"Whoever wins, the users will follow."

Written by: Deep Tide TechFlow

The BSC has been quite lively these days.

As the wealth effect of TST reignited everyone's attention to the BSC ecosystem, and MyShell made its IDO with a "welfare-level" valuation of 20 million USD, CZ's followers stirred the enthusiasm of Degen;

The celebration of one group on the chain is always paid for by another group.

A surge of traffic directed at BSC unexpectedly turned into a Waterloo for Binance's Web3 infrastructure.

If you’ve been browsing social media these past few days, you would have certainly come across complaints about the poor experience with the Binance wallet and the weak infrastructure; the first to bear the brunt of the community's accumulated grievances were the community management and marketing personnel of BSC.

The Technical Debt Behind Customer Service Controversies

Well-known crypto KOL yuyue (@yuyue_chris) posted an "urgent public complaint about the serious dereliction of duty by BNBChain's marketing personnel and damage to brand image" this morning, pointing fingers at the customer service and management personnel of the BSC Chinese community, Jiu Jiu.

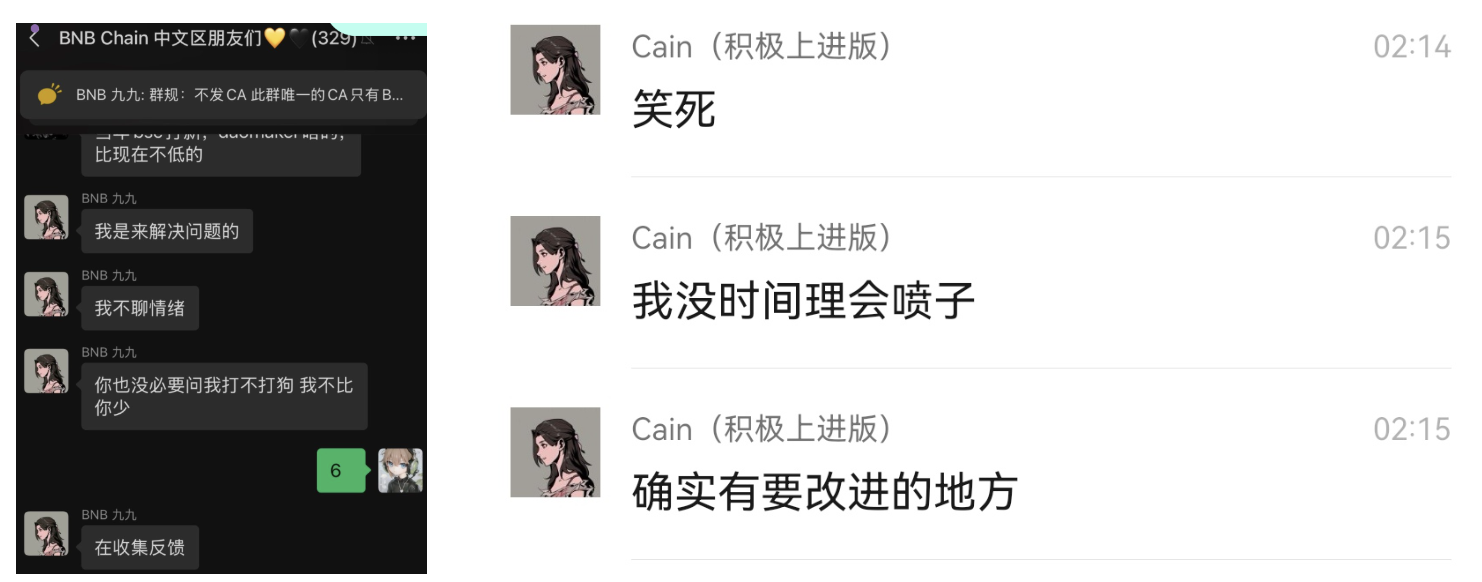

From the conversations shared by yuyue, it can be seen that the market team representative did not provide the necessary "emotional value" when responding to user feedback regarding the performance of the BSC chain, instead appearing somewhat direct and cold.

For example, responses like "I don't have time to deal with haters" and "I deal with dogs no less than you" can easily escalate emotional opposition when users' anxieties due to technical issues are amplified.

When everyone complained about being unable to buy multiple times, a sarcastic retort like "Is Sol not down?" indeed adds fuel to the fire, failing to soothe user emotions and potentially exacerbating the conflict.

Certainly, customer service and market representatives are also human, and they inevitably bear the pressure of public opinion and the responsibility to seek more solutions internally when facing technical and performance issues, often caught in a difficult position and unappreciated, making some emotions quite normal.

