作者:Jessy,金色财经

Vitalik 在 X 上消失了 20 多天。

在这 20 多天的时间里,以太坊的价格屡次跌破投资者的心理防线,3 月 12 日,ETH 兑 BTC 的汇率再创新低,跌至 0.022676,创下自 2020 年 6 月以来的新低。ETH 兑 BTC 的汇率持续走低,ICO 时期的巨鲸出逃,散户踩踏,Fud 声不断。

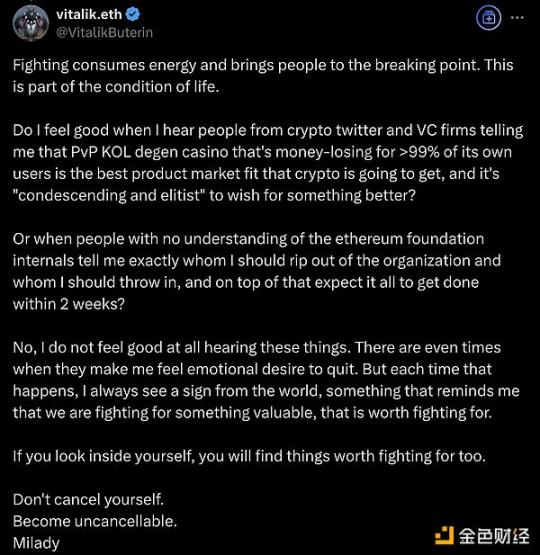

二月,以太坊社区内爆发了一次争吵,社区想要 Vitalik 低下其高贵的头颅,看看当下行业都在玩什么。面对批评,Vitalik 表示,自己不认为当下盛行 PVP 是区块链最好的产品,而他自己和以太坊所坚持则是做出更好的产品。

在 Vitalik 在网络上消失的这 20 多天的时间里,币安的两大创始人 CZ 和何一,则是带头在 X 上玩梗,借着阿布扎比投资机构对币安的投资,掀起了一场 BSC 链上 Meme 的「白布行情」。

这轮周期,Meme 赛道火爆 PVP 盛行,疯狂的赌徒情绪充斥于加密社区。除此之外,一种更广泛的迷茫情绪笼罩在加密社区上空,那种能够引领着行业蓬勃向上的真正的创新消失了。

行业一片荒芜,Meme 成了主线叙事。人们开始怀念以太坊上 DeFi 风行的 2020 年夏天。

以前叫「V 神」,现在叫「小 V」

从前,人们称他为「V 神」,把他当做精神领袖,靠他指明加密发展的方向。现在人们叫他「小 V」,让他「滚出」以太坊。

Vitalik 最近一次成为舆论的焦点,是在 2 月初。彼时,社区内充斥着对于以太坊 FUD 的声音。面对人们质疑,理性的建议,或是情绪性的谩骂,Vitalik 最终在 X 上作出回应,回应大意是:其不认同当下 PVP 模式是最佳的产品,他追求的是更好的产品。以及面对大家对于以太坊基金会革新的要求和职责,Vitalik 也表达了对于基金会内部一无所知的人的建议的心累。

Vitalik 成为众矢之的,这在两年前不能想象。

群体往往渴望强大的领袖,急切需要一个能被他们顶礼膜拜的对象,从而获得心理上的依靠与指引。这促使他们热衷于造神,将某个个体的优点无限放大,塑造出一个无所不能的 「神」。 一旦这个被塑造出来的 「神」无法达成民众过高的期望,群体态度的转变也极为迅速和残酷。他们从曾经的盲目崇拜瞬间转为激烈批判,把 「神」 狠狠推下神坛,并以谩骂、诋毁等方式宣泄自己的失望与愤怒。

Vitalik 完整经历了一个被加密社区造神和毁神的过程。曾经,在加密社区内,Vitalik 说的话,提出的思想,给加密行业指明着方向。Vitalik 乐于发表各种思想,比如早几年的 SBT、网络国家等等,都是 Vitalik 所提出或者大力支持的概念,也正是在 Vitalik 的大力推广之下,这些新概念在当时被行业内的项目方们所追捧和实践,成为了一时的风潮。

尤其是在熊市时,各大项目方会极布局牛市时会爆发的赛道,当时,Vitalik 看好 Web3 社交,创业者们蜂拥而至,而在熊市期间火了一段时间后也都熄火了。

牛市来临,Vitalik 在熊市时「指明」的这些方向,并未在牛市迎来应用层面的大爆发。混沌、迷茫,成为了大多数项目方的感受。

没有真正的创新,没有能振奋行业的新叙事,曾经在以太坊上发生的 DeFi Summer 那样的盛况,没能再出现在加密行业内。

区块链的基建都搭建完了,高速公路们都已经建好,但无车可跑了。当下区块链行业的核心矛盾,已经跟基建无关。而是区块链能给这个世界带来什么改变人类生活,或者是世界的产品。这个问题的答案是什么?

