交易的根本是生存,其次才是收益,所以每次操作之前先想清楚自己的操作是否合理,本金是否安全,要形成一套属于自己的交易思路,不断优化完善,币圈院士的建议虽然不能让你一夜暴富,但是能做到一直有你,只有在币圈长期生存下去并且坚持到最后的人,才能得到自己想要的结果,希望你能听懂,

别忘了,最黑暗的时刻往往是黎明前的时刻。在追逐梦想的路上,你永远不是孤单一人,你还有我

我是币圈院士一个一直在保护韭菜的战士,祝愿我的粉丝们在2025年实现财务自由,一起加油!

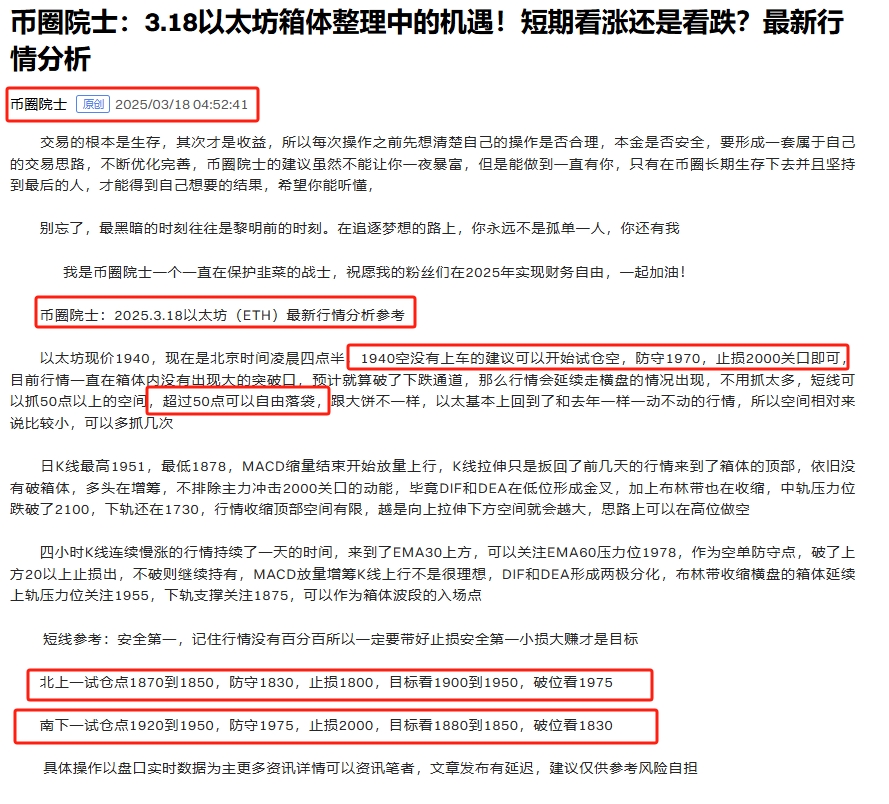

币圈院士:2025.3.19以太坊(ETH)最新行情分析参考

以太坊现价1895,现在是北京时间凌晨四点,1940昨日给出的实时策略,文章开篇就说了,利润超过50点就可以落袋,那我们来看目前盘口,日K线最高1930,最低1870,利润空间已经超过50点了,跟上的都吃到了,没有跟上的可以继续观望看老陈说的是不是那么回事,首先箱体延续,这个是不变的,

因为日K线一直都没有破箱体,上方破了1940就进入箱顶,跌破1880就进入箱底,所以多空都有机会,都有空间可以抓,EMA趋势指标向下开始减速,EMA15来到了2020,还在进一步走低,在次之前行情依旧会走箱体,MACD放量增筹K线背离向下,DIF和DEA依旧是金叉,那就说明1870多有效,可以持有,布林带收缩已经出现,下轨支撑1720延续,中轨压力位2075行情维持在比较低的位置横盘

四小时K线在EMA趋势指标下方横盘,关注EMA60压力位1965刚好是下降趋势线交汇点,可以作为多单止盈区,利润超过50点自由落袋,MACD缩量减少,DIF和DEA来到了零轴线下方,随时都有开启多头的可能,K线战力下轨1870以后出现反弹,来到了中轨1910下方,关注上轨1950压力位,思路上短多有效可以持有

短线参考:安全第一,记住行情没有百分百所以一定要带好止损安全第一小损大赚才是目标

北上一试仓点1870到1850,防守1830,止损1800,目标看1900到1950,破位看1975

南下一试仓点1930到1950,防守1975,止损2000,目标看1880到1850,破位看1830

具体操作以盘口实时数据为主更多资讯详情可以资讯笔者,文章发布有延迟,建议仅供参考风险自担

本文由币圈院士独家供稿,仅代表院士独家观点。对BTC,ETH,DOGE,DOT,FIL,EOS等有深入的研究,因文章推送时间的关系,以上观点及建议不具实时性,仅供参考,风险自担,转载请注明出处,做单合理控制好仓位,切勿重仓或满仓操作。院士也希望各位投资者明白,市场永远是对的,你自己错了该总结自身问题在哪,不要让本应到手的利润飞走。投资没有必要比市场精明,趋势来时,应之,随之;无趋势时,观之,静之。等待趋势最终明朗后,再动手也不迟。明日的成功,源于今日的选择,天道酬勤、地道酬善、人道酬诚、商道酬信、业道酬精、艺道酬心。得失都在不经意间。养成每单严格带好止损止盈的习惯,币圈院士祝你投资愉快!

温馨提示:以上内容只有公众号是笔者所创,文章末尾及评论区广告,均与笔者无关,请大家谨慎辨别,感谢阅读

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。