You may be struggling, stumbling and bruised, writing down your grievances and complaints in your state of mind. Perhaps someone will comfort you, but they won't truly empathize. This world is like that; it only sees the sweat of the victors but not the tears of the defeated. You must understand that you are not the only one busy; everyone is silently putting in effort with their own concerns. So your little pain really doesn't count for much. Treat your hardships as gifts; being forever on the road is a scenery that never changes throughout life.

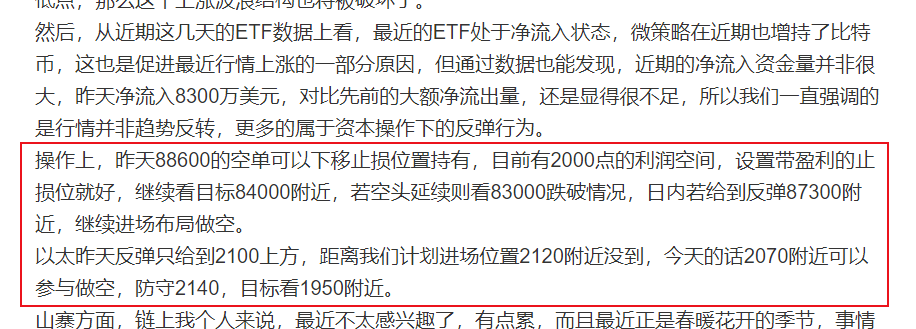

Yesterday, I had some matters to attend to, so I didn't update the article. I took a brief look, and the market from the day before was still somewhat surprising. Since the pullback began, we analyzed the support level at 86000, and the rebound that eventually emerged from this support was somewhat strong, reaching around 88500. Overall, the market in the past two days has been in a high-level fluctuation, with a fluctuation space of over two thousand points, and there hasn't been a clear trend yet. In terms of operations, there's not much to say; I've been shorting these past two days, with a short plan set at 87300. Without adding to my position later, I'm currently around the cost level.

On the market, the current situation is trapped in high-level fluctuations. On the daily level, after a surge, the market has seen two consecutive days of bearish K-lines. Currently, it is retreating and fluctuating above the MA7 line, supported by various moving averages. The technical indicator MACD's bullish cycle volume has begun to shrink. After briefly breaking the 86000 support yesterday, it quickly recovered. Today, we need to pay attention to the fact that if the market falls below this level again, it will establish a short-term pullback trend, further testing the support below.

On the four-hour level, the K-line structure shows disordered fluctuations. After testing the support yesterday, it rebounded again, showing a bit of a stalemate. Currently, in terms of technical indicators, MACD has entered a bearish adjustment period, with various indicator lines slightly moving downward. Structurally, today, around 86000 is still a short-term support level, and below that is 84000, which is also a densely packed area of bullish liquidity. On the upside, the bulls need to push above 89000 in the short term, which would form a bullish extension wave, creating a relay-type bullish performance trend.

The most critical news currently is the tariff policy. Yesterday, Trump announced a 25% tariff on all imported cars, stating that the reciprocal tariff plan would be "lenient." Insiders say that Trump will accelerate the collection of copper tariffs, which may be implemented in a few weeks. Affected by the tariff policy, U.S. stocks initially opened lower, which then impacted the crypto market. This is also the main news recently, and the bearish influence still exists.

In terms of operations, we have previously laid out short positions. I was delayed yesterday, but the shorts have generally been profitable. Those who still have shorts from 88600 and later at 87300 can continue to hold. Today, it's still advisable to short in the 87500-88000 range, with a unified defense at 89000 and a target at 84000, then we will see if the bearish trend continues.

For Ethereum, following the previous operation to short at 2070, there is profit potential. Recently, Ethereum feels like it is brewing a major market movement, with the trend beginning to show signs of differentiation, but it still needs time to build momentum. On-chain data shows that the inflow of funds into Ethereum is decent, but I haven't seen an independent market yet, so let's wait and see. Currently, the operation is still to follow Bitcoin for shorting, with participation around 2040, adding to the position at 2120, defending at 2160, and targeting 1880-1830.

【The above analysis and strategies are for reference only. Please bear the risk yourself. The article is subject to review and publication, and market conditions change in real-time. The information may be outdated, and specific operations should follow real-time strategies. Feel free to contact and discuss the market.】

Scan to follow!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。