文/HedyBi

策划/Lola Wang

出品/OKGResearch

3月24日,美国总统特朗普的数字资产顾问委员会执行董事 Bo Hines 提出了一项极具争议性的建议——利用黄金储备的收益购买比特币,以“预算中性”的方式提升国家的比特币储备。就在数日前,国际货币基金组织(IMF)正式将比特币纳入全球经济统计体系。随着比特币被纳入《国际收支和国际投资头寸手册》(BPM7) ,各国央行和统计机构需要在国际收支和投资头寸报告中记录比特币交易和持仓情况。此举不仅是对比特币在国际金融体系中影响力的正式承认,也意味着它正逐步从一种投机性资产向更具制度化的金融工具演变,从国际层面上,比特币自3月20日起可成为国家的外汇储备选项。

然而,回到美国的这一提议,最耐人寻味的地方在于,美国提议用黄金——被市场奉为“终极避险资产”的储备——来换取比特币。这一提议本身引发了一个根本性的问题即黄金真的仍然是无可争议的避险资产吗?如果答案是肯定的,那从古希腊和罗马时期的金币时代,到如今已经数十个世纪,为什么没有任何公司采取类似Strategy(原微策略公司)在比特币市场中的激进模式来长期增持黄金?随着全球各国的政策制定者重新审视这一新兴资产在金融体系的定位,美国已经率先表明了态度,比特币能否成为金融范式转移的第一枪?

OKG Research于2025年推出特别专题「特朗普经济学」,将持续跟踪特朗普2.0时代下对加密行业以及全球市场带来的影响。本文将从比特币与黄金的对比切入,拆解美国此项耐人寻味的提议有何深意。

美国卖的不是真黄金?

美国以其官方黄金储备达8133.5吨,排名全球第一长达70年。但一个值得注意的事实是,这些黄金长期以来并未在市场上流通,而是存放在肯塔基州黄金储备库、丹佛、纽约联储等地。自 1971 年“尼克松冲击”终结布雷顿森林体系以来,美国的黄金储备已不再用于支撑美元,而是作为战略性储备资产,一般不会直接出售。

所以,美国如果要用“黄金储备的盈余”去购买比特币,最可能的方式是利用黄金相关的金融工具,而非出售实物黄金。

从历史上来看,美国财政部可以通过调整黄金的账面价值,在不增加实际黄金储备的情况下,凭空创造美元流动性。这种方法本质上是一种资产的“重估”操作,其实,也可以看作是一种另类的债务货币化。

目前,美国财政部在资产负债表上将黄金的账面价值固定在42.22美元/盎司,这个价格远低于目前黄金的市场价格——2200美元/盎司。若国会批准提高黄金的账面价格,财政部的黄金储备在账面上的价值将会大幅增加。基于这一新价格,财政部可以向美联储申请更多的黄金证书,而美联储则向财政部提供相应的新美元。

这意味着,美国可以在不与其他国家协商的情况下,通过调整黄金账面价值,实施一次“隐形的美元贬值”,同时创造大规模财政收入。这些新增的美元资金可以用来购买比特币,进一步增加美国的比特币储备。黄金重估所带来的财政收入不仅为比特币购买提供了资金支持,还可能在更广泛的金融背景下推动比特币的需求增加。特朗普2.0政府的经济顾问Stephen Ira Miran引用“特里芬难题”指出,美元作为全球储备货币的地位使美国面临长期的贸易逆差,黄金重估有助于打破这一恶性循环,避免利率飙升。在不释放过多流动性的情况下,比特币将受益于这一调整。

然而这样的方式,表面上能推动其他机构和投资者的跟随,进而吸引更多流动性注入比特币市场。但不可忽视的是,若市场认定美元失去信用是长期趋势,全球资产定价体系可能发生变化,比特币的价格发现机制可能变得更加不确定。

黄金市场从未自由过

如果美国财政部用重估黄金的方式,采用盈余的“账面价值”兑换美元来购买比特币,比特币市场可能迎来短期狂热,但同时面临监管收紧和流动性控制的风险,正如黄金曾因布雷顿森林体系的崩溃而进入“自由定价”时代——机会和不确定性并存下的价格波动。

