作者:Nancy,PANews

今日(2月12日)凌晨,Solana Degens在电脑前枯坐许久,期待着Virtuals Protocol正式登陆Solana。然而,这家Base上最大的AIAgent发行平台,却并未复制以往的财富效应。正值AI Agent遇冷之际,Virtuals Protocol的多链扩张计划似乎遭遇“水土不服”的困境,不仅毕业率较低,市场参与度也不足。

上线Solana首日毕业率为8.3%,市场参与低迷

1月25日,Virtuals Protocol宣布将扩展到Solana生态系统,并推出多项新计划,包括将在Solana上推出Meteora交易、设立Strategic SOL Reserve (SSR,SOL战略储备),将1%交易费转换为SOL用于生态激励、将在今年3月举办获 Solana基金会技术支持的Virtuals AI黑客松等。

为了助力更多Base生态的智能代理拓展至Solana,Virtuals Protocol在Uniswap上的流动性池已锁定十年且无法迁移的情况下,其联合创始人Wee Kee在1月26日提出了两大解决方案来优化流动性和用户体验,一方面,团队正在探索让感兴趣的团队利用其代理钱包中50%的cbbtc作为流动性来源,在Solana链上创建额外的流动性池。另一方面,该团队还在研究链间抽象互换方案,这将允许用户用SOL购买Base上的代理,或用ETH购买Solana上的代理。

Virtuals Protocol的Solana拓展计划也引发市场猜测。对此,Virtuals Protocol核心贡献者EtherMage表示,走向多链对于Virtuals Protocol实现愿景至关重要,Solana是第一步,Virtuals Protocol还将拓展到其他几个区块链,并且也设置了专门的资源来与区块链领导者/基金会合作,以确保在生态系统中建立的项目获得资金支持。

然而,尽管Virtuals Protocol迈出了向多链扩张的第一步,但市场表现并未达到预期。2月12日凌晨,Virtuals Protocol宣布正式上线Solana,并公布多个细节:所有Solana的原型代理代币在转变为Sentient时,合约地址保持不变;一旦代理累积了42,000枚代币VIRTUAL的绑定曲线后,代理将毕业,并在Solana流动性平台Meteora(与Jupiter是同一创始团队)上创建流动性池;1%的Sentient交易税收被分配到Virtuals Protocol,并以手动方式按照30%-20%-50%的比例分配给代理创建者、代理合作伙伴和代理子DAO,直到自动化分配机制上线。

