来源: Cointelegraph原文: 《{title}》

美国最新公布的衡量通货膨胀情况的核心消费者物价指数(CPI)数据低于预期,为3.1%,低于3.2%的预期值,整体通胀数据相应下降了0.1%。

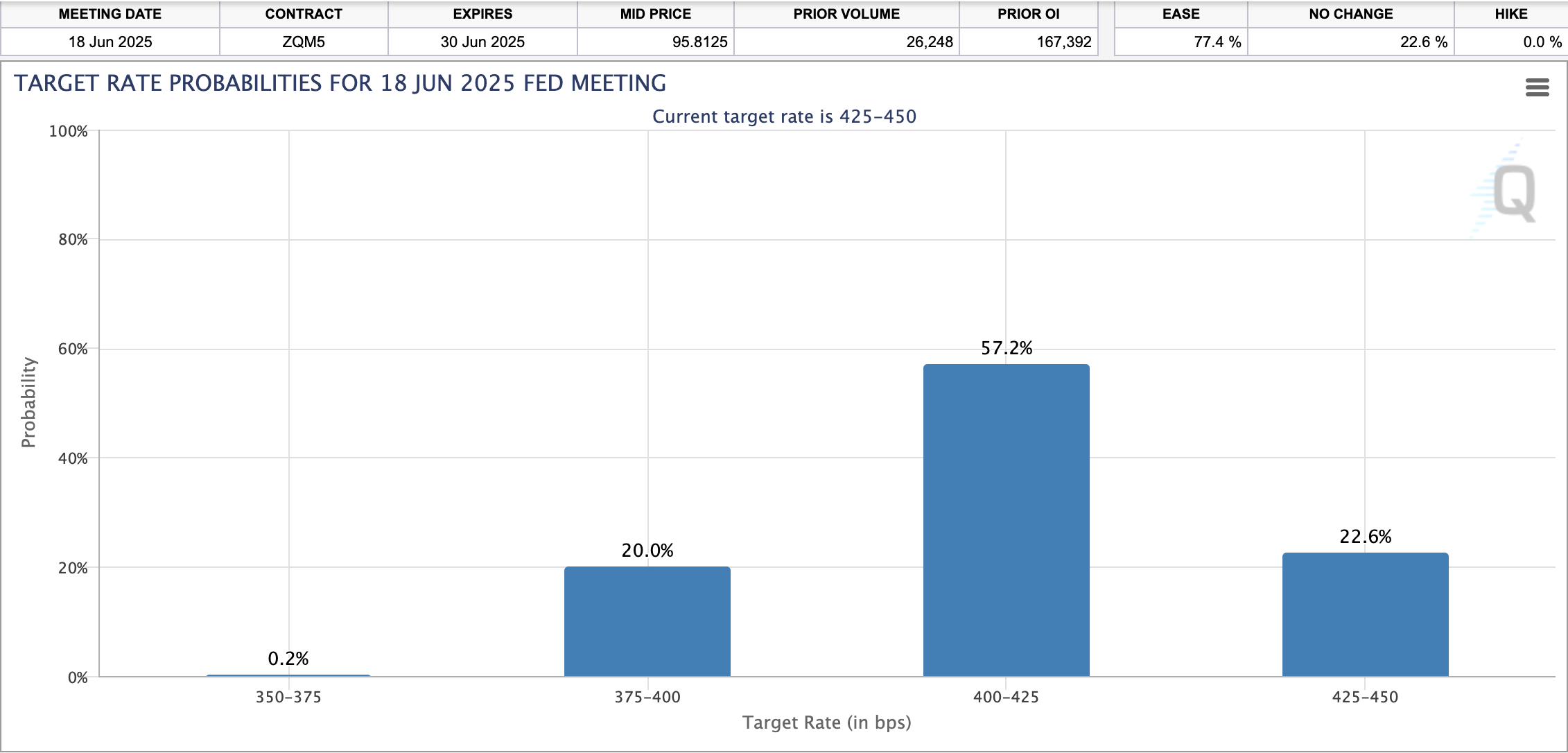

21Shares的加密货币研究策略师Matt Mena表示,降温的通胀数据增加了美联储今年降息的可能性,这将为市场注入急需的流动性,并推动风险资产价格上涨。Mena补充道:“市场对降息的预期大幅上升 —— 目前市场预计5月降息的可能性为31.4%,比上个月高出两倍多。同时,到年底前进行三次降息的预期大幅上升,比之前高出五倍多,达到32.5%,而进行四次降息的预期从仅1%飙升至21%。”

尽管通胀数据好于预期,但比特币(BTC)的价格从当日开盘时的超过8.4万美元降至目前的8.3万美元左右,原因是交易员们正在应对美国总统特朗普发起的贸易战以及宏观经济的不确定性。

大多数市场参与者认为美联储将在2025年6月前降息。来源:芝加哥商业交易所集团

特朗普总统是在让市场暴跌以迫使降息吗?

