今天的作业稍微水一下,因为一些很弱智的操作浪费了很多时间,到现在天又快亮了,有点心烦。

目前市场的情绪已经开始回暖,尤其是川普对关税的态度开始转变成暧昧的时候,市场已经开始认为关税的力度可能不会是很大,从而对于通胀的影响有限,更有趣的是两次喊话美联储不用着急降息的川普,再次改变了自己的态度,开始隔空喊话美联储应该降息了。

在不到三个月的时间反复的变化才是最让市场头疼的,但这次确实是对市场的情绪会有些帮助,不管是关税的态度缓和,还是和对美联储的喊话,都能让投资者的风险偏好有所提升,所以美股和 Bitcoin 都出现了不同程度的上涨。

还剩下的应该就是 俄乌冲突 的结束了,虽然现在还在焦灼状态,但是可以看到距离停火的预期已经越来越近了,停火对于缓解美国的通胀还是有一定帮助的。

回到 $BTC 本身的数据来看,仍然是延续前两天的状态,短线抄底的投资者提供了大量的换手,更多的投资者认为现在仍然是处于反弹的趋势,而不是进入反转,并且也有不少的投资者担心美国经济的衰退会出现,最近已经有很多美国的分析师认为经济衰退有很大概率出现了。

但如果就像前边说的一样,关税只是举起的棒子而不是落下的结果,俄乌战争真的能在短期停火,这对于通胀都有利好的作用,虽然可能不算是反转,但起码反弹的力度应该大一些了。

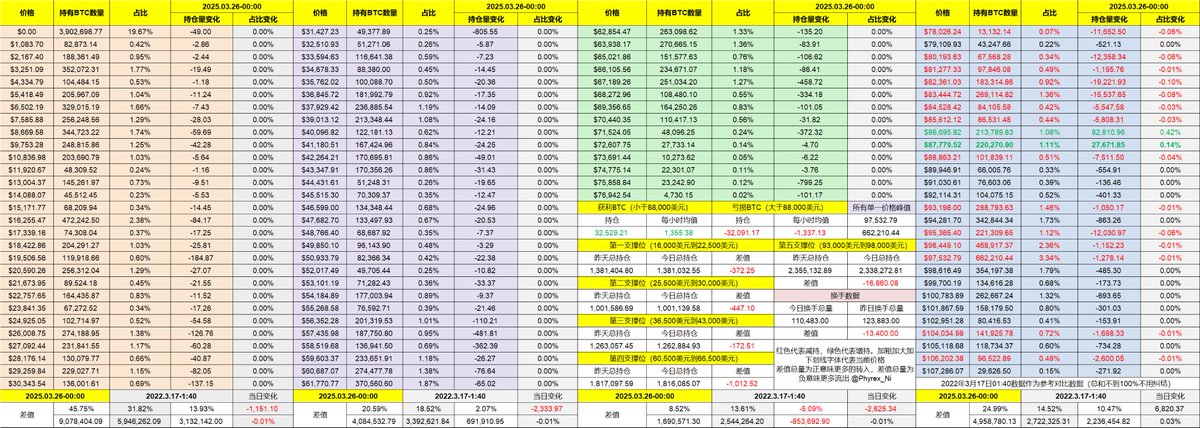

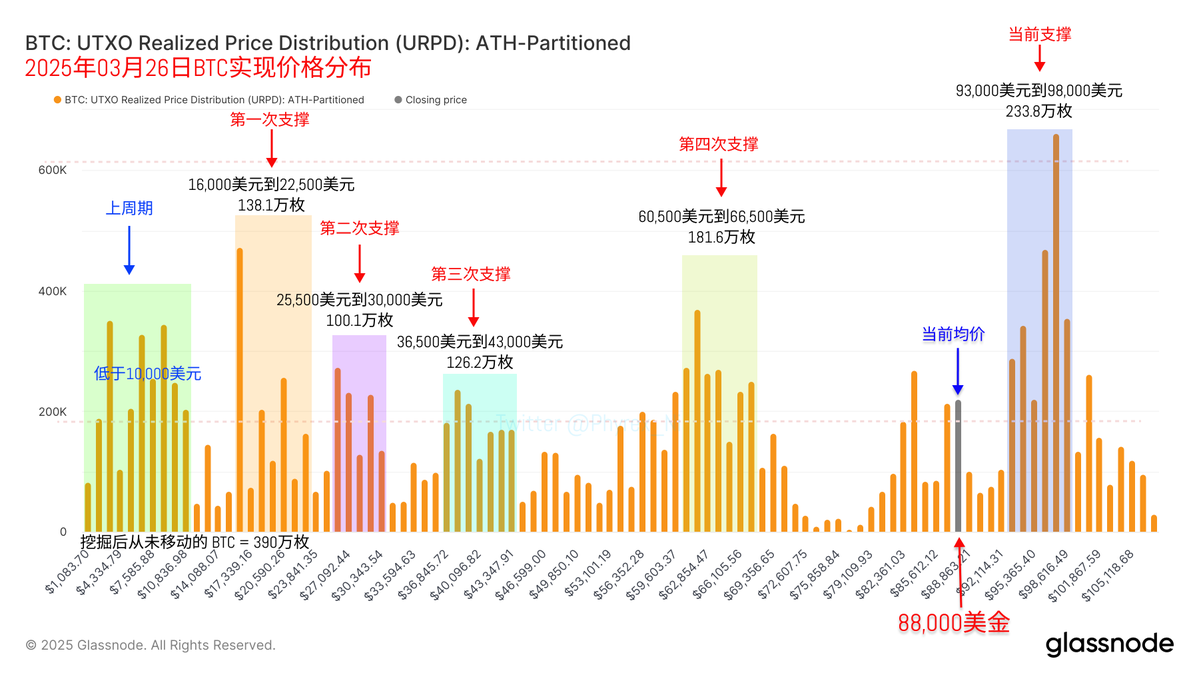

目前 93,000 美元到 98,000 美元的筹码密集区还是非常的稳定,这个区间的抛售已经越来越少了,对于价格的影响也越来越低。本周的重点仍然是周五的两个数据,核心PCE和密西根大学的通胀预期。

数据已更新,地址:https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

本推文由 @ApeXProtocolCN 赞助|Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。