作者:Heechang : : FP,Four Pillars Co-Founder

编译:深潮TechFlow

省流版

韩国投资者目前持有的美股价值超过1000亿美元。自2020年1月以来,交易量增长了17倍。

当前韩国投资者交易美股的基础设施存在诸多限制,包括高额费用、冗长的结算时间和缓慢的提现流程,这为代币化或镜像化的链上股票创造了机会。

在发行领域,Backed Finance占据了90%的市场份额,但其总锁定价值(TVL)仅为1800万美元,与传统股票市场相比规模极小。此外,@injective 最近发布了一份关于iAsset的白皮书,提出了一种新的链上股票模式。

每个代币化/镜像化项目都在不同的网络上发行,从L2到L1,甚至是私有L1。互操作性协议如@LayerZero_Core和链抽象协议如@UseUniversalX 将发挥关键作用。

随着支持链上美股市场的基础设施和平台不断完善,更多韩国交易者将进入市场,这是一个巨大的机会。

韩国市场乏味导致他们交易加密货币

韩国有哪些投资机会?包括股票、房地产、债券、基金、加密货币等。

-

房地产价格高昂。

-

债券/基金的收益率仅略高于储蓄账户。

-

韩国股市指数KOSPI被戏称为“Box-PI”,因为其图表在过去20年中几乎没有增长。人们常说:“국장 탈출은 지능 순”(“聪明人不交易韩国股票”)。想象一下,如果ETH的价格20年不变,谁还会投资它?

*蜡烛图是纳斯达克指数,底部的洋红色线是自2008年以来的KOSPI指数。

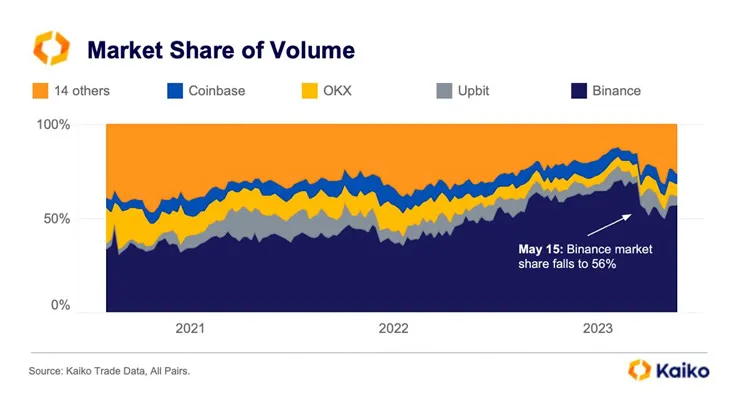

从这里我们可以看出交易者的去向。韩国人口5000万,占全球的0.6%,但其加密货币交易量却占全球的10%。每个发行代币的项目都将韩国视为重要市场。

来源:Anthony Pompliano的《加密货币市场结构现状》

在替代品尚未出现的当下,加密货币的交易量和兴趣不会消失。然而,任何与加密货币、区块链、代币和山寨币相关的东西都被视为骗局。

案例1:@terra_money 留下了最糟糕的印象。人们认为稳定币是骗局。(最近情绪有所变化,我们(@FourPillarsFP @FourPillarsKR)正在努力加速这一转变。)

案例2:2021-2022年韩国主导的代币项目简直就是骗局。散户投资者看到大机构发行代币,但这些项目只是空头承诺。它们甚至比Meme币更糟糕。

(不)交易加密货币的人交易美股

根据韩国证券存管院的数据,截至2023年底,韩国投资者持有的美股价值达到1111.81亿美元,较年初(676.09亿美元)增长了70%。这一里程碑标志着持有量首次突破1000亿美元。韩国人持有价值129亿美元的特斯拉股票、129亿美元的英伟达股票、48亿美元的苹果股票等。

市场表现出显著增长,交易量(总买入和卖出)同比增长20%,交易价值增长近80%。与2020年1月的5万亿韩元相比,五年内增长了18倍。值得注意的是,96%的外国股票流出是由国内投资者造成的。