Some commenters also mentioned that the long-standing community anger perhaps shouldn't fall solely on Jiu Jiu; "fighting public opinion, running around, and being scolded on Twitter" can easily create psychological pressure, and the ones who should be criticized are actually the chain and wallet product managers…

This seemingly ordinary customer complaint dispute is, in fact, an inevitable result of concentrated technical debt.

There is bound to be a gap between the smooth trading expectations of users migrating from the SOL ecosystem and the actual experience on BSC; if you search for keywords like BSC chain and Binance wallet on Twitter, you will also find complaints about product issues that have long existed.

BSC's marketing personnel may need to simultaneously take on the roles of technical interpreters (explaining chain characteristics), psychological therapists (soothing experience anxiety), and brand ambassadors;

Under multiple pressures, the poor communication attitude of community managers triggered a public opinion crisis; and when experience issues become entrenched, what needs to be considered even more is the misalignment between technical infrastructure capabilities and market expectations.

This may not be a problem of one person; the underlying grievances relate to technology, experience, listing processes, and even organizational structure, resembling a brand distrust and anxiety triggered by customer complaints.

Unsellable Pork Knuckle Rice

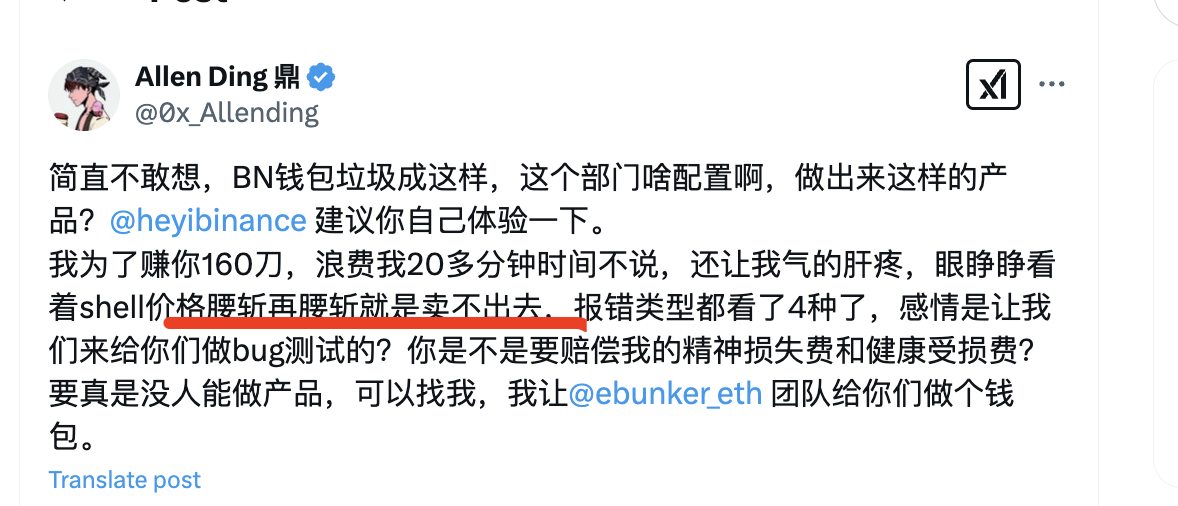

If yuyue's mention of "poor communication attitude of marketing personnel" still belongs to an individual issue, then yesterday's MyShell IDO exposed a more widespread technical problem.

The $SHELL token IDO, conducted simultaneously on Binance Wallet and Pancakeswap, attracted considerable attention and real monetary investment, with initial valuations being low, leading to oversubscription exceeding a hundred times.

However, in contrast to the enthusiasm for participation, after the IDO event ended, when everyone wanted to claim their tokens for trading, they were met with a cold splash of water as problems arose continuously.

For instance, some users pointed out that the Binance wallet is an MPC wallet bound to KYC identity with CEX. If one must export the private key, the original wallet becomes invalid; at the same time,

The purchased $SHELL cannot be directly sold in the Binance wallet due to the small pool size.

Even more perplexing is that, on the same chain and ecosystem, when connecting the wallet to Pancake, users cannot see their assets and cannot view the corresponding BEP-20 assets on BSCScan…

In a market environment where PVP competition is severe, the most important thing is to race against time.

With a poor wallet experience, many times you can only watch the new coin price drop without being able to sell, causing the returns on "pork knuckle rice" to continuously shrink, and in the end, from the perspective of time costs and asset transfer procedures, it may not be worth it.

