原创 | Odaily星球日报(@OdailyChina)

作者|Azuma(@azuma_eth)

昨日晚间,曾在美国大选期间爆火的预测市场 Polymarket 遭遇了项目创立以来最严重的一次于预言机操控攻击,导致一个押注规模超 700 万美元的预测池给出了错误的结果判定,最终押注了正确结果的用户们损失惨重,反而是押注了错误结果的用户们拿走了奖池内的所有资金。

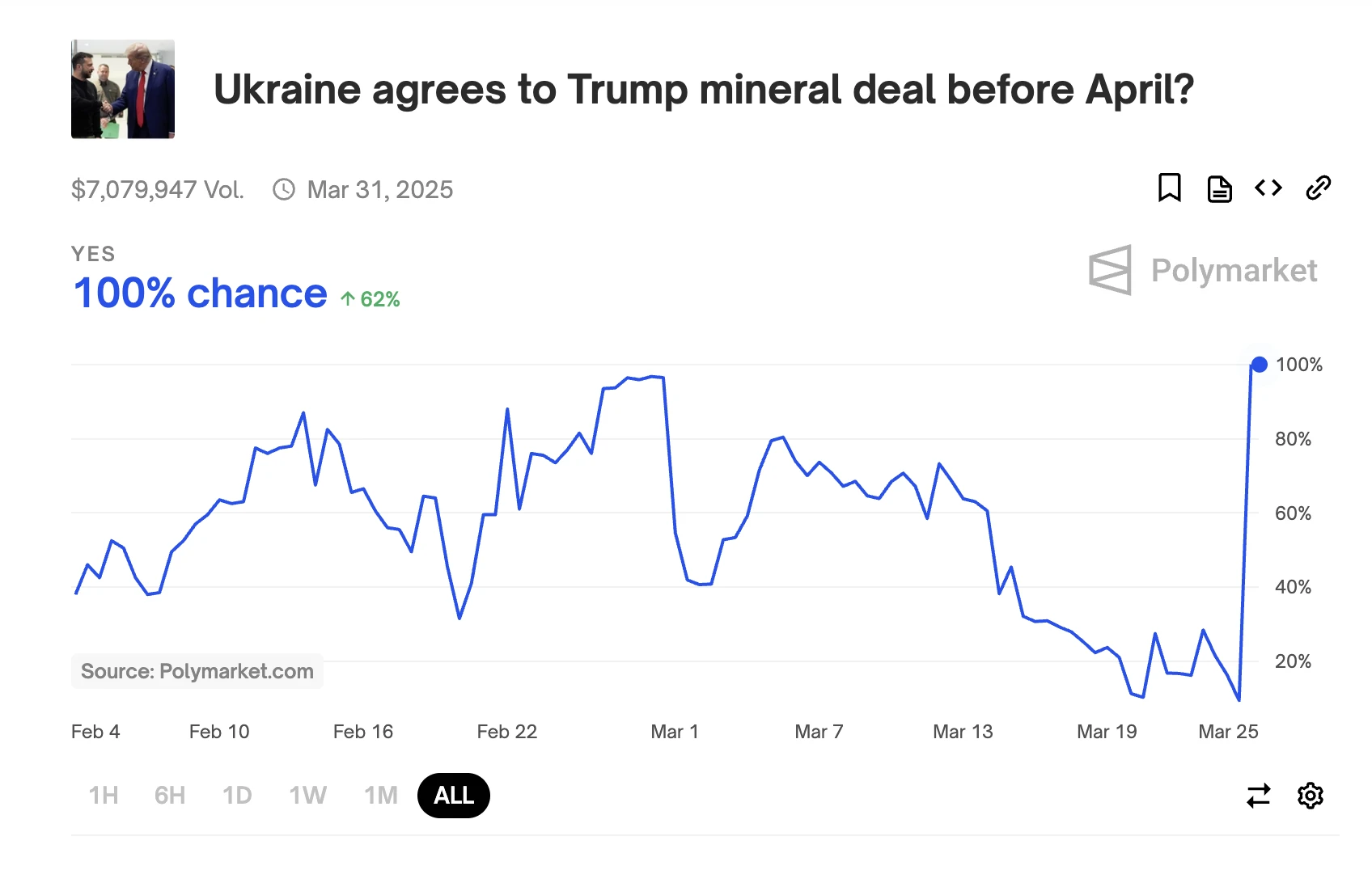

涉事预测池为“乌克兰是否会在四月之前与特朗普达成稀土交易协议”,在现实世界中,美乌双方尚未就该交易达成协定,所以该预测池的判定结果理应为“否”。然而如下图所示,该预测池的判定结果在结算之前意外地转向了“是”,最终造成了这一是非颠倒的局面。

