原创 | Odaily星球日报(@OdailyChina)

作者|南枳(@Assassin_Malvo)

自2月以来,币安已通过Pancake推出了五期Exclusive TGE,具备用时短、单账户收益率高的特点。此外还上线了多个BNB Holder空投和Launchpool,为币安用户送上了大量的“猪脚饭”。

但由于Exclusive TGE收益率过于突出,许多用户开始了增加账号的军备竞赛,BNB投入数量和超募率节节攀升。因此本文旨在复盘过去数期Exclusive TGE和Launchpool数据,推断合理价格与参与策略。

Exclusive TGE

收益情况

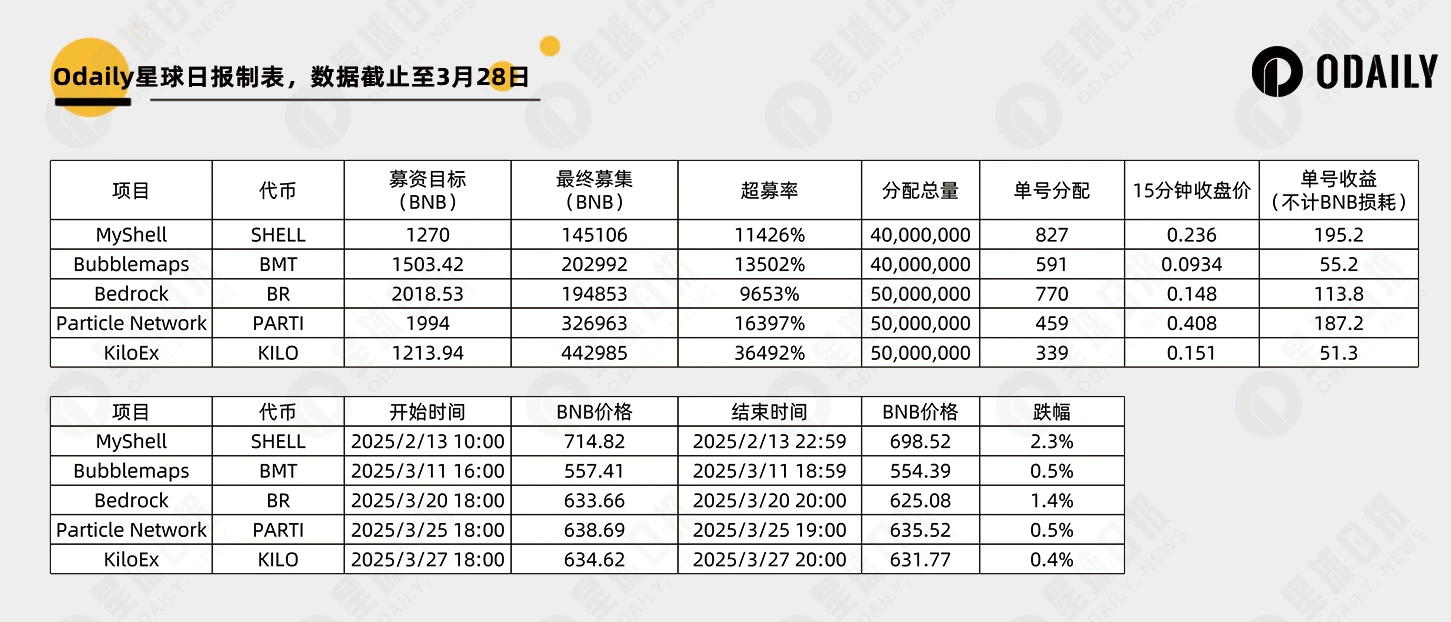

过去五期项目分别为MyShell、Bubblemaps、Bedrock、Particle Network和KiloEx,其中BNB投入数量最少的为首期的MyShell,共145106枚,最多的为最新一期的KiloEx,共442985枚,增长率达205%。

各期的单账号收益情况如下图所示:

目前来看,单账号保底收益仍有50 USDT左右,相较3 BNB的本金收益率高达2.6%,即使考虑BNB在流转途径的IDO中的损耗仍非常值得参与。

BNB的募资数量仍在持续上升,这里参考一个关键数据——币安主站Launchpool的BNB投入数量,过去16个月平均投入数量为1787 万枚,可见BNB数量完全不成问题,变量在于实名账号的数量,但由于币安公布的用户数已超2亿名,已无法预估参与账号的上限。

因此假设终极投入数量为Launchpool 的10%,代币流通市值为5000万美元,向Exclusive TGE分配20%,则最终单账号的理论收益为3÷1787000×50000000×20%=16.8 USDT。

出消息做空BNB可行吗?

