DEX does not need to be completely decentralized, but it will be more transparent than CEX.

Written by: Zuo Ye

Initially, no one cared about this transaction; it was merely a farce, a "pulling the plug," an extinction of a concept (decentralization), and the disappearance of an L1. Until this disaster became closely related to everyone.

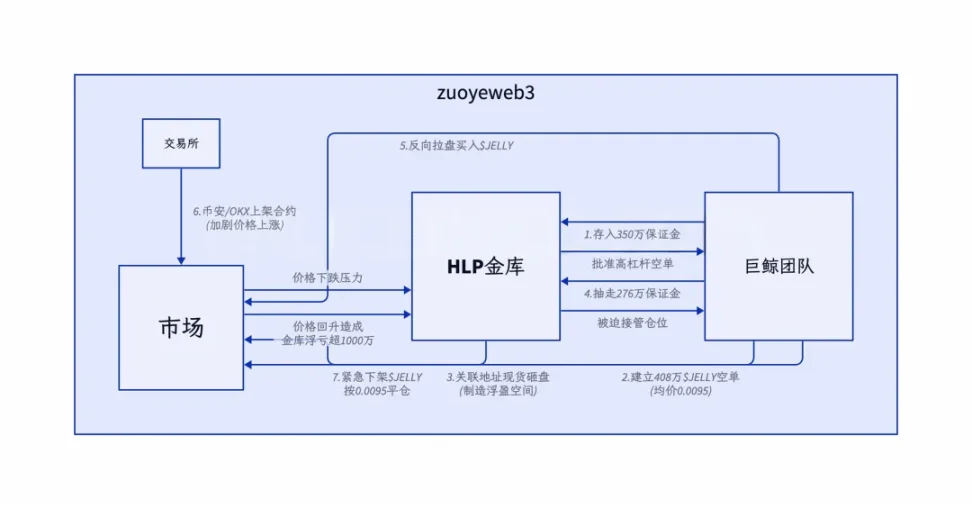

On March 26, Hyperliquid encountered a bloodbath triggered by a meme, similar to the previous tactics of 50x whales, where whales pooled funds and exploited "loopholes" to attack the HLP treasury.

Image caption: Attack process Content source: @ai_9684xtpa

Originally, this was a story between an attacker and Hyperliquid. In fact, Hyperliquid absorbed the counterparty orders from the whales. The PVP turned into PVH, and a loss of 4 million dollars for the Hyperliquid protocol could only be considered a minor ailment.

However, Binance and OKX quickly launched the $JELLYJELLY contract, which seemed to take advantage of Hyperliquid's troubles. The reasoning is similar; if Hyperliquid can absorb the losses of the whales due to its capital size, then exchanges like Binance can also continuously bleed Hyperliquid dry with deeper liquidity until it enters a death spiral similar to Luna-UST.

Ultimately, Hyperliquid chose to go against the principle of decentralization and decided to delist $JELLYJELLY "after voting," commonly known as "pulling the plug," admitting that it could not afford to lose.

Looking back, Hyperliquid's response is normal for CEX, and one can predict that after Hyperliquid, the on-chain ecosystem will gradually acknowledge this "new normal." Whether it is centralized or not is not important; the transparency of governance is more critical.

DEX does not need to be completely decentralized, but it will be more transparent than CEX, achieving a certain balance between crypto culture and capital efficiency, allowing life to go on.

9% of Binance: Crypto Culture Surrenders to Capital Efficiency

Pulling the plug is foolish, pinning is bad, and getting caught in market making is stupid.

According to data from The Block, Hyperliquid has accounted for about 9% of Binance's contract trading volume for two consecutive months, which is the fundamental reason for Binance's fierce response, nipping the danger in the bud; Hyperliquid has already left the cradle.

The market is like a battlefield. Yesterday, Binance could aggressively seize market share from OKX DEX when it delisted, and today, Binance and OK can jointly attack under Hayek's guidance, indicating the fragmented state of the contract market among the three.

Reflecting on recent industry hotspots, on-chain protocols are struggling; it is difficult to maintain decentralization. Polymarket admitted that large holders manipulated the results after UMA oracle was tampered with, which dissatisfied the community; Hyperliquid ultimately "pulled the plug" under pressure from Binance and faced repeated criticism from Bitget CEO and BitMEX co-founder Arthur Hayes.

Firstly, they are all correct. Hyperliquid's choice is not an absolute decentralization principle but prioritizes capital efficiency and protocol security. Personally, I feel that Hyperliquid's level of decentralization is even less than that of Coinbase, as the latter is genuinely subject to strict regulation, while Hyperliquid's true nature is No KYC CEX as Perp DEX.