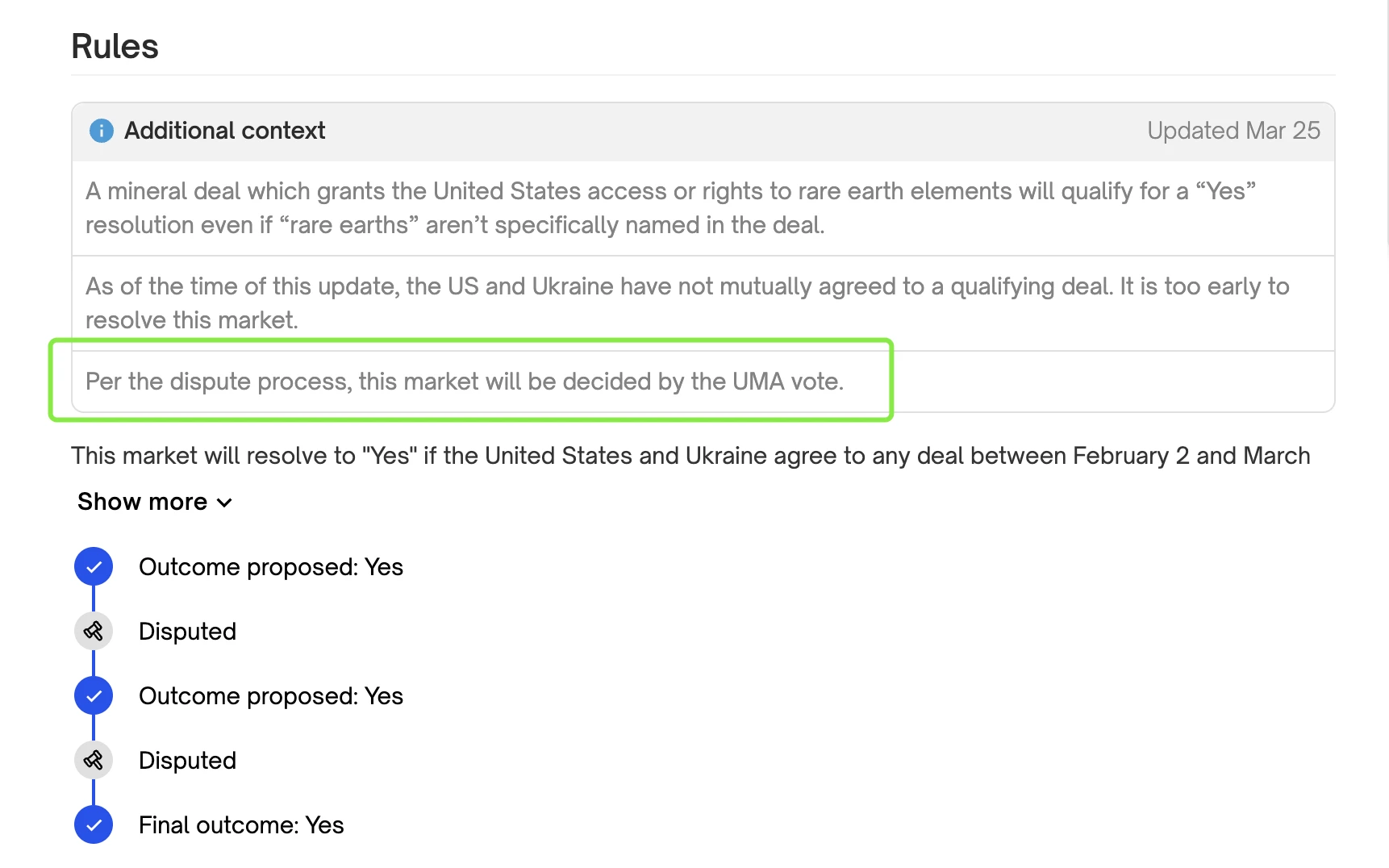

为什么会出现这种情况呢?答案在于Polymarket 的判定机制上。Polymarket 依赖于预言机 UMA 来进行事件的结果判定,其判定流程如下:

结果报告:事件发生后,任何人可以向 UMA 报告结果。

争议窗口:报告提交后会有一个争议期,任何人若认为报告有误均可提出争议。若无人争议,报告结果将被接受;若有争议,UMA 的争议解决机制会决定最终结果。

争议解决:UMA 代币持有者需投票决定正确结果,UMA 会对诚实行为进行激励,并对作恶行为进行惩罚。

根据 Polymarket 方面的流程记录,该预测池最终走到了第三步流程,这意味着有人对原始报告的结果提出了争议,所以需要通过 UMA 投票来决定最终结果。

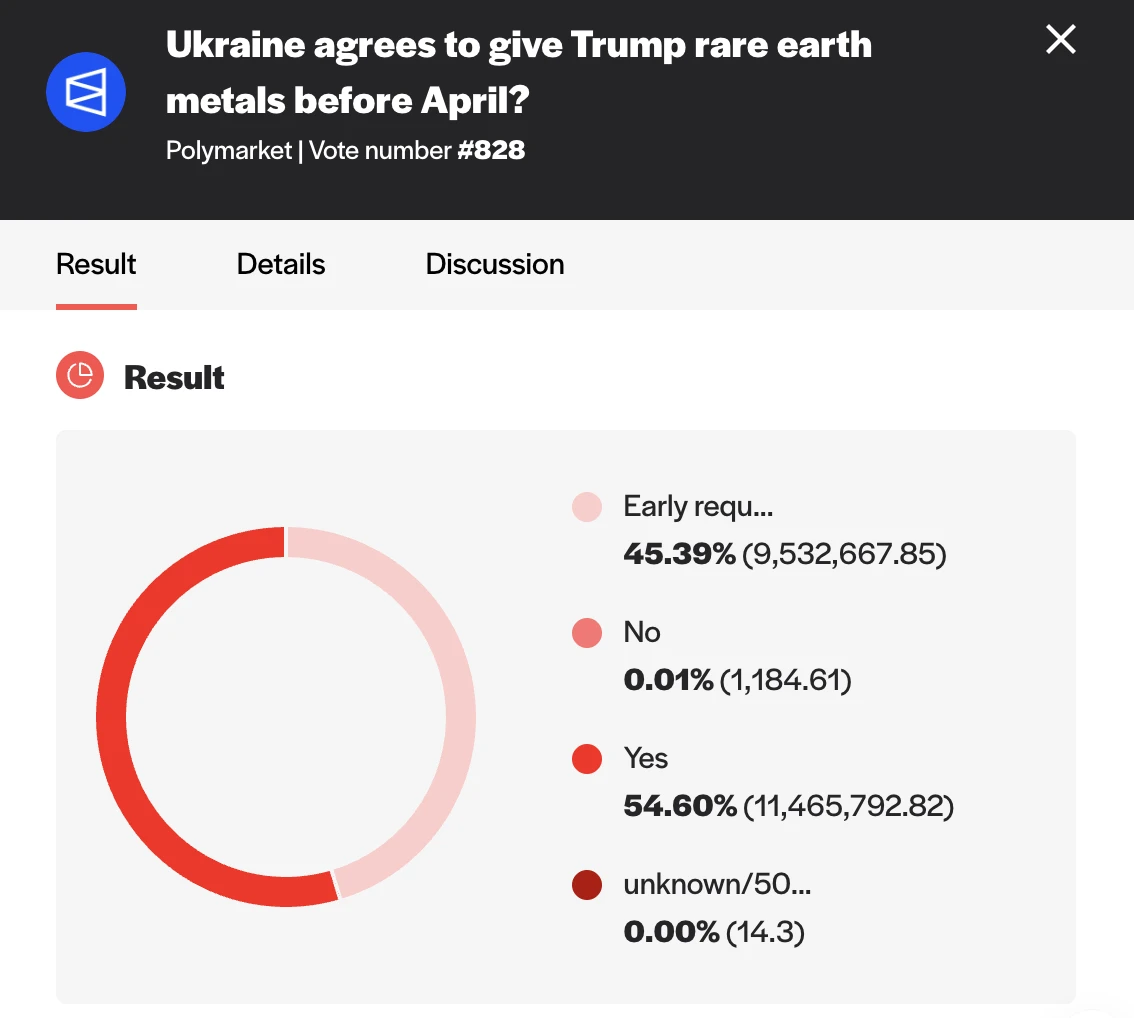

而根据 UMA 方面的最终投票结果,54.6% 的选票无视事实地选择了“是”,强行推动该预测池将最终结果判定为“是”。

而根据 Reddit 用户 @iamtheone 的记录,UMA 投票初期另一个选项“现在下结论还太早”一度占优,但最终阶段有神秘力量向“是”的选项投入了数百万枚 UMA,强行改变了投票结果。

