编译:Loxia

柠檬问题与信任危机

今天我不打算过多谈论技术,我要讨论的是我们在加密领域面临的一个社会问题。这次演讲的标题是「社会共识与自我监管」。我想先问一下大家,有没有人听说过「柠檬问题」?这个词有印象吗?

好吧,不太有印象,不太有。

那么,美国俚语中的「柠檬」指的是一辆不可靠的车,而且是你事先不知道它会不可靠的车。我不太确定这个词的起源,但「柠檬」就是这个意思。

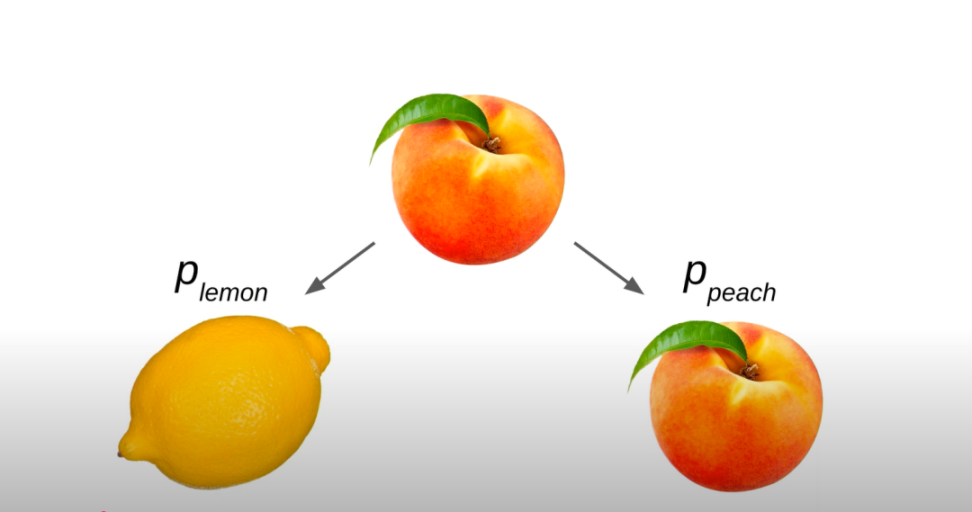

嗯,好车、可靠的车被称为「桃子」。这个我之前也不知道,是查了才知道的,挺可爱的。

「柠檬问题」基本上是二手车经销商的问题。你去二手车市场,看起来有点像这样,感觉有点骗人的味道,因为你不知道你买的车会是「桃子」还是「柠檬」。这也是当今加密领域的一个大问题——一切看起来都可能是「桃子」,但实际上很多协议都是「柠檬」。

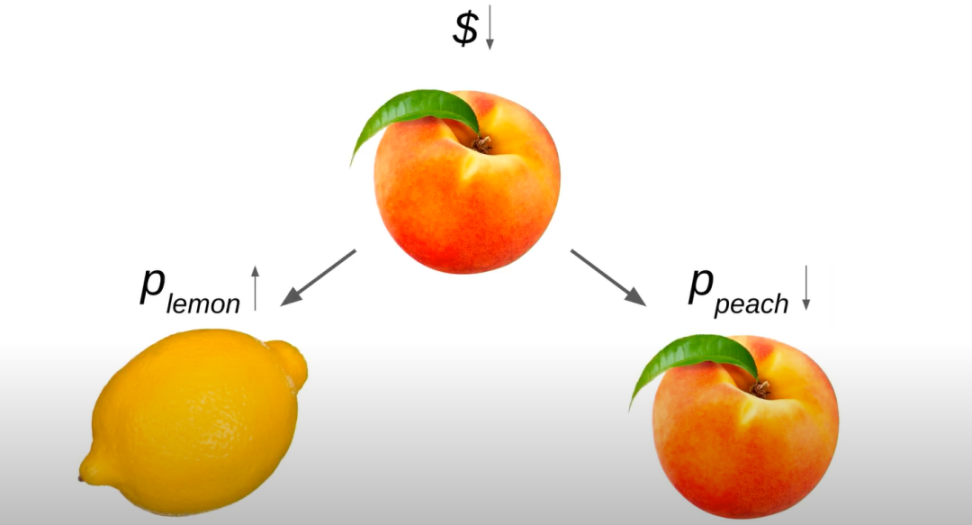

所以,当你买车或使用一个协议时,有一定的概率它是「桃子」,也有一定的概率它是「柠檬」。那么你愿意为此支付的价格是多少?你愿意为可能成为「桃子」或「柠檬」的东西支付的期望值加权平均价格是多少?

