作者:Danny @IOSG

SIMD 0228 提案,一个最近牵动 Solana 所有生态参与者心弦的重要决策,最终提案没有通过。此次投票参与率创 Solana 历史新高(接近代币总供给的 50%),但最终支持票比例不足以达到通过所需的超多数门槛(66.67%)。

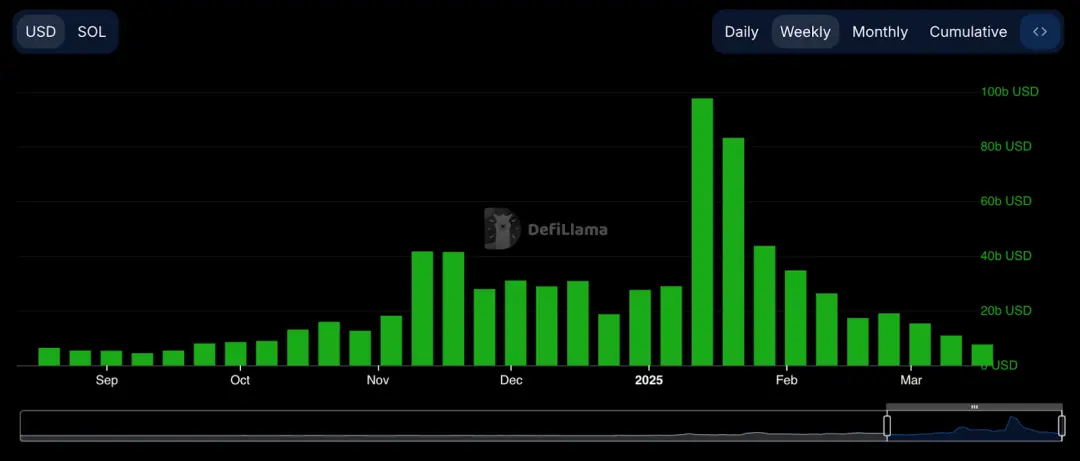

这样一个提案的背景,是 Solana 在 Trump 发币后,逐渐从 Memecoin 带来的链上狂潮归于平静的阶段。周交易量从年初接近 $100b 回退到不超过 $10b,下降 90%,已低于 Memecoin 兴起初期的交易量。

伴随着 Memecoin,Solana 成为这个周期最成功的公链。而当 Memecoin 的周期逐渐式微,Solana 也面临转型重新寻找定位的阶段,而正是这个时候,Solana 最大的资本支持者 —— Multicoin 提出了 0228 提案。提案一出,引来了社区激烈的争论。推特成为主战场,不同利益相关方据理力争,明牌号票,直到投票结束的最后一刻。

提案辩论过程,我们能看到许多以前在以太坊社区推动变化时的影子。提案本身的窗口很短,提出了许多长远的考量与短期的解决方案,当然,也有很多不太好直说的利益考量。但其透明度让我们能够看到很多 Solana 领导者在目前的态度和战略。

这次尽管提案被否决,提案提出者,来自 Multicoin 的 Tushar 仍将其称为「一次胜利」,缘由是投票的高参与率和广泛的社区讨论,展示了 Solana 的去中心化治理能力。

Solana 这次提案治理,背后到底是谁在博弈,意味着什么,为什么没有通过,程序是否正义且成功?让我们一一来看。

SIMD 0228 —— 仓促的提案

什么是 228 提案?

228 通过根据质押率动态调整通胀率,目标是维持 50% 质押率、长期降低 SOL 的增发速率。

Solana 目前的通胀模型是随着时间逐渐下降的曲线。在主网启动时(2019 年 3 月)设定了 8% 的通胀率并随时间下降,当前通胀率约为 4.8%,长期目标通胀率为 1.5%-2%。

若此提案通过,短期质押收益将降低(根据质押率在 1% - 4.5% 间),长期通胀率将趋近于 1.5%。

目前质押率为 70%,因此若 228 通过,短期内质押 SOL 收益会降低、长期来看增发会减少、质押收益率将根据质押率实时调整。

不同于 SIMD 0123 此类验证者可选择是否 opt in 的提案,0228 是强制性的,也意味着一旦启动会牵动所有质押者的利益。

支持的声音

此提案由 Multicoin Capital 的 Tushar 和 Vishal 提出,并得到来自 Anza 和前 Consensys 的研究员 Max 支持。其理由包括:

#减少不必要的代币发行,降低通胀成本

Solana 当前的固定通胀模型是一种「dumb emissions」,因为没有对网络的实际经济活动或安全需求纳入考虑。以 2025 年初的通胀率 4.8% 计算,每年会新发行价值约为 38.2 亿美元(基于 800 亿美元市值)。这种高通胀本质上是对 SOL 持有者的稀释,尤其在目前质押率高达 65.7% 的情况下 —— 网络安全已经得到充分保障。

通过此提案,即意味着质押的理念从「过度支付以确保安全」转向「寻找最低必要支付」。

有趣的是,这一点正是 Solana 中部分 KOL 此前攻击以太坊经济安全的论点,即过多的资产在支撑一个被视为「meme」的经济安全。

#释放资本,推动 DeFi 生态发展

当前的高质押率(65.7%)导致大量 SOL 被锁定,抑制了资本在 DeFi 生态中的流动。Kamino 创始人 Marius 指出,“质押鼓励了囤积,但减少了金融活动”。类似于传统金融中高利率抑制投资的道理。

值得注意的是,Solana 上主要的 Defi 协议支持者也是提出提案的 VC 们,因此释放流动性进 Defi,也是一个不可忽视的动机。

#减少「漏桶效应」,提升生态系统自主性

漏桶效应指的是生态内的价值,在经济活动发生过程中产生极大的磨损与泄漏。由于增发的 SOL 被视为普通收入,在美国是需要纳税的,因此通胀产生的增发量会成正比从整个生态提取价值。对于 Solana,已大概发生了约 6.5 亿美元的税和约 3.05 亿美元交易所抽成流出生态系统。

从第一性原理来看,本质上是 Solana 已经步入一个稳定阶段,初期拍脑袋设置的通胀模式已经显得不合理。链的发展以提高经济活动为北极星,也应对应改善通胀方案。

Placeholder 合伙人 Chris 总结说,真正的收益应来自需求侧对供给侧的溢出,而应不应沿用利于冷启动的固定通胀设置。长期来看,支持方的论点确实有一定道理。当一个公链生态度过冷启动阶段,自然就需要更理想化的经济制度推动经济发展。

反对的声音

以 Solana 基金会主席 Lily 为首的一派则是反对通过此提案。争执的点主要在于是否要如此短暂的时间内落地此提案,而不是经过更长资产属性有着极大变动的提案将会影响不同环节的参与者(网络层的工程师、产品层的开发者、经济层的机构),目前讨论居多在核心的网络层人员和产品层人员,离信息渠道更远的产品层和机构主导的经济层群体的声音较少。因此在论证不够完善之前不应着急通过。

许多反对者提出的担忧是对小验证者流失的担心。小节点无论是在规模效应还是议价能力上都逊色于大节点,因此通胀降低将会首先淘汰这部份小节点,会伤害 Solana 的去中心化程度。但笔者在和 Solana 部分节点聊完后发现,大多节点仍支持通过,究其原因是 Solana 大量补贴以及大家更相信 SOL 本身不断完善后的价值。能感受到一股 Solana 社区的向心力,这是题外话。

那么很显然,两者对目前的通胀模式都是不满的,也都认为是需要改善的。而争论点在于是否要在两周之内仓促落地。

除此之外,或许还有一些利益考量的因素。最简单的,就是大量 SOL 的持有者,尤其是能从非质押生态(Defi)获得较高收益的持有者,自然不希望通胀持续保持这么高的水平。这里的标准画像就是 Solana 背后的 VC 及其支持的项目们。

而 Solana 目前的一个重要采用,是机构方向,包括 ETF 和更多的传统机构用例。那么在推动机构采用的相关方一定会持反对态度。对于机构采用来说,SIMD 的通过是否是利好这个有争议,支持方认为传统机构对于高通胀资产更为反感,反对方认为传统资产对于通胀率动态变化的资产的不确定性疑虑更大。

这里笔者会认为,机制的不确定性可能会更阻挡机构的采用 —— 机构自己可以去评估机制下的资产属性,但如果这个机制不断变化,则为机构的评估带来了阻碍。因此对于机构来说,要么快速通过,要么等采用初步完成再共同协商 —— 此时利益纠葛更多,可能就更难通过了。

为什么是现在?