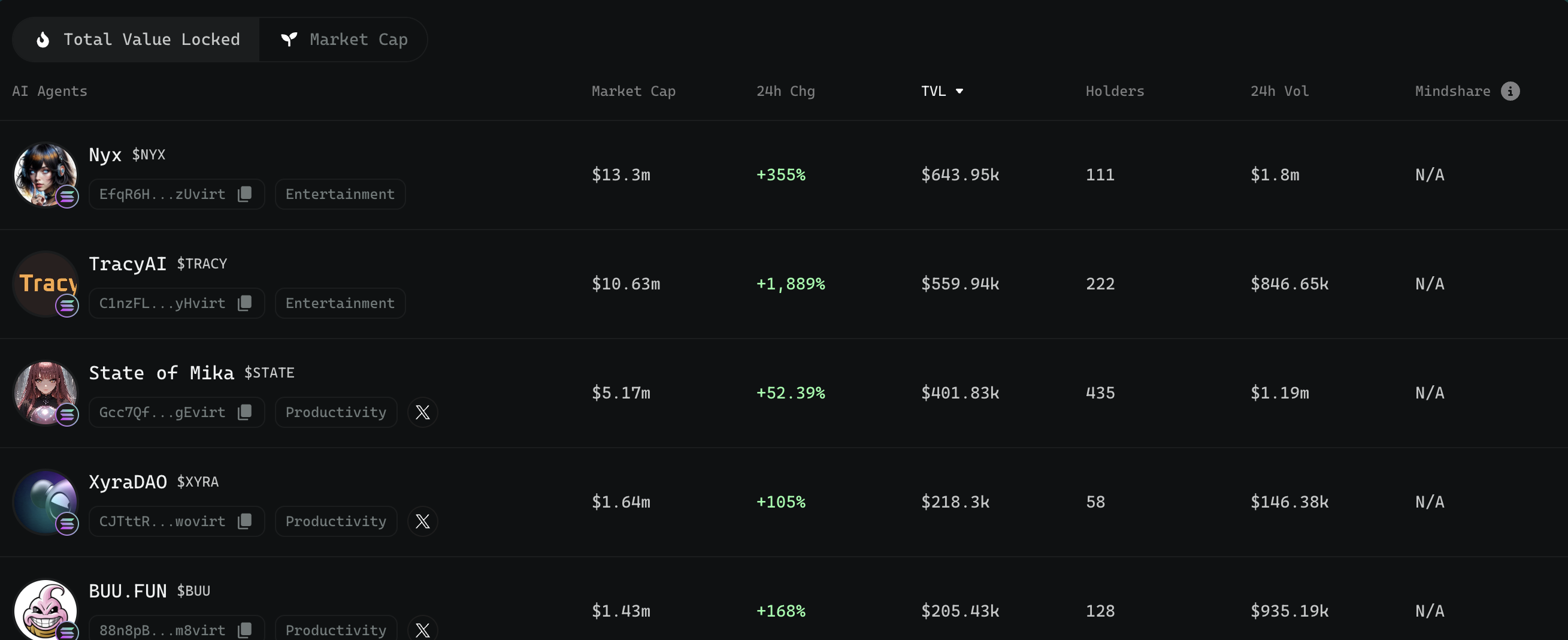

根据官网显示,今日凌晨至今,在Solana的Virtuals Protocol上创建的AI Agent代币仅156个,毕业率达8.3%。而Solana上已毕业项目的市场表现也不尽如人意,市值超过100万美元的项目仅有5个,其中市值最高的代理项目Nyx的市值约为1300万美元。不仅如此,整体来看,大部分项目的币价呈现高开低走的态势,约一半项目的价格接近归零。特别是参与情况方面,除了价格腰斩的项目cucumber tester持有地址数超2600个,其他项目的持有地址数量普遍较少,通常为数百甚至数十个地址。从数据来看,市场对Virtuals Protocol进军Solana的反响较为冷淡。

为了推动Solana生态的增长并提升网络吸引力,EtherMage也最新披露称,“我们收到了许多团队的请求,希望使用回购资金在Solana上同时建立跨链TVL。”为此,Virtuals Protocol将调整Base代理项目的回购销毁计划,计划帮助超过1万美元TVL的代理项目进行执行跨链TVL的建立(约100个项目)。