答案如果说是支付,那是比特币在 2008 年就给出过的答案,答案如果说是 DeFi,那是以太坊在 2020 年给出的答案。而币圈目前最落地的应用,可以说是稳定币,在跨境支付等各领域,它都在真实地改变着传统世界。

除了这些之外,区块链行业就再无创新了吗?这轮周期里,各个链上的资产发射平台风行,这只不过是资产发行方式的创新,赌场的内核换了一个新外衣。另一个被大家所看好则是区块链 AI 赛道,该赛道融了大笔的资金,泡沫却被 Deepseek 的横空出世戳破了。而该赛道一个更突出的问题则是,叙事的主体仍旧是 AI,区块链技术能够帮助 AI Agent 获得链上身份,搭建经济系统的等等,但始终在为 AI 做配。该赛道并不是加密原生的赛道。

一片莽荒之下,赌场则被认为是加密行业最好的产品。面对许多人的劝告,让 Vitalik 本人以及以太坊能够更多地投身于「赌场」的玩法。Vitalik 拒绝了,「如果我看看自己的内心,我会发现值得为之奋斗的东西。」

Vitalik 也曾享受这种被人们捧上神坛的感觉,而当 Vitalik 被拉下神坛,人们也看到了他作为人的一面。作为人的这一面,在一些人看来,是固执、自大、听不进去他人的意见。但也曾是这些特质,让他创造出了以太坊。

年少时让时间过得飞快的热爱可以改变世界

荣格曾说过「小的时候,做什么事能让时间过得飞快并让你快乐,这个答案就是你在尘世的追求。」

对于 Vitalik 来说,值得其为之奋斗的东西,早就写在了其童年的经历中。Vitalik 在 4 岁收到一台父亲送的电脑,其他小孩子玩电脑游戏,他则痴迷于 Excel 软件,不久就能用 Excel 撰写自动计算的程序;7 岁时,他创建了一个全是图表和数学公式的「兔子百科全书」文档,不久后被确定具有数学、程序设计方面的天赋;10 岁时,他的三位数心算速度已经是同龄人的一倍还多;11 岁,他开始在「天才少年班」提前学习数学、编程和经济学等科目……

编程技术本身让 Vitalik 快乐,而用技术来改变世界,是他的追求。而对比起币圈的一些投机者们,他相对来说一贯保守。

2018 年,以太坊暴跌,遭到了社区的质疑,Vitalik 就曾发出告诫——不要让以太坊沦为投机者投机生财的「郁金香」。彼时,和当下一样,Vitalik 也曾考虑过离开以太坊,「Should I dorp ethereum and work for Google」。

对于以太坊的质疑,每到币价低迷时就会出现一下。而面对着社区的质疑和谩骂,Vitalik 也总是会想到「离开」。

Vitalik 一直有着自己的坚持。对于技术的坚守,对于「泡沫」的警惕也从未变过。也正是这些坚守曾给加密世界带来了变革和创新。

回望加密发展的历史,引领行业发展的最重要的创新,在过去十年的时间里,大多发生在作为「世界计算机」的以太坊上:以太坊广泛地采用了智能合约,为 DeFi 如流动性挖矿等创新金融机制的繁荣提供平台,多种二层方案如 Rollups、Plasma 等的搭建,Dao 的治理模式的实践等等。

当下特朗普家族的 DeFi 项目、索尼的 Layer2、德意志银行的 Layer2 等越来越多的各大机构在以太坊上构建 Web3 应用和基础设施解决方案。以太坊生态不管在技术资源储备、开发团队支持、链上资金体量、客户端安全性等方面都是成熟且领先的。

而且,Vitalik 不仅仅在用以太坊实现他的技术理想,他把社会理想也寄托在以太坊上,又不仅仅局限于以太坊。如他所倡导的去中心化、抵御审查、平方投票法(Quadratic Voting)等理念涉及民主实践、互联网结构、商业与公益组织。这使得他的影响力超越了加密社区。

以太坊真的没救了?