美联储主席Jerome Powell曾多次表示,央行不会急于降息,美联储理事Christopher Waller也表达了同样的观点。

2月17日,在澳大利亚悉尼新南威尔士大学发表演讲时,Waller表示,在通胀下降之前,美联储应暂停降息。

市场分析师对这些言论表示担忧,他们称,不降息可能会引发熊市,并导致资产价格暴跌。

3月10日,市场分析师兼投资者Anthony Pompliano推测,特朗普总统是在故意让金融市场暴跌,以迫使美联储降息。

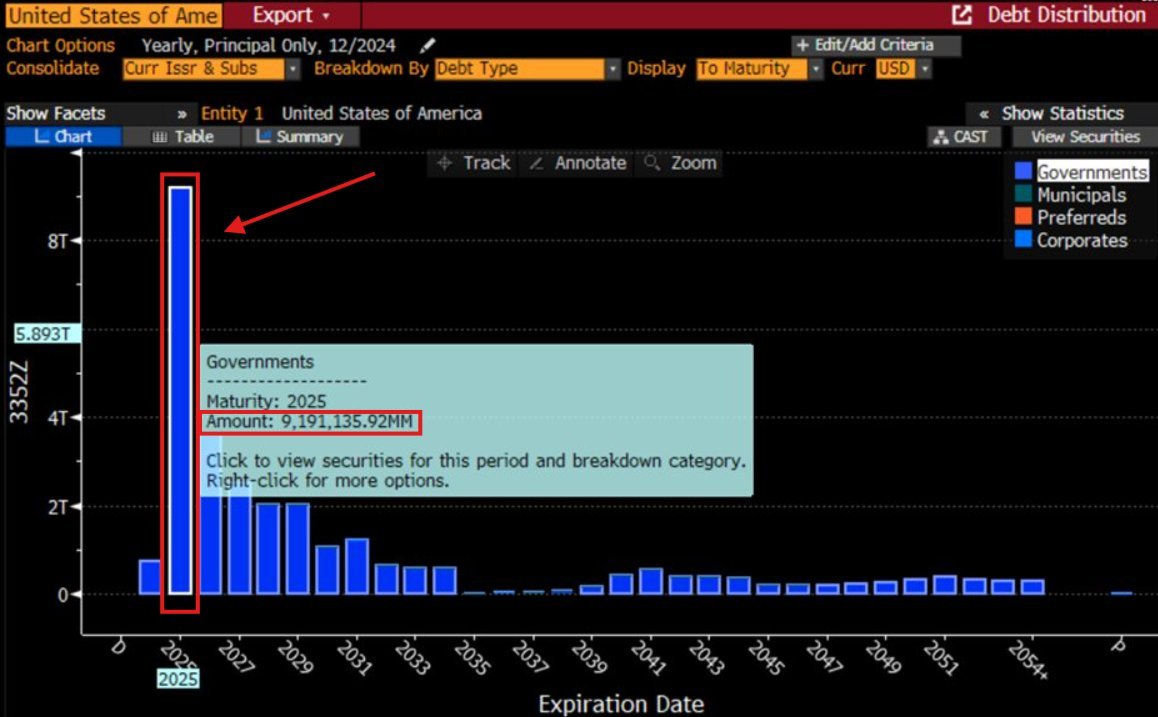

美国政府约有9.2万亿美元的债务将于2025年到期,除非进行再融资。来源:《科比西通讯》

据《科比西通讯》称,美国政府需要在2025年债务到期前对约9.2万亿美元的债务进行再融资。

如果无法以较低的利率对这些债务进行再融资,将推高目前已超过36万亿美元的国债规模,并导致债务利息支付大幅增加。

出于这些原因,特朗普总统已将降息列为其政府的首要任务之一,即便这会在短期内牺牲资产市场和商业利益。

相关推荐:分析师:美联储2025年“完全不”降息可能会引发熊市

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。