“红与黑,是野心与现实的交织,是热望与冷酷的碰撞。”--《红与黑》

在加密市场中,价格的涨跌是一场永不停歇的博弈;而项目的成败,更像是一次次信任与怀疑的较量。

正如名著《红与黑》中描绘的那样,红色象征着激情与希望,黑色则代表着阴影与危机。

当我们将目光投向最近在币安 Launchpool 上线的项目 RedStone 时,这种“红与黑”的对比尤为鲜明:

作为新跨链预言机的代表,RedStone 之前以其创新的多链架构和强大的投资背景(包括 Coinbase Ventures 和 Blockchain Capital 等)吸引了市场的关注。

在过去一周内,这颗“红石”一度成为沉闷市场中的亮点,其代币 RED 在币安盘前市场的价格表现一度飘红。

然而,随着热度的升温,最近社媒热议的空投争议和盘前价格异动等问题也逐渐暴露,让这颗“红石”在部分社区成员眼中逐渐“黑化”。

一场红与黑,一次关于社区信任与市场规则的检验。

涨停试验里的红石

在加密市场中,创新往往是吸引目光的关键。

而币安此次针对 RedStone(RED)推出的“涨停板机制”(Price Cap Mechanism),无疑成为了这场实验的最大亮点。

2025 年 2 月 25 日,币安宣布将在 Launchpool 的盘前交易中测试这一机制,旨在通过限制价格的涨幅来控制波动性,避免代币发行初期出现最近大家见怪不怪的“圣诞树”式的剧烈波动。

自 RED 在盘前市场上线以来,这一机制迅速引爆了市场热度。

在连续三天的交易中,RED 的价格屡次触及涨停板上限,解除价格限制后更是一度飙升至 1.4 美元,成为盘前市场的焦点。

截至目前,RED 现报 0.83 美元,市值 3300 万美元,完全流通市值则为 8.3 亿美元。对于一个在市场走熊中刚刚上线的项目而言,初始的表现确实亮眼,也给了大家一种“涨停板都封不住涨势“的感觉。

能赚钱,大家也自然喜欢。

涨停板机制的确为 RED 带来了市场热度,但这种“红”的背后,其适用性仍有待检验。

价格的持续上涨虽然吸引了大量关注,但也可能掩盖了社区中可能会发酵的潜在问题。

空投争议中的黑点

利益的纠缠点,还是空投。

在之前的玩法里,RedStone通过Zealy和Discord平台推出三期“探险活动”,要求社区成员完成不同任务,如研读技术文档、撰写分析文章、制作图像素材,甚至在春节假期持续输出内容。

