作者:Nancy,PANews

继Sky、Uniswap、Ether.Fi、Synthetix和Ethena等DeFi协议相继采用或提出代币回购策略后,去中心化借贷龙头Aave也即将加入DeFi分红大军。

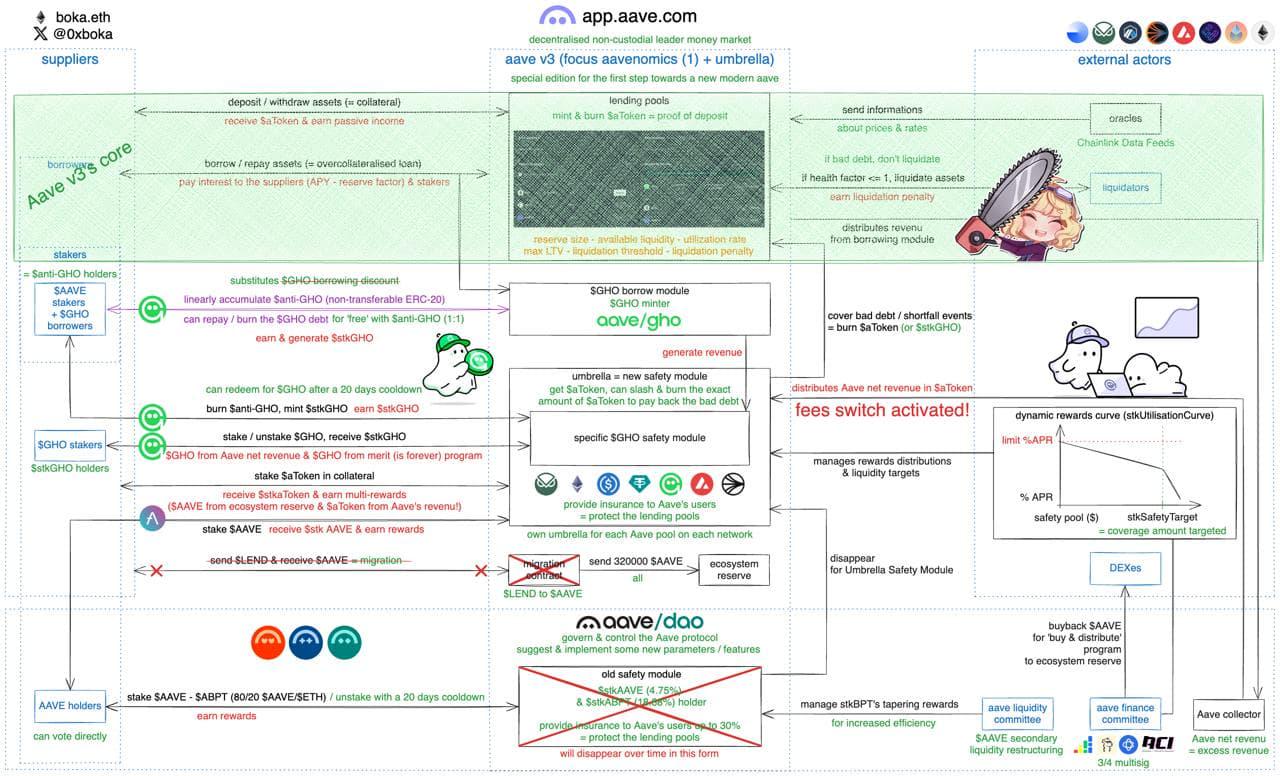

3月4日,Aave社区提出了一项全新重量级提案,计划更新其代币经济模型,包括启动AAVE回购、重新分配协议超额收入、终止LEND代币迁移,并升级二级流动性管理。受此提振,CoinGecko数据显示,过去24小时,AAVE的涨幅达21.3%。

Aave计划开启分红模式,提案仍处意见征集阶段

在DeFi的流动性争夺战中,Aave凭借着充沛的现金流和创新能力稳坐DeFi借贷领域的头把交椅。

Aave的全新Aavenomics(Aave经济学)提案也披露,过去两年Aave市场份额与收入节节攀升,包括GHO稳定币的供应量突破2亿美元,Aave DAO的现金储备达到1.15亿美元。这一增长得益于Aave在借贷协议领域近乎垄断的收入主导地位,以及其对创新的持续投入,如最近升级至Aave 3.3和即将推出的Umbrella自我保护系统。更值得关注的是,Aave预计其2025年收入将因SVR(波动率保护机制)将显著增长(每年可能超过1000万美元),可为Aavenomics的实施提供资金支持。