Secondly, Hyperliquid should be criticized in the context of both CEX and Perp DEX. All of Hyperliquid's current issues have been experienced by CEX, including Arthur Hayes of BitMEX, who criticized Hyperliquid for not being decentralized enough. During the March 12 incident in 2020, if they hadn't pulled the plug, it could have doomed the entire crypto industry.

Decentralization and centralization are a classic trolley problem. To decentralize, capital efficiency will inevitably be inferior to centralization; to centralize, it cannot attract free capital flow.

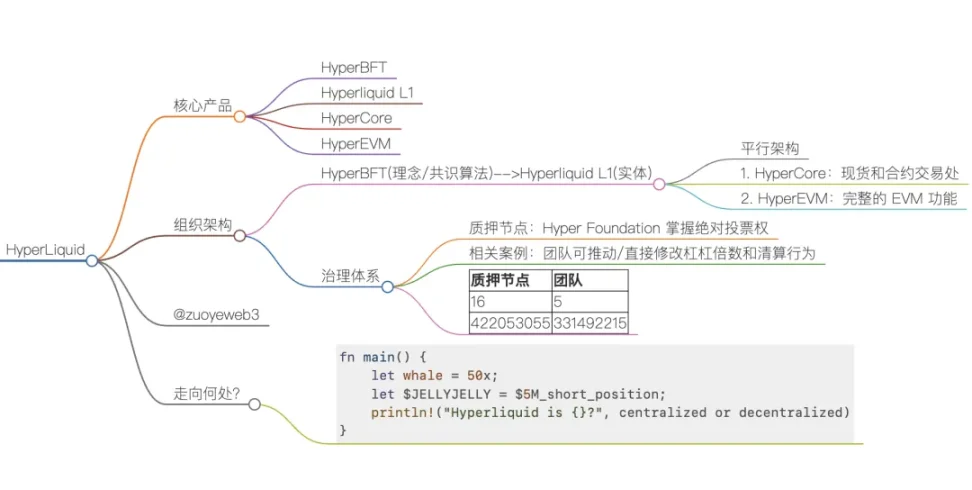

Image caption: Hyperliquid organizational structure Image source: @zuoyeweb3

Hyperliquid is essentially a consensus with two business points:

The consensus is the HyperBFT algorithm and its tangible product, Hyperliquid L1;

The businesses are HyperCore, built on L1, which is a customized spot and contract exchange, essentially controlled by Hyperliquid, and parallel to it is HyperEVM, built on L1, which is the conventional "EVM chain."

In this architecture, the cross-chain behavior between L1 and HyperCore/HyperEVM, as well as the interactions between HyperCore and HyperEVM, are all potential attack points. Therefore, the complexity of the organizational structure is a necessary measure for Hyperliquid's project team to maintain high control.

In the sequence of Perp DEX, Hyperliquid's innovation lies not in architectural innovation but in adopting a "slightly centralized" approach to learn from GMX's LP tokenization, combined with listing and airdrop strategies to continuously incentivize market speculation, successfully capturing the derivatives market firmly held by CEX.

This is not a defense of Hyperliquid; it is the inherent nature of Perp DEX. To have absolute decentralized governance would be unable to respond to black swan events quickly. To respond efficiently, it inevitably requires a sword-bearer.

Just as LooksRare did not overthrow OpenSea, ultimately Blur did, the discussion of centralization is also layered. Hyperliquid focuses more on protocol changes. The emphasis of this article is not to debate whether it is centralized or not but to highlight that capital efficiency will automatically drive the new generation of on-chain protocols to do this—be a bit more centralized in exchange for capital efficiency.

