- VC 和做市商是交易所的最主要前端屏障

- 空投和 Meme 开启链上价值体系重估进程

- 项目方更复杂的代币经济学掩盖增长乏力

散户最近有点烦,先是 RedStone 一波三折,最终散户阻击失败,RedStone 还是上了币安,再是 GPS 拔出萝卜带出泥,币安重拳出击做市商,展现了宇宙所的绝对实力。

故事并不会很完美,在 VC 币逐渐倾颓之势下,价值币沦为项目方和 VC、做市商出货的借口,在每个市场的震荡期紧急完成基金会建立、空投方案上线和上所砸盘的三部曲。

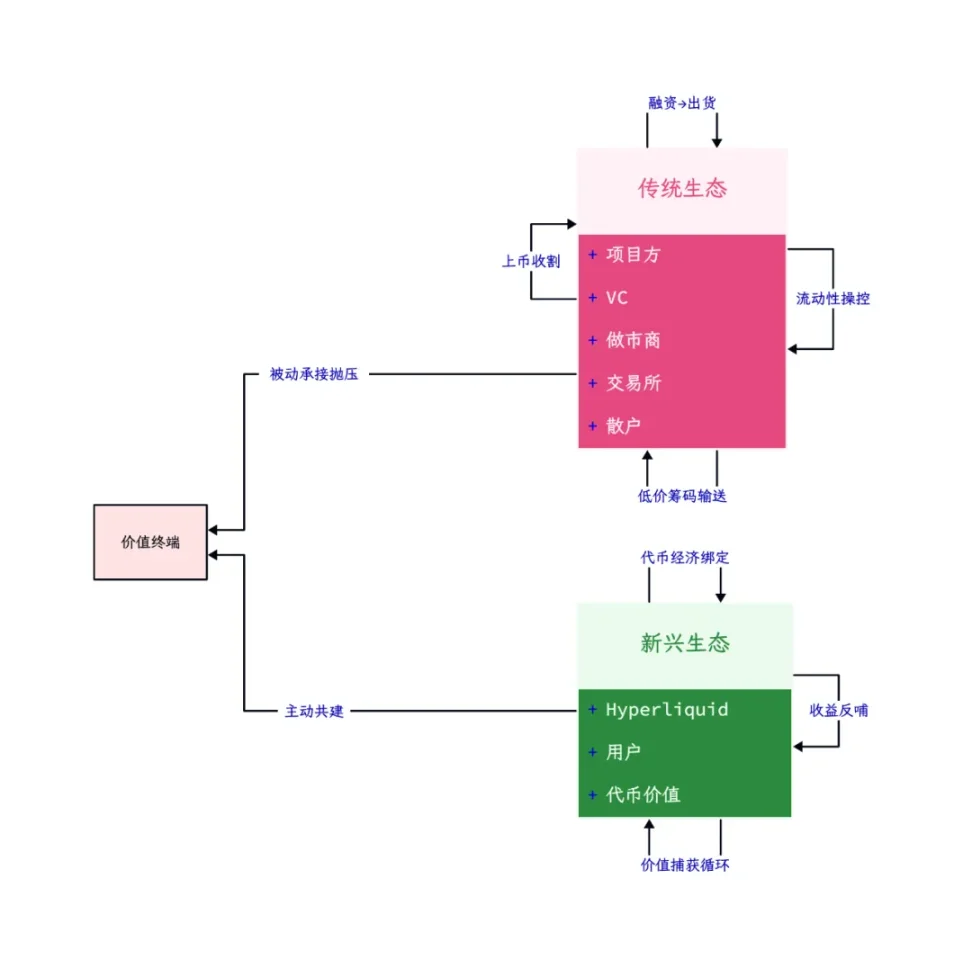

图片说明:传统和新兴价值流转,图片来源:@zuoyeweb3

可以预测一下,Babylon、Bitlayer 等 BTCFi 生态都会重复这个过程,可以回顾一下,IP 上所后的诡异走势和项目表现没有任何关系,和韩国人疯狂的购买力正相关,并且不排除做市商和项目方、交易所的合力。

正因如此,Hyperliquid 的路线确实独特,无投资、无大所和无利益割裂,在项目方和早期用户之间达成平衡,所有的协议收入赋能自身代币,满足后期买入代币人群的保值需求。

