来源: Cointelegraph原文: 《{title}》

美国证券交易委员会(SEC)在3月21日举办首场加密货币圆桌会议后,计划再举办四场加密货币圆桌会议——重点关注加密货币交易、托管、代币化和去中心化金融(DeFi)。

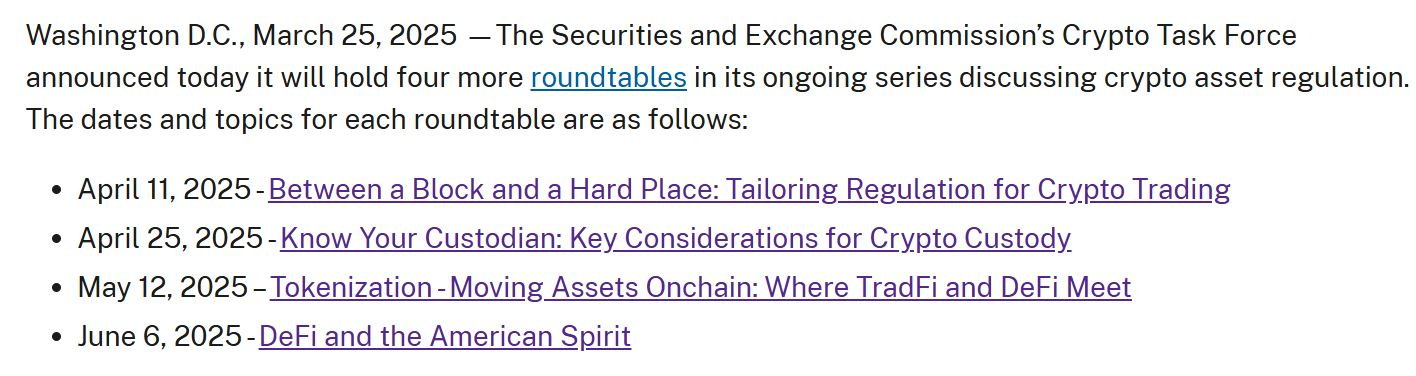

根据SEC在3月25日的声明,由SEC加密货币工作组组织的这一系列圆桌会议将于4月11日开始,首先讨论为加密货币交易量身定制监管。

随后,4月25日将举行关于加密货币托管的圆桌会议,5月12日将讨论代币化和资产上链。该系列的第四场圆桌会议将于6月6日讨论DeFi。

4月到6月计划举行四场加密货币圆桌讨论会。来源:SEC

“加密货币工作组圆桌会议让我们有机会听到专家之间的热烈讨论,了解监管问题是什么,以及委员会可以做什么来解决这些问题,”SEC委员、工作组的负责人Hester Peirce表示。

每场圆桌会议的具体议程和发言人尚未公布,但所有会议都向公众开放,可以在线观看或前往SEC位于华盛顿特区的总部参加。

该机构的加密货币工作组由SEC代理主席Mark Uyeda于1月21日成立。工作组的任务是建立一个可行的加密货币框架供该机构使用。

该工作组于3月21日举行了首场圆桌会议,讨论主题为“我们如何走到这一步以及如何走出困境——定义证券地位”。

根据3月25日的公告,SEC还将于3月27日举办一场关于人工智能在金融行业中的作用的圆桌会议。

Join us on March 27 for a roundtable discussion on artificial intelligence in the financial industry. Topics include the risks, benefits, and governance of AI.More details: https://t.co/ekX2RWp2KQ pic.twitter.com/7fH3j1tlwj

该圆桌会议将讨论人工智能在金融行业中的风险、益处和治理,Uyeda、Peirce和SEC委员Caroline Crenshaw将发表讲话。

在特朗普政府领导下,SEC正逐步放松其在前SEC主席Gary Gensler领导下对加密货币形成的强硬立场。

监管机构已经撤销了越来越多的在Gensler领导下对加密货币公司发起的执法行动。

Uyeda在Gensler于1月20日辞职后接任,他于3月17日表示计划废除拜登政府时期提出的一项规则,该规则将收紧投资顾问的加密货币托管标准。

Uyeda还在3月10日的演讲中表示,他已要求SEC工作人员提供选项,以放弃部分拟议的变更,这些变更将扩大对替代交易系统的监管范围以包括加密货币公司,要求它们注册为交易所。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。