Author: BUBBLE

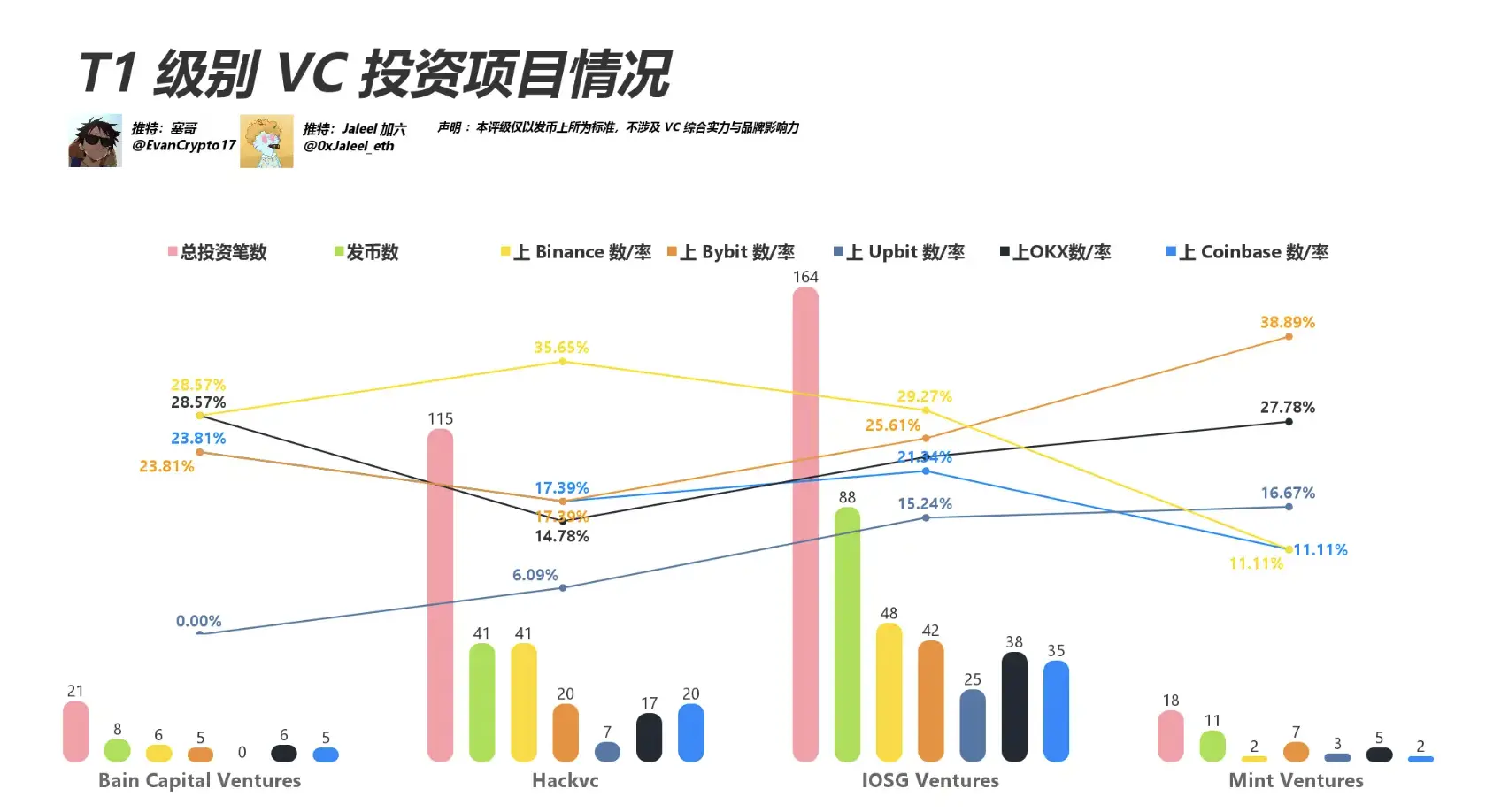

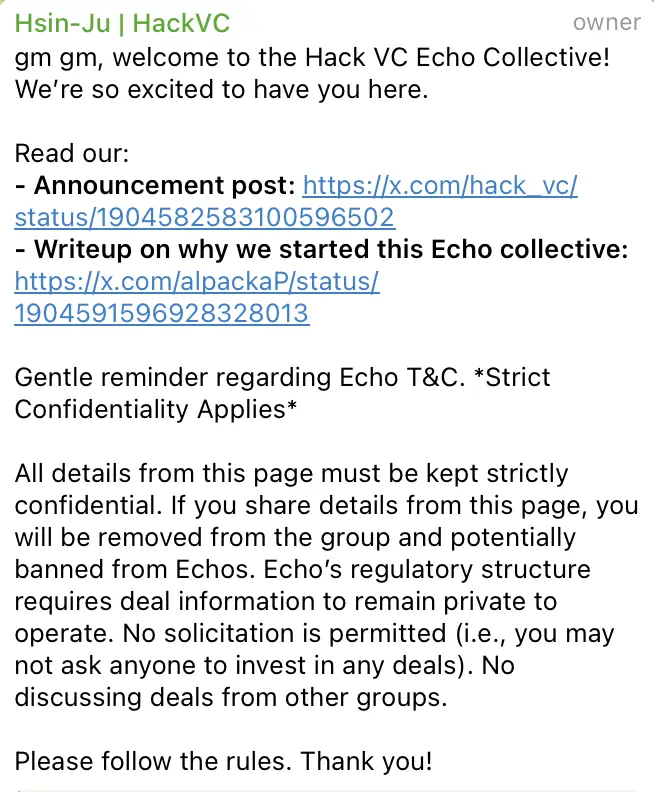

Recently, the well-known blockchain venture capital firm HackVC announced the launch of a community round investment group on Echo. As one of the first regulated U.S. crypto fund management companies to introduce a "community round" on Echo, they hope to use this opportunity to make Hack VC a truly community-oriented VC. After the crypto market gradually lost trust in VCs, it seems that VCs are also beginning to seek transformation, hoping to be closer to the market.

HackVC's founder, Alexander Pack, made his first investment in cryptocurrency at the age of 22 at a venture capital firm in Hong Kong focused on fintech. At that time, the cryptocurrency market was still in its infancy, but Pack believed it would be the trend of the future. He later returned to the U.S. to join Bain Capital, helping it invest in crypto assets. In 2018, Alexander ventured out on his own, co-founding the crypto venture capital fund Dragonfly Capital with Feng Bo, and served as its first managing partner. The firm has since become one of the largest crypto funds in Asia. In 2020, Alexander left Dragonfly Capital and founded Hack VC.

From its name alone, it is clear that HackVC places a strong emphasis on technology in its investments. In Pack's own words, HackVC is a group of hackers investing in another group of hackers. Managing partner Ed Roman initiated the well-known hackathon event hack.summit(), while research partners Christopher Maree and Sean Brown come from the oracle team at UMA. The former was a member of the Ethereum Foundation's Devcon V Scholar program, and the latter served as a senior advisor for IBM Blockchain. It can be said that HackVC's investment preferences focus to some extent on the feasibility and scalability of technology.

This has allowed HackVC to achieve quite good results in this round of investments, having invested early in high-quality projects such as Berachain, EigenLayer, Morpho, Grass, and Soon.

Finding the Original Intention of the "Echo Model"

However, with the emergence of investment ecosystems like Agency's research and KOL rounds, which feature shorter financing cycles, deeper project participation, and higher success rates, VCs seem to need to find better investment logic and models.