这些任务被宣传为“共建生态”的机会,社区成员通过完成任务赚取RSG积分,RedStone承诺这些积分将是未来RED代币空投的关键凭证。

用更加直白的话说,这个羊毛薅的有点肝。

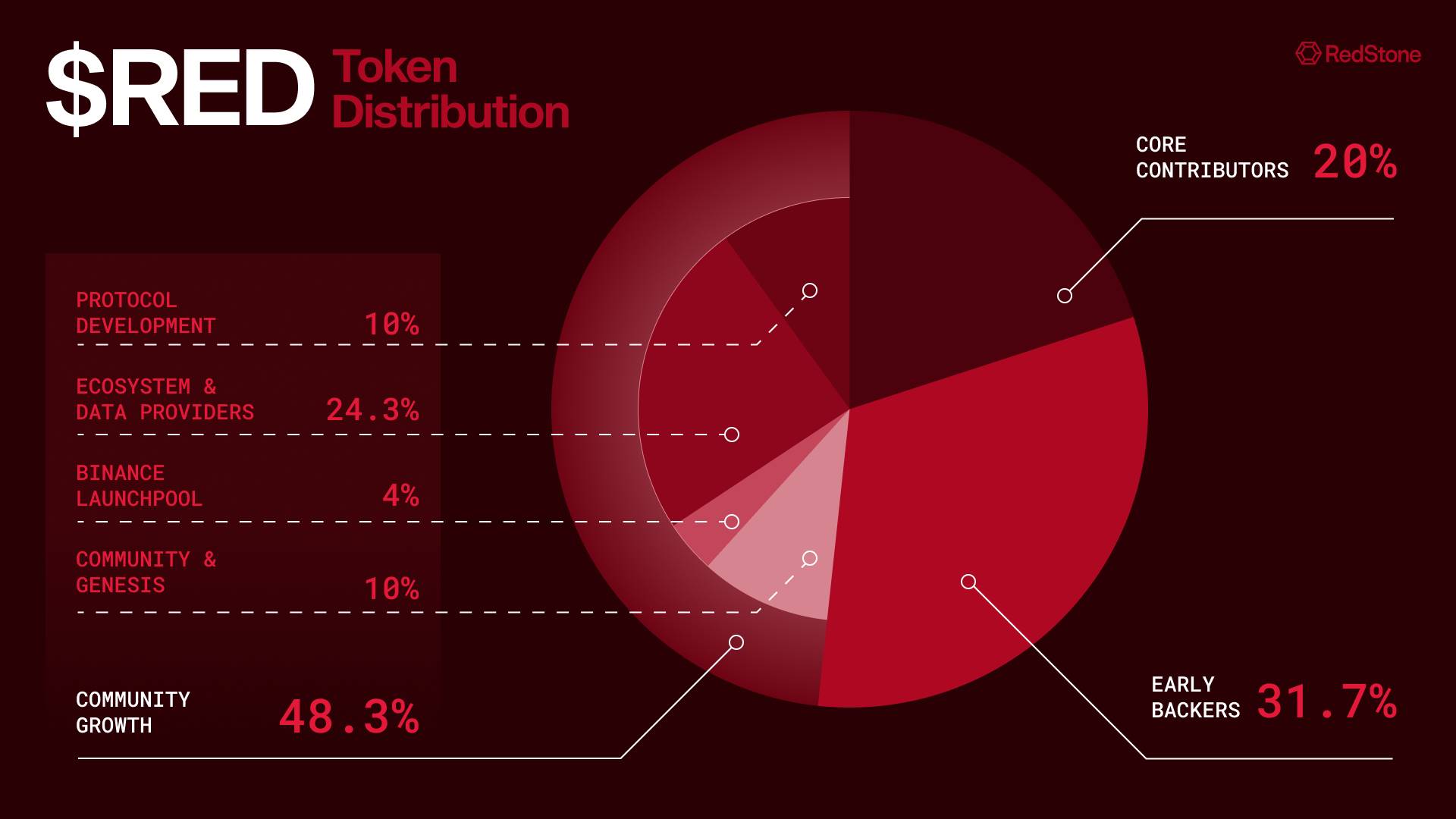

根据其代币经济学(RED代币经济学),RedStone计划将48.3%的代币分配给生态系统和社区,其中10%用于社区初始认领,被社区玩家们寄予厚望。

然而,2025年3月5日,RedStone公布空投结果时,社区的热情迅速冷却。

官方宣布,仅2.19%的社区成员(共4386人)获得RED代币奖励,剩余的大量玩家的RSG积分被判定无效,肝帝到最后似乎一无所有。

不患寡而患不均,肝任务可能一无所获,但有身份则可能获得空投。

根据 RedStone的官贴描述,Discord 中的身份成为了获取空投的关键。符合资格的角色包括 Vein Master、Deep Miner、Professor、IRL(参与过线下活动)等。而公开数据显示,项目DC群组中拥有以上角色的人数比例仅 2%。

因此按照社区总人数23万左右来计算,能拿到这个空投的人,也就是上文所说的4000+。

空投结果一出,社区成员在各类社媒中的不满情绪开始蔓延。

有网友自嘲表示,RED 的空投你没拿到请不要担心,因为你永不独行。

而更加愤怒的玩家则直接开始控诉,比如有些黑帖在中英文社群快速转发,笔触尖锐甚至字眼有些敌对,直指 RedStone 通过压榨的方式收割社区用户。

作为中立的观察者,笔者无从考证这些帖子的控诉文字是否句句属实;但其中社区的积怨不可漠视,毕竟水能载舟,亦能覆舟的故事在加密世界频繁上演。

但究其本质,社区的愤怒,说白了还是”我努力肝但没有资格“。

许多用户即使积攒数百万积分,仍被排除在外,被视为“无效劳动力”:仅2.19%的奖励比例,凸显了老生常谈的“空投PUA”的问题——即项目在代币上线前通过高强度任务引导用户劳动,却未完全按照预期兑现承诺。