你愿意为此支付的价格是多少?这就像某种加权平均,我们都可以内化这个概念——有一定的「柠檬」概率乘以「柠檬」的价值,加上「桃子」概率乘以「桃子」的价值。

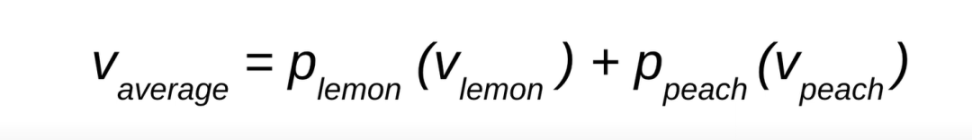

你可能会直觉地认为,你愿意支付的价格介于你知道它是「桃子」时愿意支付的价格和你知道它是「柠檬」时愿意支付的价格之间。那么,为什么这是一个奇怪的动态,我们为什么要谈论水果呢?

那么,这对二手车经销商有什么激励作用呢?如果你知道每个人都会支付介于「桃子」和「柠檬」之间的价格,你的激励是什么?

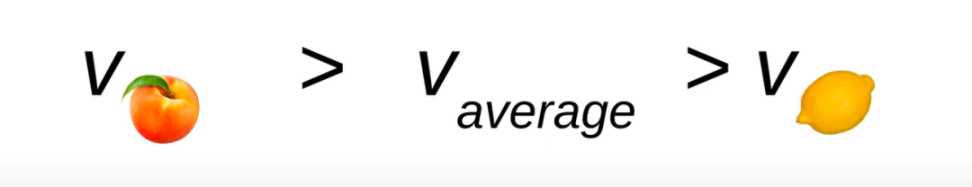

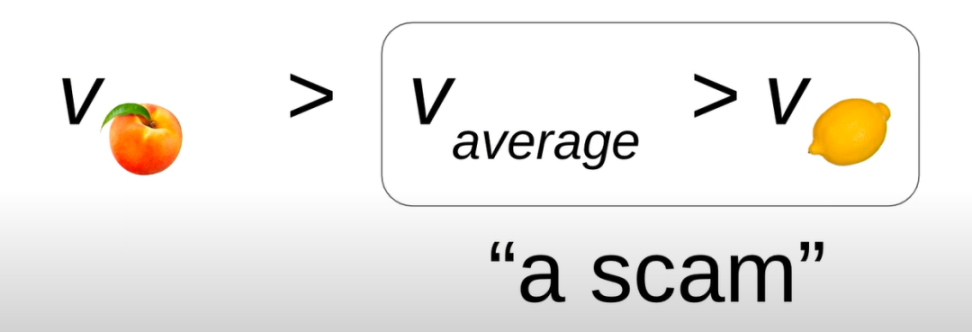

你的激励应该是只卖「柠檬」,对吧?如果人们愿意支付比「柠檬」更高的价格,你没有理由卖「桃子」,你可以直接把「柠檬」卖给他们。

这通常被称为骗局。

嗯,我想暂停一下,这是加密领域今天面临的一个大问题——柠檬问题。

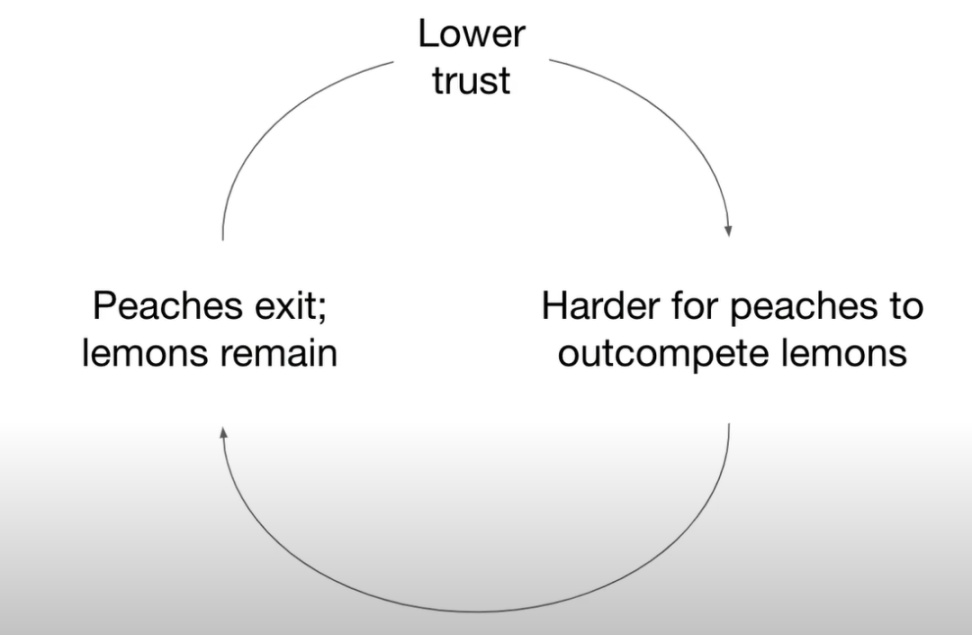

