As of March 26, 2025, Bitcoin (BTC/USDT) has recently shown a characteristic of pullback and consolidation. We conduct an in-depth analysis from three dimensions: candlestick patterns, large fund flows, and technical indicators, and make precise predictions for today's market.

Candlestick Pattern Analysis

- Trend Structure

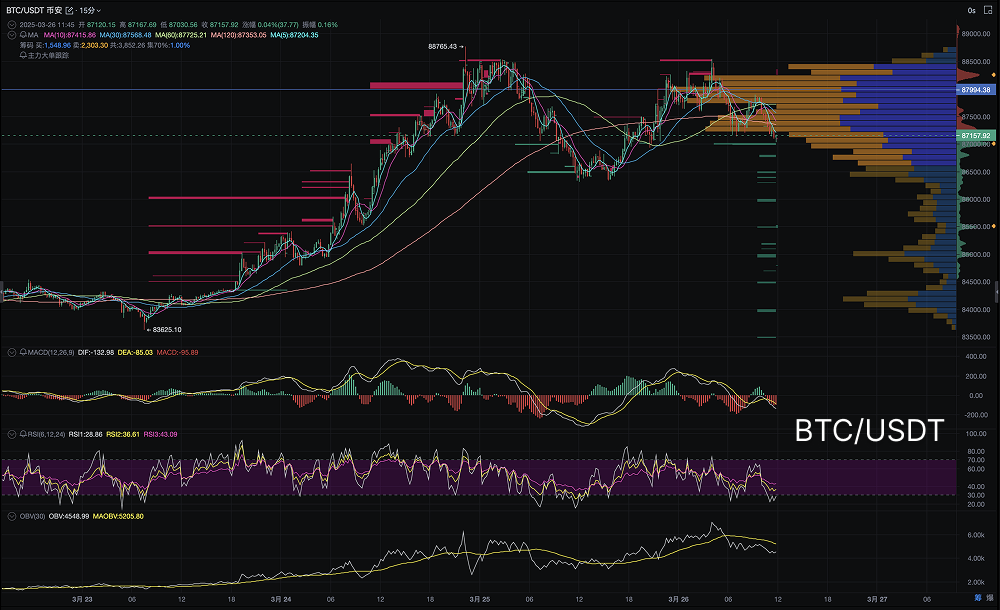

Bitcoin has recently shown an upward trend, forming a steady rising structure before March 24, and then entering a phase of consolidation and pullback.

A local top was formed near 88765.43 USDT, followed by multiple retests that failed to effectively break the previous high, indicating strong selling pressure at this level.

Currently, the candlestick is testing the short-term support area (around 87000 USDT). If this support is lost, it may further dip into the 86500-86000 USDT range.

- Volume Analysis

The rising phase was accompanied by a significant increase in volume, indicating strong buying momentum.

In the recent pullback phase, trading volume has decreased, suggesting that the market is in a wait-and-see state, with relatively low bearish pressure, but short-term funds still show signs of exiting.

Observing the right-side VPVR (Volume Profile), the current main trading concentration is in the 87000-88000 USDT range. If the price falls below 87157 USDT, it may accelerate downward.

Large Fund Movements

From tracking large orders, it can be seen that a large number of sell orders appeared near 88500 USDT, indicating that some funds chose to take profits.

The OBV (On-Balance Volume) shows a certain downward trend, but there has not yet been a significant outflow warning, indicating that market sentiment is still in an adjustment phase.

The large buy order support area is mainly concentrated in the 86000-86500 USDT range, which may become a short-term support.

Technical Indicator Interpretation

Moving Average System: MA5, MA10, and MA20 are converging, indicating an unclear short-term direction, with the market in a consolidation pattern. MA60 still maintains an upward trend, indicating that the overall bullish trend remains intact, but short-term pullback pressure persists.

MACD Momentum: DIF has crossed below DEA, and the MACD histogram has turned green, indicating a short-term bearish advantage. However, bearish momentum has weakened compared to the previous period, and the market may gradually enter a consolidation bottoming phase.

RSI Strength: RSI (6,12,24) has fallen to the 30-40 range, approaching the oversold area, raising expectations for a short-term rebound. However, reversal signals have not yet been established, and a second bottom test may be needed for stabilization.

Today's Market Outlook

Short-term (1-3 hours)

If the 87150 USDT support holds, the rebound target points to 88000 USDT; if the rebound is weak, the price may further dip to 86500-86000 USDT.

Intraday (4-12 hours)

- Bullish Scenario: If it stabilizes above 87150 USDT and breaks through 88000 USDT, it could rise to 88700-89000 USDT.

- Bearish Scenario: If it loses 87000 USDT, the next support level of 86500 USDT, or even 86000 USDT, will be tested.

Trading Suggestions

- Long Position Strategy: If the price stabilizes at 87150 USDT, consider light buying, targeting 88000 USDT.

- Short Position Strategy: Observe after breaking below 87000 USDT, and wait for stabilization at 86500 USDT before planning further.

Summary and Outlook

Bitcoin is currently in a pullback and consolidation phase, with cautious market sentiment, but the overall bullish trend remains intact. If the short-term support at 87000 USDT is lost, the downside may open up to 86500 USDT. Investors are advised to remain patient and wait for key support to stabilize before taking action, while also being wary of short-term volatility risks.

This article represents the author's personal views and does not reflect the stance and views of this platform. This article is for information sharing only and does not constitute any investment advice to anyone.

AiCoin Official Website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AiCoinzh

Email: support@aicoin.com

Group Chat: Customer Service Yingying、Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。