【加密货币行情解读与操作策略】

比特币(大饼)方面: 昨日多头再次发力,成功突破88000美元关键心理关口,最高触及88800美元后进入技术性回调。从1小时级别K线观察,布林带通道呈现"三线平行"的收敛形态(上轨88800,中轨87500,下轨86300),这种形态通常预示价格进入震荡蓄力阶段。当前币价在中轨87500附近徘徊,如同弹簧压缩等待方向选择——若多头能强势突破并站稳88800上方,则上涨空间将彻底打开,预计将向92000-94000美元高位发起冲击,反之若失守86300支撑,则可能回踩8万-8.2万美元平台。因为从日线级别可以看出上一阶段的阻力在9.2万-9.4万;日线级别需要注意的是,目前k线触及布林带上轨有承压,如果多头站稳不了88800上方,可以能日线级别8.2万-8.6万区间震荡一段时间。

操作建议:

长线思路:可以在86300-87500区间可以分批建仓多单,待行情突破上方关卡,目标可以看至9万上方至92000-94000区间,然后可以平掉多单,反向分批建仓空单。

短线思路:可以围绕1小时布林带上下轨边沿开展操作,靠近上轨轻仓试空,接近下轨分批做多

激进型:等待明确突破88800后回踩顺势追多,或在有效跌破86000后反弹反手做空

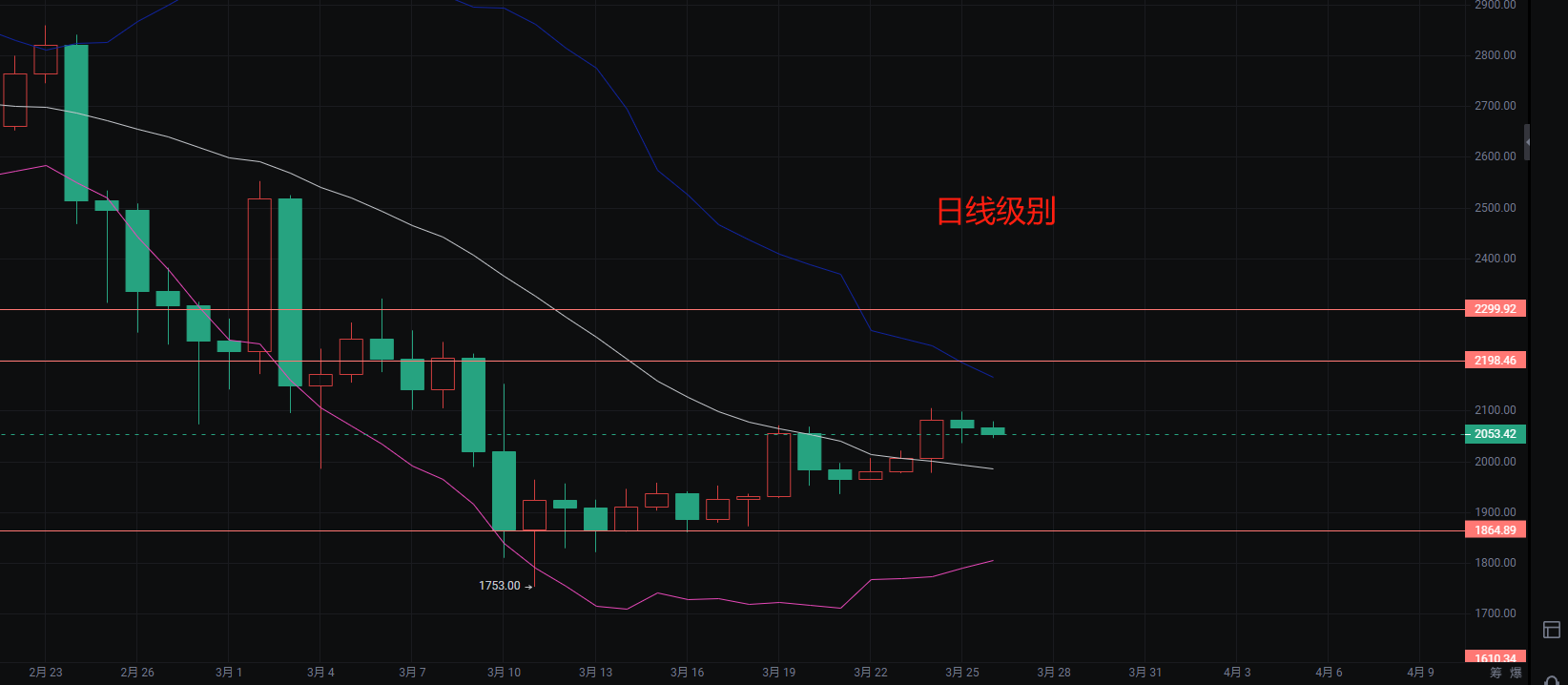

以太坊(ETH)方面: 相较于比特币的波动,以太坊近期走势更为温和。昨日短暂上探2100美元后回落,目前维持2050-2080美元窄幅震荡(波动幅度仅1.5%)。这种"温水煮青蛙"的行情显示市场观望情绪浓厚,需重点关注2050支撑位是否稳固,以及能否重新站稳2100美元激活买盘。

操作策略:

长线思路:可以在2030-2060区间分批布局多单,待上方突破有限阻力2100并站稳,可以看至2200-2300区间,具体策略思路要结合盘面实际情况来及时应对(因为以太有时候妖起来会不跟大饼同步的)

短线思路:可以围绕2050-2080区间高抛低吸来回撸,上下突破2030或2100即可止损,带走势明朗再继续操作

激进型:放量突破2085可回踩开多看向2120,若跌破2040则考虑短空至2000关口

(注:📣 由于公开平台的信息时效性和深度有限,市场瞬息万变,关键拐点、精准操作策略、突发风险提示,等内容需在(公众号——比特大熊)第一时间同步。在这里,你能获得: 实时策略推送,深度分析支持、互动答疑,针对个人持仓提供风险预警和优化建议。 🚨 谨记:市场永远奖励行动更快、信息更准的人!做少数派的赢家。)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。