Beijing time, the day has already brightened, and it's really hard to submit an assignment. I'm going back to Singapore tomorrow, and I can finally return to a normal update status. The recent short essay should be a trilogy, based on the story of a little friend I met these days. I originally planned to shoot a video, but he was unwilling to show his face, so I used this new method instead. However, I won't write the third part for now; it will probably have to wait until I see him next time. Don't worry, it's not a career change story; I just think it's meaningful, so I recorded it.

I was busy outside all day on Monday, and this outing has come to a conclusion, resulting in a pretty good outcome, even exceeding my expectations. The world of cryptocurrency is progressing, and it's not just in the United States; unexpected results will occur in this region outside of the U.S.

From day to now, Bitcoin's price trend has been good, even attempting to break $90,000 today. Although it still fell slightly short, the positive news today was quite good, the biggest being Trump's repeated definitions regarding tariffs. Just a few days ago, we were discussing that the reciprocal tariffs would start to be implemented when the market opens on April 2. Is it really going to be enforced, or is it just another bluff like the previous two times? Today, Trump's conclusion was that the tariffs would not be very strict.

This statement directly stimulated market sentiment. U.S. stocks were already rising well before the market opened, and after the news came out, it injected some vitality into the market. However, as long as things do not ultimately happen, what Trump says cannot be completely trusted. Moreover, today Trump called for the Federal Reserve to cut interest rates, just less than a month ago he said he would not ask the Fed to cut rates.

Looking back at Bitcoin's own data, today's trading volume began to rise significantly. On one hand, it is back to a working day; on the other hand, the rise in $BTC price has led many short-term investors to choose to take profits and exit. This group of investors may believe that BTC is only in a rebound, so taking profits is not necessarily wrong.

But I wonder if Trump's remarks will cause the market to return to a FOMO sentiment in the short term. After all, this recent decline was mainly due to tariffs, and if tariffs are not that scary now, the impact on inflation may be limited. Trump also called for the Fed to cut rates again; I wonder if Powell will listen.

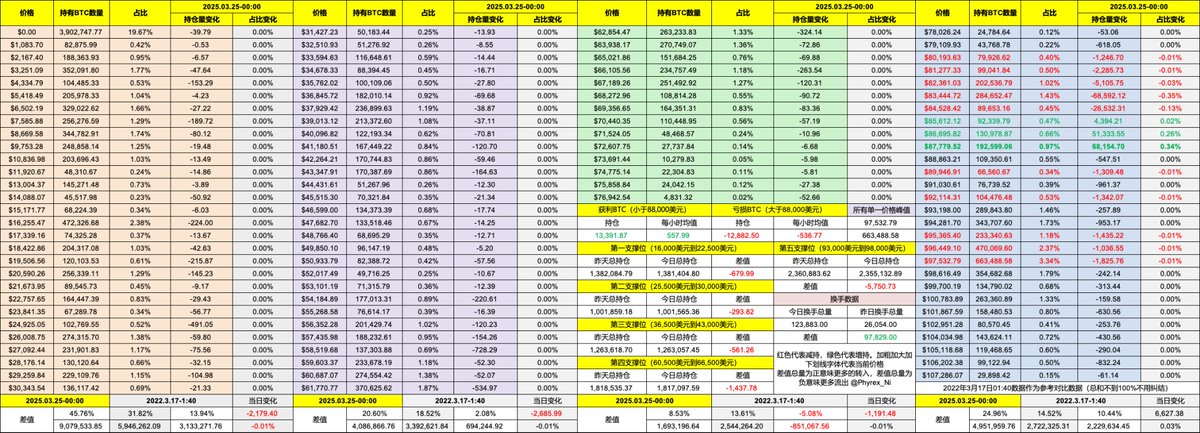

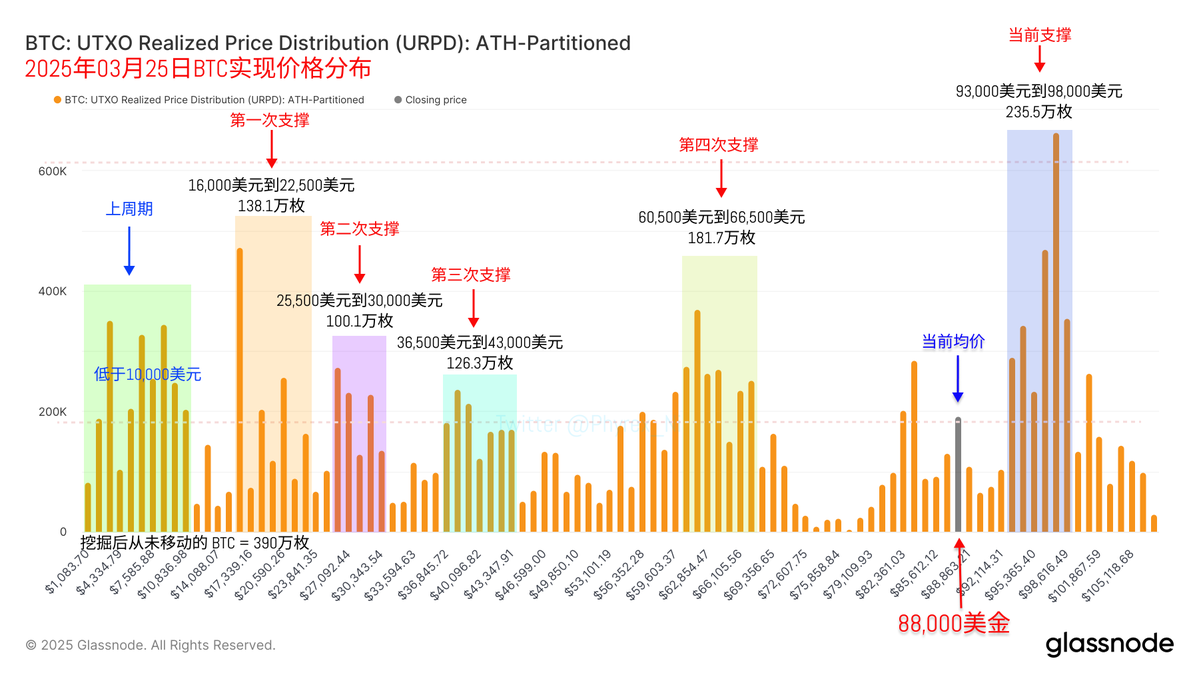

Although the turnover has increased, there hasn't been much change in the current support. The dense chip area between $93,000 and $98,000 remains very solid.

The data has been updated, address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。