The U.S. Core PCE Price Index for February, to be released this Friday, may become a key variable that disrupts market balance.

Written by: BitpushNews

In the past 24 hours, the cryptocurrency market has shown a mild rebound, with Bitcoin's price fluctuating around $87,400 and Ethereum slightly retreating to $2,070. Among mainstream coins, Solana (SOL) rose against the trend by 2%, reaching a daily high of $146.

As of March 26, Beijing time, the total cryptocurrency market capitalization has slightly increased by 0.4% to $2.87 trillion, and the market sentiment index (Fear & Greed Index) has dropped to 34, indicating that investors remain cautious.

On the news front, the former "Wall Street meme" stock, game retailer GameStop, officially announced on the 25th local time that the board unanimously approved a resolution to include Bitcoin in its balance sheet reserves. GameStop surged 7% in after-hours trading, with its stock price rising to $27.19.

In fact, there were signs of this decision two months ago when a photo of GameStop CEO Ryan Cohen meeting with BTC bull Michael Saylor was leaked, prompting its major shareholder, Strive Asset Management, to publicly call for the company to emulate MicroStrategy's holding strategy. Strive's CEO Matt Cole stated at the time, "We believe GameStop can improve its financial situation by purchasing Bitcoin; this is a strategic allocation."

Is BTC emerging from adjustment?

On-chain data reveals a new trend in capital flow. CryptoQuant data shows that despite Bitcoin's stable price movement, on-chain data is revealing key signals:

Institutional-level capital migration: In the past 24 hours, there were 17 BTC transfers exceeding $100 million each, with total on-chain transfer volume surging by 268%, reaching a three-month high.

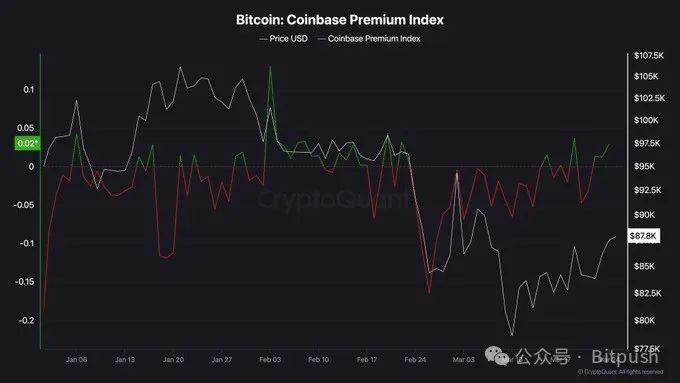

Exchange flow: Coinbase experienced a maximum premium of 0.3%, while exchange BTC reserves decreased by 1%, with approximately 12,000 Bitcoins flowing into cold wallets. This "low volatility, high turnover" situation suggests that institutional investors may be conducting large-scale asset custody transfers.

Derivatives market balance: The perpetual contract funding rate has returned to the neutral range of 0.01%, and the options volatility surface shows that the put/call ratio (PCR) has dropped to 0.85, indicating a slight recovery in bullish sentiment.

Notably, the Bitcoin Net Unrealized Profit and Loss (NUPL) indicator has fallen from 0.68 last week to 0.55, indicating that some short-term holders are beginning to take profits. Glassnode data shows that the number of addresses holding over 1,000 BTC has increased by 12, indicating that whale accounts are still quietly accumulating.

Hani Abuagla, a senior analyst at XTB MENA, believes that Bitcoin is emerging from the second deepest adjustment of this cycle. If the expectations for a Federal Reserve interest rate cut and easing trade policies align, the possibility of breaking through the $100,000 mark in spring still exists.

Macroeconomic variables: PCE data as a key litmus test

The U.S. Core PCE Price Index for February, to be released this Friday (March 28), may become a key variable that disrupts market balance. As the inflation indicator most closely watched by the Federal Reserve, the market expects the core PCE year-on-year growth rate to slightly rebound from January's 2.6% to 2.7%. If the data exceeds expectations, it may further delay the market's expectations for interest rate cuts.

Currently, the CME FedWatch tool shows that traders' expectations for the Federal Reserve's interest rate cuts this year have narrowed to 50-75 basis points, with the first rate cut potentially delayed until the third quarter. If the PCE data reinforces the narrative of "sticky inflation," U.S. Treasury yields may rise again, and a stronger dollar could exert short-term pressure on risk assets. In the current market context, slight fluctuations in inflation data may indirectly influence the direction of the cryptocurrency market by altering liquidity expectations.

TradingView analysts suggest that for short-term traders, attention can be paid to the breakout direction of Bitcoin's support level at $87,000 and resistance level at $90,000, combined with volatility strategies using options at low implied volatility. For medium to long-term holders, the on-chain MVRV ratio (1.98) remains below the historical bull market peak (3.5), and the address dispersion indicator shows a healthy chip structure, making it a feasible option to accumulate in batches during pullbacks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。