There have been previous opinions suggesting that MyShell's TGE serves as a pressure test for the Binance wallet, to see how much performance and experience can actually accommodate users while giving out benefits.

But from the current results, it is evident that the pressure has fallen on Binance itself.

And early this morning, CZ's followers appeared, with tokens like $brocoli further igniting everyone's enthusiasm for the chase, but also further exposing the fragile technical issues of the BSC chain and Binance wallet and related ecosystem, causing temporary lags on the chain that affected trading experiences.

Degen even joked: "After experiencing Binance's Web3 wallet, you truly realize how resilient the SOL chain is."

The author does not intend to provoke opposition between public chains, nor does he have any stance to undermine others; just at this moment when Twitter is being flooded with complaints, the issues users are raising about the BSC chain and Binance wallet cannot be ignored.

Competitors Become "Lifeguards," Black Humor

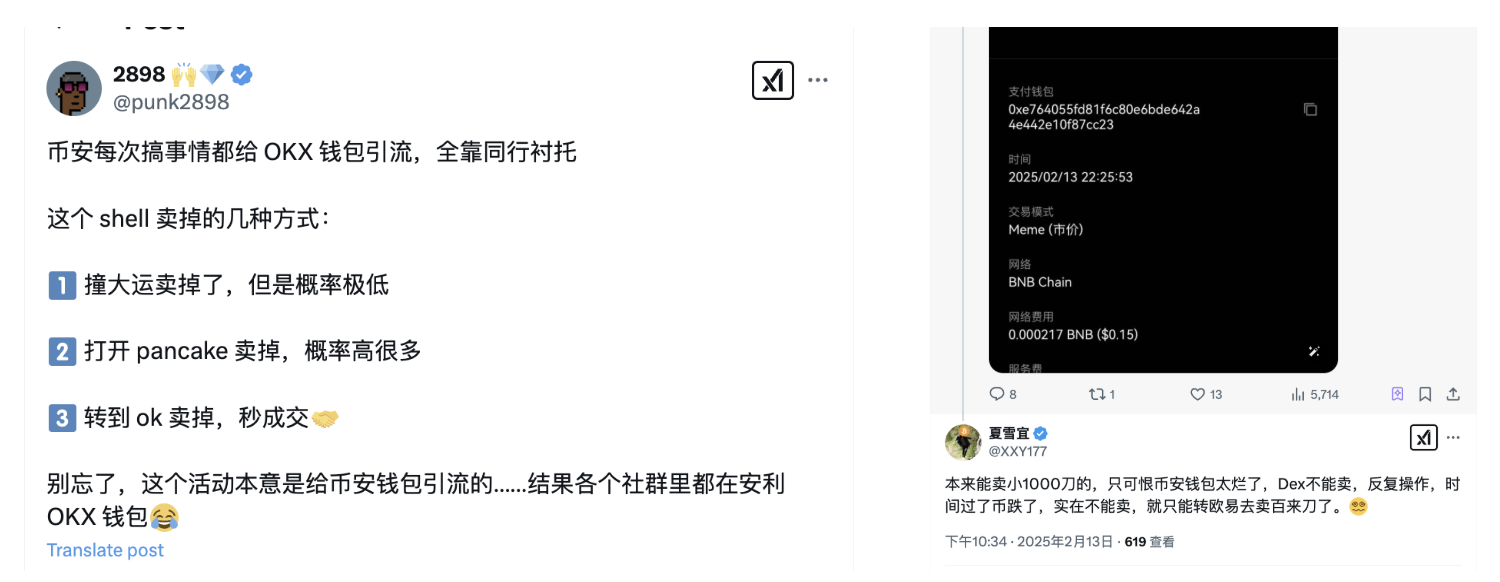

What’s even more ironic is that the issue of not being able to claim the SHELL pork knuckle rice actually gave a traffic bonus to the neighboring OKX Wallet.

After the TGE of the SHELL token, users who were unable to sell in the Binance wallet immediately chose to transfer their SHELL to OKX Wallet to sell, including myself.

This has a bit of a dark humor flavor… The ecosystem project and marketing activities of one's own company ultimately require the neighboring wallet to solve the last mile of the selling problem.

From the user's perspective, loyalty is actually a very abstract concept.

Especially when seeing the price drop and being unable to sell for a long time, it’s very similar to a car sinking into water with the water level rising slowly; at this moment, you certainly won't care which brand of sledgehammer you have in hand.

