来源: Cointelegraph原文: 《{title}》

内在价值指的是资产基于其基本特性的实际价值,而非其市场价格。例如,在传统金融中,股票的内在价值通常来源于盈利、现金流和增长潜力等因素。

在加密货币领域则并不那么简单。由于加密资产不与实体或稳定的收入流(如股息)挂钩,评估其内在价值涉及技术、经济和实用性等多种因素。简单来说,内在价值回答了这个问题:除了交易所上的价格外,是什么让这种加密货币有价值?

加密货币的内在价值来源于以下因素:

例如,比特币的内在价值在于其固定供应(2100万枚)、去中心化网络和由工作量证明(PoW)挖矿提供的安全性。

另一方面,以太坊的价值很大程度上来自于它作为去中心化应用(DApps)和智能合约的基础。

你知道吗?根据2024年6月Triple A的报告,全球加密货币拥有量从2023年的4.2亿增至5.62亿,覆盖全球人口的6.8%,其中亚洲引领增长。

示例:以太坊

以太坊是一个由开发者、DApps和DeFi项目组成的庞大生态系统。成千上万的开发者积极在其区块链上构建,数百万用户与其应用交互,增强了其价值。具体来说,日活跃地址数可以作为其“网络规模”的代表。

根据YCharts数据,截至2024年12月13日,以太坊的日活跃地址为543,929个。应用梅特卡夫定律:

网络价值 = (543,929)² = 296,086,104,841或约2960亿单位(相对度量,非美元)。

这表明网络价值随用户数量呈指数级增长。如果以太坊的日活跃地址增加,网络价值将以更快的速度增长。

局限:

示例:比特币

比特币的内在价值常常与其挖矿成本挂钩。

局限:

示例:BNB

BNB的内在价值来源于其在币安生态系统中的角色。

BNB用于支付交易费用、参与代币销售和获取质押奖励。根据YCharts数据,截至12月14日,BNB智能链每天处理约379.5万笔交易。分析师可以计算这些交易费用随时间的贴现值,以估算BNB的内在价值。

以下是使用贴现效用模型估算BNB内在价值的方法:

假设每笔交易的平均费用为0.10美元,每日交易费用总计:

3,795,000 × 0.10 = 37.95万美元/天

这转化为年度交易费用:

379,500 × 365(非闰年)= 1.3852亿美元/年

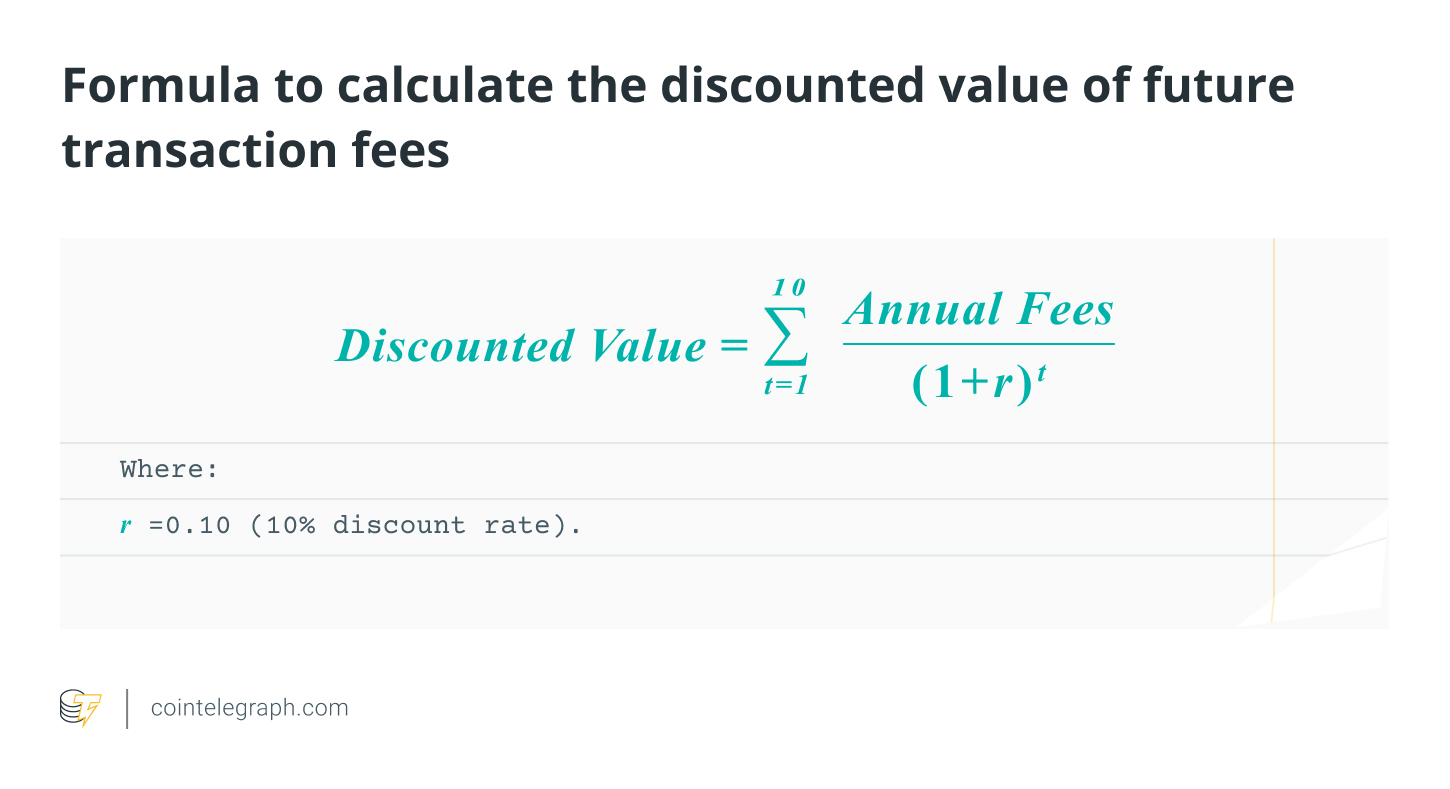

要计算BNB在未来10年的内在价值,可以应用10%的贴现率。使用下面的贴现值公式,BNB预期交易费用在10年内的总贴现值为8.5113亿美元。

贴现值 = 年度现金流 ÷ (1 + 贴现率)^年数