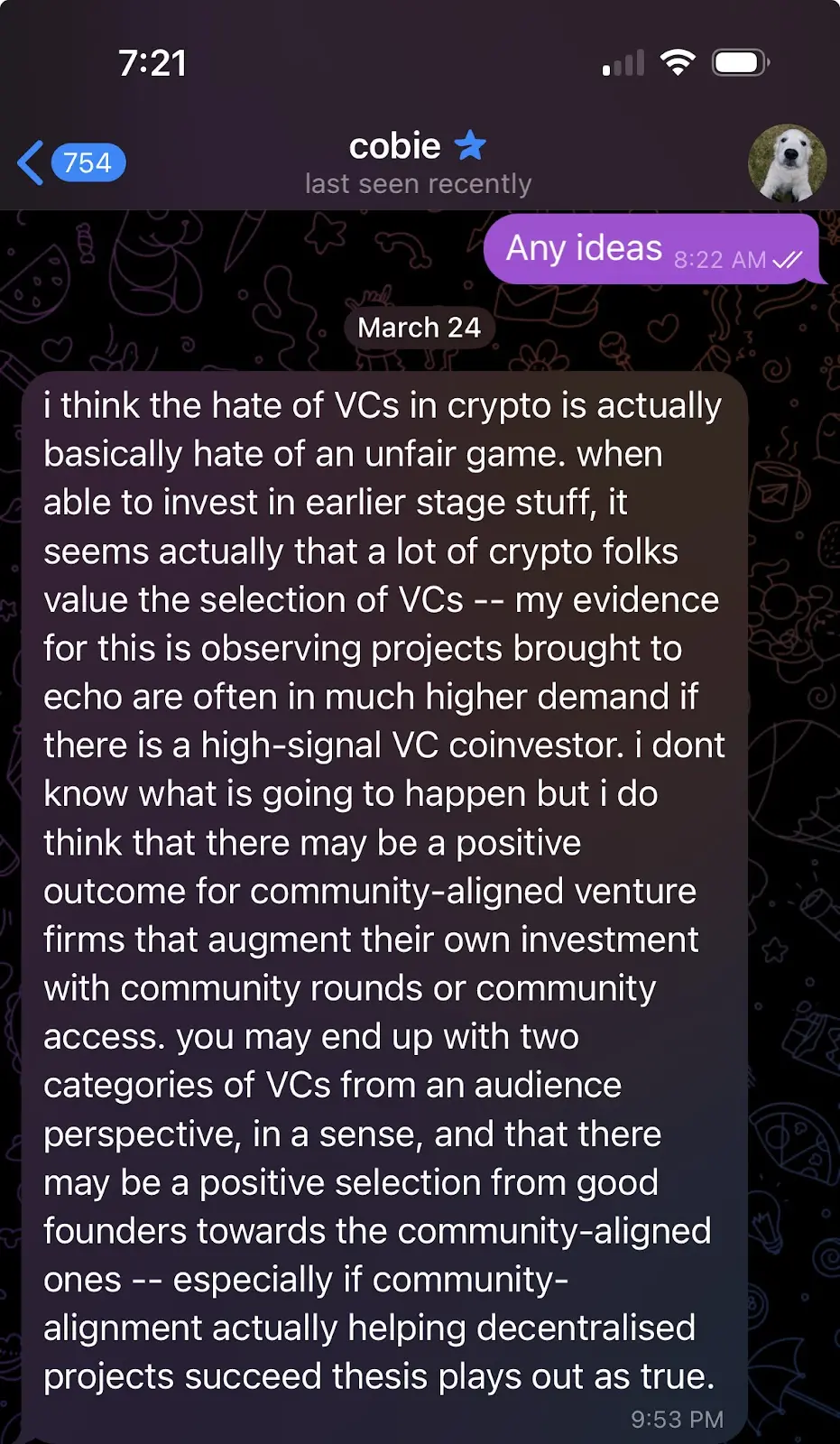

The dialogue between Pack and Echo's founder Cobie reflects the purpose of Echo. Cobie believes that the current cryptocurrency community's dislike for venture capital "VCs" is actually a dislike for unfair games. When individuals can invest in the early stages, projects backed by high-signal VC firms usually have higher demand. Cobie believes that a community-friendly VC may emerge, which will enhance its investments through community rounds or community access. If community alignment can indeed help blockchain projects succeed, it will allow VCs to make positive selections from good founders aligned with the community.

This undoubtedly aligns with Pack's philosophy. He stated on Twitter that he entered the cryptocurrency field 11 years ago because he believed that cryptocurrency could democratize the channels for technology investment. Early in his career, he participated in the crowdfunding platform AngelList and became its first analyst, helping AngelList legalize crowdfunding through the CROWDFUND Act in 2012. However, it did not meet Pack's expectations, as regulatory red tape hindered progress, and most Web2 founders and venture capitalists did not see the value of bringing their "community" into financing rounds.