而随着当前投资者愈发关注DeFi协议的价值捕获能力,促使许多DeFi项目开始转向分红或回购模式以提升代币价值回馈能力。Aave的回购提案展现了多个优势,包括强大的现金储备支撑、多元化的收入结构、高质量的资产奖励以及高效治理和执行效率。

该提案提出了以下几项关键举措:

· 代币回购与分配:Aave计划启动“购买并分配”(Buy and Distribute)计划,利用协议超额收入在二级市场或通过做市商伙伴回购AAVE代币,并将其分配至生态系统储备。初期计划以每周100万美元的规模执行6个月,即2400万美元用于回购,此后根据协议整体预算进行调整。这一机制旨在减少流通供应、提升代币价值,同时为DAO的AAVE预算提供可持续来源。

· Umbrella和AFC设立:提案指出Umbrella是Aave用户的保护机制和增长工具,建议将部分Aave DAO超额收入重新分配给Umbrella aToken质押者。为实施这一计划,提案提议组建Aave金融委员会(AFC),由Chaos Labs、Tokenlogic、Llamarisk和ACI组成,设定3/4签名门槛。AFC将负责管理收集器合约资产、定义Umbrella流动性目标,并通过Tokenlogic的月度财务管理AIP执行预算分配。

· 协议收入再分配:提案建议创建ERC20代币来Anti-GHO增强对Aave生态系统质押者的奖励,这是由AAVE和StkBPT质押者生成。Anti-GHO的初始生成量设定为GHO收入的50%,其中80%分配给StkAAVE持有者,20%分配给StkBPT持有者。而按当前GHO借贷利率和供应量,Aave每年向GHO质押者分发的协议收入为1200万美元。

· LEND迁移终结:在LEND到AAVE迁移合约运行近五年后,Aave将关闭这一通道,并回收剩余的32万枚AAVE(约6500万美元),并将其注入生态系统储备,为增长和安全提供更多资金。

· 二级流动性管理优化:Aave DAO目前每年从生态系统储备中分配约2700万美元(按当前AAVE估值计算)用于二级流动性激励。提案建议采用混合模式,结合StkBPT质押与Aave流动性委员会(ALC)的直接管理,以更低的成本实现更大流动性。

不过,目前该提案仍处于意见征集阶段,如果达成共识提案升级至Snapshot阶段。如获通过,Aave将授权设立AFC并通过AIP逐步实施。

DeFi或迎政策利好,白宫支持撤销“DeFi经纪人规则”

Aave提案发布之际,DeFi行业或因政策利好迎来喘息与增长窗口。

据白宫管理和预算办公室(OMB)发布的《行政政策声明》,美国政府支持S.J. Res. 3,该法案由参议员Ted Cruz等人发起,旨在否决美国国税局(IRS)关于“数字资产销售经纪人总收益报告”规则。

据了解,该规则原由拜登政府在2024年末提出,扩大了经纪人定义,涵盖DeFi协议相关软件,并要求部分DeFi用户报告加密交易总收益及纳税人信息。白宫认为,这一规定不当增加美国DeFi企业的合规负担,阻碍创新,并引发隐私问题。声明明确表示,如果S.J. Res. 3提交至总统,白宫高级顾问将建议总统签署该法案,使其成为法律,以废除IRS的相关规定。

对此,美参议员Lummis评论称,“国税局针对DeFi的规定根本上误解了去中心化技术的运作方式。我亲眼见证了监管清晰度——而非过度监管——如何促进创新。这些强硬的联邦规定可能会将美国的加密企业家推向海外,而此时我们本应在国内培育这一行业。很荣幸与Senator Ted Cruz一起撤销这次对加密社区的攻击。”

白宫的支持信号或意味着加密政策方向的重大转变。对于DeFi行业而言,若规则被废除,包括Aave在内的DeFi项目将免于繁琐的报告义务和降低运营合规成本,保留去中心化特性,且可能带来资金和人才的回流,进一步激发美国DeFi创新的热潮。

在DeFi行业或迎更宽松的发展环境之际,Aave对代币经济学革新不仅可以强化自身在流动性战局的竞争优势,也将加速DeFi向可持续的价值捕获模式转型,真实收入不仅是财务指标,更是构建可持续生态的基石。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。