但黄金市场从未真正自由。

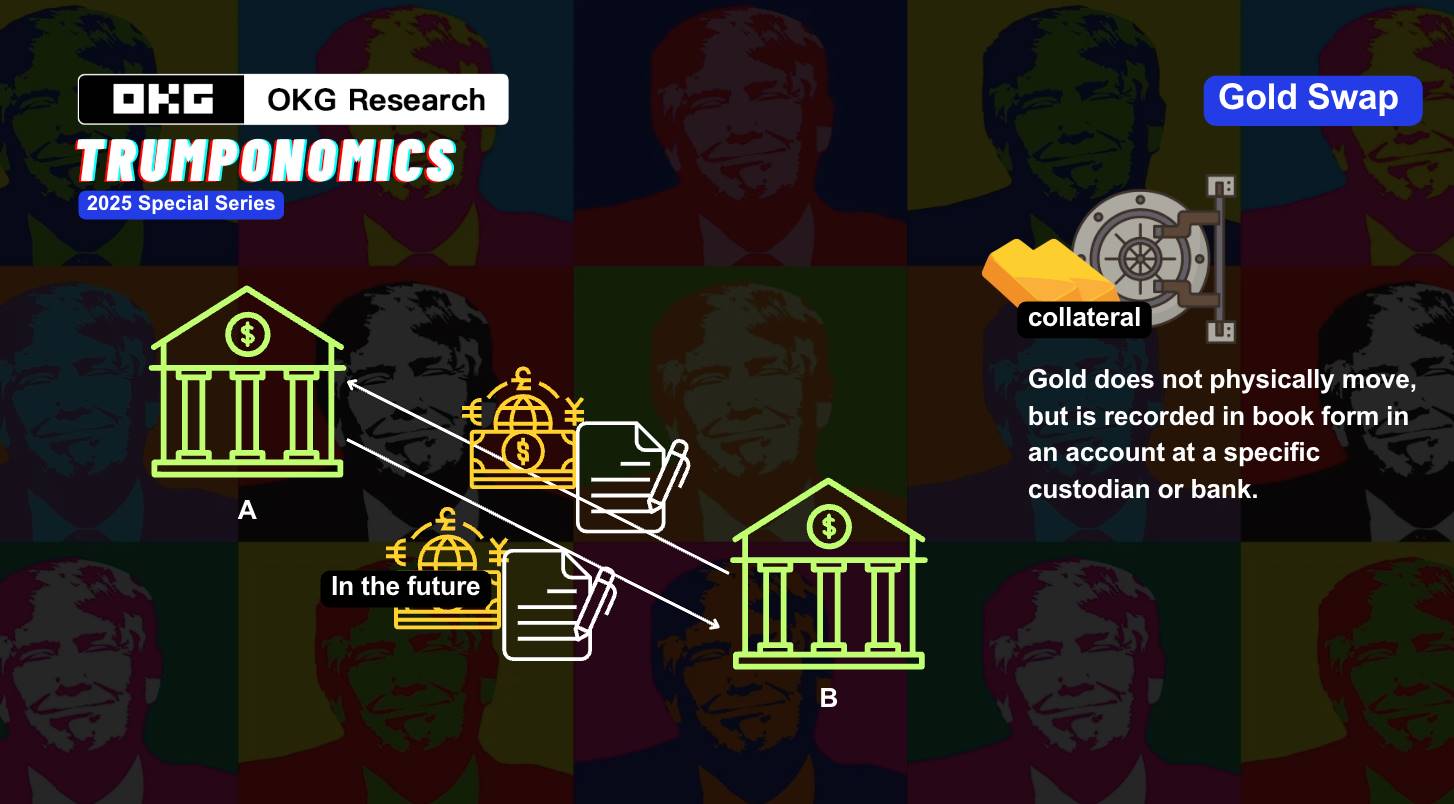

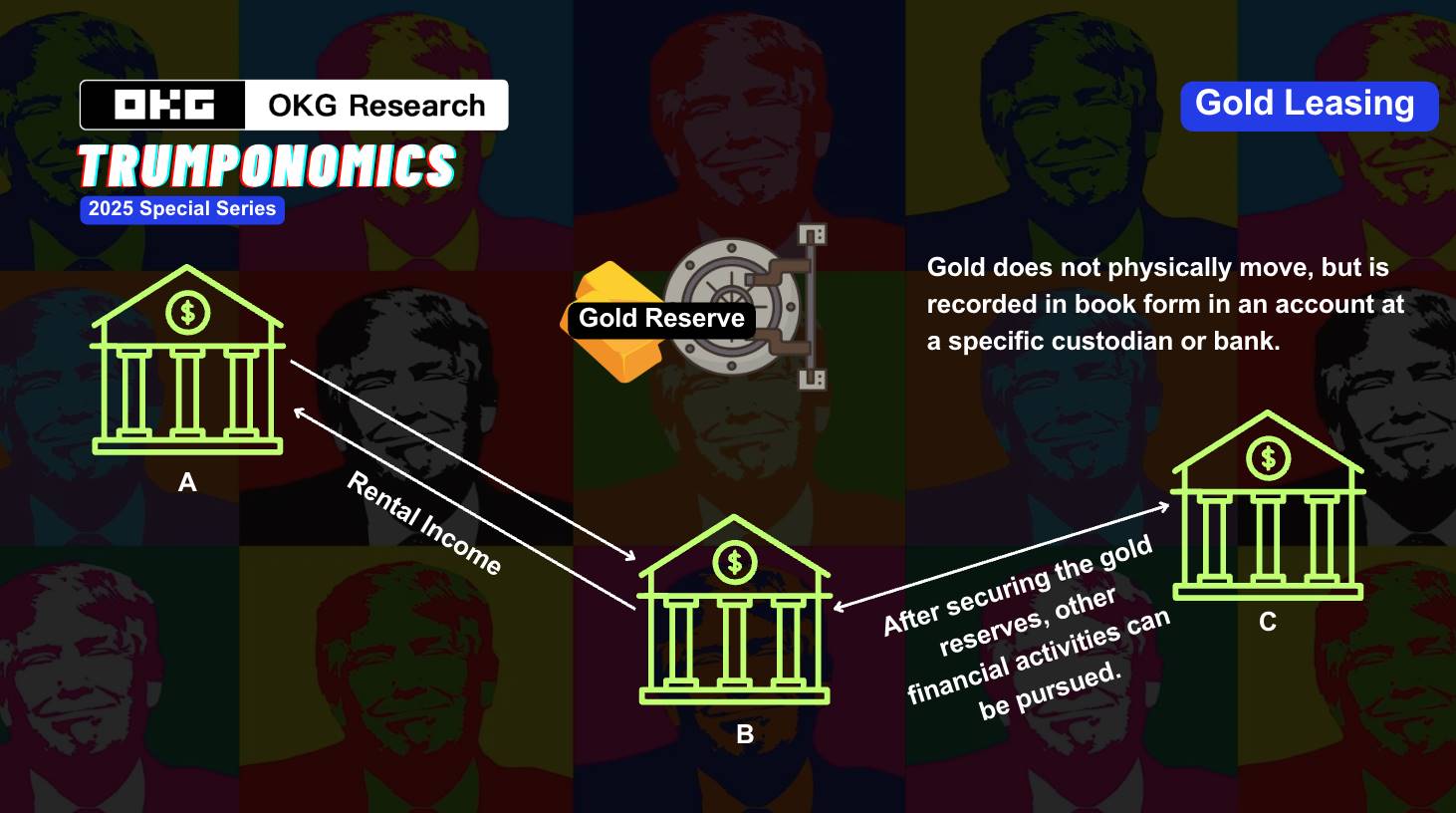

历史上,除了避险资产,黄金还扮演着货币体系的“影子杠杆”角色,利用黄金进行地缘政治博弈的历史不乏其例,最著名的案例之一便是1970年代的“黄金门事件”。在那个时期,美元的国际信誉因越战和其他内外因素遭遇冲击。为了稳住全球市场对美元的信心,美国通过提高黄金的相对价格来保护美元。此外,上世纪 80 年代,里根政府通过“黄金掉期(Gold Swap)”操作,间接干预市场价格;2000 年代,美联储通过黄金租赁市场释放流动性,以维持美元强势地位。