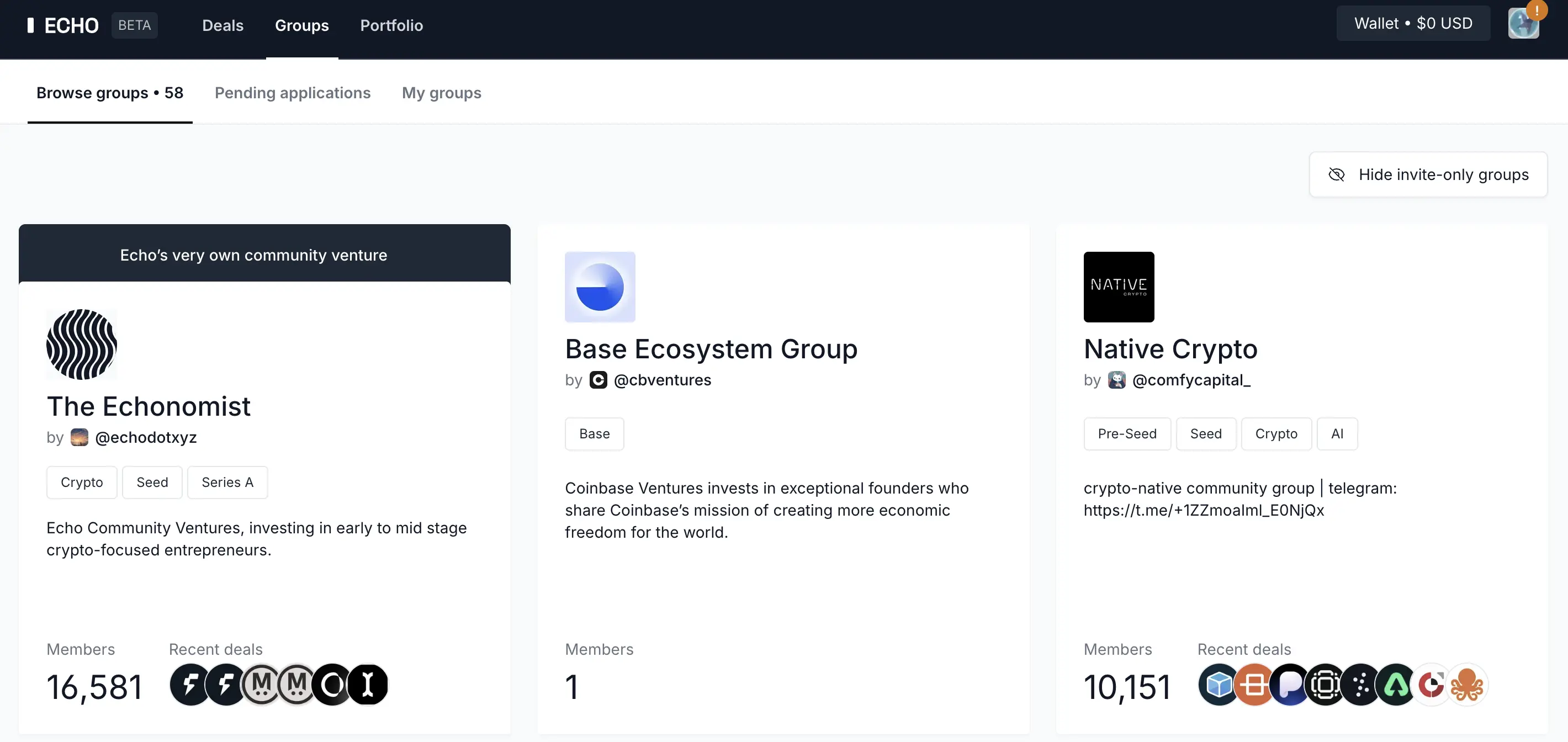

The Echo model is indeed different from traditional ICO platforms. Echo was founded by crypto KOL Cobie "@echodotxyz" in March 2024. Cobie was previously the head of growth at Lido and hosted the popular Web3 podcast UpOnly. The core of Echo lies in the "lead investor recommendation mechanism," where users can create investment communities as lead investors, share projects with members, and earn a share of the profits.

