作者:Jeffrey Gogo,Cryptonews

编译:Tim,PANews

关键要点

- 自马克·扎克伯格全面押注元宇宙已过去四年,如今这一概念已被列为科技界近年来最大的败笔之一。

- 元宇宙衰落的主要原因之一在于生成式人工智能的崛起。

- 尽管行业整体低迷,仍有部分项目保持强劲发展势头。专家指出,这一领域正在经历去伪存真的过程,逐步挤出不实参与者。

当马克·扎克伯格于2021年10月阐述他对元宇宙的愿景时,人们可以在沉浸式虚拟环境中连接与互动的数字乌托邦设想,听起来可以实现。

这位亿万富豪创始人认为元宇宙标是互联网的下一个前沿领域,公司随即开始投入数十亿美元开发实现其元宇宙战略愿景所需的技术。

扎克伯格甚至将Facebook更名为Meta,以体现其打造元宇宙的新战略雄心。元宇宙是一个依托虚拟现实和增强现实技术构建的虚拟世界,人们可在此环境中实现互动、工作与创造。

鉴于Meta(该公司自2021年以来已向元宇宙领域投资约460亿美元)及其他竞争对手为这一概念投入的巨额资金规模,让人难以想象的是为何元宇宙未能成功起飞。

曾经,包括Elton John爵士和Travis Scott在内的艺术家们纷纷在元宇宙中举办演唱会,与此同时,人们也开始在虚拟环境中游览城市、参观艺术展览。

然而在Meta首席执行官扎克伯格战略转型四年后,元宇宙已成为近年来科技界最重大的失败案例之一。由于未能兑现其宏大承诺,曾经涌入该领域的数十亿美元资金潮水已然退去,公众关注度也呈现断崖式下跌。

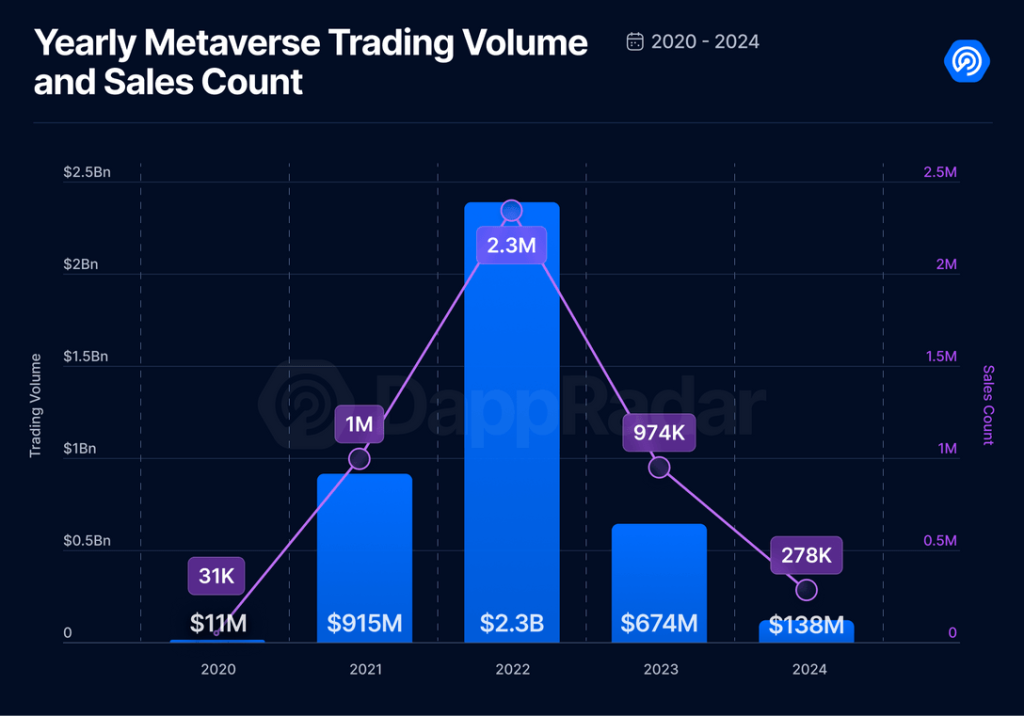

根据DappRadar数据,2024年元宇宙NFT项目的交易额与销售数量均跌至2020年以来最低水平,交易量同比骤降80%,销售量较上年同期暴跌71%。

来源:DappRadar

AI“截胡”元宇宙

根据专家观点,元宇宙衰落的主要原因之一在于生成式人工智能(AI)聊天机器人(如OpenAI的ChatGPT与谷歌的Gemini)的兴起。

BQ9生态系统增长机构联合创始人兼首席执行官Irina Karagyaur告诉Cryptonews:"生成式人工智能实现了即时且可扩展的商业影响力。"