此外,黄金的信用也并非牢不可破。8133.5吨的数据是几十年来从未被接受独立审计的数字,Fort knox(诺克斯金库,位于肯塔基州)的黄金是否完好无损,一直是市场热议的“黑箱”问题。更重要的是,美国政府虽不直接抛售黄金,却可能通过金融衍生手段例如前文所提的“账面调整”等手段操纵其价值,实现影子货币政策操作。

更深层次的问题在于,如果黄金被重新估值以释放美元流动性,而比特币成为美元对冲工具,市场将如何重新定义信用?比特币是否真的会成为“数字黄金”,还是会像黄金一样,被美元体系所吸收并重新控制?

比特币,会成为美国影子货币政策Play 的一环吗?

若比特币可能正在走向类似黄金被美元体系被吸附与控制的命运,随着美国对比特币的持有兴趣上升,市场或将步入“比特币成为影子资产”阶段——官方承认比特币价值,却通过政策和金融工具限制其对现有体系的直接冲击。

假设美国政府将比特币纳入战略资产,并开始囤积比特币。比特币作为一种去中心化的资产,与传统的黄金不同,政府不可能直接控制比特币的供应量或价格。然而,政府可以通过影子机构(如比特币ETF或比特币信托基金等金融工具)进行市场操作,间接影响比特币的价格和市场情绪。

这些影子机构可以利用比特币市场的流动性和波动性,将大量比特币纳入“囤积”状态,以期在特定时机释放这些比特币,从而影响市场供需和价格走势。这种操作类似于黄金市场的“黄金掉期”和“黄金租赁”,不涉及实际的比特币交易,而是通过金融工具和市场策略实现目的。

更别提黄金衍生品的“泡沫”又或是黄金的真实存在:在2011年时,有分析师估计COMEX的纸面黄金与实物黄金的比例可能高达100:1。又或是存在的2013年的德国黄金回运长达7年之久,引发猜测称美联储可能没有足够的实物黄金,或者部分黄金已被租赁或抵押。

