来源: Cointelegraph原文: 《{title}》

据分析师称,泰达币的链上活跃度已达到六个月来的新高,这可能表明交易员们正准备重新入场。

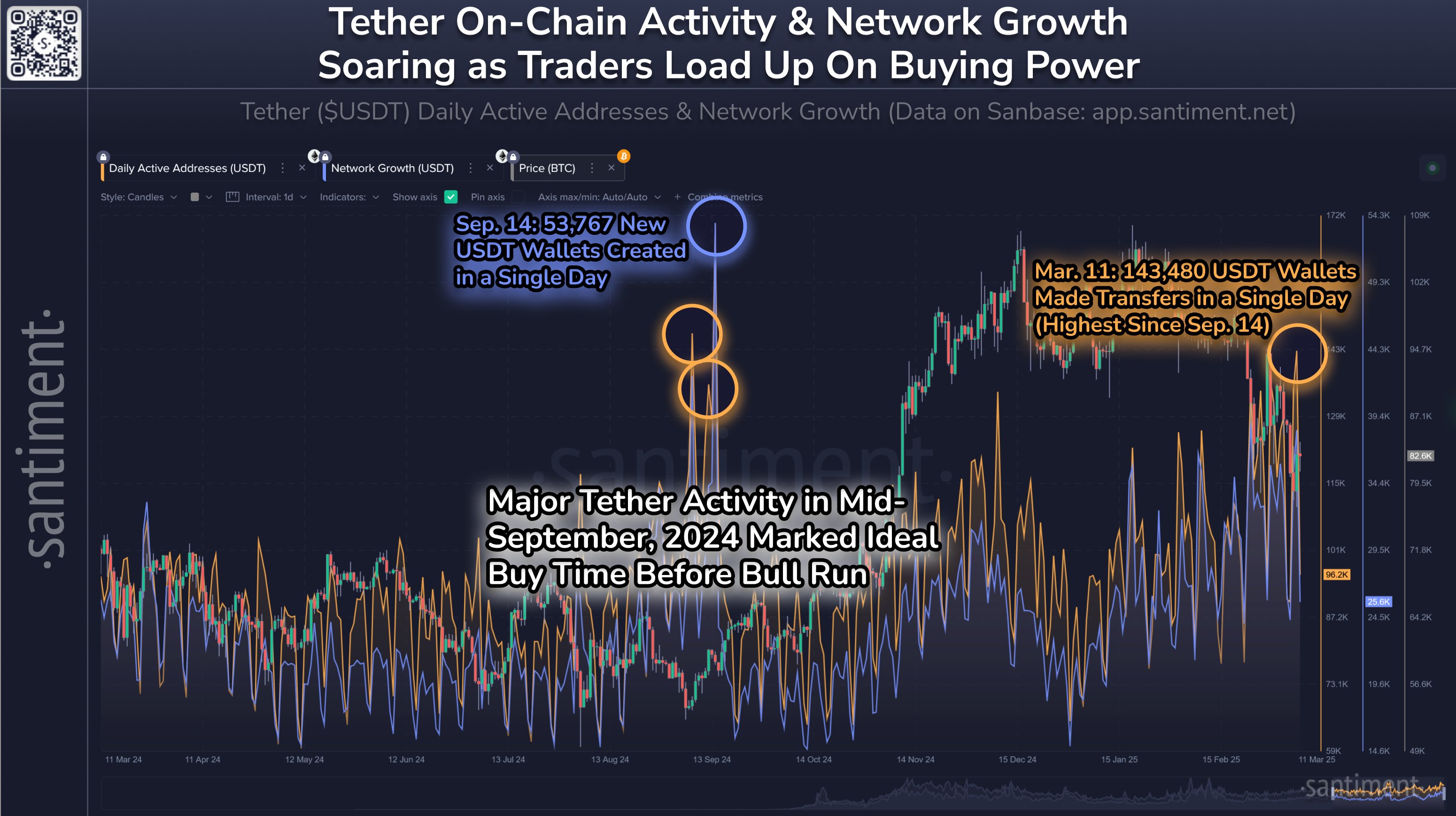

区块链数据平台Santiment在3月12日发布于社交平台X的帖子中分享的数据显示,泰达币的链上活跃度一直在上升,在3月11日达到峰值,当天有超过14.3万个钱包进行了转账,这是六个月来的最高水平。

Santiment表示:“当泰达币及其他稳定币的活跃度在价格下跌期间飙升时,交易员们就在准备买入。增加的买入压力有助于加密货币价格回升。”

泰达币的链上活跃度飙升,达到六个月来的新高。来源:Santiment

这一情况出现之际,比特币(BTC)在3月11日跌至7.67万美元的四个月低点,由于宏观经济的不确定性以及关税战的不断升级,整个加密货币市场在此次美国大选后取得的涨幅进一步缩水。

Kronos Research的首席投资官Vincent Liu在接受Cointelegraph采访时表示,交易员们通常会在价格下跌时积累泰达币,以便为买入机会做好准备,他还补充称,这种买入压力有助于加密货币价格回升。

他推测,泰达币钱包活跃度的上升很可能反映出交易员们在利用近期的市场波动获利。

刘表示:“可能的原因包括更广泛的经济不确定性、加密货币领域的特定事件,如监管动态或大选后的情绪变化,以及泰达币作为稳定避险资产的角色,这使得它成为那些准备战略性配置资金的投资者的理想持有资产。”

刘称,泰达币活跃度的飙升是一个看涨信号,表明有大量的购买力在观望,但加密货币市场的复苏可能取决于宏观经济状况、监管的明确性以及投资者信心等因素。

他说:“不过,由于2月份的通货膨胀率降至2.8%,低于近期消费者物价指数(CPI)数据中的预期,这可能会减轻加密货币价格的压力,并预示着一个更有利的环境。”

刘还补充道:“此外,即将于3月18日召开的联邦公开市场委员会(FOMC)会议可能会就利率和货币政策提供进一步的指引,这有可能会影响市场的发展和复苏。”

作为比特币和加密货币情绪的关键追踪指标,加密货币恐惧与贪婪指数在2月26日跌至两年多来的最低值,进一步陷入“极度恐惧”状态,指数值降至10。

自那以后,加密货币市场情绪有所回升,但该指数在3月13日仍为45,仍处于恐惧区间。

泰达币首席执行官Paolo Ardoino美国之行

与此同时,在立法者们着手对加密货币行业进行监管之际,泰达币首席执行官Paolo Ardoino目前正在美国访问。

在3月12日Cantor Fitzgerald Global Technology Conference上的一次演讲中,他表示,就目前情况而言,约37%的泰达币用户将其用作储蓄账户来储存价值。

Ardoino说:“他们没有银行账户。他们生活中通常拥有的唯一东西就是现金。”

“现在他们终于可以持有世界上使用最广泛、最重要的稳定币,也就是美元,但他们把它存在智能手机里,当作自己的储蓄账户。”

CEO of @Tether_to, @paoloardoino, speaks at Cantor's Global Tech Conference. #CantorTechhttps://t.co/2z8d46WDMG

Ardoino同时表示,在人们越来越担心美元可能失去其作为世界储备货币以及国际交易和大宗商品交易首选货币的主导地位之际,泰达币正充当着“美元的最后堡垒之一”。

据Ardoino称,这家稳定币发行商还一直在努力遏制该领域的不良行为者,参与了170多次执法行动,并冻结了25亿美元的非法资金。相关推荐: Paxos公司首席执行官敦促美国立法者制定跨境稳定币监管规则

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。