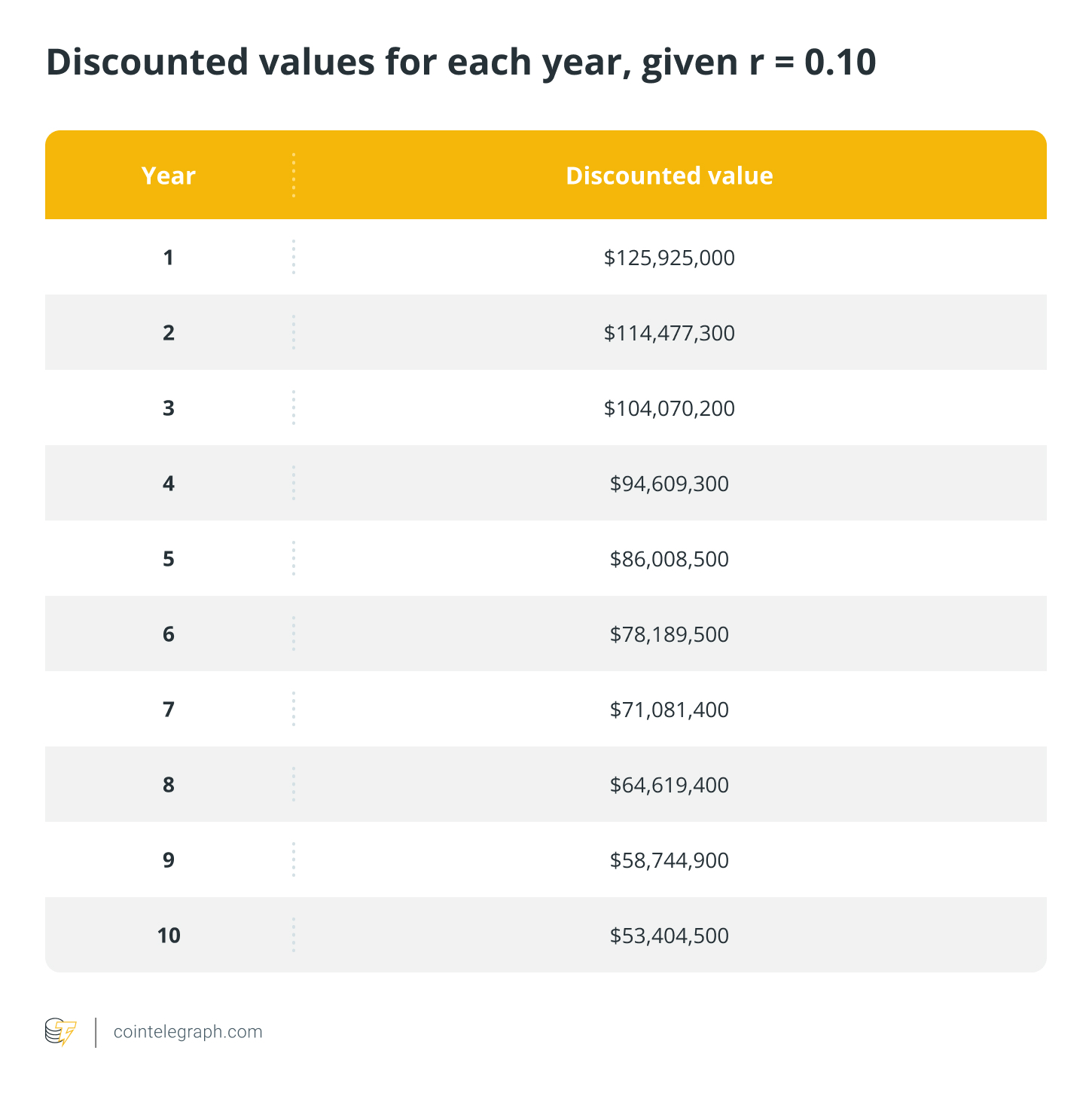

以下是基于1.3852亿美元的年度交易费用的各年贴现值,10年按10%的贴现率(在上述公式中输入值):

在上述例子中,我们使用了一个假设场景来展示如何应用贴现效用模型估算BNB的内在价值,这里假设交易费用随时间保持不变。然而,现实世界中的费用各不相同,BNB折扣、账户级别和交易类型等因素在确定确切成本方面起着关键作用。

局限:

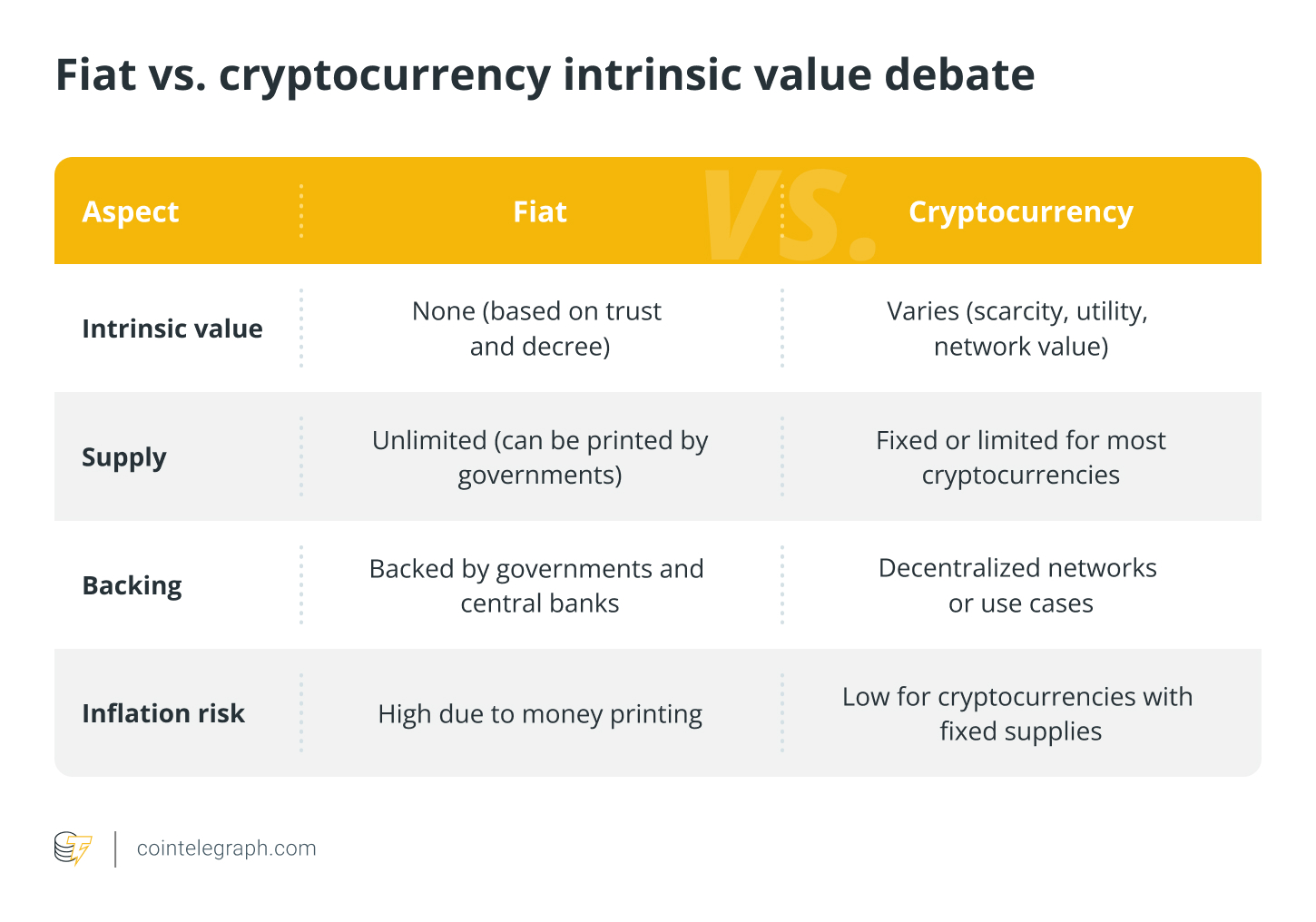

法定货币,如美元或欧元,不具有传统意义上的内在价值。与黄金或白银不同,法定货币不由实物商品支持。其价值来源于政府法令、信任和作为交换媒介的能力等因素。甚至学术文献也将法定货币定义为“本质上无用的无担保代币”。

即使没有内在价值,法定货币也能发挥作用,因为:

关于法定货币或加密货币是否具有“真实”价值的辩论常常突显以下差异:

根据《牛津价值理论手册》(第29页)提供的定义,内在价值是“因其本身而有价值的东西,凭借自身,以其自身权利,作为目的,或就其本质而言有价值的东西”。相比之下,外在价值是“作为手段而有价值的东西,或为了其他事物而有价值的东西”。

基于上述定义,法定货币没有内在价值;其价值来自政府支持和法律框架(外在价值)。然而,比特币通过其稀缺性(2100万上限)、去中心化和作为无需信任的点对点网络的效用,具有使其独立有价值的特质。

法定货币依赖中心化信任,比特币的价值源于其独特、自我维持的特性,这引发了关于其内在价值的辩论。

你知道吗?2008年全球金融危机动摇了对传统银行系统的信任。它暴露了不负责任的贷款做法、有缺陷的监管和曾被认为“大而不倒”的机构的脆弱性。这种信任侵蚀推动了对替代方案的寻求,最终为2009年比特币作为去中心化、无需信任的金融系统的创建铺平了道路。

了解内在价值有助于投资者区分强劲项目和投机性项目。在2017年ICO热潮期间,成千上万的代币几乎没有内在价值就被推出。许多项目崩溃,因为它们缺乏维持长期需求的基本特性——实用性、安全性或稀缺性。

通过关注内在价值,你可以做出明智决策,避免被炒作所迷惑。例如,比特币之所以保持主导地位,是因为它通过稀缺性、网络效应和实用性展示了强大的内在价值,而许多其他代币则逐渐消失。

最后,理解加密货币与法定货币内在价值的关键在于把握内在价值与外在价值的正确含义,以及这些概念如何分别适用于两者。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。