嗯,今天加密领域的动态是,由于这个柠檬问题,「桃子」的概率实际上下降了,越来越少的人愿意种植「桃子」,因为「桃子」很昂贵,而「柠檬」经销商涌入市场,因为他们觉得哇,我可以直接把「柠檬」卖给那些愿意为我的产品支付比它实际价值更高价格的人,因为他们被误导认为这是「桃子」。总的来说,用户参与生态系统的意愿下降了,这很合理。

现在我可以在脑海中听到你们中的一些人,或者你们想象中的对话者说:「这就是无许可的代价,我们必须接受好坏参半,就像加密领域的 30% 折扣一样,你知道这就是现实。」

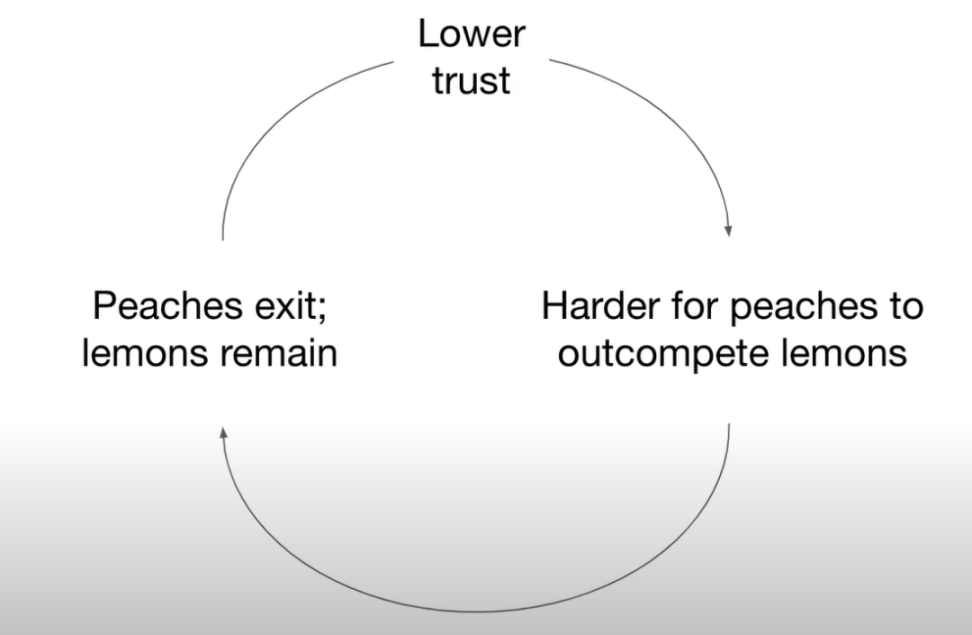

但这并不是一次性成本,柠檬问题不是一次性成本,它实际上是一个死亡螺旋。

因为当我们信任度降低时,「桃子」更难胜过「柠檬」,「桃子」退出市场,我们只剩下「柠檬」,这不是一个好地方。

所以我们需要以某种方式帮助消费者识别「柠檬」,我想说,如果我们不这样做,Gary 会——事实上他已经很努力了——所以这就是为什么我推动,如果我们想保持我们在加密领域发展的精神并解决柠檬问题,我们需要某种形式的自我监管。

让我们把这个和做得好的东西做个比较,这可能会引起争议。

赌场模式:构建安全与公平的信任机制

好吧,我在说什么?

