作者:Bitcoin Magazine Pro Team

编译:BitpushNews

在突破10万美元创下历史新高后,比特币已进入持续的下行趋势。这次价格修正自然引发了市场对比特币是否仍遵循2017年周期规律的质疑。本文将通过数据分析,评估当前比特币价格走势与历史牛市周期的关联度,并展望BTC未来可能的发展路径。

是否复刻2017年走势?

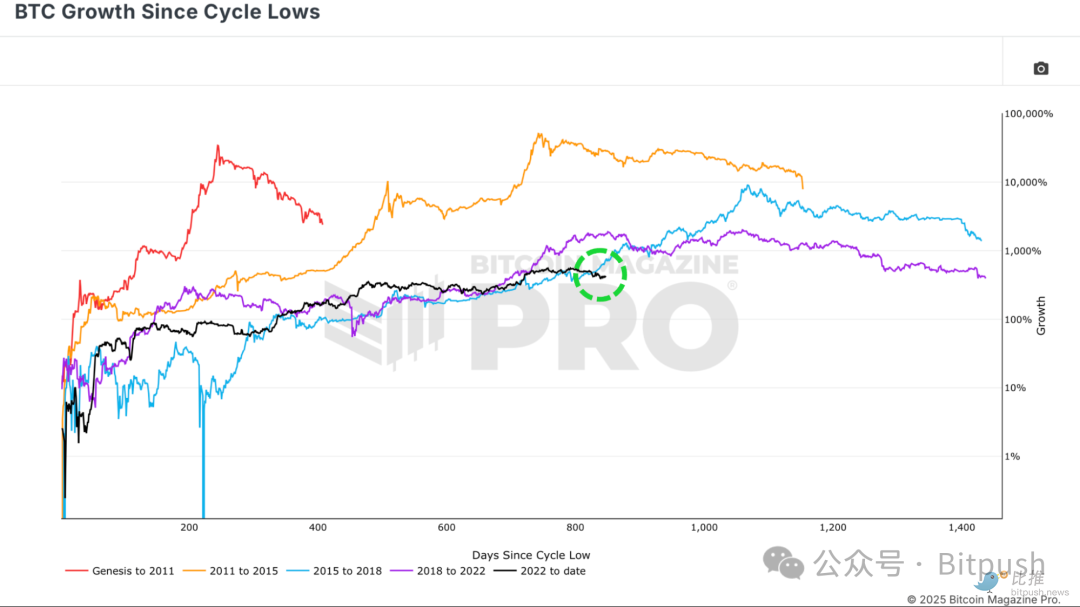

自2022年熊市周期低点以来,比特币的价格轨迹与2015-2017年周期(即最终在2017年12月触及2万美元的历史性牛市)展现出惊人的相似性。

然而近期比特币的下跌趋势,标志着其走势首次与2017年周期出现显著背离——若严格遵循2017年模式,过去一个月本应是比特币再创新高的上涨期,但实际行情却呈现横盘整理和下跌态势,暗示两个周期的关联性可能正在减弱。

图1:当前周期走势轨迹近期与历史规律出现偏离

尽管近期走势分化,当前比特币周期与2017年周期的历史关联度仍处异常高位。今年早些时候,当前周期与2015-2017年周期的相关性约为92%。近期价格偏离使相关性微降至91%,这在金融市场中仍属于极高水平。

