从2月20日左右开始的故事很明确 - 资金在从美国撤出,或者说:回流,向欧洲、中国..

表现:中国股票涨、汇率涨;欧洲股价涨、汇率涨;黄金涨。

这也许是两个因素的结合:一个是投资者对美国关税政策的结果不看好,另一个是海湖庄园协议中对美元中长期贬值的规划。

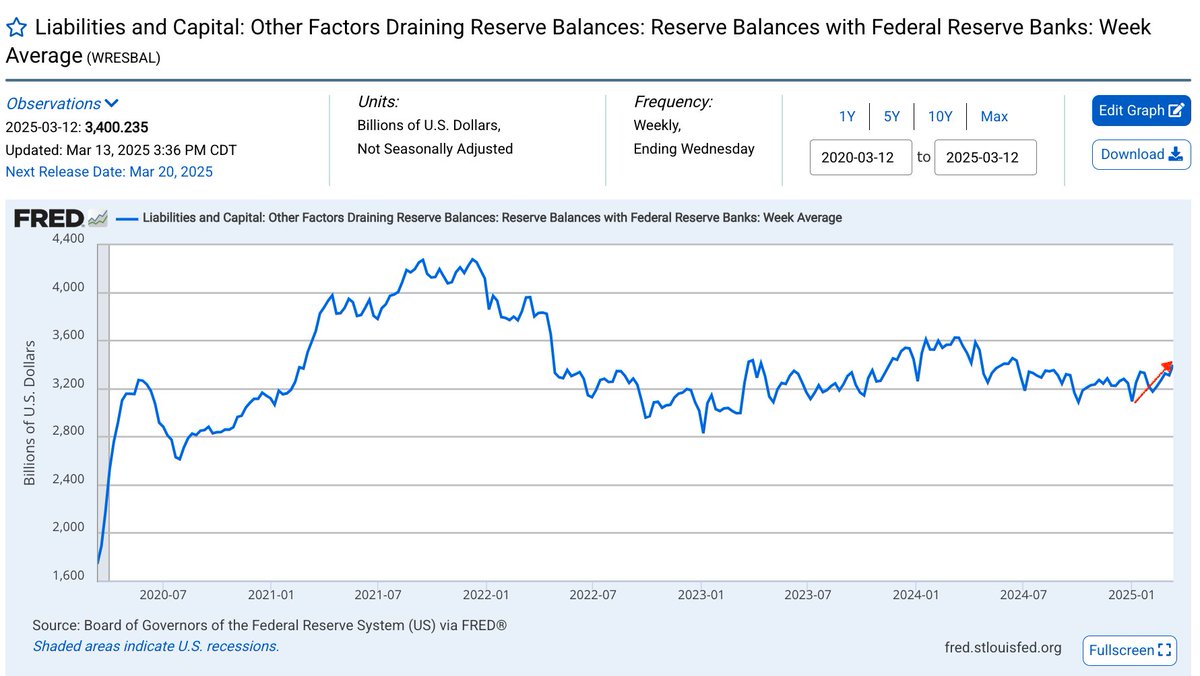

这些完全抵消了财政部tga放水带来的效应。

最关键的问题是,资金流出是否会持续下去?

从今天的中国股票、黄金涨幅来看,至少现在还在继续。

或者反过来问,资金需要什么条件才能回流美国?

1/ 不确定性消除 - 这几乎不可能,关税是个武器,把他挥舞的虎虎生风是川普的新爱好。

2/ 美联储将息,放水,或者预示会这么做。这有个障碍就是通胀...美元贬值,会影响通胀,关税会影响通胀,赶非法移民会影响通胀。 只有一个油价目前是利好通胀消除的...

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。