Karagyaur同时也是联合国国际电信联盟(ITU)元宇宙焦点组专家成员,她进一步指出:

不像元宇宙那样需要高昂的基础设施投入,以ChatGPT、MidJourney、DALL·E为代表的人工智能工具则展现出即时可用性。企业用户与消费者因自动化流程优化、内容生成效率提升等而纷纷转向AI领域。风险投资的战略转向尤为显著:资本大量涌入AI初创企业,元宇宙相关项目则遭遇降级。

元宇宙创投孵化机构Improbable首席执行官Herman Narula向Cryptonews透露,人工智能在元宇宙的衰退中起到了相当的作用。

他表示,AI技术以"下一代颠覆性技术"的姿态抢占行业关注焦点,导致元宇宙的关注度被大规模转移。此外,这种演变还涉及其他多重因素。

“‘元宇宙’一词曾因与投机性加密货币炒作挂钩而招致批评,这些公司筹集了大量资金、出售了大量资产,并作出了一系列最终未能兑现的承诺。”Narula进一步指出:

“更重要的是,早期的元宇宙版本或原型元宇宙未能达到预期,它们提供的封闭且受限的环境极大地限制了用户的活动。”

在Meta(原Facebook)宣布入局元宇宙领域后,相关代币,如Decentraland(MANA)、The Sandbox(SAND)和Axie Infinity(AXS)价格曾出现大幅上涨。

如今,随着外界对Meta元宇宙梦想未来的质疑声持续发酵,相关代币价格在每日活跃用户数极度低迷的情况下出现暴跌。

自2021年11月创下历史高点以来,SAND、MANA和AXS代币价格均已从峰值暴跌超95%。其中,MANA曾触及6.96美元的历史高位,SAND最高突破5.20美元,而Axie Infinity代币AXS更是一度达到约153美元的天价。