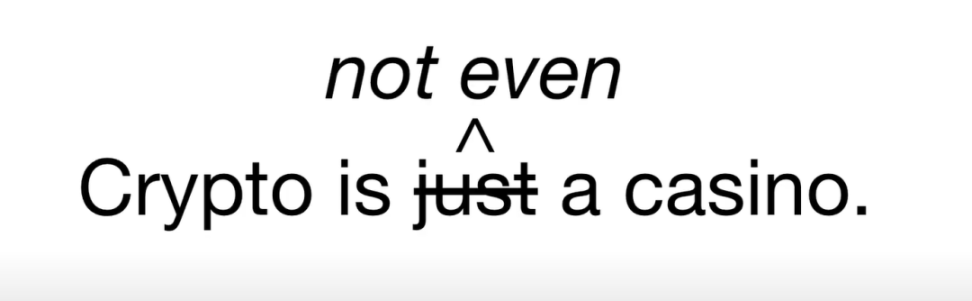

所以我是说加密领域就是个赌场吗?

不,我是说加密领域甚至不如赌场,

我们至少需要做得和赌场一样好。如果加密货币能行,

我们至少需要做赌场做得好的事情,

我认为这值得一看,这是我接下来要讲的。

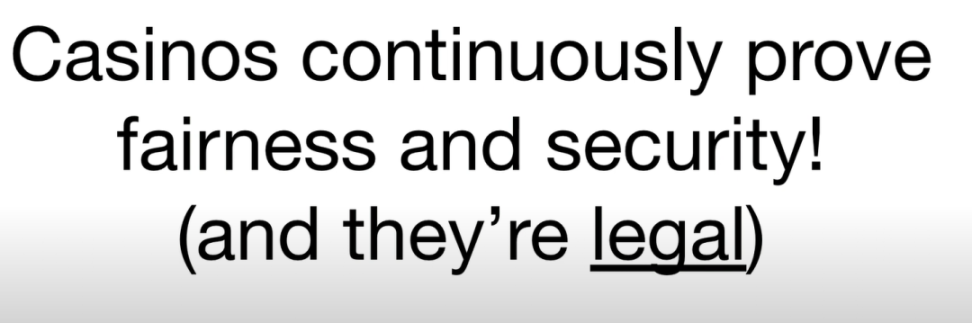

赌场以公平和安全著称,他们大力宣传这一点。他们为什么要这么做?他们不遗余力地证明赌场没有被操纵,当然除了它显然被操纵的方式。

让我给你们举几个例子,这是一台自动计牌机。

嗯,他们为什么要这么做?为什么他们改用这个而不是让发牌员手动发牌?

他们想向你证明你没有被欺骗,当然除了你在结构上被欺骗的方式,但他们想向你证明这是可验证的随机性。

他们禁止作弊者,并与其他赌场分享作弊者信息。为什么他们愿意联合起来对付作弊者?如果我是火烈鸟赌场(拉斯维加斯的一个赌场),我发现了一个作弊者,为什么我要与赢家分享这些信息?

他们有这些骰子卡尺来确保骰子重量均匀,所有这些都是为了说服消费者,你没有被骗,你在公平地玩,尽管胜算对你不利,但你不会被骗或受骗。

政府和赌场实际上共同投资于使赌场安全。我们忘记了赌场是非常合法且快速增长的,你知道以太坊今年有望实现 20 亿美元的手续费收入,而全球赌场行业将实现 3000 亿美元的收入。

营销安全是赌场与政府合作得非常成功的一种方式,说服他们让这个东西安全对每个人都有好处。

好吧,这是如何运作的?这是良性循环,更高的信任等于更多的用户等于投资和公平与安全,

所以我们需要以去中心化的方式做到这一点。我们知道一个事实,这周我没有在任何对话中听到的三个字母—— FTX,没有人谈论它,我们喜欢假装它只是一个噩梦,你知道,坏人真的侵蚀了整个生态系统的信任,不仅仅是他们针对的人,而是所有人。