Compared to the model of the established ICO platform Coinlist, where investors directly support projects allowing them to raise funds quickly, Echo's business model promotes the formation of community capital for the "token economy," allowing on-chain native users to invest in startups through group investments. The process involves lead investors creating investment groups, and group members can choose to follow the investment, with funds flowing indirectly to the company through intermediary investment tools. The investment may involve not only token rights but also company equity. In simple terms, Coinlist invests in the tokens of companies/projects, while Echo invests directly in companies through intermediaries.

Since its launch, over 30 crypto projects have raised funds through Echo, including well-known projects like Ethena, Morph, Usual, Hyperlane, Dawn, Monad, and MegaETH. In one year, a total of $100 million was raised, with MegaETH completing $10 million in funding through the Echo platform in two rounds in December 2024, with the first round raising $4.2 million in 56 seconds and the second round raising $5.8 million in 75 seconds.

The model is similar to an "elite alliance" for crypto investors, inclined to choose high-potential projects recognized by a small circle, such as Larry Cermak, CEO of The Block, and Marc Zeller, founder of Aave, who have created their own Echo communities. Users wishing to join must first answer some questions and undergo identity KYC verification. Additionally, some communities require certain conditions to be met to gain access to specific investment opportunities, with a total of 58 community leaders having created communities on Echo.

This community-driven model manages investments through smart contracts, ensuring that lead investors do not access user funds and allowing users to decide when to sell tokens. If lead investors succeed in their investments, they can earn a percentage of the profits from followers, incentivizing quality projects to share. Although its elite orientation makes its user base relatively niche, this screening mechanism ensures project quality and attracts trust-focused investors.

Coinbase's Vice President of Corporate Development, Shan Aggarwal, and Base founder Jesse Pollak stated in a statement, "On-chain investment allows qualified investors to participate in ways that were previously unattainable, while enabling founders to access a broader and more vibrant capital base. We are excited to expand the capital channels for Base builders, allowing more people to participate in the next wave of innovation."

Some industry experts suggest that the more relaxed regulatory environment in the U.S. may lead to a revival of public sales. Matt O'Connor, co-founder of the currently popular ICO platform Legion, stated, "Once ICOs regain vitality, they may shift their focus away from the memecoin craze." In the current period, there are fewer real products being built, while more wealth is being accumulated behind the scenes.

HackVC's Initial Attempt with the Community

Hack VC has launched the Echo group, deciding to open core project resources to selected high-quality community members through a privatized access mechanism, while implementing a zero-performance fee policy for the first year. Additionally, it requires invested companies to set up community financing rounds and implement a "community-first protection" principle in their valuation system. This means that if it is a first-time investment, the community round valuation must be lower than the concurrent institutional round; if it is not the first time, it must be lower than the latest VC entry valuation, ensuring that the community gains a price advantage through structural design.

Although there are still many discussions in the community about this model lacking "governance tokens" and not being a "DAO," regardless of the outcome of HackVC's attempt, it has set a precedent for future VC and community collaborative project development models. The evolution of cryptocurrency financing models is a history of continuous innovation in community coordination mechanisms, from the Bitcoin PoW mechanism opening the era of fair mining, to Ethereum's $18 million crowdfunding in 2014 pioneering on-chain financing, and then to the ICO boom in 2017, where community-driven efforts have always been the core thread.

Subsequently, the ICO era explored two paths: centralized platforms like CoinList successfully operated star projects like Solana but were limited in scale; while on-chain airdrops and yield farming, although lowering barriers, faced the dilemma of user commitment loss.

Now, under the mature background of compliance frameworks and on-chain infrastructure, Echo reconstructs the crowdfunding process through a non-custodial Syndicate model, and Legion introduces an on-chain reputation system to optimize investor screening, marking the entry of community financing into the next stage. It inherits the open gene of ICOs while balancing efficiency and fairness through technological means, suggesting that a new era of compliant and refined operations may be on the horizon.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。