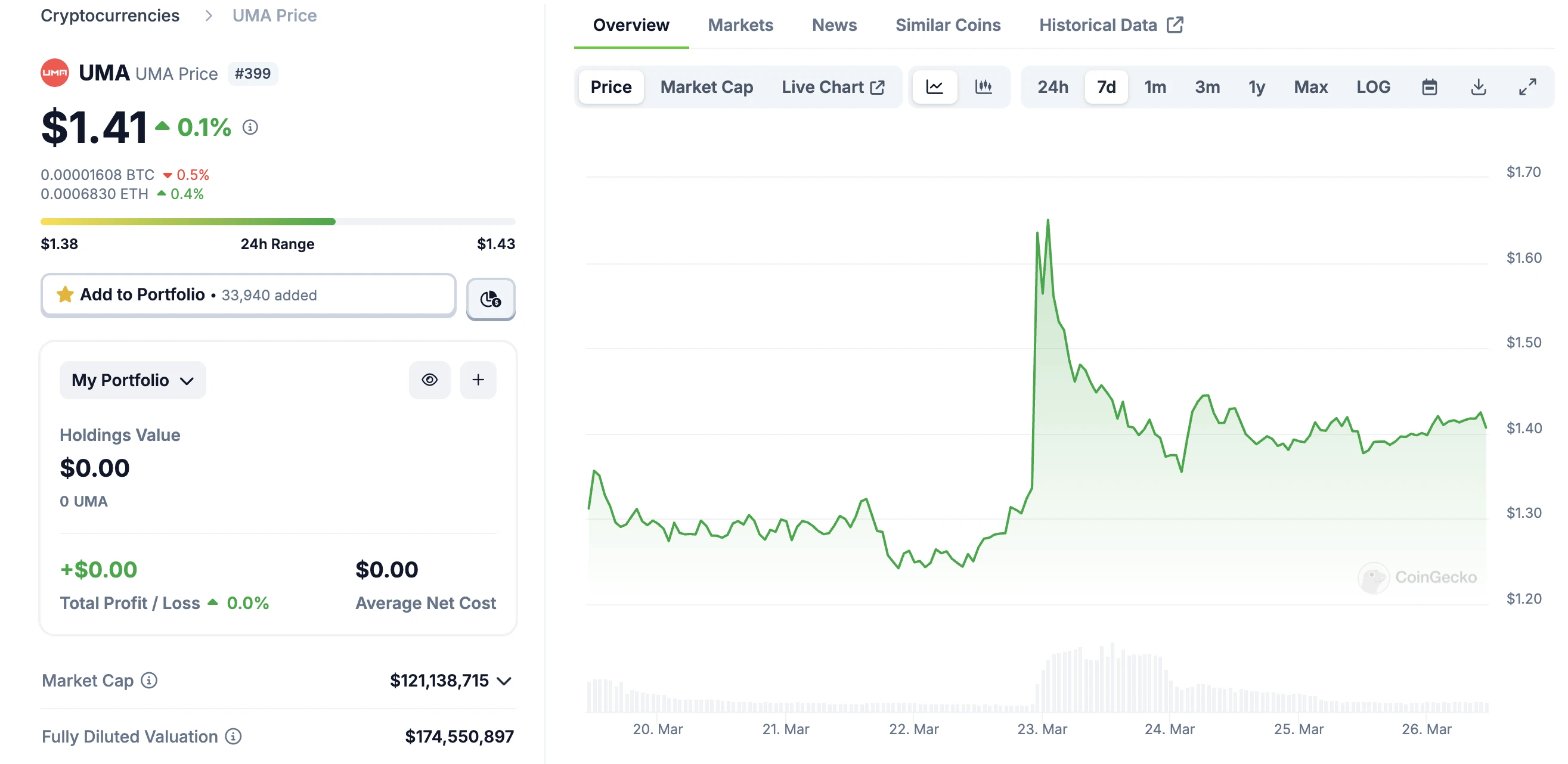

与此同时,UMA 的价格也曾在 3 月 22 日无故暴涨 24%,随后逐渐回落,或意味着该神秘力量早在数日前便已筹备好了计划。

该Reddit 用户补充表示,这并不是 Polymarket 之上的首例预言机操控事件,该平台此前已发生多起小额市场操纵(比如将委内瑞拉总统判定为 Edmundo González,声称特朗普对诺克斯堡进行了审计),但本次涉案金额最大,涉事预测池的押注总金额超 700 万美元。

而造成该事件的关键原因在于,Polymarket 赖以做出最终决策的 UMA 投票机制仅对错误投票设置了 0.05% 的惩罚,这使得作恶成本极低,在扭转事实的潜在利润面前,诈骗者有充足的动机去实施预言机操控。

更令人震惊的是,Polymarket 官方人员今晨在 Discord 内发布公告表示,已获悉该意外情况,但无法对用户进行退款。

我们已获悉乌克兰稀土协定预测市场的异常情况。该市场的结算结果与用户预期及我方此前的澄清相悖。由于此次事件不构成系统故障,我们无法进行退款操作。当前情况实属前所未有。我们已与 UMA 团队展开全天候紧急会议,确保此类事件不再发生。这绝非我们想要构建的未来 —— 我们将建立更完善的系统监控机制,制定更明确的规则框架,并优化时效性更强的澄清流程。具体措施将在全面评估后陆续公布。

不难想象,Polymarket 的这一回应很快便遭到了社区的口诛笔伐,原始预测池的下方评论区现已累积了 5554 条评论,大量用户都在抨击 Polymarket 的机制与回应。

作为去年整个加密货币市场最惊艳的项目之一,Polymarket 显然并不缺钱去足额赔付,如此回应势必会损害其市场信誉及社区情感。考虑到当前沸沸扬扬的社区情绪,后续事态能否有转圜余地,Odaily 星球日报将继续实时跟进。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。