MUBARAK刚达到了150M(发文时已达200M),不少社区特别Fomo,更有甚者单币A7/A8。对于这种“事件性”的拉盘,不少用户姗姗来迟,这个预示着什么?让我们用通过三个指标带大家回看今天之前的数据,看看到底这波操作,对BNB生态什么影响。

重要时间线

- 3月13号币安宣布获得阿联酋主权基金MGX高达20亿美元的投资;官方在X发布了一条推文,配图是一位头戴中东特色头巾的“土豪”形象,CZ转发该推文并配文“Mubarak”

- 3月14号CZ随后转发了一位来自“0x5c...46f6”社区成员的相关推文;CZ在币安广场发文称“周末去见个朋友”。

- 3月15日,Binance Alpha上线Mubarak;CZ在次日花费各1 BNB买入TST和mubarak,并在币安广场发文“周末做点测试。”这一系列操作将Mubarak的炒作推向高潮

- 3月16日,CZ发推称“考虑更换新头像;Mubarak赢得了币安提供的440万美元永久流动性池支持

下面正式进入分析环节:

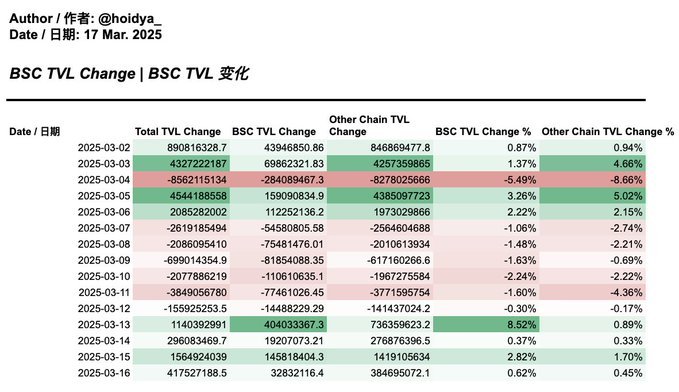

1/TVL

从TVL来看,BNB Chain主要流动性是从3月13号流入,主要可能受到MGX投资信息影响。

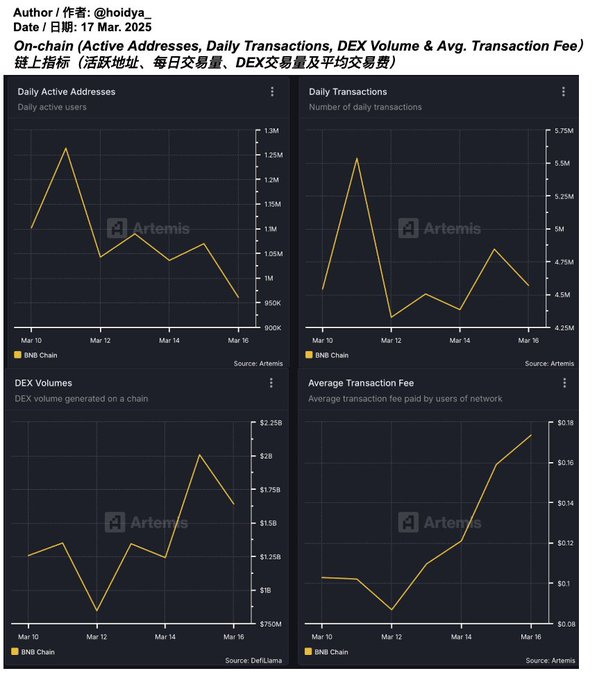

2/链上指标

- 每日活跃地址:没有因为MGX投资信息而出现用户增多,分别在13号和15号新增500k 地址

- 每日交易量:交易量在经历11号暴跌后,15号稍微拉升到4.8 m

- DEX交易额:交易额在13号和15号分别增加了~500m & ~750m

- 交易手续费: 交易手续费在12号后就持续爬升,从0.1到0.18

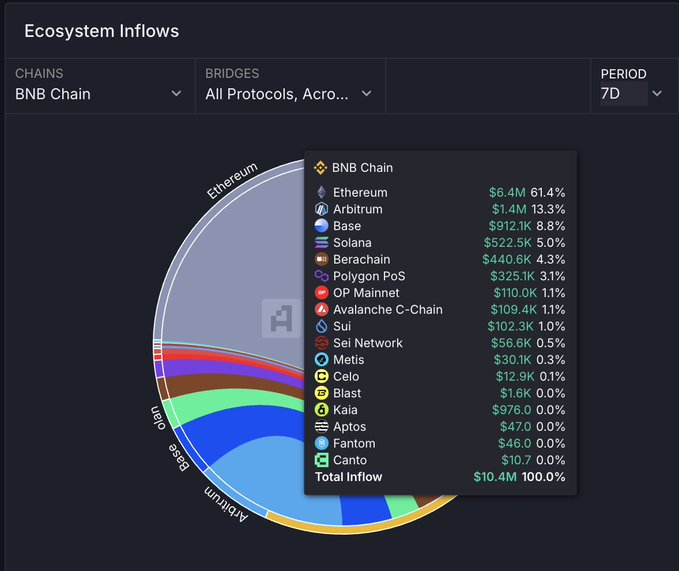

3/7d跨链流动性来源

最近7d流动性主要来自于Ethereum,占了61%。Solana 只有5%。

