来源: Cointelegraph原文: 《{title}》

加密货币交易所MEXC首席运营官Tracy Jin警告说,实物资产代币化(RWAs)带来大量中心化风险,可能导致审查、流动性问题、法律不确定性、网络安全问题,以及通过国家或第三方中介机构进行的资产没收。

在接受Cointelegraph采访时,这位高管表示,只要代币化资产仍然受到国家监管机构和中心化中介机构的监督,那么“代币化将仅仅是旧金融基础设施的新版本,而非金融革命”。Jin补充道:

“大多数代币化资产将在许可型或半中心化区块链上发行。这赋予了当局发布限制或没收资产的权力。房地产或债券等资产的代币化仍然与国家法律体系挂钩。”

“如果代币背后的财产或公司位于法律环境不稳定或政治波动较大的国家,没收风险就会增加,”这位高管继续说道。

随着全球资产上链,RWA代币化预计在未来十年将成为一个数万亿规模的行业,这将提高货币流通速度并扩大全球资本市场的覆盖范围。

RWA板块总市值。来源:RWA.XYZ

代币化实物资产包括股票、债券、房地产、知识产权、能源、艺术品、私人信贷、债务工具、法定货币、商品和收藏品。

根据RWA.XYZ的数据,目前链上代币化实物资产超过196亿美元,不包括稳定币行业,后者在2024年12月市值已超过2000亿美元。

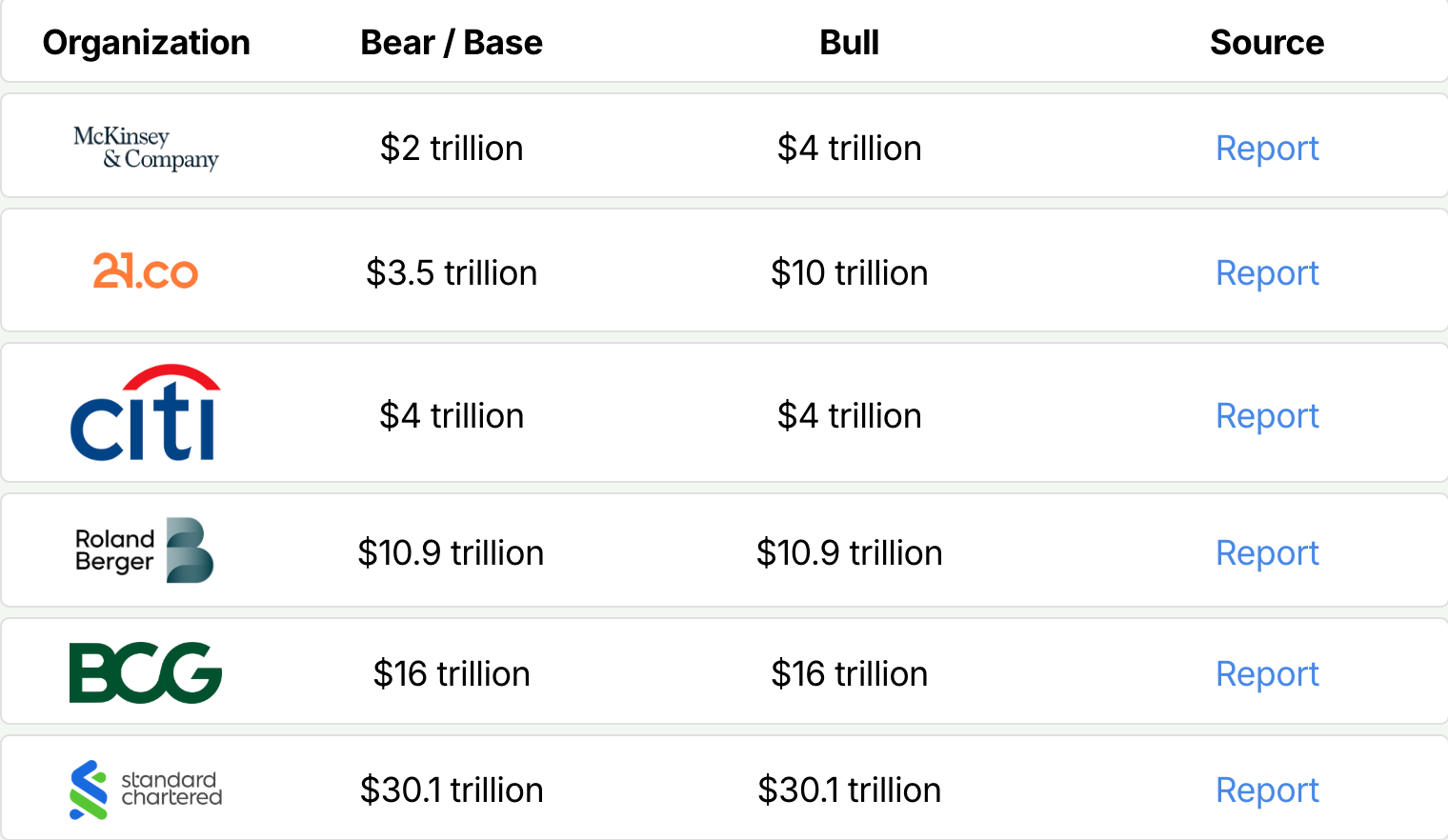

Tren Finance的一份研究报告调查了包括花旗银行、渣打银行和麦肯锡在内的大型金融机构。报告发现,参与者预测到2030年RWA市场规模将在4万亿至30万亿美元之间。

金融机构对代币化RWA市场未来的不同预测。来源:Tren Finance

麦肯锡预测,到2030年RWA行业规模将在2万亿至4万亿美元之间——相比其他预测,这是一个相对保守的评估。

同时,渣打银行等机构和区块链网络Polygon的高管表示,RWA市场在未来十年将达到30万亿美元。

相关推荐:10 亿美元的代币化房地产蓝图: 塑造迪拜的 RWAs

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。