撰文:decentralised

编译:Odaily 星球日报 Golem

所有数据都来自 Funding Tracker。

加密风险投资现状

理性的市场参与者可能认为资本市场也有高潮与退潮,就像自然界中拥有周期的其他事物一样。然而,加密货币的风险投资似乎更像是一个单向瀑布——一场持续往下落的重力实验。我们可能正在见证一场始于 2017年智能合约和ICO融资狂热的最后阶段,这场狂热在新冠疫情的低利率时代加速,现在正回到更稳定的水平。

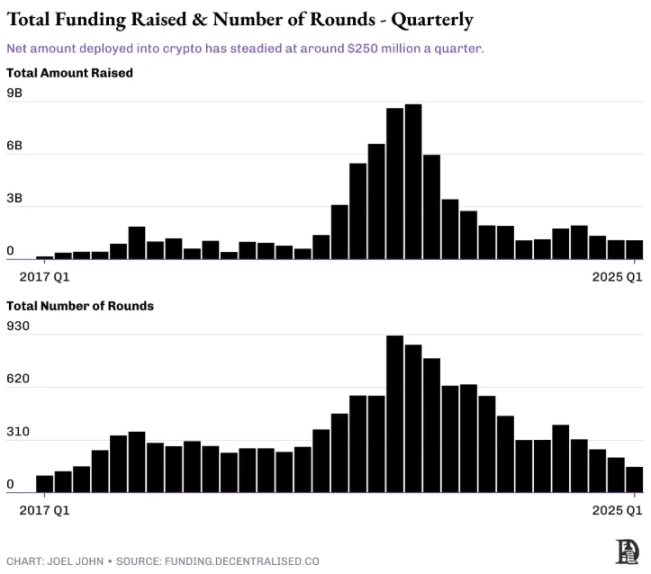

总融资与总融资轮数

在2022年的高峰期,加密货币的风险投资额达到了230亿美元,在2024年,这一数字降至60亿美元。这其中有三个原因:

- 2022年的繁荣导致VC给具有周期性且估值极高的项目分配了过多的资金。例如,许多DeFi 和NFT项目未能带来回报。OpenSea巅峰估值为130 亿美元。

- 基金在2023至2024年很难再筹集到资金,在交易所上市的项目也很难获得 2017至2022年所看到的估值溢价。缺乏溢价使得基金筹集新的资金变得困难,尤其是许多投资者表现没有跑赢比特币的情况下。

- 随着AI成为下一个重点科技前沿,大型资本转移了配置重点。加密货币失去了其曾作为最有前途的前沿技术所拥有的投机势头和溢价。

当研究哪些初创公司发展到足以保证进行 C轮或D轮融资时,另一个更深层次的危机就变得明显。加密行业中许多大型的退出都来自代币上市,但是当大多数代币上市呈负面趋势时,投资者的退出就会变得困难。若是考虑到继续进行A、B或C 轮融资的种子阶段的公司数量,这种对比就会显而易见。

自2017年以来,在 7650 家获得种子轮融资的公司中,只有1317年升至A轮(毕业率为17%),仅344 家达到 B轮,只有月1%进入 C轮,D轮融资的几率为 1/200,与其他行业的融资毕业率相当。不过需要注意的是,在加密行业中许多成长阶段的公司通过代币化绕过传统的后续轮次,但是这些数据指出的是两个不同的问题:

- 在没有健康的代币流动性市场的情况下,加密货币的风险投资将会停滞。

- 在没有健康的企业发展到后期阶段并上市的情况下,风险投资偏好将下降。

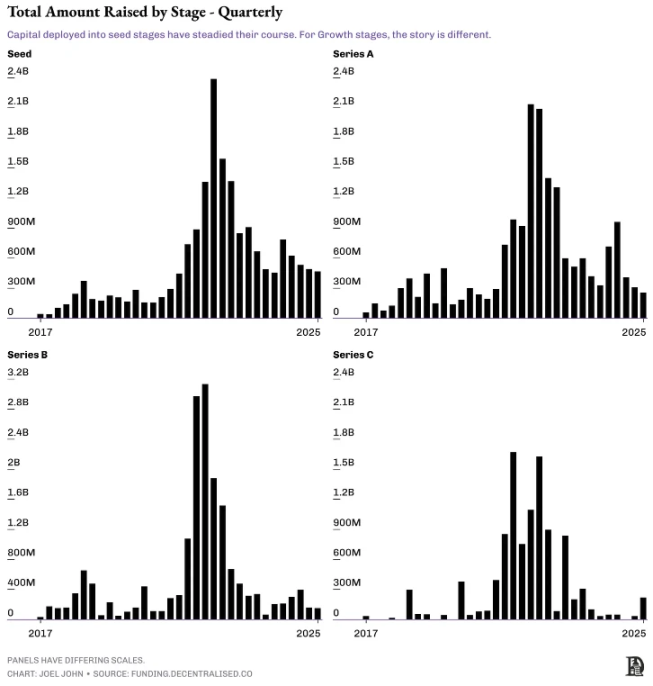

以下各个融资阶段的数据似乎都反映了同一个事实。尽管进入种子和A轮融资的资本已基本稳定,但 B和C 轮融资的资金仍较保守。这是否意味着现在是种子轮阶段的好时机?不完全是。

不同阶段的总融资金额

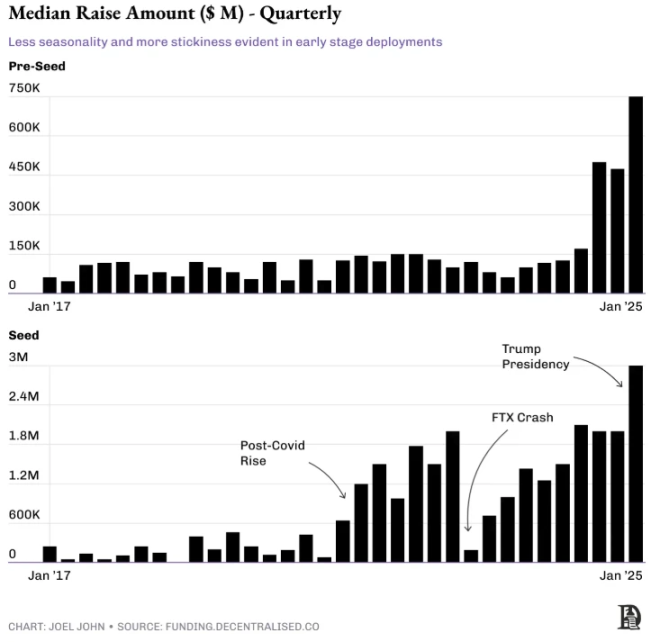

下面的数据跟踪了每个季度Pre种子轮和种子轮融资的资金中位数,随着时间的流逝,这一数字在稳步上升。这里值得两点观察:

- 自2024年初以来,在Pre种子轮阶段的融资中位数大幅提高。

- 多年来,种子轮融资中位数随宏观环境不断变化。

随着对早期资本的需求下降,我们看到公司筹集了更大的Pre种子和种子轮融资,曾经的「亲朋好友」轮融资现在由早期基金更早地部署来填补。这种压力也扩展到种子轮阶段的公司,自2022年以来,种子轮已经发展壮大,可以弥补不断上涨的劳动力成本和更长达到PMF的加密行业时间。

募集资金额度的扩大意味着公司在早期阶段的估值会更高(或稀释),而这也又意味着公司未来需要更高的估值才能在提供回报。在特朗普当选后的几个月里,种子轮融资数据也出现了大幅上涨。我的理解是,特朗普上任改变了基金的 GP(普通合伙人)筹集资金的环境,基金中的LP和更传统的配置者兴趣增加,转化为对早期公司的风险投资偏好。

融资困难,资金集中在少数大公司

这对创始人意味着什么? Web3 早期融资的资本比以往任何时候都多,但它追求的是更少的创始人,更大的规模,并要求公司比前几个周期增长得更快。

由于传统的流动性来源(如代币发行)现在正在枯竭,因此创始人花费更多的时间来表示其信誉和企业可以实现的可能性。「50% 折扣,2 周后以高估值进行新一轮融资」的日子已经过去了。资金无法在追加投资中获利,创始人无法轻松获得加薪,员工也无法从他们的既得代币中获得增值。