从 IP 和 Hyperliquid 的表现而言,项目方自身的团结和赋能意愿,可以压制交易所和 VC 的筹码集中和砸盘行为。

一进一退,随着币安把做市商推向台前,自身的行业壁垒在迅速坍塌。

自我实现的预言,红色石头现形记

我的世界中,RedStone 深埋地下 16 层,需要开采后才能研磨。

在整个掘金的过程中,交易所凭借自身绝对的流量效应和流动性,成为代币的最终归宿,在这个流程中,表面是交易所和用户的皆大欢喜,交易所获得更多币种,借此吸引用户,而用户可以接触新资产,博取潜在收益。

在此基础上,可以叠加 BNB/BGB 等平台币的赋能价值,进一步巩固自身行业地位。

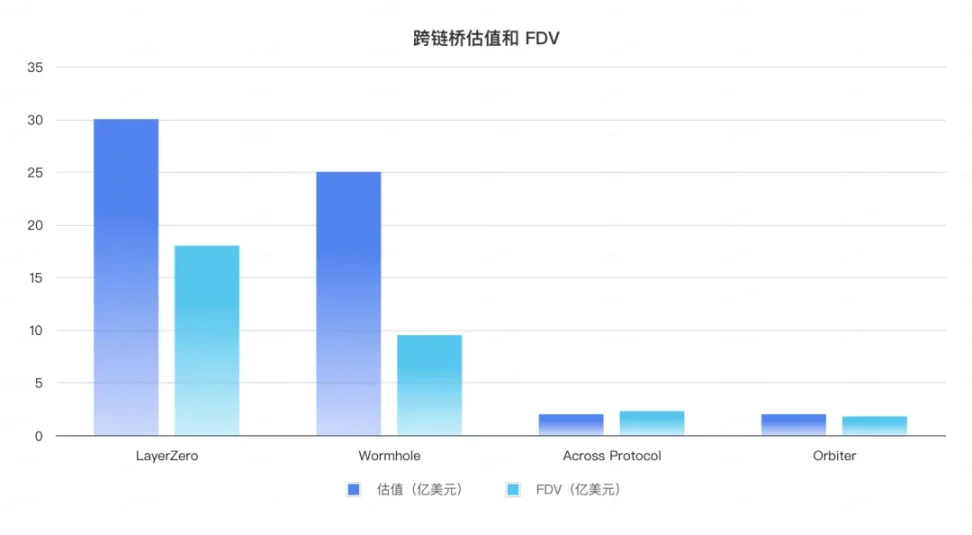

但是自 2021 年开始,在欧美大型 Crypto VC 的参与下,整个行业的初始化估值过高,以跨链桥行业为例,以上所前最后披露估值计,LayerZero 估值 30 亿美元,Wormhole 估值 25 亿美元,Across Protocol 2022 年估值 2 亿美元,Orbiter 估值为 2 亿美元,而目前四个项目的 FDV 分别为 18 亿美元、9.5 亿美元、2.3 亿美元和 1.8 亿美元。

数据来源:RootData&CoinGecko,制图:@zuoyeweb3

为项目增加的每个 Big Name 背书效果,实际上都是以散户的利益为代价。

从 2024 年年中开启的 VC 币风暴,到 2025 年初的何一」闺蜜币风波「 AMA 为止,交易所和 VC 的关系在表面上已经无法维系,VC 自身的背书和上所帮助效果,在 Meme 的狂欢下显得可笑,唯一剩下的作用只有提供资金,在回报率的驱动下,面向代币投资已经事实上取代了面向产品投资。

至此,Crypto VC 茫然失措,Web2 VC 投不进 DeepSeek,Web3 VC 投不进 Hyperliquid,一个时代正式结束。

VC 崩塌之后,交易所面对散户只有做市商充当避风塘,用户在链上冲土狗,做市商只能负责 PumpFun 内盘跑出后,DEX 外盘冲出后,少数上所代币的做市工作,当然,链上业务和做市商的关系本文不深究,我们集中在交易所内。

此时的 Meme 币,对于做市商和交易所而言,和 VC 币是一样的定价高昂,如果价值币都没有价值,那么空气币显然不能基于空气去公允定价,快吸快抛成为所有做市商的共同选择。