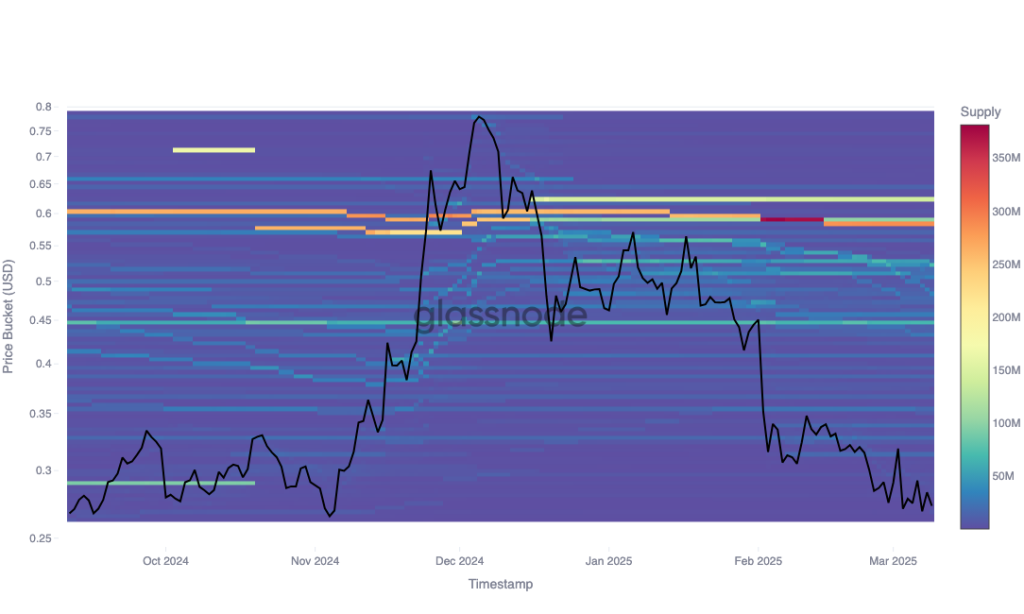

不过,来自加密货币研究公司Glassnode的一项最新链上数据分析显示,尽管价格波动剧烈,但在这三个项目中,"信念坚定的持有者正在稳步增持其仓位"。

例如,Glassnode指出,MANA代币在0.60美元附近形成了显著的筹码集中区,这反映出价格下跌后市场买入活动的增加。类似的筹码积累模式同样出现在SAND和AXS代币上。

Glassnode认为:"主要元宇宙代币持续出现的筹码积累现象表明,许多投资者认为这些项目是被低估的投资机遇,而非失败案例。"

根据CoinGecko数据显示,截至发稿时,Decentraland平台原生代币MANA现报0.27美元,日内下跌2%;The Sandbox平台代币SAND下跌3.2%至0.28美元;Axie Infinity生态代币AXS则下跌超1%,暂报3.43美元。

硬件成落地“拦路虎”

Charu Sethi是Web3领域的专家,同时也是波卡的首席大使。在接受Cryptonews采访时,Sethi表示,元宇宙的商业模式在其概念流行时未完全成熟。

“当时各大品牌纷纷推出NFT和昂贵的虚拟土地项目,但几乎没有用户获得持续性价值。”她表示,“例如,Decentraland和The Sandbox尽管吸引了数百万美元投资,其每日活跃用户数却长期徘徊在5000人以下。”

Sethi还谈到,高端虚拟现实(VR)与增强现实(AR)头显设备的高昂价格以及“复杂的登录流程”进一步阻碍了元宇宙的普及。

硬件设备是增强元宇宙体验的关键所在。

“因此,资金与关注度转向了能带来即时投资回报率的人工智能,”她强调称:”对许多企业来说,人工智能带来的快速收益使元宇宙相形见绌。”

作为元宇宙竞赛的一部分,Meta和苹果公司推出了VR头显设备,能够让用户沉浸在虚拟空间。

使用这些硬件设备之后,人们可以通过数字分身在元宇宙里做各种各样的事情:游戏、社交互动、甚至虚拟办公。但这些类头显设备有点贵。

苹果Vision Pro售价达3500美元,Meta Quest 3头显起售价500美元。相比之下,ChatGPT等AI工具提供有限的免费服务,其20美元/月的高级会员版提供无限服务,且不需要用户额外购买硬件设备。

国际电信联盟(ITU)元宇宙专家Karagyaur指出,VR头显市场增长停滞,原因在于苹果Vision Pro、Meta Quest 3等设备"仅能吸引小众用户群体,未能打开大众消费市场"。

她说:"由于未能探索出可持续盈利模式,元宇宙领域高投入、高风险愈发难以自圆其说。"

Decentraland基金会市场总监Kim Currier指出,元宇宙不仅是VR/AR硬件的叙事。"它更创造人类协同的虚拟空间,用户可以在这里社交,共同探索并创造新事物"她特别强调。

Currier继续说道:尽管苹果Vision Pro与Meta Quest 3"已经掀起了革新浪潮,但消费端仍将面对一个事实:绝大多数用户对全天候佩戴头显设备不现实"。

Currier她更感兴趣的是人工智能和元宇宙如何能为人们带来真正的益处,她将这些人称为“元宇宙的核心用户”。

这位Decentraland高管并不将生成式人工智能的兴起视为"竞争",而是视为"机遇",并表示:

“AI工具能够加速虚拟世界的构建,帮助人们在虚拟空间中实时追踪动态,并让元宇宙的体验更具动态感和个性化。可以说,AI将帮助虚拟世界以我们才刚刚开始探索的方式不断进化。”

行业大洗牌

Decentraland基金会市场总监Currier将元宇宙衰弱的原因归结为:"预期透支引发的市场泡沫;技术瓶颈难以突破;科技行业的结构性转变"。

Currier告诉Cryptonews,当前元宇宙的阶段性遇冷实为行业价值重构,这次洗牌正在筛选忠实建设者:

"如同所有熊市周期一样,这是一次行业大洗牌——通过市场出清为忠实建设者留下空间,他们将了解元宇宙的作用边界,并聚焦于用户真正需要的产品。"

BQ9生态机构首席执行官Karagyaur强调,元宇宙并未走向消亡,而是在经历技术范式转型——该领域正"基于公众需求导向,演进为AI赋能的垂直领域应用集群"。

“虽然最初的炒作可能已经消退,但剩下的则是一些更具深远意义的东西:从企业控制的虚拟世界向以人类为中心的社区驱动型生态系统的转变,”她详细阐述道,并补充说:

“尽管工业应用(例如西门子与英伟达在数字孪生领域的合作)仍在持续发展,但真正的活力已转向Roblox、堡垒之夜和永生世界这类平台。在这里,是由用户社群而非企业主导着体验的塑造。这些平台并不兜售逃避现实的解决方案,而是赋能人们进行创造、建立连接并展开协作。”

Polkadot区块链项目方代表Sethi援引行业数据指出:游戏平台Roblox在2024年日活跃用户突破8000万大关,今年更创下400万同时在线人数峰值,持续领跑元宇宙用户粘性指标。

Epic Games旗下现象级游戏《堡垒之夜》保持强劲增长势头——据最新运营数据显示,其单场活动用户触达量稳定突破千万量级,持续巩固元宇宙社交娱乐头部平台地位。

Polkadot区块链分析师Sethi深度解构《堡垒之夜》生态赋能模式——通过与奢侈品牌Balenciaga、现象级影视IP《星球大战》等开展虚实联动的品牌战略,该平台成功构建日均百万级用户留存的商业闭环,印证元宇宙IP运营的持续价值创造力。

黑夜中的希冀

专家称,扎克伯格对元宇宙的豪赌已演变成一场彻底的灾难。2024年,Meta旗下负责开发元宇宙产品的部门Reality Labs报告了177亿美元的创纪录运营亏损。

