Although the sentiment was good yesterday and the Federal Reserve provided a viewpoint that was generally in line with expectations, investors seem to be unconvinced. The net inflow of Bitcoin spot ETFs saw a significant decline yesterday. While American investors still maintained a net inflow, the amount was only 18 coins, which is indeed a bit low. Although there were no purchases, there weren't many sellers either. Perhaps the market participants were still anticipating Trump's speech today.

We have already mentioned the content of the speech, which did not include the expected adjustments to the capital gains tax on cryptocurrencies, so many investors were left disappointed. However, overall, the hard peg of stablecoins is a crucial part of the U.S. development in the cryptocurrency sector, and Trump reiterated the goal of making the U.S. a major player in cryptocurrency.

Although many may not take it seriously, in reality, there has already been a political shift towards cryptocurrencies. It is hard to imagine that in the previous cycle, there were reports of the U.S. or various states formulating strategic reserves for cryptocurrencies. While there wasn't the anticipated surge, it is still very beneficial for the future trends of cryptocurrencies, especially BTC.

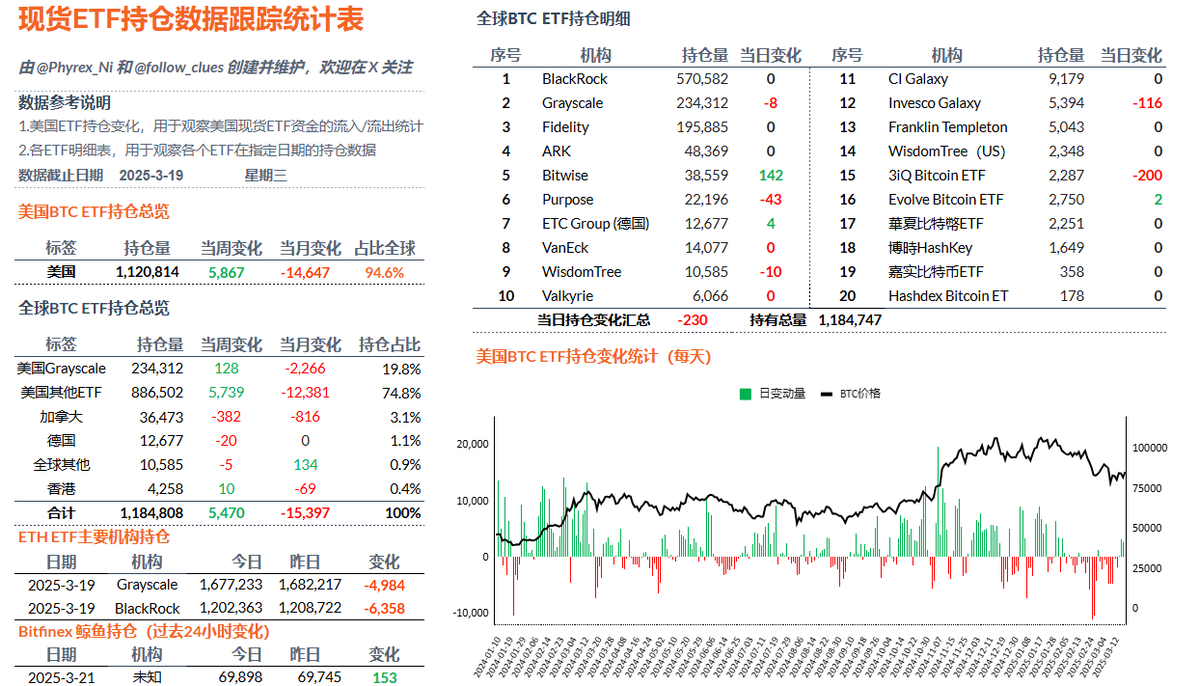

The data has been updated, address: https://docs.google.com/spreadsheets/d/1N8YIm1ZzDN197hMAlkuvH3BgFb8es0x1y4AJLCbDPbc/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。