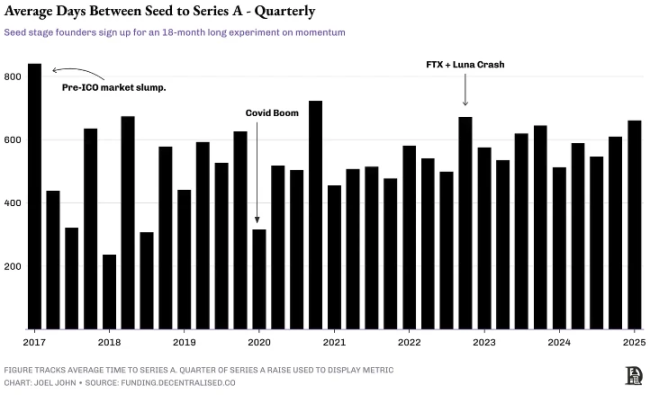

检验这一论点的一个方法是通过资本动量的视角。下图测量了初创公司自宣布种子轮融资以来筹集 A 轮融资的平均天数。数字越低,资本周转率越高。也就是说,投资者正在以更高的估值向新的种子轮公司投入更多资金,而无需等待公司成熟。

同时根据上图,也能观察到公共市场流动性是如何影响私募市场的。一种观察方法是通过「安全性」的视角,每当公开市场出现回调时,A 轮融资就会大规模发生,如2018 年第一季度的急剧下降,在2020年第1季度,该下降再次重复出现,这是在新冠疫情爆发的时候。当流动性部署听起来不太乐观时,有资本可部署的投资者反而会受到激励,在私募市场建立头寸。

但是,为什么在FTX崩溃发生的时候, 2022年第4季度却是相反的情况呢?也许它象征着人们对加密货币投资作为一种资产类别的兴趣被彻底消磨殆尽的确切时间点。多个大型基金在FTX的320亿美元融资中损失了巨额资金,这使人们对该行业的兴趣下降。在随后的几个季度里,资本只聚集在几家大公司周围,此后,来自 LP 的大部分资本都流入了那几家大公司,因为这已经是可以部署最多资金的地方。

在风险投资中,资本的增长速度比劳动力的增长速度快。你可以投入 10 亿美元,但你无法按比例雇佣 100 人。因此,如果你从一个 10 人的团队开始,假设不再招聘更多人,你就会被激励获得更多投资。这就是为什么我们能看到大量大型项目的后期融资,这些融资通常集中在发行代币上。

未来加密风险投资会变得如何?

六年来,我一直在跟踪这些数据,但我都会得出相同的结论:筹集风险融资会变得更加困难。市场的狂热最初容易吸引人才和可获得的资本,但市场效率决定了事情会随着时间的推移变得越来越困难。在2018年,成为「区块链」就能获得融资,但到了2025年,我们开始关注项目盈利能力和产品与市场的契合度。

缺乏便捷的流动性退出窗口意味着风险投资者将不得不重新评估他们对流动性和投资的看法。投资者期望在18-24个月内获得流动性退出机会的日子已经一去不复返了。现在,员工必须更加努力才能获得相同数量的代币,而这些代币的估值也变得较低。这并不意味着加密行业里已经没有了盈利的公司,它只是意味着就像传统经济体一样,将出现少数几家吸引该行业绝大多数经济产出的公司。

如果风险投资人能够让风险投资再次伟大,即看清创始人的本性,而不是看他们能发行的代币,那么加密风险投资行业还是可以向前迈进的。如今在代币市场中发出信号,接着匆忙发行代币并希望人们在交易所购买它的策略已不再可行。

在这样的限制下,资本配置者被激励花更多时间与那些能够在不断发展的市场中占据更大份额的创始人合作。从 2018 年风险投资公司只问「什么时候发行代币」到想知道市场可以发展到什么程度的转变,是 web3 中大多数资本配置者都要经历的教育。

不过问题还是,有多少创始人和投资者会坚持寻找该问题的答案?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。