但比特币会重蹈覆辙吗?从当前区块链技术的发展趋势来看,答案或许是否定的。

1. 黄金的“黑箱” VS. 比特币的透明性

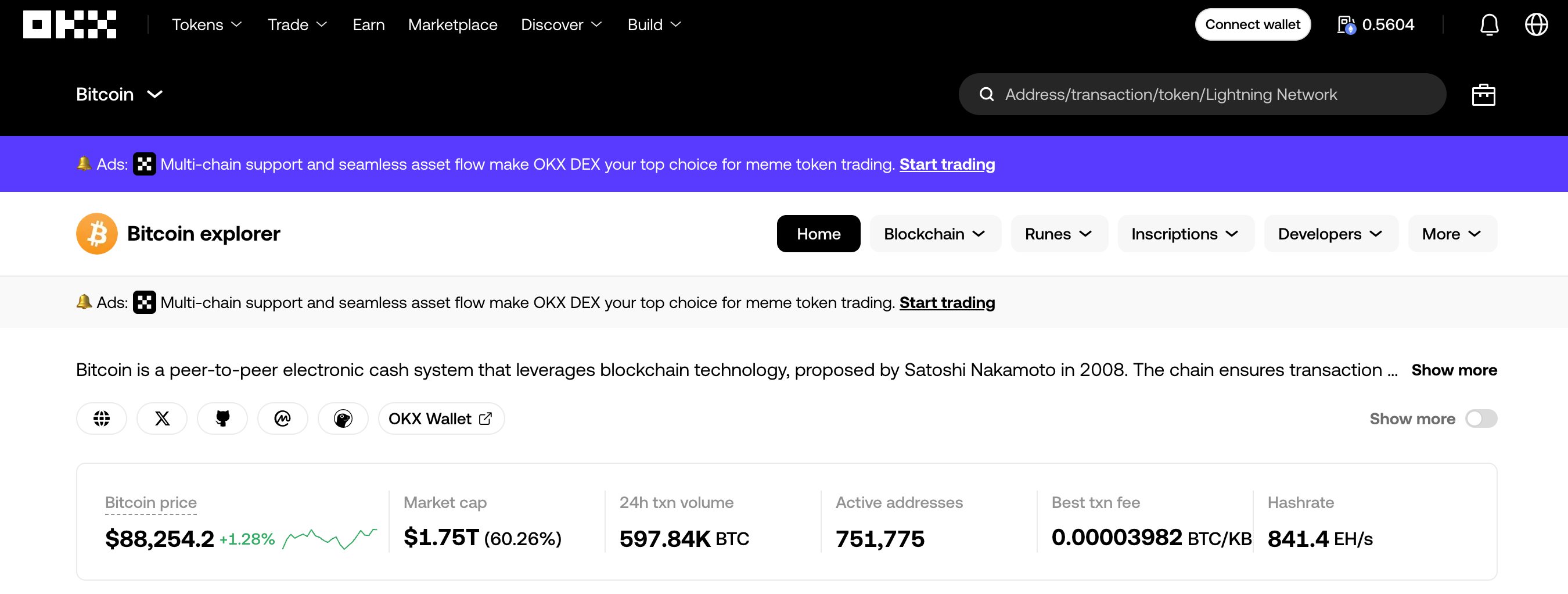

比特币并不是“黑箱”操作,所有交易链上可循。比特币的去中心化特性使其在透明度和可审计性方面优于黄金。作为区块链上的原生资产,比特币所有交易都是公开可审计的,任何人都可以通过链上数据工具(如OKX Explorer)追踪比特币的流通情况。

此外,比特币的网络是由去中心化的独立节点组成,每个节点都持有完整的交易账本,并且共同验证交易,单一的机构或者国家无法篡改或操作比特币的交易数据。比特币无需依赖第三方机构进行审计,根据OKX Explorer的链上数据显示,巨鲸钱包(1000+ BTC)的总持有量维持在30%~35%,即600万~700万BTC,仅这一项已经高于目前的中心化交易所热钱包比特币存储以及机构托管和ETF的比例,主要存放在链上的比特币钱包的资金流动是完全公开且全球可查询的。

实时的效率远高于大多数国家以季度或者年度为周期进行更新的黄金储备报告,也不会再次出现像美国曾丢失了7份诺克斯堡黄金审计报告的情况。由于储备报告的滞后性,市场对这些变化的反应也往往滞后。

2. 金融挤兑风险VS. 比特币的抗风险能力

传统金融体系的问题之一,是银行和金融机构的集中化管理模式,这种模式带来了系统性风险。例如,在2008年金融危机期间,雷曼兄弟的倒闭引发了连锁反应,而2023年硅谷银行(SVB)的破产再次让市场意识到银行体系的脆弱性。当市场出现流动性恐慌时,银行可能会面临大规模挤兑,而传统金融系统依赖于政府的紧急救助和美联储的货币政策干预来维持稳定。

即使储存在中心化交易所的比特币,也有技术办法来证明中心化交易所的实际存储情况。OKX于2022年11月23日正式推出其PoR计划(Proof of Reserves, PoR),并将其作为透明度和用户保护的核心工具。超额PoR(即 PoR 大于 100%)意味着交易所或托管机构持有的资产不仅覆盖所有用户存款,还额外储备了一定比例的资金。这一超额部分可充当安全缓冲,确保即使在极端市场波动或部分资产意外损失的情况下,机构仍有足够的储备满足所有用户的提款需求。而不会出现类似传统银行体系的“部分准备金”模式。相比之下,传统金融体系中的银行储备率通常远低于100%,一旦信任危机爆发,银行便会面临严重的流动性问题。

美国将黄金重新估值并通过这一方式创造“新”美元,再用这些资金购买比特币的策略,不仅是一种影子货币操作,也暴露了全球金融体系的脆弱性。比特币能否在此过程中真正成为独立的自由的“数字黄金”,而非仅仅是美国金融体系的附属品,我们尚未得知。但从技术层面去看,无论是链上的实时可查询交易还是中心化机构的PoR都为传统金融体系提供了全新的解决方案。用黄金换比特币的提议则开启了一场关于未来金融体系的深刻对话。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。