作者:Weilin,PANews

现实世界资产(RWA)代币化是本轮加密周期资金量增长最快的赛道之一,根据rwa.xyz的数据,截至3月10日,现实世界资产的链上资产价值达到了179.25亿美元,相比于去年同期的91.62亿美元,过去一年内实现显著增长,涨幅达95.64%。

RWA正在为加密世界带来更多可能性,与此同时,人工智能与RWA也在进行着有机结合。例如基于区块链的房地产RWA项目Propy通过采用AI技术,有效地将利润率提高至40%,实现了7x24小时的在线产权交易运转,带来加密世界特有的高效率、透明度和安全性。

Propy:AI赋能房地产交易,打造高效去中介化模式

RWA房地产头部项目Propy支持房地产资产上链、智能合约和房产代币化,实现了跨境房地产交易的便捷性和安全性。Propy有三个核心产品,分别是Propy房地产买卖交易平台、Propy产权和托管服务,以及PropyKeys,Propy致力于以区块链技术革新传统房地产行业,解决其中介过多、流程慢、交易可能面临欺诈的痛点。

其中,PropyKeys基于以太坊Layer 2网络Base,实现房地产的代币化。去年3月,PropyKeys正式向公众开放。用户可以通过PropyKeys app来铸造和存储与实体房产、产权证书相对应的链上地址。PropyKeys现已在全球范围内正式突破30万个铸造地址。

Propy采用人工智能技术,成为AI与区块链这两种技术结合的一个值得关注的典型案例。房地产专业人士现在可以告别耗时的手动数据输入,轻松达成交易,节省宝贵的时间和精力。