当整个流程被行业卷来卷去,一年速通币安不是做市商原罪,币安能被速通才是行业危机,作为流动性的最后一环,币安已经无法发掘真正的长期主义代币,行业危机就此诞生。

币安这次可以对 RedStone 带病提拔,也可以正义审判做市商,但是之后呢,行业并不会改变既有模式,依然有定价高昂的代币等待 listing 流程。

繁复和巨型化意味着终结

以太坊的 L2 越来越多,所有的 dApp 最终都会变成一条链。

代币经济学和空投方案越来越复杂,从 BTC as a Gas 到 ve(3,3) 的环环相扣,早已超过普通用户的理解能力。

从 Sushiswap 依靠对 Uniswap 用户发放代币空投以占领市场开始,空投成为刺激早期用户的有效买量手段,但是在 Nansen 的反女巫审查下,空投已经成为专业撸毛工作室和项目方之间斗智斗勇的保留节目,唯一被排斥在外的,只有普通用户。

撸毛党想要代币,项目方需要交易量,VC 提供初始资金,交易所需要新币,最终散户承担所有,只留下跌跌不休和散户的无能狂怒。

转向 Meme 只是开始,真正严重的是全行业的散户在重新估算自身利益得失,如果不在币安交易,而在 Bybit 和 Hyperliquid 开合约得失几何?

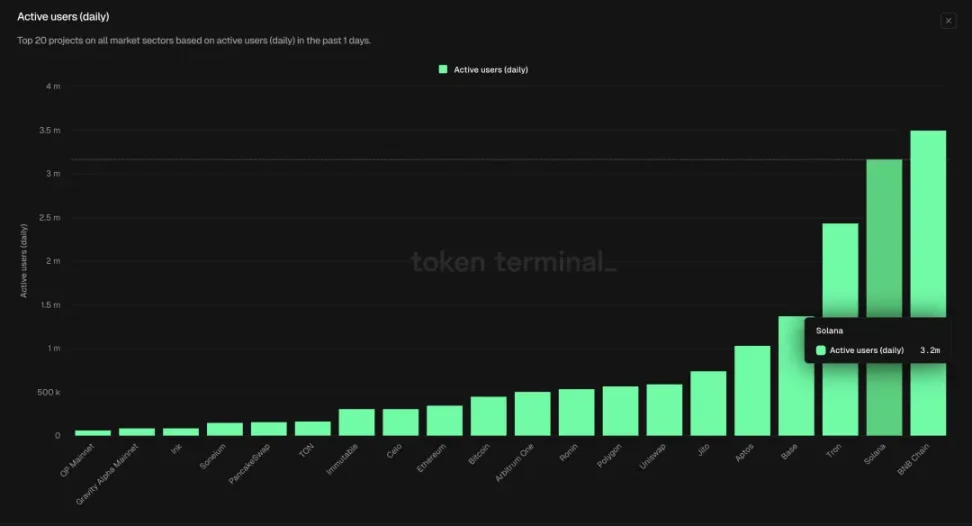

目前,链上合约的日交易量已经可达币安的 15%,其中 Hyperliquid 可占币安 10% 的份额,这并不是结束,而是链上进程的真正开端,刚好, DEX 占 CEX 的交易量比例在 15% 左右,而 Uniswap 占币安的比例在 6% 左右,凸显 Solana DeFi 的后来居上。

图片说明:On Chain DAU,图片来源:Tokenterminal

而币安的用户数在 2.5 亿,Hyperliquid 只有 40 万,Uniswap 活跃用户数 60 万,而 Solana 日活用户 3 百万,我们整体估算链上用户群体在 100 万的规模,仍旧处于极早期采用阶段。

但是现在不仅 L2 越来越多,dApp 的代币经济学也同步复杂,都在体现项目方无力在自身利益和散户之间取得平衡,不引入 VC 和交易所的承诺,则项目无法启动,但是接受 VC 和交易所的利益划分,则必然让渡散户的利益。

在生物学的进化历程中,无论是达尔文的进化论还是分子生物学家的概率测量,都无一例外指出一个基本事实,一旦某种生物变得巨大无比、造型精妙绝伦,比如风神翼龙,一般意味着走入灭绝周期,现如今,最终占领天空的是鸟类。

结语

交易所对做市商进行清理门户,本质上是在存量竞争格局下的蚕食行为,散户依然要面对 VC 和项目方的围剿,情况并不会根本性改观,转移至链上仍是进行中的历史行程,强如 Hyperliquid,依然没做好亿级用户的冲击。

价值和价格的波动,利益和分配的博弈,依然会在每个周期内相互运动,构成散户的血泪史。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。