As long as it can break open the liquidity to exit, who cares which wallet is actually being used? And if there’s no necessity, who would want to change to another hammer?

When on-chain tokens have liquidity, but your own wallet cannot display or trade them, the trend of users voting with their feet is very obvious, after all, their losses are real money.

However, the targeted liquidity and attention created by the BSC ecosystem ultimately could not be captured, leaving the competing wallet to reap the benefits, which is indeed regrettable and helpless.

This situation is not only present in the selling phase of MyShell's token but also appeared during the dog-chasing phase last night.

When the in-house wallet cannot support the traffic and enthusiasm, while everyone waits for CZ to announce the name of the dog, many will also prepare an OKX wallet or a third-party bot wallet to get ready to rush;

And when too many people rush, causing lag on the chain or being unable to get in, wallets associated with bots can set higher fees to buy in faster, and OKX's wallet also has a similar meme trading model, aimed at enabling quick trades for popular assets.

What to Make of It?

Looking back, the overwhelming traffic and opportunities also need to be supported by sufficiently sound and usable infrastructure. Without it, users will naturally choose to use better options.

Stance is not important; interests are crucial. What can we learn from this incident?

First, the competition between chains and exchanges has genuinely entered the user experience war stage.

The prosperity of an ecosystem no longer solely relies on how TPS or gas fee data looks, but rather on the overall smoothness of tools, abnormal handling mechanisms, and loss recovery paths;

If the above aspects are well executed, it can yield twice the result with half the effort; if poorly executed, it may result in losing both brand and users.

Second, on-chain wallets have become de facto traffic distributors. The initial experience of users when accessing DApps determines their sense of belonging to the ecosystem and subsequent habits.

Third, when users have formed self-rescue plans (using other wallets), compensation measures or sincerity must directly address the gaps in competitor experiences, rather than being resolved by an AMA or mere slogans.

Talk is cheap, show us products.

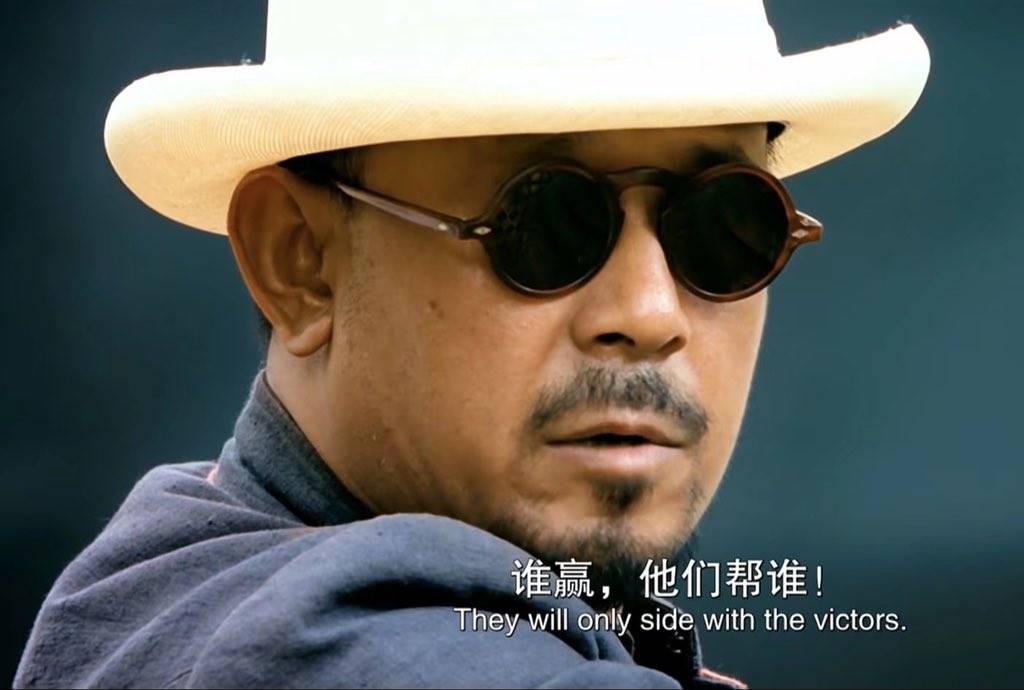

This absurd pressure test resembles the metaphor of Zhang Mazi in "Let the Bullets Fly": "Whoever wins, the users will follow."

When immense wealth descends, it is never the grandiose words on Twitter that catch the flow, but the smooth "confirm" button in the wallet—after all, in the on-chain MEME season, every second of lag is carving a moat for competitors.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。