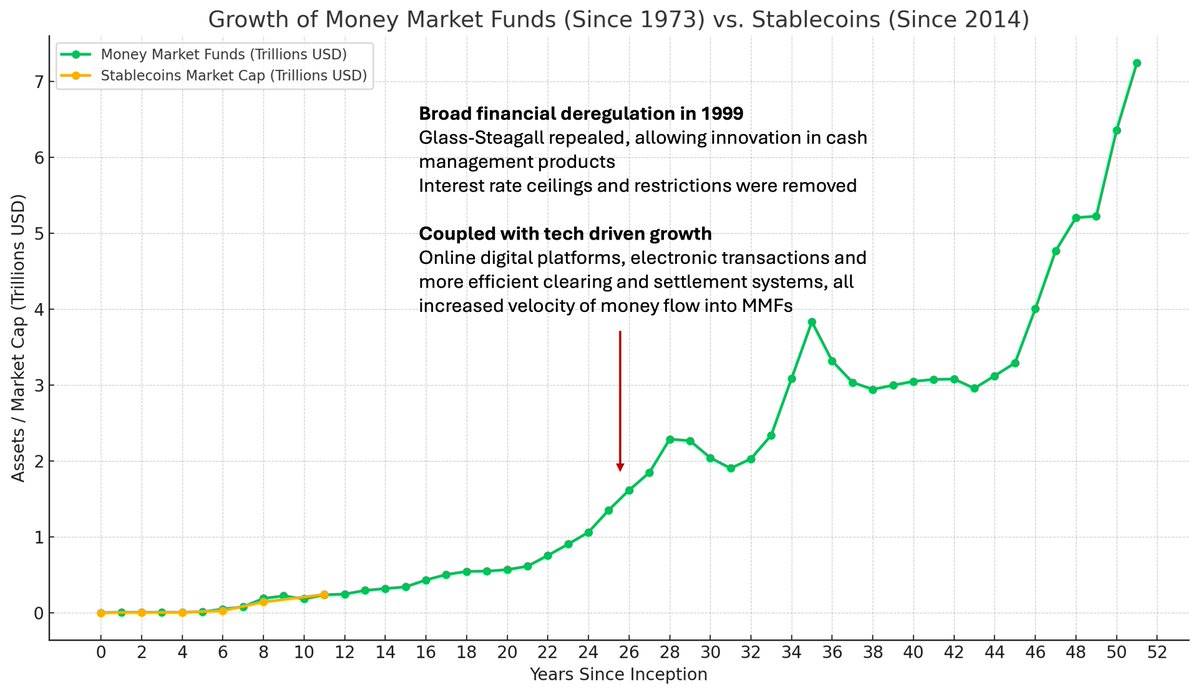

即将出台的美国稳定币立法是一次千载难逢的机会,可以推动金融系统的全面升级。对于金融历史的研究者来说,这一进程与半个世纪前货币市场基金(Money Market Funds)的发明和发展有着诸多相似之处。

货币市场基金诞生于20世纪70年代,最初是为企业提供的一种现金管理解决方案。

当时,美国银行被禁止对支票账户中的余额支付利息,而企业通常也无法开设储蓄账户。

如果企业希望让闲置资金获得利息收益,就必须购买美国国债(US Treasury Bills)、签订回购协议(Repo Agreements)、投资商业票据(Commercial Paper)或可转让存单(Negotiable Certificates of Deposit)。这种现金管理方式繁琐且耗时,给企业带来了极大的不便。

货币市场基金的设计初衷是保持每份基金份额的固定价值,每份份额与1美元挂钩。

1971年,Reserve Fund, Inc. 推出了首个货币市场基金,作为一种“便捷的替代方案”,用于直接投资于如国债、商业票据、银行承兑汇票或存单等货币市场工具的临时现金余额。当时,该基金的资产规模仅为100万美元。[1]

在此之后,其他投资巨头也迅速跟进,例如Dreyfus(现为@BNYglobal)、@Fidelity和@Vanguard_Group。值得一提的是,Vanguard在20世纪80年代其传奇性共同基金业务的增长中,几乎有一半归功于其货币市场基金(致敬@awealthofcs)。

保罗·沃尔克(Paul Volcker)在担任美联储主席(1979年至1987年)期间,对货币市场基金(MMFs)持高度批评态度。即便到了2011年,他仍在继续抨击货币市场基金。

有趣的是,今天反对稳定币的政策制定者提出的许多批评,与半个世纪前针对货币市场基金的指责如出一辙:

-

系统性风险及对银行业稳定性的威胁

货币市场基金不像受保险存款机构(如银行)那样享有存款保险和最后贷款人支持(Lender of Last Resort Facilities)。因此,货币市场基金容易受到快速挤兑的冲击,这可能加剧金融不稳定并引发连锁反应。此外,人们还担忧,存款从受保险的银行转移到货币市场基金,会削弱银行业,因为银行失去了低成本且稳定的存款基础。

-

不公平的监管套利

货币市场基金通过维持稳定的1美元份额价值,提供了类似于银行的服务,但却没有受到严格的监管审查或资本要求。这种“银行功能”的实现被认为存在监管漏洞。

-

削弱货币政策的传导机制

随着资金从银行流向货币市场基金,美联储传统的货币政策工具(如对银行施加的存款准备金要求)变得不再那么有效,从而可能削弱货币政策的执行能力。

如今,货币市场基金已持有超过7.2万亿美元的金融资产。相比之下,美国的M2货币供应量(大致排除了货币市场基金资产)为21.7万亿美元。

货币市场基金资产管理规模(AUM)在20世纪90年代末的迅速增长,得益于金融自由化(《格拉斯-斯蒂格尔法案》(Gramm-Leach-Billey Act)的废除和《格雷姆-里奇-布利利法案》(Gramm-Leach-Billey Act)的通过,推动了金融创新浪潮)。

与此同时,互联网繁荣带来的电子和在线交易系统的进步,也加速了资金流入货币市场基金的速度。

发现规律了吗?

(值得注意的是,围绕货币市场基金的监管之争,即使过去了半个世纪,也并未结束。美国证券交易委员会(SEC)在2023年通过了新的货币市场基金改革措施,其中包括更高的最低流动性要求,以及取消基金管理者限制投资者赎回的权力。)

[1] 不幸的是,Reserve Fund 在2008年金融危机后走向了终结。该基金持有的一些雷曼兄弟(Lehman Brothers)的债务证券被减记为零,导致基金发生脱锚事件,并引发了一波赎回潮。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。