来源: [个人投资者逃离韩国股市] “西学蚂蚁”持有的美股金额超过160万亿韩元 | 亚洲经济

加密货币项目能做什么——发行代币与互操作性

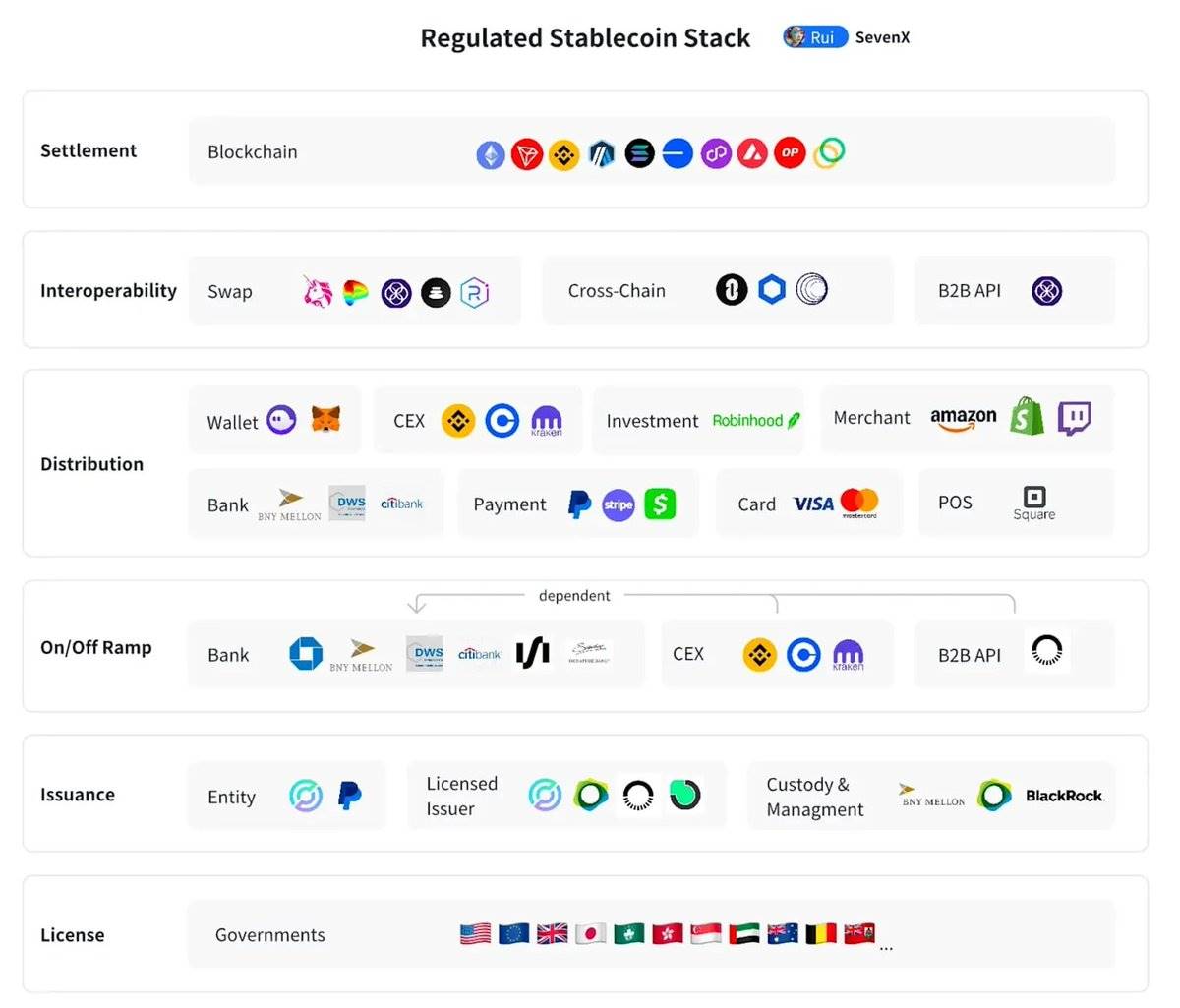

借鉴Rui在sevenx提出的“受监管稳定币堆栈”框架,并将其应用于代币化/镜像化股票,两个核心基础设施组件至关重要:

-

股票的发行

-

这些资产的互操作性

3.1 发行——目前市场规模小,需要关注Injective提出的iAsset

加密货币中的代币化股票市场规模很小。代币化股票的总价值峰值约为1700万美元。与传统股票市场相比,这个数字微不足道,因为个别公司的市值往往达到数十亿甚至数万亿美元。此外,大部分价值集中在少数资产上,如Backed Finance的bCSPX(代币化标普500指数)和bCOIN(代币化Coinbase)。

代币化股票的发行者数量有限:

-

Backed Finance以1382万美元的市值领先,约占90%的市场份额。

-

其他发行者如Dinari(89万美元)、Swarm X(71万美元)和日本公司(249.98美元)的市值显著较小。

所有发行者的总市值不到1600万美元。

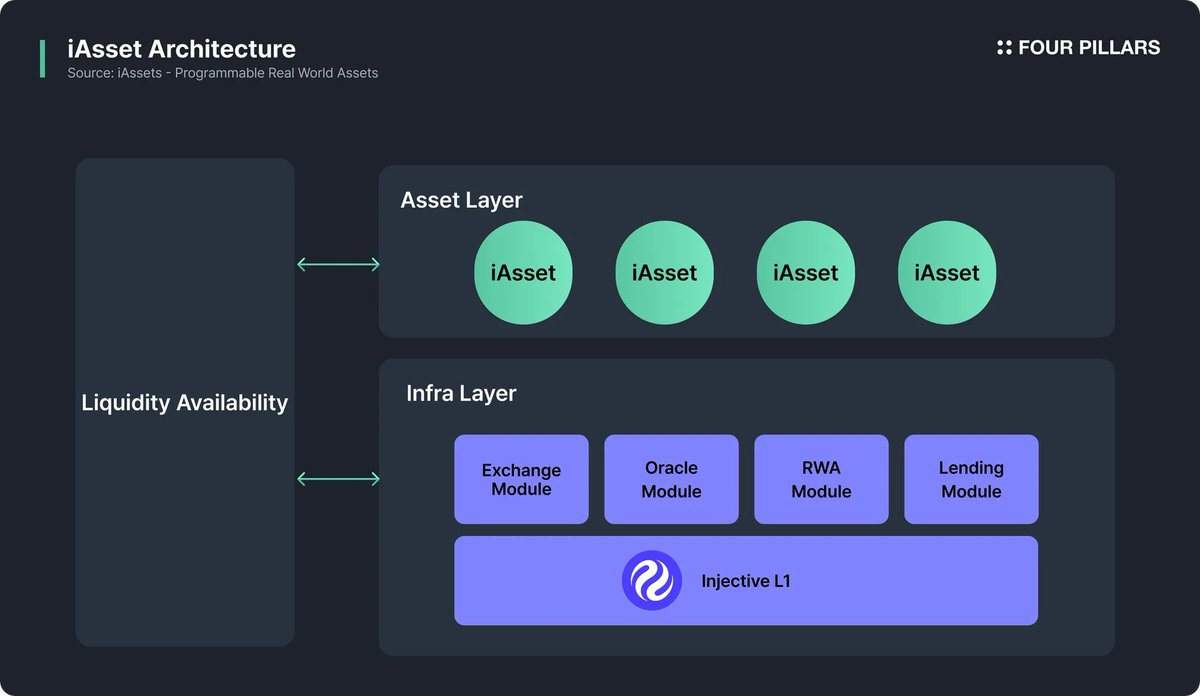

最近,Injective引入了一个名为iAssets的概念,旨在克服传统金融和早期DeFi模型的低效性。与传统的代币化资产不同,iAssets不需要预先锁定抵押品,而是作为可组合的链上工具运行。

什么是“无预融资”? 在传统金融中,现实世界资产的代币化表示通常需要用户预先锁定大量抵押品。例如,如果用户想要铸造合成股票,他们必须存入并锁定一定数量的抵押品。

与传统的代币化方法不同,iAssets不需要过多的抵押品或锁定资本。它们利用Injective的共享流动性网络,根据实时市场需求动态分配流动性。(Four Pillars将很快发布详细文章)

iNVDA现已可交易,iTSLA和其他股票很快也将在Injective上链交易。

3.2 互操作性——LayerZero和链抽象将解决发行分散化

代币化资产的发行项目正在增加,主要金融科技公司/机构也在参与:

-

@OndoFinance正在推出自己的L1

-

@noble_xyz L1 正在发行更多RWA代币

-

@coinbase正在考虑在Base上发行其$COIN股票

-

@RobinhoodApp的 CEO@vladtenev公开倡导将现实世界资产代币化,以民主化传统上仅限于合格投资者的私人市场投资。(他们可能会推出自己的私有L1)

-

Apollo正在推出其链上私人信贷基金Apollo Diversified Credit Securitize Fund(ACRED),该基金可在Solana、Link、Ethereum、Aptos、Avalanche和Polygon上使用。

这些代币将在30多个甚至数百个网络中发行。我认为两家供应商将解决“碎片化”问题:

-

@LayerZero_Core - OFT和DVN:OFT正在对代币做的事,是稳定币曾经对法币做过的。它解放了在单一环境中孤立的限制。OFT将允许代币化资产在不同网络之间发送和管理。然而,安全性如何?DVN可以定制,发行者可以处理跨链交互。例如,Ondo Finance和Tether为其代币运行自己的DVN。

-

@ParticleNtwrk 和 @UseUniversalX:最终,资产将以分散的方式发行。一些将分散在以太坊、Solana、Monad、L2s、Sui等链上发行。这将为用户带来碎片化的体验。我认为UniversalX可能是最佳平台。代币化股票、基金、指数将以分散的方式发行,而Particle Network和UniversalX似乎处于最佳位置。

有了这些基础设施,用户就能够在链上交易股票而无需跨越不同网络。

做大做强并接受监管

然而,代币化和镜像化股票仍处于早期阶段。构建支持多种资产和大规模交易的基础设施需要时间。然而,吸引对更具成本效益的股票交易感兴趣的新零售交易者具有潜力。

对于交易美股的韩国人来说,当前系统涉及高额费用、冗长的结算时间和缓慢的提现流程。随着支持美股市场的基础设施和平台不断完善,新的用户群体可能会进入市场。

如果这一市场大幅增长,韩国政府将介入监管。我希望这一领域能够发展到足以获得此类监管。

来源

[全球经济社论] 韩国人对美国股票的投资在5年间增长了18倍 - 全球经济

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。