投资者行为分析

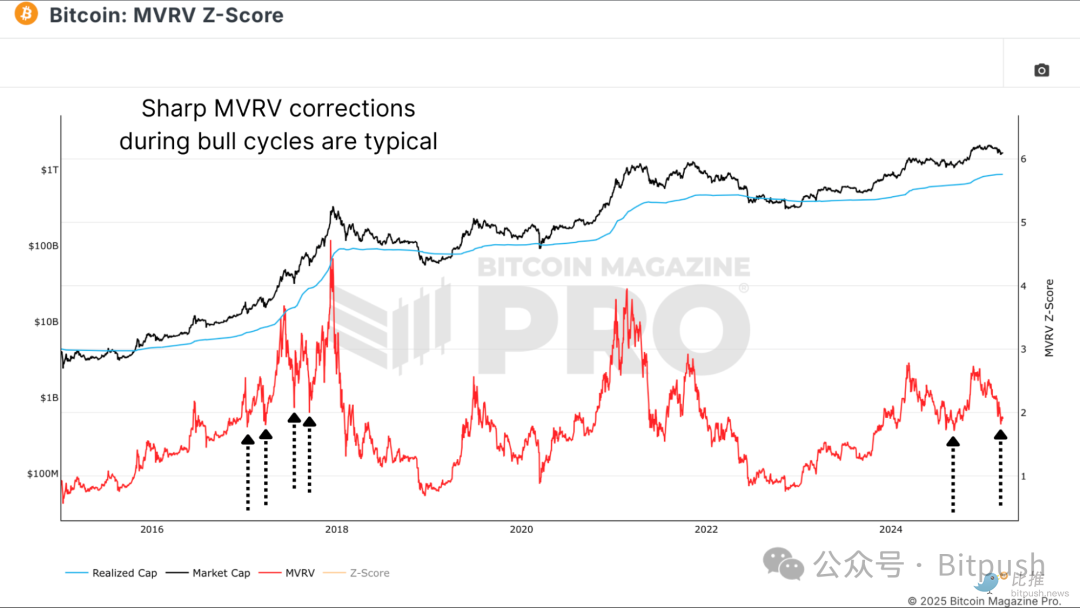

MVRV比率(市场价值与实现价值比率)是观测投资者行为的关键指标,用于衡量比特币当前市价与链上所有BTC持有者平均成本价的关系。

当MVRV比率急剧上升时,表明投资者账面浮盈显著扩大,这一现象往往预示市场顶部形成;而当该比率向实现价格回落时,则意味着比特币价格接近投资者平均持仓成本,通常标志着市场进入筑底阶段。

图2:MVRV比率仍与2017年周期保持相似波动形态

MVRV比率的最新动态

近期MVRV比率的下降反映了比特币从历史高点回调的现状,但其整体结构与2017年周期仍存在相似性——早期牛市冲高后伴随多次深度修正,因此两者的相关性仍保持在80%。