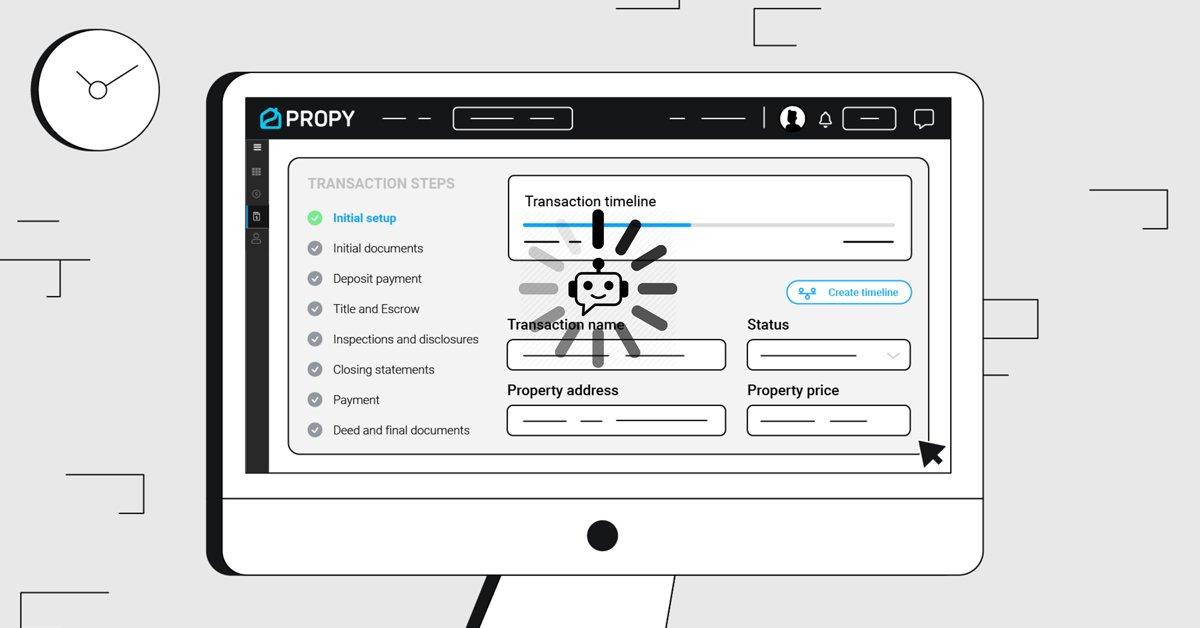

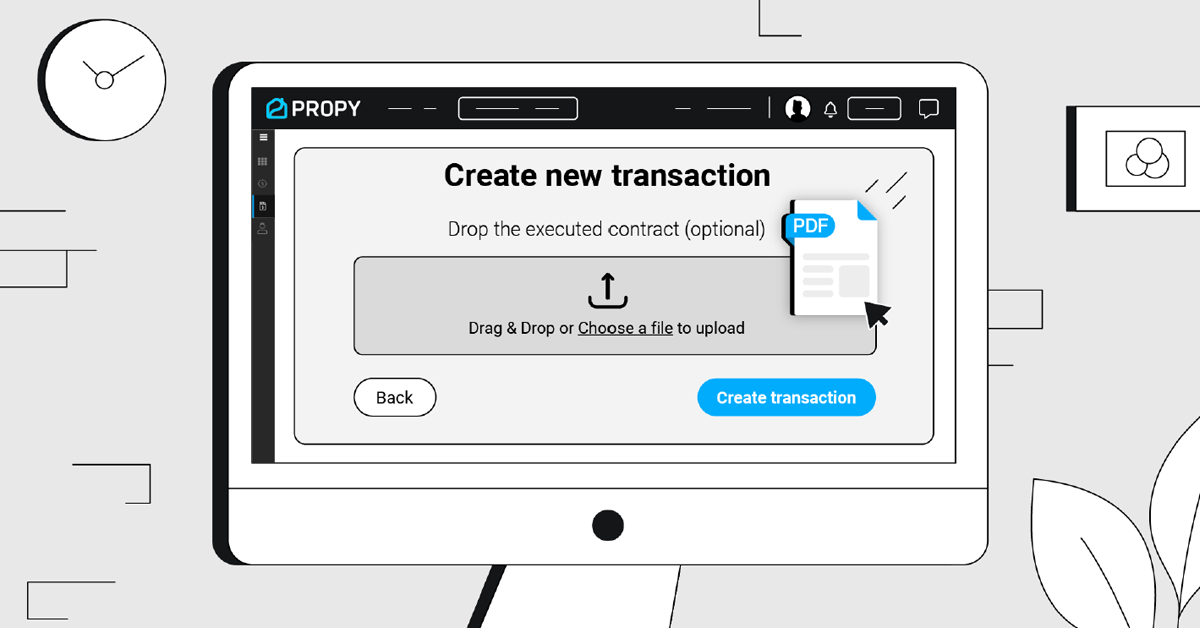

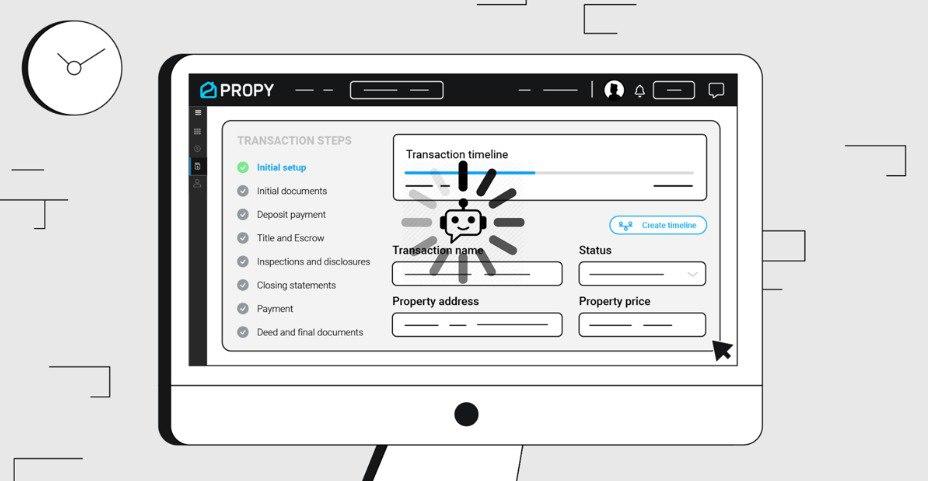

为了提供最先进的工具,Propy平台创建了交易时间轴,帮助代理商、卖家和买家清晰地了解每个交易环节的时间安排。借助Propy AI,管理交易时间轴变得轻而易举,该工具可自动读取购房协议,为用户生成交易跟踪器,并启动结算流程。

它还能智能地为交易的各个环节添加截止日期,指导所有相关方了解何时支付第一笔和第二笔定金、何时完成贷款审批等——一切都在瞬间完成。告别繁琐的文书工作和无休止的信息沟通,现在,房地产交易变得更加高效便捷。

