作者:Alea Research Daily Newsletter

编译:深潮 TechFlow

DeFi(去中心化金融)货币市场曾被认为是一场真正的革命,可能会颠覆传统金融的某些关键领域。尽管链上借贷依然蓬勃发展,但其消费者体量或机构渗透率并未达到一些人的最初设想。

阻碍 DeFi 借贷进一步增长的最大障碍可能不是用户体验、智能合约风险或其他因素,而是无法实现低抵押或无抵押贷款。无论是工薪阶层申请抵押贷款,还是大公司为完成收购而借款,借款方能够借到超过其抵押物价值的资金都是至关重要的。

传统来说,加密货币领域的无抵押贷款几乎具有神话般的地位。如果去中心化协议无法访问用户的信用信息并为其提供担保,用户就很难证明自己的信用评分或还款能力。

3Jane 针对无抵押贷款问题提出了一种新方法,结合了 CeFi(中心化金融)和 DeFi 的元素。在今天的文章中,我们将解读昨天发布的 3Jane 白皮书,讨论无抵押贷款如何改变链上市场,以及其他相关内容……

无抵押贷款的现状

无担保信贷行业是一个价值近 12 万亿美元的市场。而在 DeFi 中,这一市场几乎不存在,尤其是在零售端。虽然有像 Maple Finance 和 Goldfinch 这样的协议通过 DeFi 智能合约向机构提供贷款,但这一市场仍然很小。

在加密货币的中心化领域,借贷仍未恢复到 2021 年的巅峰时期。Celsius 和 Genesis OTC (场外交易)等主要参与者曾为该领域的大玩家提供无抵押贷款服务。这一趋势在 2022 年戛然而止,至今仍未恢复。尽管这对于确保当前周期的相对稳定性和可持续性可能是件好事,但它仍然留下了亟待填补的市场空白。

当涉及到主流资产和市值较大的资产时,机构借贷仍然是最大化流动性流动的必要因素。然而,如果无抵押贷款能够在链上实现,可能会对链上市场产生重大影响。如果像 3Jane 这样的解决方案能够按预期工作并得到更广泛的应用,这可能会为 DeFi 借贷带来重大突破。

3Jane 的背景

3Jane 通过利用现有的从法币到加密货币的接入基础设施,绕过了阻碍无抵押贷款的障碍。自上一个周期以来,加密货币的用户体验已经悄然显著提升,其中之一就是接入的便捷性。Plaid 提供 API 服务,使用户能够将银行账户连接到 Robinhood 等金融科技应用和其他应用程序。

