作者:Fairy,ChainCatcher

编辑:TB,ChainCatcher

一场隐蔽而高效的操盘游戏在周末上演。

短短几周内,一家未知实体累计收购超 20% 的 AUCTION 总供应量,推动交易量飙升、持仓量增长、CVD持续上行,一切看似是多头主导的强势行情。然而,在这背后,“庄家”却在不动声色地精准出货。

代币价格走出“圣诞树”行情,看似节节攀升,实则暗藏杀机。这是一场怎样的操盘布局?“庄家”如何在“看似多头占优”的局面下完成大规模出货?本篇文章将深入解析这场操盘布局的真相。

AUCTION 市场异动:巨鲸操盘轨迹浮现

AUCTION是Bounce Brand的治理代币,Bounce 是一个去中心化拍卖平台,融合了流动性挖矿、去中心化治理和质押机制。

昨晚,Bounce Brand 发布声明,澄清团队未参与AUCTION 价格操控,并披露了一系列市场异动:

- 过去几周内,一家未知实体累计收购了超过 20% 的 AUCTION 总供应量。

- AUCTION 交易量在主要交易所大幅攀升,Binance 上AUCTION 期货交易对成为 BTC 和 ETH 之后的第三大交易对。Upbit 上AUCTION 现货交易量连续多日超越 BTC。

- Upbit 的 AUCTION 交易价格出现显著溢价,大量 AUCTION 从主流交易所提取,以进行套利交易。

此外,市场流动性也出现明显失衡,呈现出一系列不健康的状况:

- Binance 热钱包持仓量骤降,目前仅剩 AUCTION 总供应量的 10% 以下。

- 借贷利率年化超过 80%,资金费率在多个周期内维持在 -2%。

- 主要交易所调整 AUCTION 永续合约的仓位限制及风险控制措施。

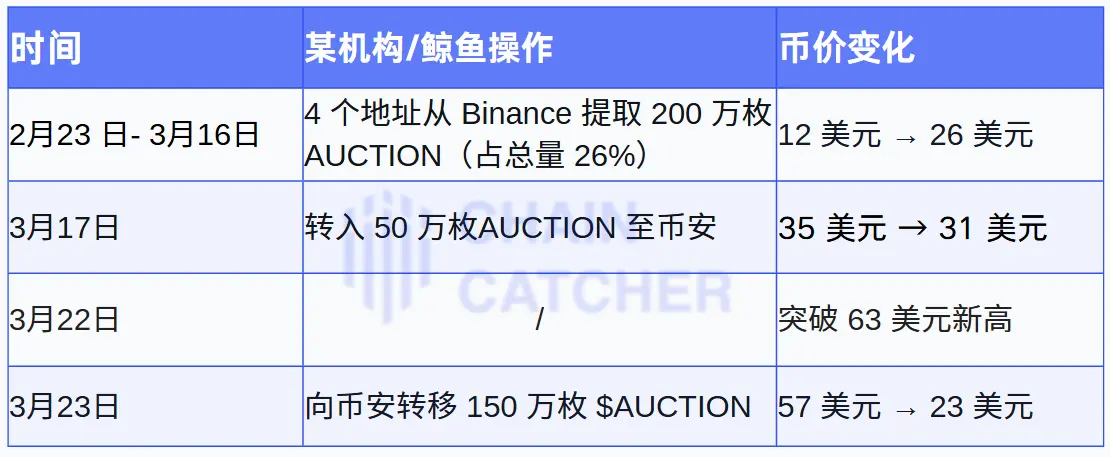

根据余烬的监测数据,我们整理了 AUCTION 巨鲸近期的关键操作轨迹与币价变化情况:

从巨鲸一系列资金调动以及市场异常情况来看,AUCTION 的价格走势并非简单的资金推动,背后存在更复杂的操盘布局。

隐蔽出货术:“被动卖单”操盘策略

在 AUCTION 暴跌的过程中,市场数据呈现出一种看似矛盾的信号:CVD(累计成交量增量)持续上涨、资金费率不断走高、持仓量也在增加。按照常规逻辑,当 CVD 上升且持仓量增加时,通常意味着市场上有大量主动买单涌入,价格理应上涨。然而,AUCTION 的价格却一路下跌,呈现出明显的市场背离现象。

根据加密 KOL Biupa-TZC 的分析,AUCTION 的“庄家”采用了一种极为隐蔽的“被动卖单”出货策略,在看似多头主导的市场中完成了大规模出货。

1.挂巨量被动卖单

“庄家”在盘口靠近市价的位置不断挂出超大被动卖单,让主动买单撞上来成交。

由于现货主要由“庄家”控制,市场上几乎没有主动卖单。CVD的计算方式为主动买单成交量减去主动卖单成交量,在缺乏主动卖单的情况下,CVD 持续上升,但价格却始终承压。

2.制造“价格坚挺”的假象

“庄家”避免主动砸盘,而是让市场上看起来都是买盘,给投资者制造市场在上涨的假象。

由于 CVD 一直上涨,持仓量也在增加,散户误以为资金在积极涌入,便可能主动做多或抄底。

3.逐步吸收市场买盘,完成出货

“庄家”通过不断挂新的被动卖单,将主动买盘一一吃掉。

每当主动买盘冲击被动卖单后,市场出现短暂的流动性真空,“庄家”就再次向下调整卖单,使价格逐步下跌。

由于成交量较大,这些卖单不仅仅是压价,而是真正地在卖出,最终导致 AUCTION 价格暴跌。

操盘游戏落幕,市场警钟敲响

AUCTION 的这场暴涨暴跌,背后是“庄家”精心策划的资金调配与操盘布局。尽管 Bounce Brand 为稳定市场流动性,已在多家交易所提供流动性支持,并锁定约 150 万枚 AUCTION,但这场事件依然暴露了加密市场中隐藏的风险与复杂性。

对于普通投资者而言,这是一次深刻的教训:面对高波动资产,盲目信号交易只会沦为“庄家”收割的筹码。唯有保持警觉,深入剖析市场动态,才能在风云变幻的交易场中立于不败之地。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。