以太坊还有可以被期待的地方吗?答案是肯定的。

4 月,以太坊将迎来 Pectra 升级的主网上线。此次融合了执行层(布拉格升级)和共识层(Electra 升级)的变化。Pectra 引入了 11 个关键的以太坊改进提案(EIPs),旨在增强可扩展性、质押灵活性和用户体验。整体来说,整体来说,此次升级过后,在技术层面,将提升了以太坊网络的性能和稳定性;在经济层面,改变了以太坊的质押经济模型,这将影响以太坊的供需关系和市场价格;在应用层面,则能吸引更多开发者和用户进入以太坊生态,推动去中心化应用的创新与发展等等。

在美国,可质押的以太坊现货 ETF 也或将通过。2025 年第一季度,资产管理公司 21Shares 代表 CBOE BZX 交易所提交申请,计划将质押功能引入其现货以太坊 ETF。除此之外,富达为拟议的以太坊现货 ETF 提交了 S-1 表格,其中包括质押功能。灰度也申请了为现货以太坊 ETF 提供质押功能。

Pectra 升级的实现预计将缩短以太坊质押的解除绑定期,这是最初为现货 ETF 引入质押时的一个重大障碍。

此次升级,或将成为推动质押 ETF 通过的催化剂。

行业内存在一个共识,目前以太坊现货 ETF 的吸引力较弱的一大原因,便是当下的 ETF 并未有质押功能。质押功能的上线,将允许以太坊现货 ETF 的持有者,可以得到质押以太坊的奖励。质押后,投资者们将获得 3~3.5% 的年化报酬。随着可质押的以太坊现货 ETF 的上线,或将大大提升以太坊现货 ETF 的资金流入,从而推高以太坊的价格。

以上这两者,都是在今年可以预见的以太坊价格上的实质性的利好。

但另一个真相却是,接下来以太坊这些值得被期待的变革,都只是在可以预见的路径上的进行的一些完善。这些变革,只是在把高速公路修得更宽更平坦。这并不是什么颠覆性的行业创新,又或者是开创性的产品或者应用。

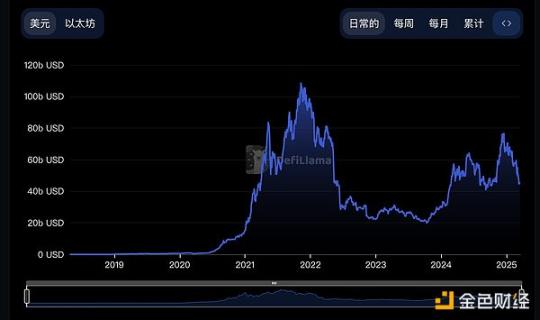

以太坊的用例其实已经发展到了巅峰。在这轮周期中,以太坊主链上没有涌现什么全民参与的项目,价格上也未超过前高。而其 TVL 量最高的仍然停留在 2021 年。

曾经它是建立智能合约平台的首选,现如今,当区块链世界的基建已经发展完备,有了更多更好用且便宜的平台公链可供选择,以太坊已经不再是唯一。这轮周期中,类似 Solana、Sui、TON 等公链分别跑出了自己的生态特色。头部的以太坊 Layer2 如 Base 等,也作出了自己的成就。

Vitalik 的去神化,对于一个行业来说,是好事,行业发展成熟,以太坊不再一家独大,更多的后起之秀能与之竞争,也就能激发更丰富的生态。而随着丰富的区块链生态的建立,以太坊在行业中的重要性也必然会下降。

Vitalik 在接受端传媒的采访时曾说过,「我的人生就是成为所有事物的桥梁。」以太坊基金会从 2015 年开始,对外资助上花费的资金已经超过内部运营上的费用。这些资助使得以太坊得以串联起更多的团队,也促进了加密行业各色项目的发展。无论是以太坊本身还是 Vitalik 所做的都是为加密打地基的事。

而以太坊以及 Vitalik 本人,都不该承担人们对于整个行业缺乏创新的迷茫和愤怒。

「If you look inside yourself, you will find things worth fighting for too.」知道自己该为何而奋斗的 Vitalik,在短暂的失望后,会再度回归。

在加密社区中迷茫且愤怒的人们,叩问过自己的内心后,也会作出选择,是留下做个「builder」,在荒芜之上沉住气创造点新东西。还是离开、奔赴下一个风口继续做个精明的「投机者」。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。