当社区成员的努力逐渐被贬为“数字包身工”的牺牲品,身在局中的玩家自然会觉得自己是被PUA了免费给项目打工做宣传,最后革命的果实被更有身份的人给窃取了。

盘前价格的异动

在上述空投让社区成员不悦的前提下,如果代币价格上再有异常,显然则更会加深大家的误会和不信任感。

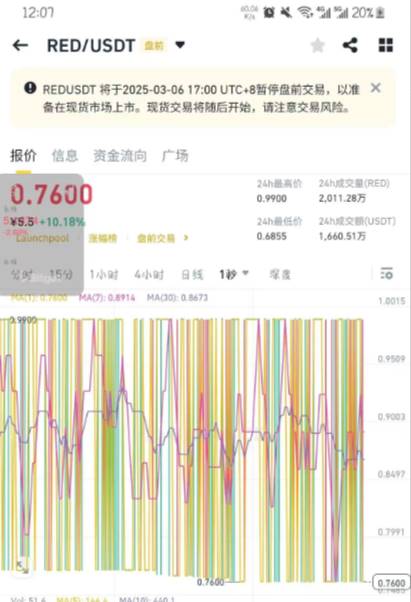

今天下午,有部分社区群友晒出截图,RED 在盘前市场的价格曲线呈现出非常离谱的震荡状态,完全不像正常的价格走势。

随后,知名 KOL @_FORAB 也发现了类似的问题,并推测 RED 的做市商似乎出现问题,大量挂单被撤,导致高价差的大波浪走势出现。

这种情况也很容易让大家误认为做市商在玩独角戏,来回拉动价格,而没有成比例的散户对手盘。

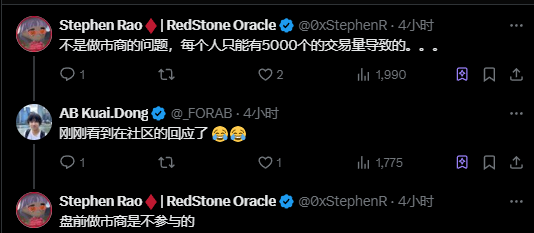

不过,RedStone 的中文区社区经理 Stephen 随后在评论区澄清,问题并非由做市商产生。RED 在盘前市场没有设置做市商参与,价格的变化实际上是由每人只能交易5000个RED 的交易规则设计而导致的。

随后,币安官方回应RED/USDT限价单功能在2025年3月6日11:39至12:09期间出现故障,但市价单功能正常使用,平台目前已完成修复。

从结果上看,事情虽然并非源自做市商操纵,但在当前 RedStone 社区情绪本就不稳定的情况下,价格的剧烈波动也让“操控论”在社区中迅速传播。

尽管 RedStone 和币安都已澄清问题的实际原因,但在加密市场中,散户往往更倾向于相信阴谋论,而非技术性解释。这种舆论效应进一步加剧了社区的不信任感。

总结

利字当头,加密行业中项目方与社区之间总是有着微妙关系:他们互相需要,但有时彼此也觉得在互相伤害。

从其创新的多链架构到币安的涨停板机制,再到空投争议和价格异动,这个项目在短时间内经历了高度的市场关注,也遭受了社区信任的严峻考验。

RedStone 的空投结果让绝大部分参与者感到失望,甚至引发了“PUA”式压榨的质疑。这种情绪在加密市场中极具传染性,尤其是在社区对公平性高度敏感的环境下。

对于 RedStone 来说,未来的挑战在于如何修复社区关系,并在技术和运营层面建立起更加透明和稳健的机制。

或许,从更大的视角看这一轮的加密项目们,需要的不仅是技术上的创新,更是对社区情绪的深刻洞察和对市场规则的全面优化。

得社区,得天下。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。