零知识证明驱动的自我监管与社会共识

但我们有技术来证明安全和合法性,我们只需要在社会层采用它,所以这周必要的挥手——零知识,对吧?这是我们都知道的词。

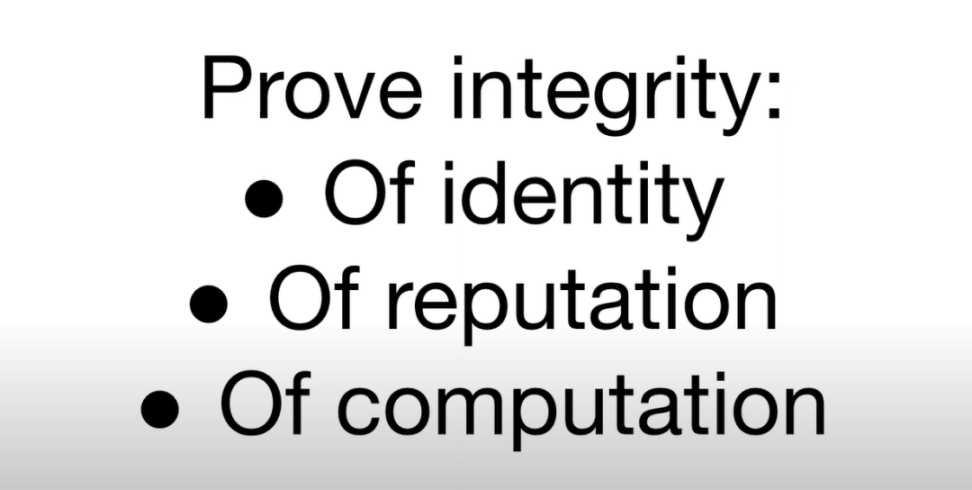

我们有能力证明完整性,证明身份、声誉和计算的完整性。

问题不在于技术,我们不断参加这些会议,不断谈论技术,部分问题实际上在于社会共识和意识形态。

我们知道我们有能力围绕保护应用程序和用户创建新的社会共识形式,我们需要接受这是我们必须要做的事情,我们需要自我监管,然后才能被他人监管。

所以我认为我们在意识形态上非常极端,要么完全无许可,要么完全许可,非黑即白,非此即彼。

但实际上,在这之间有非常广泛的社会共识光谱。

让我给你们举个例子,ZK 和 ASIC 最终将要研究的东西可以解锁什么——这简直是意识形态的诅咒,你知道只有能证明资金合法性的第三方识别代币持有者才能进入一个池子。这可以既是无许可的,也是有许可的。我可以建立一个有这些规则的池子,你可以选择是否进入,所以我们有这种自由意志家长主义的概念。

有人,某个地方,比如这个房间里的社会共识,将决定这是我们安全运作的方式,然后用户决定他们想做什么,而不是我们完全非黑即白,如果有任何许可,即使是社会的,即使是民主的,我们也不能允许。

另一个例子是 Vitalik 和我们的联合创始人 Zach Williamson 一直在研究的去中心化清洁提供者的概念,这是一个社会图,个人在其中证明你的资金和交易的合法性,他们观察行为并说这不是我们想与之相关的东西。这与中心化非常不同,与审查非常不同,这是一种民主形式的社会共识,是我们所有人说我们不会容忍我们生态系统中的某些行为。

这里的目标是仍然允许用户在各种协议设计中表达他们的偏好,这不是为了限制自由,而是给用户比我现在说的更多的选择。

所以 ZK 在基础层实现了这种无许可,同时在应用层提供了许可的社会共识。

这些都是更多的例子,你知道有很多关于储备证明的讨论,防钓鱼,选择加入的合规池子,合法资金证明。

但这一切都是为了说,我们需要把 zachXBT 变成 ZK,我们需要使用数学和社会共识,而不是信任或集中式合规。

所以总结一下,我们需要 ZK 来解锁三大改进。

首先,我们需要在允许自我监管和合规的同时保留用户选择,我们作为一个社区和生态系统还没有真正谈论过自我监管,我们只是希望并祈祷别人不会注意到。

我们不会达到目标,如果我们允许这种情况发生,Web3 不会成功。我们需要向某人证明我们在互相照顾和照顾我们的用户,所以我们需要向用户证明我们作为一个社区在支持他们。

我们不要试图把意识形态强加给用户,让我们给他们选择他们想去的地方,这最终是这个空间的意义所在,它是关于自由,关于自主。

最后,我们需要提高安全性,我们需要让它可靠,我们需要让加密成为必需品而不是可选品。我们忘记了政府至少据称是由选民组成的,为什么 Uber 和 Airbnb 曾经是非法的,现在又合法了?因为有人走到国会台阶上说「除非我死了,否则你不能拿走我的 Uber」,有人这么做了,个人这么做了,我不知道你们是否记得这件事。

我们让加密成为必需品并融入我们经济生活结构的一种方式是确保它是可靠和安全的,并且我们支持我们的用户。

这就是我们如何把「柠檬」变成「桃子」的方法。

本期带来来自 BlueYard Capital 发布在 Youtube 的视频 《Jon Wu (Aztec) @ If Web3 is to Work... A BlueYard Conversation》

原视频链接:https://www.youtube.com/watch?v=o17GnPJXxgU&t=244s

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。