在上图的第二部分,我们统计了IDO开始到结束时BNB的跌幅,从往期数据来看这一区间中 BNB均为下跌,并且通常情况下Exclusive TGE消息刚公布后,BNB价格往往比TGE开始时更高,因此当前做空策略具有一定的、明确的利润空间。

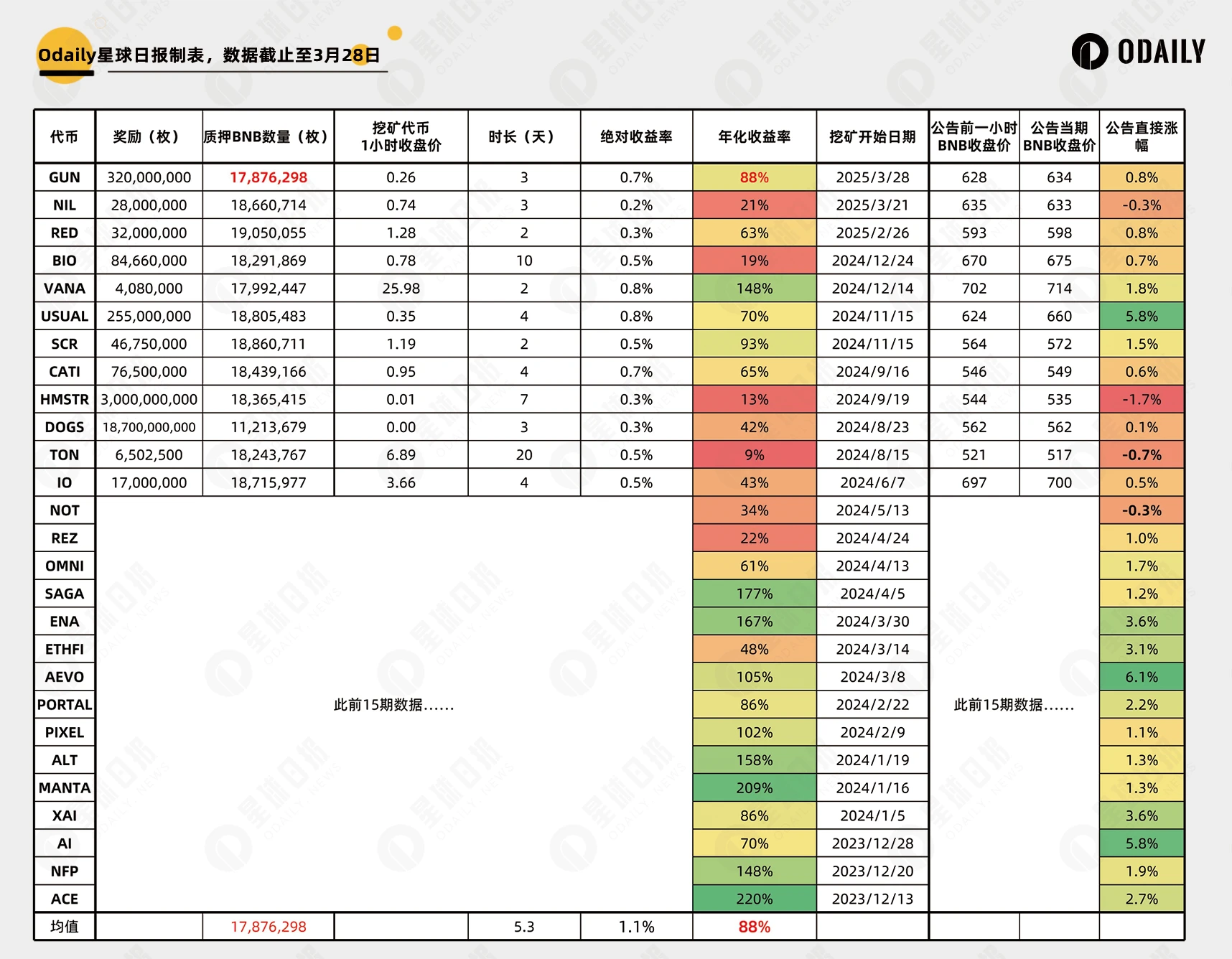

Launchpool收益预估

过去27期Launchpool数据如下图所示,可以明显看出Launchpool的收益率存在明显的下降趋势。27期的年化收益率均值为88%,按照这一收益率计算GUN的价格为0.26 USDT,但考虑到此前的几期表现不佳,建议保守估算,按照一半收益率则合理价格为0.13 USDT。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。