近期,Propy还推出了线上营销活动Own Your Tomorrow,投资者和用户可以通过分享推广视频、注册和邀请朋友、推荐朋友使用加密托管服务(Crypto Escrow)来赢得不同数量的PRO代币,用户可以通过这里了解更多。

作为房地产RWA赛道的龙头,Propy持续推动创新理念的落地。今年1月,Propy上线新的贷款产品,支持抵押加密资产购买夏威夷公寓。该公寓的起始价格为250,000 USDC,作为链上RWA资产,买家可以跳过传统的30天交易流程,通过支付加密货币实现几乎即时交易。2月2日,Propy宣布成功售出了这个夏威夷房地产资产——通过多个链上报价,最终通过首个比特币支持的贷款完成交易。2024年10月,Propy还推出了基于Coinbase Prime平台和服务的加密货币第三方托管服务,这些最新进展进一步为房地产资产上链和快速、高效、安全的交易提供优质服务,成为RWA与AI结合的最新采用场景。

AI+RWA趋势崛起,房地产赛道或成关键应用领域

从更广阔的视角来看,Propy深耕的RWA赛道正逐渐成为加密市场的新引擎,释放出源源不断的增长动能。RWA的核心概念是将传统金融市场中的各类资产(如债券、房地产、股票、艺术品、私募股权等)进行数字化,并通过区块链技术将其转换为可在链上交易、抵押或借贷的代币化资产。这一过程不仅增强了资产的流动性,还降低了传统金融市场中的摩擦成本,例如交易清算时间长、中介成本高、流动性受限等问题。

现在,一股全新的RWA发展趋势正吸引着越来越多的资本力量和市场关注——人工智能与RWA的有机结合。它可以涉及以下几个方面:AI驱动的资产估值,风险管理与预测分析,AI 在智能合约自动化中的应用,AI驱动的流动性优化,AI赋能的安全性与欺诈检测,通过个性化提升投资者体验,以及AI在合规与监管监控中的应用,等等。

通过观察加密市场上的动态可以发现,近期,许多RWA项目都对人工智能技术进行更多规模的集成,尽管二者结合仍处于早期阶段。根据风投和数字资产基金Decasonic的分析,在代币化长期以来承诺提升流动性并实现去中心化访问的同时, AI的加入进一步加速了实时优化、风险评估和自动化进程,使 RWA 资产变得更加动态和高效。

AI+RWA赛道动态频频,行业专属RWA代币化趋势愈发明显

近年来,AI+RWA市场正朝着增强流动性和提升效率的方向发展。例如,Ondo Finance在2024年获得9500万美元 BlackRock BUIDL 资产配置,并开始探索 AI 驱动的收益优化,以提高其代币化国债的回报率。

AI还在利用庞大的数据集,包括市场趋势、天气模式、监管动态等,提高 RWA 资产的估值精度。例如,MakerDAO不断扩大的RWA资产敞口可能正借助AI进行收益分析,同时,AI驱动的实时估值模型也在不断优化资产定价的准确性。

此外,行业专属的 RWA 代币化趋势愈发明显,通用型代币化模式正在逐步让位于针对特定行业的解决方案。例如,Agrotoken在Algorand上代币化大豆等农产品。与此同时,AI 也在优化代币化稳定币的收益管理,如 Superstate的 $USDM,其资产由国债支持,并提供 5% APY的回报率。

宏观监管环境的变化有望推动AI集成与RWA的深度融合,进一步加速这一进程。在美国,特朗普政府支持数字资产,已发布加密行政命令,涉及加密银行业务解禁、SAB121会计规则改革,甚至建立美国战略比特币储备,BTC将被作为储备资产被持有。同时,特朗普政府投入5000亿美元用于AI研究与基础设施建设,推动新一代AI+区块链解决方案的发展。

在亚洲,随着DeepSeek的走红,人工智能再次点燃了科技市场的热情。加密行业也有望借助人工智能等前沿技术,进一步实现突破与增长。

随着RWA链上资产价值的快速增长以及AI+RWA技术的深度融合,房地产板块正成为值得关注的领域。Propy作为该赛道的先行者,利用AI优化交易流程、提升效率,并通过创新的营销活动吸引用户参与。未来,AI与区块链的结合或将进一步加速房地产市场的数字化变革,为全球投资者提供更加透明、高效、安全的交易体验。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。