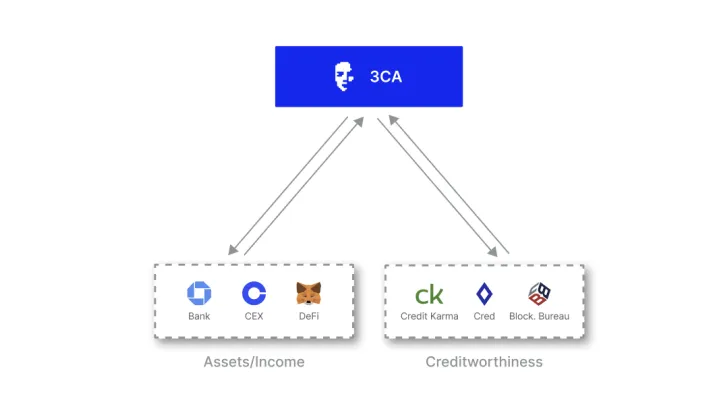

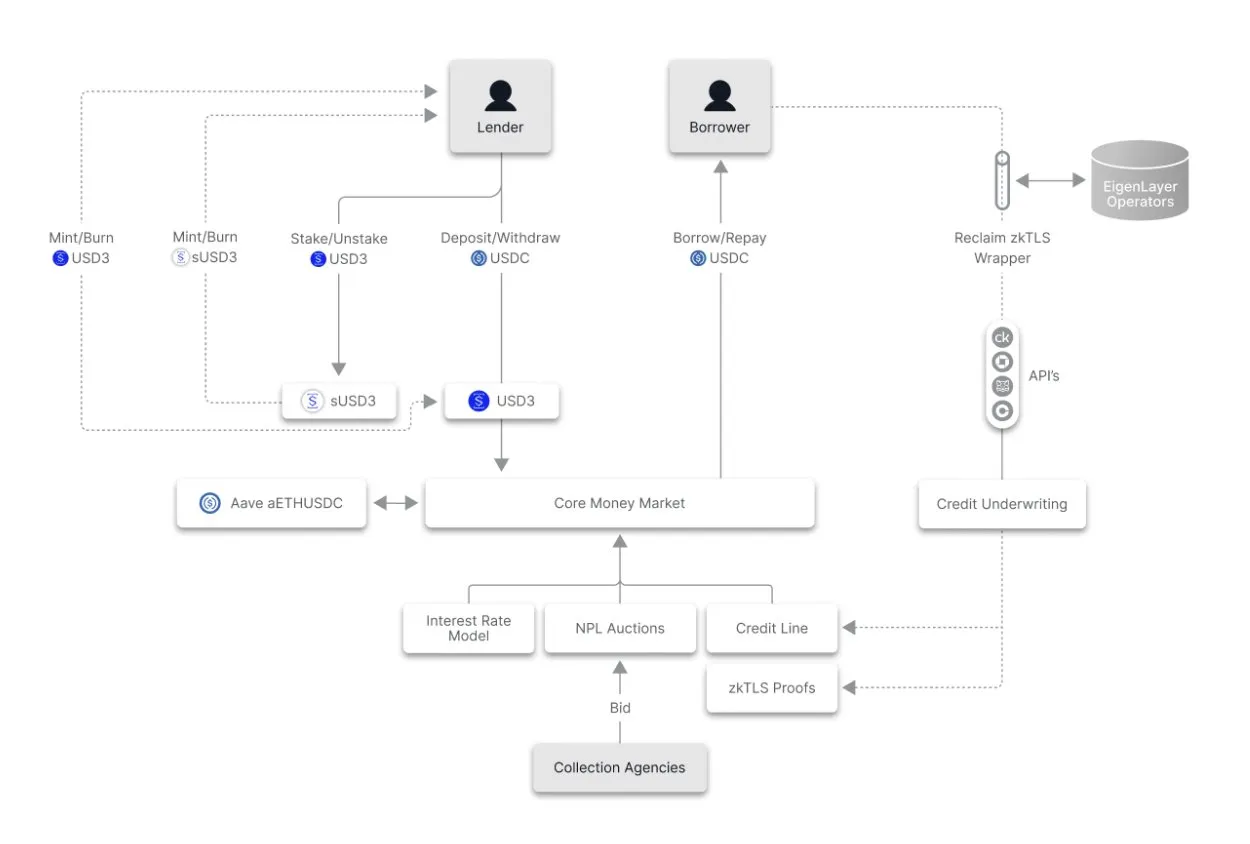

Plaid 是 3Jane 最初将链外声誉与链上以太坊地址连接起来的方式。在用户隐私方面,zkTLS 被用于将链外数据安全传输到 Jane3 协议。

担保并不在链上进行,而是交给一个链外算法,该算法在呈现贷款条款之前会根据借款人的风险进行调整。影响信用评分的因素包括用户的钱包余额、潜在的 DeFi 活动、银行余额和预期收入,还有关联银行账户相关的信用数据。Plaid 本身并不提取信用记录,这是通过其他提供商完成的。

一旦所有因素都符合,就可以发放贷款。其运作方式是,资金提供方存入自己的 USDC 以铸造 3Jane 的原生 USD3 或 sUSD3,并承担某些信贷额度的风险。3Jane 上的贷款完全无抵押,因此还款成为关键步骤,若未能妥善处理,可能导致资金提供者减少或完全消失。

3Jane 上的未偿还债务基本上被视为信用卡债务或其他类型的无担保债务,未能还款可能导致信用评分下降并面临催收威胁。在 3Jane 的案例中,协议会将债务拍卖给美国的催收机构。这些机构将获得催收债务的一部分,其余部分归原始资金提供方所有。

鉴于加密货币的国际性,尚不清楚这些措施对违约行为的威慑力有多强,以及资金提供方是否会因这些措施而感到安心。尽管如此,这是一个链上行为产生链下后果的有趣例子,这种情况通常只在高调破产或漏洞事件之外才会出现。

3Jane 自己声明的用户群体包括个人交易者、矿工、企业,甚至 AI 代理。这意味着该服务主要适用于资产丰富的用户,这可能会让资金提供方感到更放心,而且如果这些用户未能还款也会更容易催收。

用户可以在还清贷款后从平台删除其个人数据,如果用户未能还款,这些数据对催收非常重要。后续,这些数据会与竞标某些未偿还贷款的特定催收机构共享。

总体而言,3Jane 为解决无抵押贷款问题提供了一种独特的方法。即使在实践中,这最终主要服务于超高净值个人(UHNWIs)或机构,与过去我们看到的中心化无抵押贷款并无太大不同,3Jane 仍然为加密货币领域在 ZK 技术和 Web2 集成方面的可能性提供了一个有趣的案例。

重要链接

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。