Cryptocurrency Market Performance

Currently, the total market capitalization of cryptocurrencies is $2.84 trillion, with BTC accounting for 60.8%, which is $1.73 trillion. The market cap of stablecoins is $233.4 billion, with a 7-day increase of 0.98%, of which USDT accounts for 61.88%.

This week, BTC's price has shown range-bound fluctuations, currently priced at $84,094; ETH has also shown range-bound fluctuations, currently priced at $1,902.

Among the top 200 projects on CoinMarketCap, most have declined while a few have increased, including: BERA with a 7-day increase of 28.09%, CRO with a 7-day increase of 27.92%, GRASS with a 7-day increase of 27.74%, and SAFE with a 7-day increase of 25.94%.

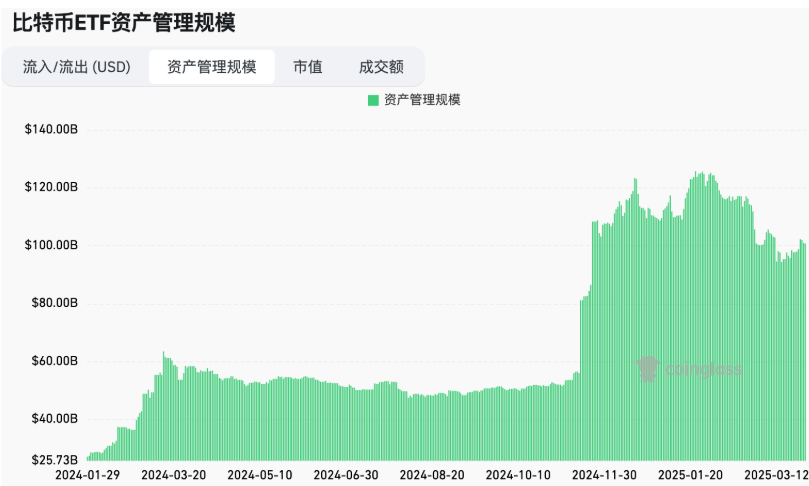

This week, the net inflow for Bitcoin spot ETFs in the U.S. was $196.4 million; the net outflow for Ethereum spot ETFs in the U.S. was $8.7 million.

On March 29, the "Fear & Greed Index" was at 26 (lower than last week), with the sentiment this week being: 3 days of fear and 4 days of neutrality.

Market Prediction: The market has shown range-bound fluctuations this week, with sentiment remaining in fear. On-chain stablecoins have seen a slight increase in issuance, the net inflow speed for U.S. spot Bitcoin ETFs has slowed, and the net outflow speed for Ethereum ETFs has also slowed. The SOL chain's MEME shows signs of a comeback, with the standout being the Ghibli-themed GHIBLI. The U.S. PCE index for February exceeded expectations, and the Trump administration threatened that if the EU and Canada jointly harm the U.S. economy, high tariffs will be imposed. The probability of the Federal Reserve maintaining interest rates in May is 87.8%. It is expected that the market will remain volatile during a period (April to June), with potential opportunities in popular projects on the BSC and SOL chains, and attention can also be focused on the “Hotcoin New Coin List” to unlock more wealth opportunities.

Understanding Now

Review of Major Events of the Week

On March 24, according to official news, Japanese listed company Metaplanet Inc. announced an additional purchase of 150 BTC, raising its total holdings to 3,350 BTC;

On March 23, according to data from the DeFilama platform, as of March 22, Ethena's TVL surpassed $6.5 billion, reaching a historical high of $6.558 billion. The supply of USDe reached 5.413 billion, and the supply of USDtb reached 1.142 billion;

On March 23, according to DefiLlama data, PancakeSwap's revenue in the past 24 hours reached $3.45 million, ranking third in the cryptocurrency revenue leaderboard, while Tether and Circle ranked first and second with 24-hour revenues of $18.37 million and $6.25 million, respectively;

On March 25, the crypto prediction platform Polymarket announced its official launch on the Solana network, allowing users to deposit using SOL. Previously, the platform mainly operated on the Polygon network and only supported USDC stablecoin for deposits;

On March 25, the Dogecoin Foundation officially launched the "Official Dogecoin Reserve" through its newly established commercial entity, completing the purchase of the first batch of 10 million DOGE;

On March 25, Bloomberg reported that the world's largest asset management company, BlackRock, announced the launch of Bitcoin exchange-traded products (ETPs) in Europe, continuing its successful experience with the U.S. Bitcoin spot ETF (which has a scale of $48 billion);

On March 25, CPIC Investment Management, a subsidiary of China Pacific Insurance (CPIC) in Hong Kong, announced the launch of a dollar money market fund (MMF) based on HashKey Chain, which was subscribed for $100 million on its first day, open to professional and institutional investors;

On March 26, according to Lookonchain monitoring, Hyperliquid liquidated 392 million JELLY (approximately $3.72 million) at a price of $0.0095 before delisting JELLY, with no losses, instead making a profit of $703,000;

On March 27, several celebrities, including Musk and Altman, posted Ghibli-themed AI images on the X platform;

On March 27, GameStop announced plans to privately issue $1.3 billion of 0.00% convertible preferred notes (due 2030) to qualified institutional investors. Depending on market conditions, the company may also authorize the initial purchasers to add up to $200 million in notes within 13 days. GameStop stated that the funds raised will be used for general corporate purposes, including purchasing Bitcoin according to the company's investment policy;

On March 27, official news announced that the Bitcoin ecosystem NFT project Taproot Wizards will open a Dutch auction tonight at 11 PM, with a starting price of 0.42 BTC, decreasing by 0.01 BTC every 3 minutes. A total of 80 NFTs will be auctioned, with bidding supported in Bitcoin and SOL;

On March 27, the airdrop query page for the Bitcoin ecosystem yield network Corn has been launched;

On March 28, the U.S. core PCE price index for February was 2.8%, higher than the expected 2.7%.