4/跨链交易量

近24小时的跨链交易量:

- LayerZero 2585 tx 大额交易

- UniversalX 586 tx 小额交易

- Orbiter Finance 145 tx 小额交易

- Meson 125 tx 大额交易

- deBridge 111 tx 大额交易

可以看得出LayerZero、 meson 、 deBridge主要解决的是大额交易。而Orbiter Finance&UniversalX 专注于小额交易。但UniversalX的交易量要比 Orbiter Finance要高。

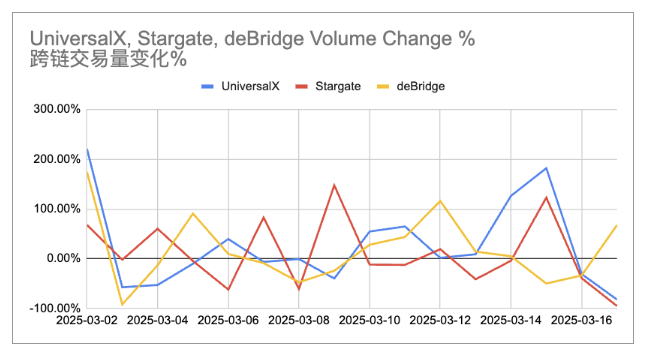

5/跨链交易额变化%

可以看出UniversalX 很明显因为上周末的BSC Meme 浪潮而增加了交易额,而Stargate和deBridge在增量变化相对低一些。

6/总结

MUBARAK的拉升造成的Fomo,让BNB Chain 生态增加了不少流动性。DEX 交易量、平均交易费也因此拉到了一周内的新高。但是核心用户群体,没有得到激增,甚至对比7天前呈下降趋势。这可能意味着链上DEX生态交易变得更为活跃,但是这依旧没有让BSC得到更多用户。

从流动性来源来看,主要的来源是EVM生态,而来自Solana的流动性不多,这也可能解释了BSC为什么没有增量用户—大量meme用户的流动性还在Solana。

从跨链来源来看,这类“事件性”爆发机会,如果只是通过主流跨链桥未必能高效解决即时买币需求,所以对于用户采用UniversalX 这类跨链桥+聚合交易平台也是不足为奇。而事实上,交易额增量也确实比其他不带“买币应用场景”的跨链桥要高。

数据应该会过几天再更新一版,验证一下我的思路,主要是我觉得BSC还会有别的事件性的机会。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。