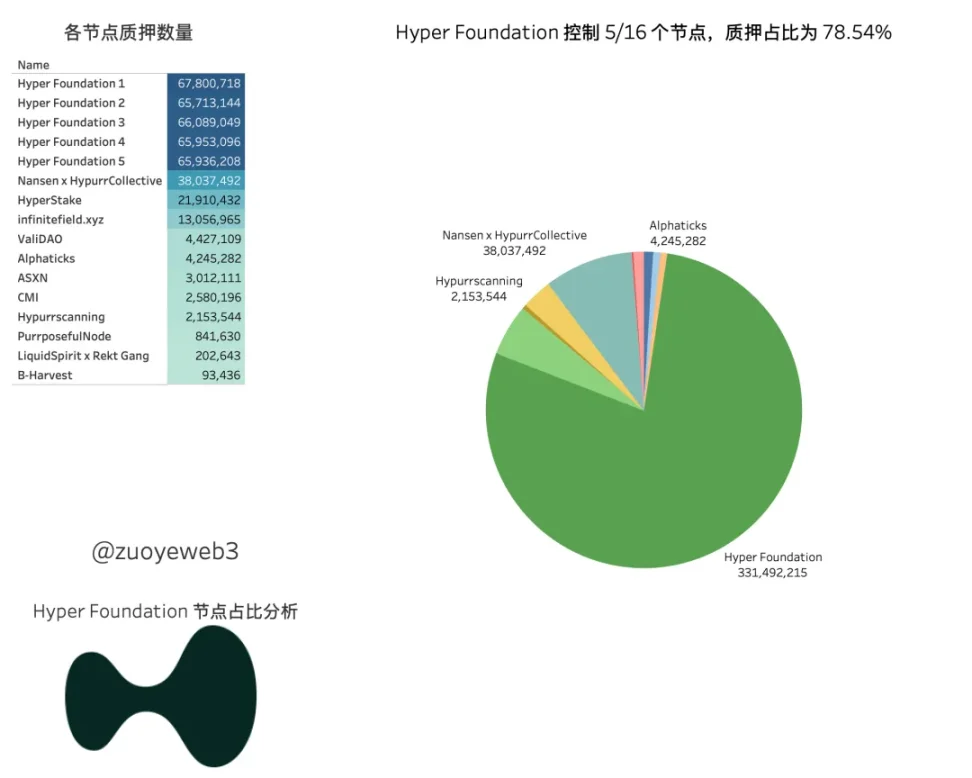

78% Centralization: An Inevitable Result of Token Economics

Hyperliquid's uniqueness lies in exchanging on-chain structure for CEX efficiency, token economics for liquidity, and a customized tech stack for security.

Beyond the technical architecture, the real danger of Hyperliquid lies in the sustainability of its token economics. As mentioned earlier, Hyperliquid is an upgraded version of GMX LP tokenization, allowing users to share in the protocol's revenue, thereby creating more liquidity and supporting the token price for the project team.

However, the premise is that the project team must have sufficient control to maintain the normal operation of protocol revenue, especially in the leveraged contract market, where amplified returns are also more dangerous. This is the biggest difference from spot DEX like Uniswap.

The above outlines the economic principles behind Hyperliquid's choice of a relatively centralized architecture. Currently, among 16 nodes, the Hyper Foundation controls 5, but in terms of staking proportion, the Foundation's total holding is 330 million Hyper, accounting for 78.54% of all nodes, far exceeding the 2/3 majority.

Image caption: Hyperliquid nodes Image source: @zuoyeweb3

Looking back at security incidents over the past six months:

In November 2024, a prominent figure criticized Hyperliquid's architecture for not being centralized enough: basically true.

In early 2025: 50x whales: made mistakes that every exchange would make, but on-chain transparency became the target of criticism.

On March 26, 2025: "Pulling the plug" to liquidate JELLYJELLY is entirely true; the foundation controls the vast majority of voting rights.

It is through repeated games and confrontations that the principle of decentralization gradually bows to the reality of capital efficiency. Hyperliquid has tried to minimize the evils of VC, airdrops, and internal liquidations (compared to the continuous selling by XRP founders), retaining a normal product form and hoping to profit from transaction fees.

Compared to the NFT market being discredited, Perp DEX is an on-chain necessity, so I believe Hyperliquid will inevitably be accepted by the market.

However, just as the community suspected whether exchanges would fleece after Bybit was hacked, it is more concerning whether the mindset of Hyperliquid's founders and team will change after the crisis. Will they insist on being the good guys with a gun pointed at them, or will they collude with exchanges and further close the rules?

In other words, getting entangled in whether it is centralized or not deviates from the main discussion point. Or one might consider whether completely transparent protocol rules leading to open hunting across the market is an inevitable pain for on-chain protocols or will cause a regression in the process of on-chain migration.

The truly profound lesson or experience is: should we adhere to the principle of decentralization or directly surrender to capital efficiency, just like this increasingly wavering world, where the middle ground has become a narrow passage.

Should it be partial centralization + transparent rules + intervention when necessary, or 100% centralization + black box status + constant intervention?

Conclusion

After the 2008 financial crisis, the U.S. government directly rescued the market without taxpayer consent, saving Wall Street at the expense of retail investors, becoming the mother of Bitcoin. Now, Hyperliquid is merely a rehash of an old script, but the roles have changed to the on-chain Wall Street in need of rescue.

After the Hyperliquid crisis, prominent figures have repeatedly criticized it: from Arthur Hayes to AC, all want Hyperliquid to adhere to the principle of decentralization. This is also a continuation of the on-chain business war. AC once criticized the feasibility of Ethena, but that does not prevent the two from standing on the same side today.

Once a player enters the game, they must be prepared to become a pawn.

Whether on-chain or off-chain, there must be absolute principles and relative bottom lines.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。