On the last weekend of March, the market continues to struggle with declines, and the biggest variable for next week may be the impending tariffs.

There is no qualification to evaluate the tariffs themselves; we can only look at the results they bring. A few hours ago, Trump's trade advisor Navarro mentioned in an interview with Fox that the auto tariffs will increase by about $100 billion in next week's tariff policy, while other tariffs will generate about $600 billion in revenue annually.

What does this mean? In 2025, the interest expenditure on U.S. debt is expected to be about $1.3 trillion, which is an increase of about $111 billion compared to 2024. This means that the incremental revenue from auto tariffs alone could theoretically cover this additional interest expenditure, and the overall increase in tariff revenue could nearly halve the U.S. interest expenditure.

However, the real world is not an Excel spreadsheet; the mathematical significance of fiscal revenue often succumbs to the chain reactions of macroeconomics.

First, tariffs are a pass-through tax. They are not paid by foreign entities but are passed on to American consumers and businesses, which means imported goods become more expensive, business costs rise, consumer spending increases, and inflation naturally rebounds.

Second, tariffs can be "reciprocal." If the U.S. imposes tariffs, other countries may retaliate with their own tariffs, which will directly impact U.S. export industries, especially manufacturing, ultimately affecting employment and GDP growth.

Once GDP growth slows, government tax revenue decreases, and the U.S. debt ratio rises instead of falling. Not to mention, if high prices lead to weak consumer spending and unsold goods, even the expected tariff revenue may be discounted.

Therefore, the tariffs in April will be a major reason for the increased difficulty in the risk market; it cannot be simply commented on as good or bad, but is more about "game theory."

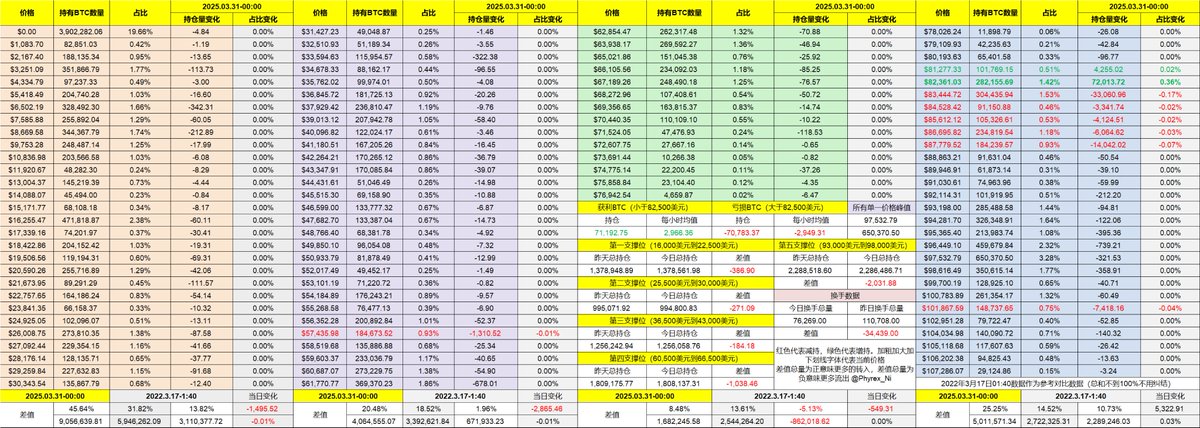

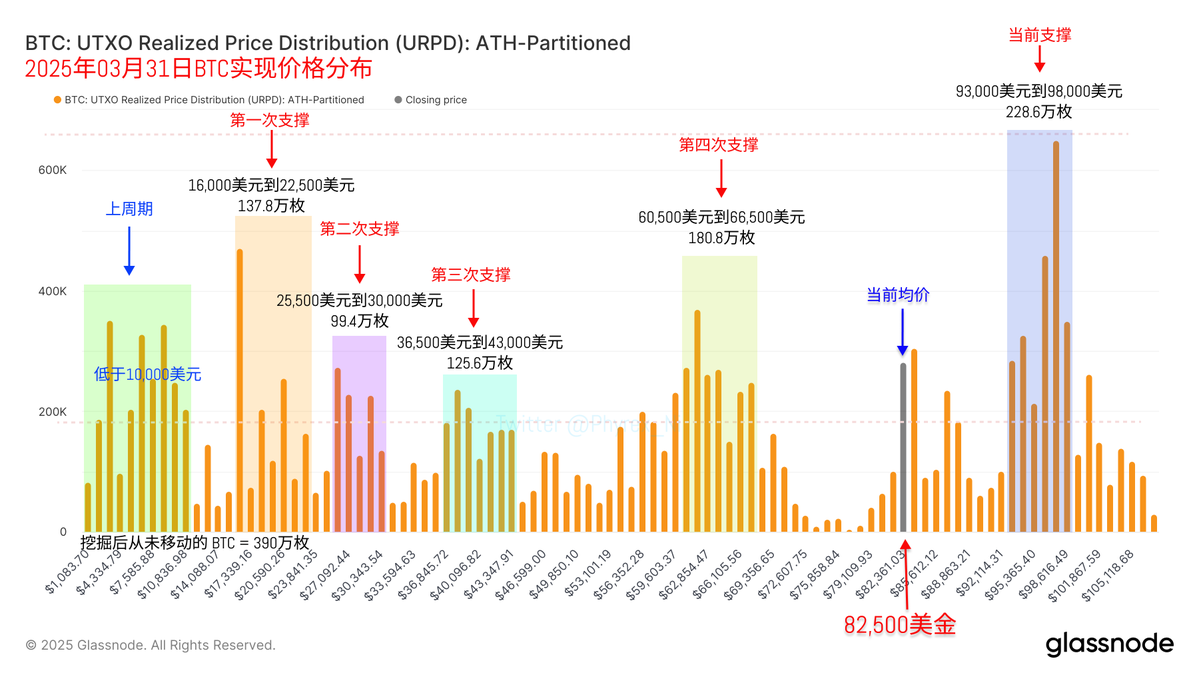

Looking back at Bitcoin's data, although the weekend prices were not friendly, there was no panic sentiment, and trading volume remained very low. Some retail investors began to exit due to fears about the tariffs, and if this is the case, risk aversion may continue to increase on Monday.

There is not much more to say; the price changes on Sunday did not trigger significant panic, and most investors are still on the sidelines, with only recent short-term investors who bought at the bottom facing losses and exiting.

Currently, the concentrated chips between $93,000 and $98,000 are still quiet, and the bottom formation at $83,000 is still slowly taking shape.

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。