Bitcoin Valuation:

I have rechecked the data (mainly adjusted the timing of the bull market peaks and bear market lows) and included estimates for the bear market.

First, let's discuss the basis for the calculations, which is based on Metcalfe's Law: the value of a network is proportional to the square of the number of its nodes. Here, we use the number of addresses with a balance >0.01 BTC as the number of nodes to calculate its network value, distinguishing between bear and bull markets:

1/ During the bear market, the price of the coin and the square multiple of the number of addresses are relatively stable, having stabilized at 2.5x during the past two instances. Therefore, I believe we can use 2.5x to estimate where the next bear market low will be.

2/ The multiples during the bull market exhibit a "high-low-high-low" characteristic, which can also be referred to as alternating years. This can be understood as roughly corresponding to the tightening and loosening of the macro environment. For example, the multiple at the peak at the end of 2021 was 36x, while the multiple at the end of 2024 is only 13. It is generally believed that the next bull market should have a high multiple, as the macro environment should also be loose next time.

3/ Bull Market Cycles:

This point is the most troublesome. In the past few instances, the cyclicality has been very obvious, with approximately 4 years between bull market peaks and about 4 years between bear market bottoms. However, this time there is a problem; the biggest question is whether the end of 2024 will be the peak of the bull market. If so, the 4-year cycle would turn into a 3-year cycle or perhaps no cycle at all.

I think it is not impossible. The key issue now is the impact of halving in the crypto space; the inflation rate of Bitcoin has already reached 0.83%, while the annual throughput of similar ETFs, MSTR, etc., has exceeded this. This means that miners are no longer the main driving force.

This remains questionable, and there is also a possibility that it is still a 4-year cycle, meaning there could be another wave by the end of the year. If that is the case, the price of the coin might reach around 130,000 to 140,000 by the end of the year.

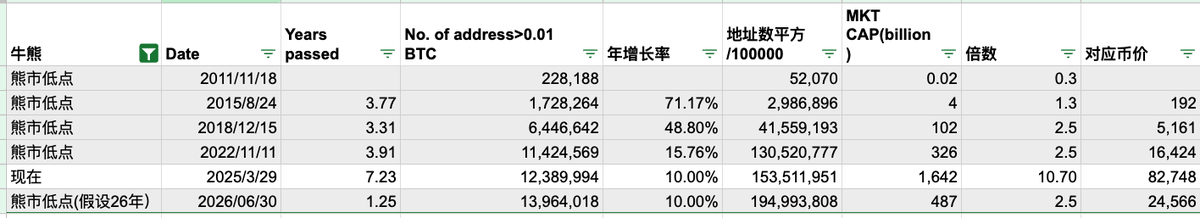

Bear Market Prediction (Figure 1):

Assuming the low point of the bear market occurs in 2026. As mentioned earlier, the multiple at the bear market bottom is relatively stable at 2.5x. Based on the growth in the number of addresses, it can be estimated that the market value of Bitcoin will be around 500 billion, corresponding to a coin price of about 25,000 to 30,000.

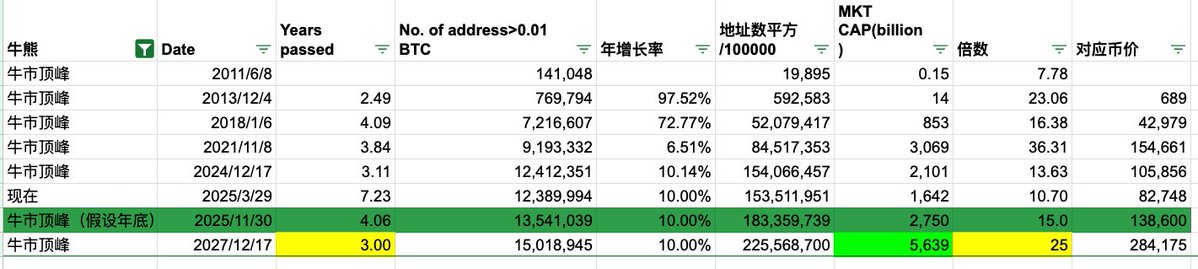

Bull Market Prediction (Figure 2):

Similarly, the timing is the hardest to predict. Assuming the next bull market peak occurs at the end of 2027, it would correspond to a market value of about 5 to 6 trillion, with a coin price around 300,000.

I have shared this document; feel free to provide feedback.

https://docs.google.com/spreadsheets/d/19hI81FxhgxDj55JHKA-P5aeos0igUpHl7Xnv7oolJ5Y/edit?gid=0#gid=0

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。