Macroeconomics

On March 25, U.S. President Trump reiterated in a cabinet meeting his hope for the Federal Reserve to lower interest rates;

On March 27, Trump threatened that if the EU and Canada jointly harm the U.S. economy, the U.S. will impose high tariffs. Trump posted on social media that the tariffs would "far exceed current plans";

On March 28, according to CME's "FedWatch": The probability of the Federal Reserve maintaining interest rates in May is 87.8%, while the probability of a 25 basis point rate cut is 12.2%;

On March 28, official news announced that the SEC has officially withdrawn lawsuits against Kraken, Consensys, and Cumberland, and has released relevant notices;

On March 28, FOX Business reporter Eleanor Terrett reported that the U.S. Securities and Exchange Commission (SEC) has officially concluded its investigation into Crypto.com and will not take any enforcement action against the trading platform.

ETF

According to statistics, from March 24 to March 28, the net inflow of U.S. Bitcoin spot ETFs was $196.4 million; as of March 28, GBTC (Grayscale) had a total outflow of $22.48 billion, currently holding $16.2 billion, while IBIT (BlackRock) currently holds $48.182 billion. The total market capitalization of U.S. Bitcoin spot ETFs is $96.526 billion.

The net outflow of U.S. Ethereum spot ETFs was $8.7 million.

Envisioning the Future

Event Preview

Southeast Asia Blockchain Week 2025 will be held from March 30 to April 5, 2025, in Bangkok, Thailand;

MEME.ing will hold an offline event themed "Meme 2025 · PALAU" from April 2 to April 3, 2025, in Palau;

Foresight News will co-host the global cryptocurrency summit "BUIDL 2025" with The Block at the JW Marriott Hotel in Hong Kong on April 5, aiming to build an efficient bridge for global crypto practitioners through strong bilateral media influence in the East and West;

ETHGlobal Taipei 2025 will be held from April 4 to April 6, 2025, in Taiwan;

The 2025 Hong Kong Web3 Carnival will be held from April 6 to April 9, 2025, at the Hong Kong Convention and Exhibition Centre, Hall 5BCDE.

Project Progress

Investment management company VanEck will waive management fees for the Bitcoin spot ETF HODL from March 13 to March 31, 2025. If the amount exceeds $150 million before the deadline, the management fee for the excess will be 0.2%. After March 31, 2025, the management fee will revert to 0.2%;

The ZKsync Ignite Season 1 event will run from January 6 to March 31, during which 100 million ZK tokens will be allocated to DeFi users providing liquidity in DEX, lending, and Perps, with rewards available weekly;

The DAG-based order book DEX Vite Labs will close the Vite gateway in April, but users can still use community gateway operators and need to transfer funds to exchanges/community gateways.

Important Events

Binance will delist trading pairs of stablecoins that do not comply with MiCA standards for users in the European Economic Area (EEA) on March 31, 2025, to comply with regulatory requirements. Affected assets include USDT, FDUSD, TUSD, USDP, DAI, AEUR, UST, USTC, and PAXG. Stablecoin pairs that comply with MiCA standards (such as USDC and EURI) and fiat currency pairs (EUR) will remain available and unchanged;

New licensing rules in the Cayman Islands will take effect on April 1, 2025. Under the 2025 "Virtual Assets (Service Providers) (Amendment) Regulations," all entities providing virtual asset custody and trading platform services must obtain a license from the Cayman Islands Monetary Authority (CIMA). Existing virtual asset service providers (VASPs) must submit a license application within 90 days of the effective date.

The Japanese listed company Metaplanet will execute a 10-for-1 stock split on April 1, and the company has been purchasing Bitcoin since April 2024.

Token Unlocking

Hooked Protocol (HOOK) will unlock 8.33 million tokens on April 1, valued at approximately $1.14 million, accounting for 1.67% of the circulating supply;

dYdX (ETHDYDX) will unlock 8.33 million tokens on April 1, valued at approximately $5.71 million, accounting for 1.13% of the circulating supply;

Conflux (CFX) will unlock 8.75 million tokens on April 1, valued at approximately $7.46 million, accounting for 1.71% of the circulating supply;

Gravity (G) will unlock 18 million tokens on April 5, valued at approximately $2.81 million, accounting for 1.5% of the circulating supply.

About Us

Hotcoin Research, as the core research and investment hub of the Hotcoin ecosystem, focuses on providing professional in-depth analysis and forward-looking insights for global cryptocurrency investors. We have built a "trend analysis + value discovery + real-time tracking" integrated service system, offering in-depth analysis of cryptocurrency industry trends, multi-dimensional assessments of potential projects, and round-the-clock market volatility monitoring. Combined with our weekly live strategy sessions of "Hotcoin Selected" and daily news updates from "Blockchain Today," we provide precise market interpretations and practical strategies for investors at different levels. Leveraging cutting-edge data analysis models and industry resource networks, we continuously empower novice investors to establish cognitive frameworks and assist professional institutions in capturing alpha returns, collectively seizing value growth opportunities in the Web3 era.

Risk Warning

The cryptocurrency market is highly volatile, and investing carries risks. We strongly recommend that investors conduct investments based on a complete understanding of these risks and within a strict risk management framework to ensure the safety of their funds.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。