As Bitcoin faces significant downward pressure, the impact of broader economic indicators is becoming increasingly apparent. The development of the U.S. stock market, particularly President Trump's tariff statements, has greatly influenced trader sentiment. Bitcoin's current trading price is around $81,600, having fallen for seven consecutive days. Analyzing how these external factors affect digital assets is crucial. The correlation between cryptocurrencies and the stock market is evident, with Bitcoin reacting sharply to fluctuations in U.S. futures. For example, on March 30, the Dow Jones futures fell by 206 points, and Bitcoin followed suit. This synchronized movement indicates that investor behavior across different asset classes remains intertwined. Traders are becoming increasingly cautious, attributing this to heightened volatility and uncertainty in economic forecasts, including recent inflation data that has intensified market concerns.

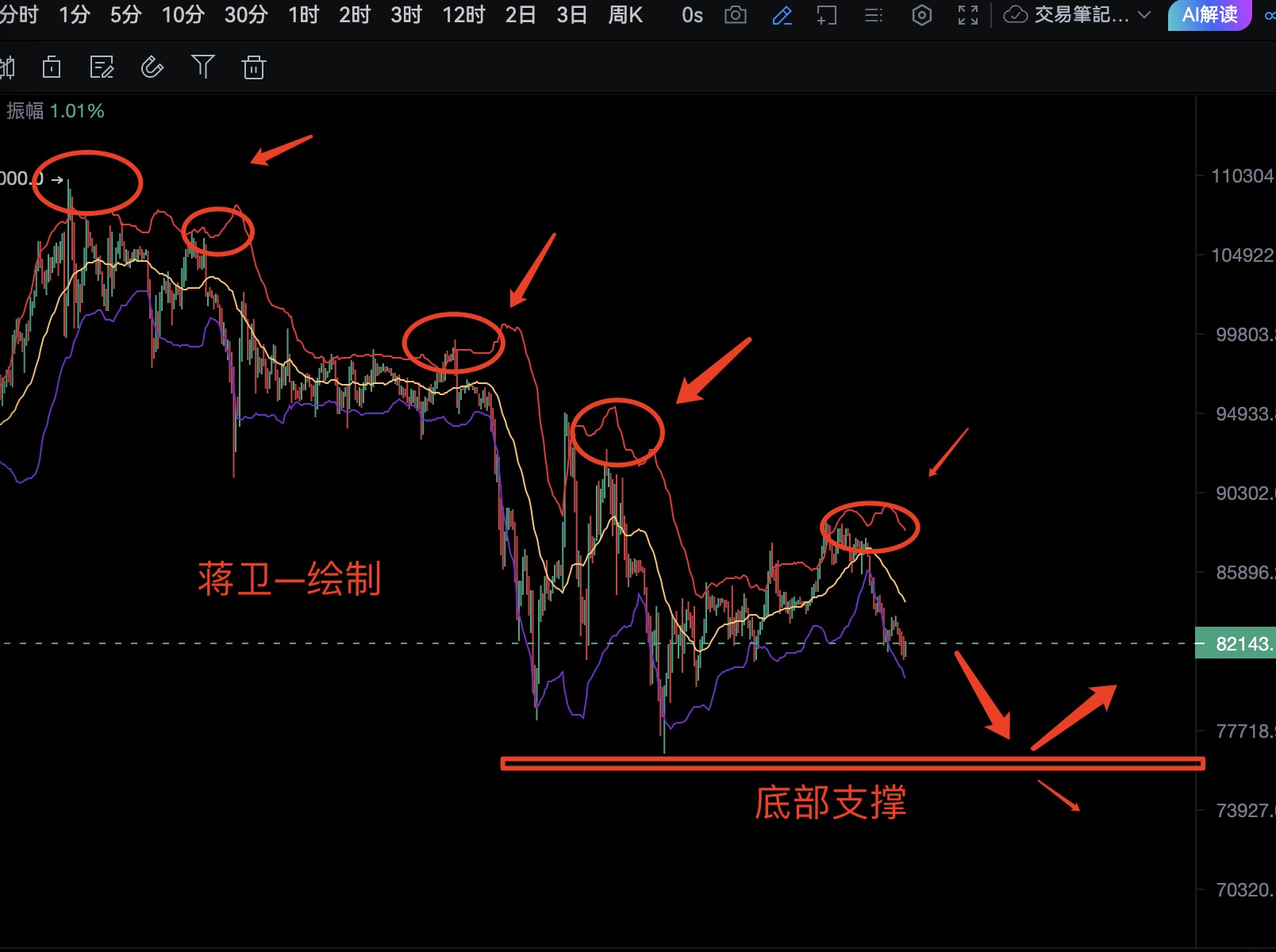

The bears have exploded, directly entering a downward trend, testing the lows around 81,000. If this level is broken, the price will likely return to the 70,000 range and stabilize below, making it difficult to see a one-sided rise in the near future.

On the daily chart, two bearish candles accompanied by two small bearish bars have broken below the middle track and are stabilizing below it, indicating the strength of the bearish trend. Currently, the support level is at 79,500, which will be a necessary path for the bears to open the door. The weekly K-line has already fallen below, and while a short-term price rebound may occur, the bears will ultimately be the main theme this year. In short, it is advisable to look downward during the day.

For Bitcoin, it is recommended to short in batches in the range of 82,500-82,000, with a short-term target of 81,200 and a long-term target of 77,000. These levels are for reference only.

Follow the public account, for what can relieve worries, only Jiang Wei.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。