这里就引出一个问题,为什么要如此仓促的引出并推动这样一个提案?

或许是 Solana 在 meme 的余温中仍保有大量的交易量,导致节点目前的费用和 MEV 收入仍保持高位,因此质押机制调整并不会迎来过大争议。2024 年,Solana 的 MEV 收益总计达到了 6.75 亿美元,且有明显上升趋势,Q4 的节点的 MEV 收益甚至超过了通胀奖励。也正为此,节点目前对于短期内通胀收入的敏感度相对较低。若在 Solana 链上彻底降温的阶段,此提案导致的收入雪上加霜,必将引起质押社区的反对。

Solana 的 Restaking 即将拉开序幕,Renzo、Jito 等都已初现端倪。纵观以太坊的历史,流动性质押和 Restaking 的出现,会给质押和验证者带来极大的补贴性收益,也能让节点减少对于通胀奖励的顾虑。

以太坊基金会也在去年年中曾经提出过改善通胀曲线的提案,类似的将质押率锚定固定比率,以减少过多的质押。当时所提出的论点在于在经济安全已经远远足够的前提下,希望释放更多流动性的同时,减少 Lido ETH 等 LST 对于 ETH 的替代作用。

这个提案在提出后,也引发了短暂的讨论。那是 OG 们在 POS 转型之后再次重新审视以太的 POW 的经济相关机制。提案本身,和讨论过程,都提出了大量的计算推演支撑,但最终在理论依据没有辨清的情况下,这个提案也没有推进。以太的经济论证或许给 228 提供了一些参考依据,但其收到的反对声音,也体现了通过这样一个「削减」利益的提案之困难。

最后的结果也是情理之中。或许是在基金会的主持下,验证者们形成了对提案 bearish 的看法,对机构采用的担忧。又或是这一决定确实过于仓促,导致验证者内部并未形成共识,投票出现分歧。又或是小验证者们形成了短期收入压力的共识,集体选择了反对。讨论的广不一定意味着讨论的深,讨论不深就会发生分歧。仓促推动的提案也体现了目前 Solana 各方对于链自身的定位不明晰,阶段不清晰,在 memecoin supercyle 后下一步何去何从的共识阵痛

治理过程是一场胜利

此提案固然仓促,但在短短几周时间里爆发了非常透明和开放的讨论。双方在推特上直言不讳,没有中间派,直接给出赞成与否,并给出论证。这样的讨论模式让所有人都能理解双方的考量。在最激烈的时刻,甚至直接拉了个 Space,相关方在 Space 中各抒己见。

另一个亮点是对于社区声音的接纳。大量 Solana 项目方/建设者在推特上的中肯建议都得到了回复,也被纳入 Space 的讨论。提案不再是晦涩的一纸公式,而是化作每个社区的声音,被提出探讨。投票让人诟病的一点是质押者无法直接参与意见表决,这也带来许多大节点的自我矛盾 —— 如何协调所有质押者的意见并给出最后的决定。这是所有公链都需要解决的问题,Solana 第一次点亮了这个问题。

提案吸引了 74% 的质押供应参与,仍展示了高度的社区参与性。SIMD 明确的投票机制和通过门槛,使得决策过程更加清晰和可预测。相比之下,以太坊的提案决策过程相对模糊,主要依靠核心开发者之间的讨论和共识,缺乏正式的投票机制。

最后是提案的效率。纵使我们总在批评其过于仓促,但提案从提出、投票到完成投票不超过两个月的时间,让人不得不感叹这个生态从上至下落地想法的效率。这也是 Tushar 认为这是一场胜利的原因吧。

结语

整体来看,SIMD228 提案体现出了 Solana 在革新资产发行模式的繁荣期后,步入了机构采用和继续建设链上消费者应用的抉择阶段,利益分配开始出现矛盾是整个事件的契机。

支持者也正是需要借着这个链上活动繁荣阶段,以小摩擦快速推动改革,但显得过于仓促导致讨论虽激烈但并不充分,对于小验证者的支持和教育不到位,导致验证者共识不够统一。提案的生命周期很短暂,这个过程中也体现了 Solana 生态的执行力和开放度,是一个值得所有生态学习的优秀治理案例。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。