来源: Cointelegraph原文: 《{title}》

作为全球最大的资产管理公司,贝莱德(BlackRock)在多个欧洲证券交易所推出了比特币交易所交易产品(ETP)。

根据贝莱德的产品页面,iShares比特币ETP于3月25日开始在Xetra、阿姆斯特丹泛欧交易所和巴黎泛欧交易所交易。此次推出是继其iShares比特币信托交易所交易基金(ETF)在美国市场取得成功之后的举措,该ETF目前管理着507亿美元资产,占比特币总供应量的约2.73%,在美国市场占据主导地位。

加密投资公司Algoz的战略和收入总监Stephen Wundke告诉Cointelegraph:“iShares比特币ETP在欧洲的推出可能不会产生与美国相同的反应”:

“与美国相比,在整个欧洲更容易获得通过受监管的资产管理公司提供的优质投资产品,其次,也更容易购买比特币。[…] 然而,欧洲各地的传统家族办公室能够将其资产基础的一小部分以‘数字黄金’持有,这无疑是一件好事。[…] 只是不要期望第一季度会有600亿美元的购买量。”

新的ETP在Xetra和巴黎泛欧交易所以IB1T为交易代码,而在阿姆斯特丹泛欧交易所则使用BTCN。彭博社此前报道称,该公司正准备推出这款新产品,这是继该公司在加拿大CBOE推出比特币ETF之后的举措。

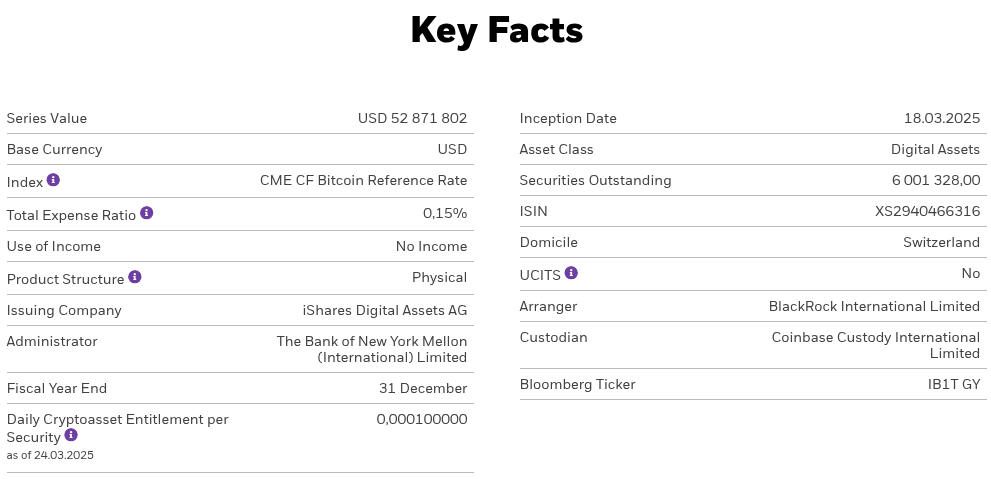

贝莱德iShares比特币ETP细节。来源:贝莱德

根据彭博社报道,该产品推出时暂时豁免了10个基点的费用,这使得费用率降至0.15%,直到2025年底。欧洲排名第一的加密ETP是CoinShares Physical比特币ETP,目前收取0.25%的费用,这使得贝莱德的产品在豁免期内便宜得多。

Wundke表示:“毫无疑问,贝莱德激进的费用结构旨在将竞争对手排除在市场之外,并质疑任何新进入者的承诺。”

Wundke补充道,“这种竞争对投资者有利,最终对数字货币也有利”,他强调市场参与者将不得不竞争以向投资者提供最佳产品。

这是贝莱德首次在北美以外发行加密ETP。贝莱德欧洲和中东iShares产品负责人Manuela Sperandeo告诉彭博社:

“[此次推出]反映了行业中真正可被视为转折点的现象——零售投资者的既有需求与更多专业人士如今真正加入其中的结合。”

去中心化交易所聚合器Unizen的研究主管Ajay Dhingra告诉Cointelegraph,此举反映了贝莱德对欧盟《加密资产市场监管框架》(MiCA)的信心:

“从特朗普到拜登,再到现在又回到特朗普,美国的数字资产政策在很大程度上是不一致的。相比之下,欧盟一直稳步接受合规的区块链采用——提供了企业所寻求的监管稳定性。”

贝莱德最近的收益报告显示,该公司在2024年第四季度平均管理着超过11.55万亿美元资产。除了领先的比特币ETF外,该公司还推出了灰度以太坊信托ETF——这是管理资产达34.6亿美元的顶级以太坊ETF。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。