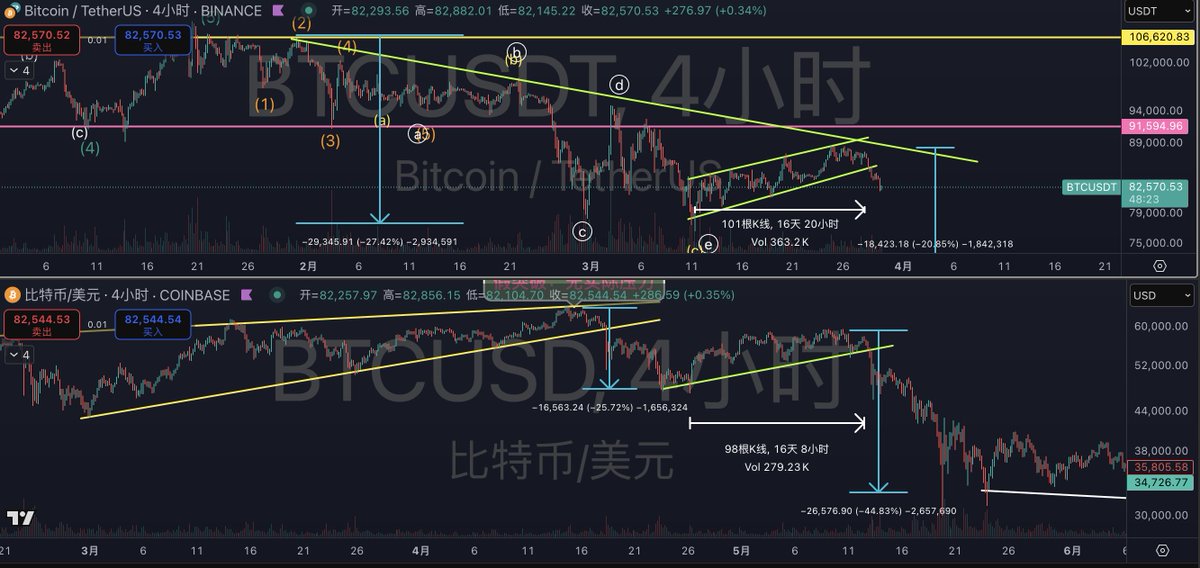

多么有趣的图表,多么有趣的历史重演呀

这一次下跌27%,上一次25%

这一次低点反弹震荡了16天,上一次也是16天

上一次反弹结束后下跌了45%,迎接了519

这一次会一样吗?

我认为不会简单的重复历史

这一次高点下来跌了39天,上一次只有11天

上一次反弹结束后暴跌9天,持续跌71天至7月下旬

这一次应该不会像上次那样直接跌45%-50%这么深

插一根针,7万大概率能支撑

但如果对应上一轮的下跌历史,那就得去5万刀咯...

反正,7万刀我会抄,破了才看5万,这里有极优的性价比

况且,比特币ETF的流动性支持与历史不相似

技术图表的解读全在个人的交易认知

仅供参考~

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。