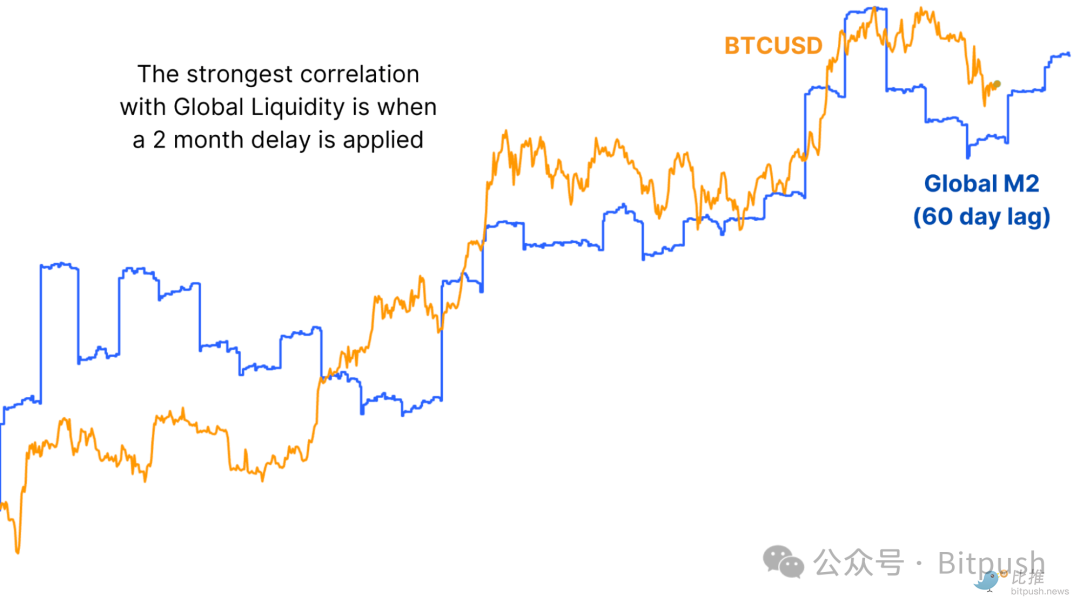

数据滞后效应

当前走势分化的一个可能原因是数据滞后性的影响。例如,比特币价格走势与全球流动性(主要经济体的货币总供给量)高度相关,但历史数据显示,流动性变化通常需要约两个月时间才能反映在比特币价格中。

图3:全球M2货币供应量对比特币价格存在滞后传导效应

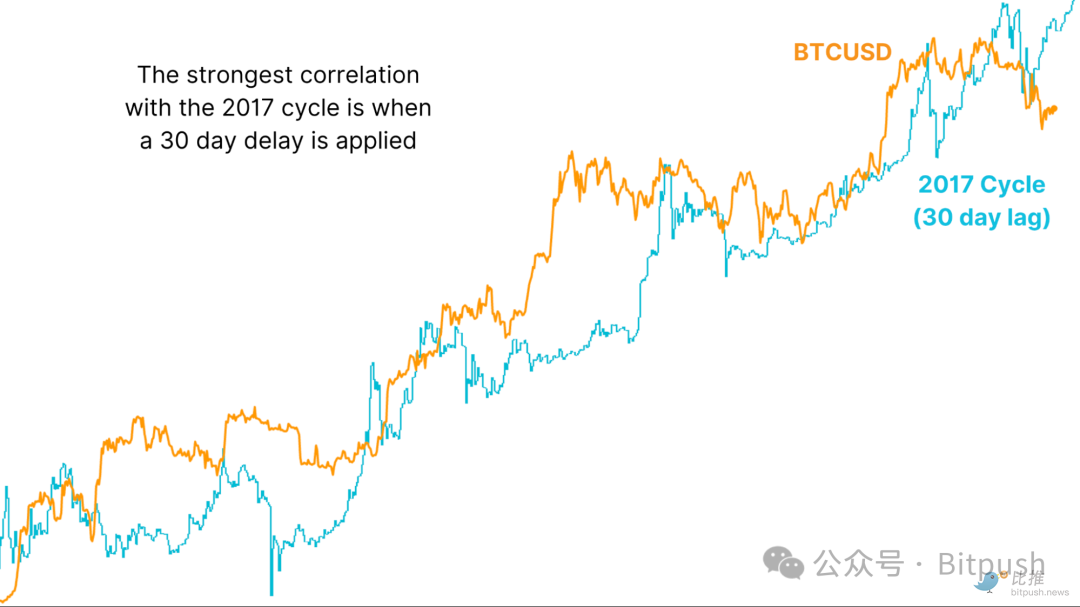

滞后效应验证

若将当前比特币价格走势与2017年周期进行30天滞后处理,两者的相关性将升至93%,成为两轮周期有记录以来的最高关联值。这一滞后调整后的走势规律暗示,比特币可能很快重归2017年轨迹,意味着一轮强劲上涨行情可能即将到来。

图4:价格走势经30天滞后处理后仍与2017年数据高度吻合

核心结论

历史不会简单重复,但常有相似韵脚。当前比特币周期或许难以复刻2017年式的指数级暴涨,但市场深层心理机制仍展现出惊人的相似性。若比特币重新与滞后的2017周期恢复联动,历史规律表明:比特币可能即将从当前调整中复苏,并迎来突破性上涨。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。