Meta官方财报显示,Reality Labs过去六年累计亏损逼近700亿美元。尽管扎克伯格的元宇宙蓝图已化为泡影,但该生态体系内仍有若干项目展现逆势生长态势。

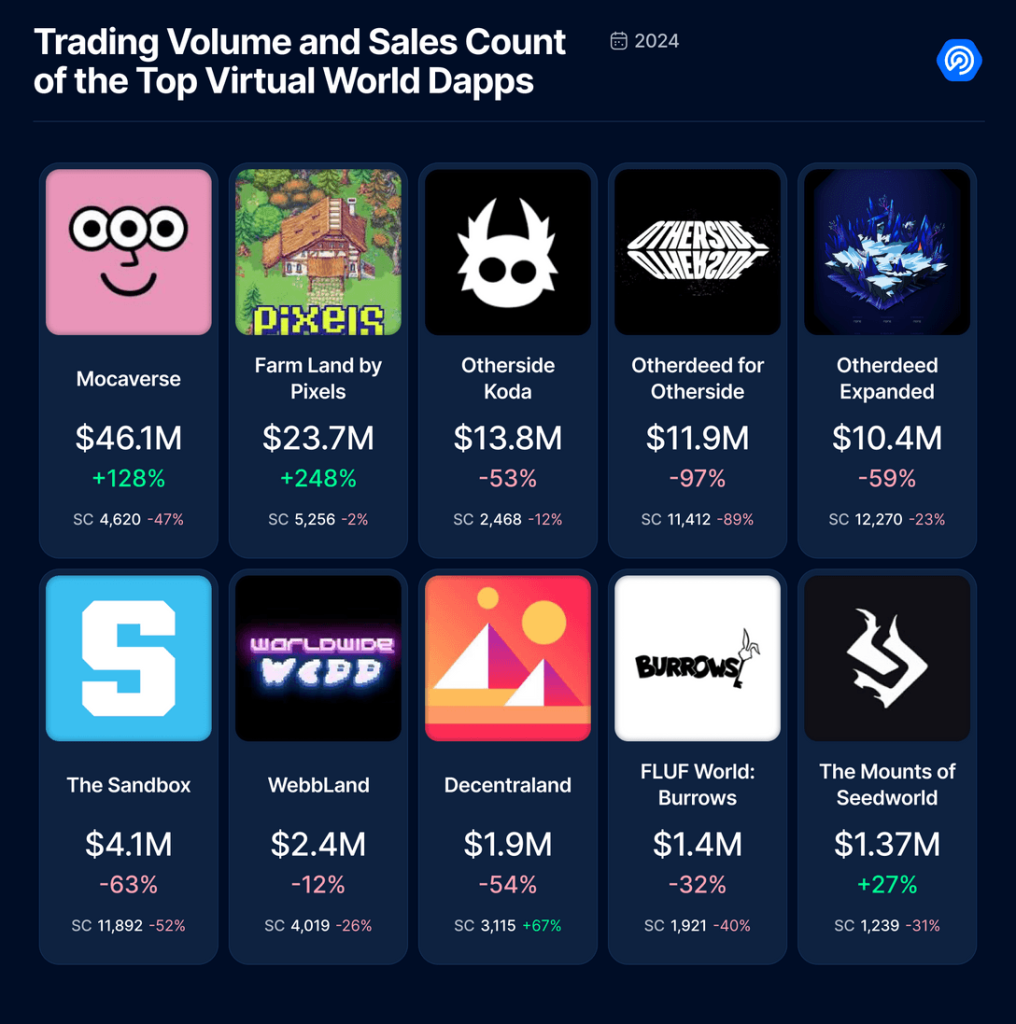

区块链数据分析机构DappRadar发布《2024年度游戏产业报告》,重点推介本年度最具行业影响力的两大元宇宙项目:数字身份协议Mocaverse与链游平台Pixels,二者通过差异化生态构建策略实现用户规模与商业价值的双重突破。

来源:DappRadar

由Animoca Brands打造的Mocaverse项目推出了MOCA代币及名为Moca ID的链上去中心化身份标识,短时间内吸引了179万用户注册,并成功与160个Web3应用程序实现集成。

该报告指出,该项目已获得2000万美元融资,用于扩展其生态系统,并推出了旨在"促进游戏、音乐和教育领域互操作性"的Realm Network。

Pixels于2022年首次推出。去年,这款基于浏览器的农场主题多人在线游戏"获得了巨大的关注",其日活跃用户数量突破一百万大关。

Pixels项目已从Polygon迁移至Ronin Network,并将其名为"农场土地NFT"的资产整合到Mavis Marketplace中。

DappRadar还提到了Yuga Labs旗下Otherside元宇宙、The Sandbox以及Decentraland的一些重要进展。其中,Decentraland推出了新版桌面客户端,据称该版本"提升了运行性能并优化了视觉效果"。

该报告指出,Decentraland平台以创作者为核心的经济体系是其"显著特色",创作者不仅可保留其销售额的97.5%,还能在数字资产二次交易时获得2.5%的版税分成——这一收益分配比例创下全行业最高纪录。

尽管如此,某些方面仍存在严重不足。根据DappRadar的数据:

“由于缺乏能够推动大规模普及的‘杀手级应用’,媒体关注度随之下降,此前在虚拟世界领域投入巨资的公司也纷纷转移了业务重心。”

元宇宙走向衰落?

国际电联专家Karagyaur在接受Cryptonews采访时表示,元宇宙的成功将“取决于融合,而非孤立”。她解释道:

"它只有在能够补充现有产业的地方才能持续发展,而非在试图取代它们的领域。数字技术发展的下一阶段将不再以逃避现实为目标,而是致力于改善现实本身。"

打造Yuga Labs元宇宙平台The Otherside的Improbable公司创始人兼CEO Narula指出,价值驱动型创新将能挽救元宇宙。超越炫目的视觉效果,用户必须具备实用价值。

“元宇宙一直是一个更深层次、更扎根现实的概念,其根源在于满足人们对于实现自我的基本需求。”他说。

“虽然‘浮夸的’Meta投资者大会式元宇宙已逐渐淡出,但我们正在努力打造技术、注重实效的版本依然坚挺。”他说。

Narula还提到,青少年和未成年人"在《我的世界》、Roblox和《堡垒之夜》等游戏平台上花费大量时间,参与日益复杂的虚拟体验、经济活动,甚至从事虚拟工作。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。