业务面遭遇周期性波动挑战,市场份额仍居榜首

随着近一段时间AI Agent整体赛道迎来深度回调,包括Virtuals Protocol等项目正遭遇周期性波动带来的市场挑战。

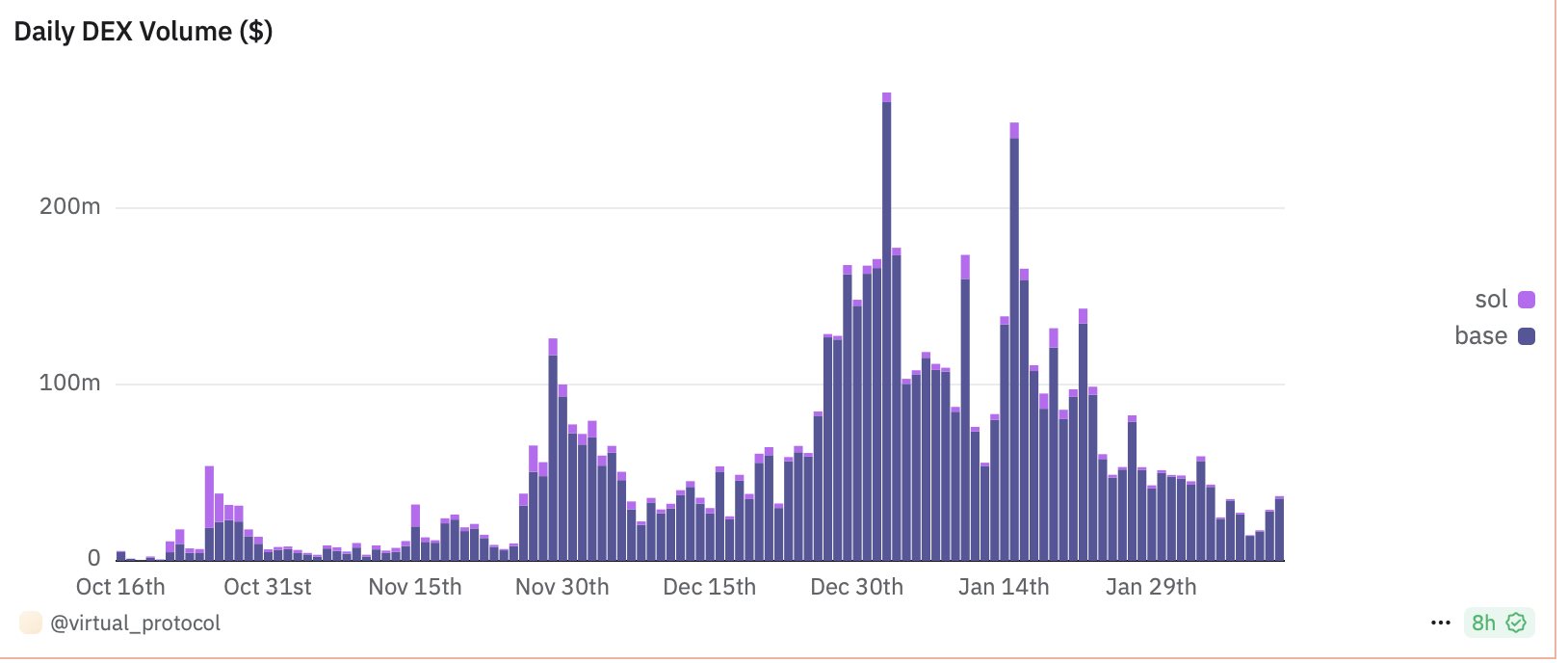

Dune数据显示,截至2月12日,Virtuals Protocol已成功上线了超1.7万个Agent,这些代理的DEX交易量近67.4亿美元,累计收入超3776.6万美元(仅Base网络)。

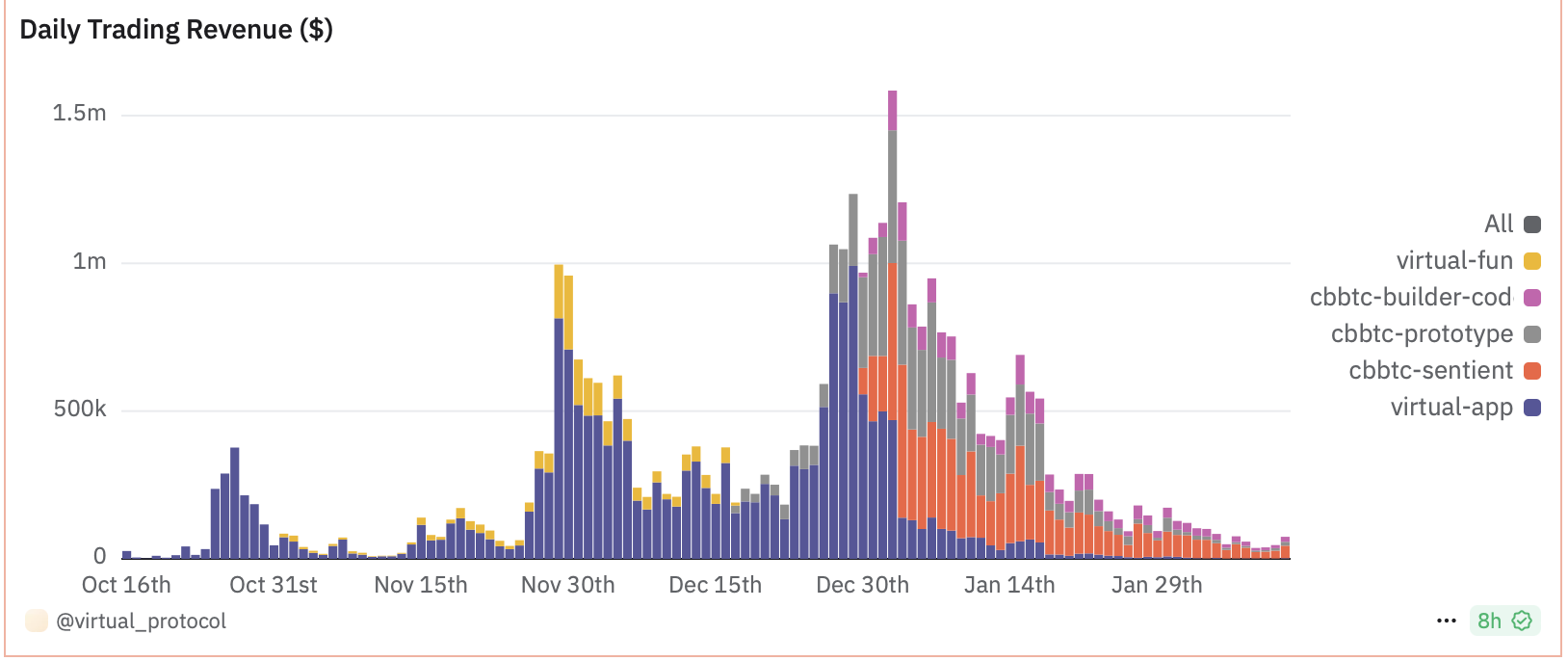

然而,Virtuals Protocol的多项数据呈现出增长放缓,甚至显著下滑的趋势。Dune数据显示,从AI Agent的创建数量来看,自1月下旬以来,日均创建数量大幅下降,多数情况下仅为两位数,远低于去年11月底时超过1300个的峰值。同时,这一期间的收入也出现了明显下滑,日收入大多仅为数十万甚至数万美元,而今年初一度曾突破158万美元。AI Agent在DEX上的交易量也经历了大幅度下滑,从年初时日交易额最高数亿美元的水平,降至如今的千万美元级别。

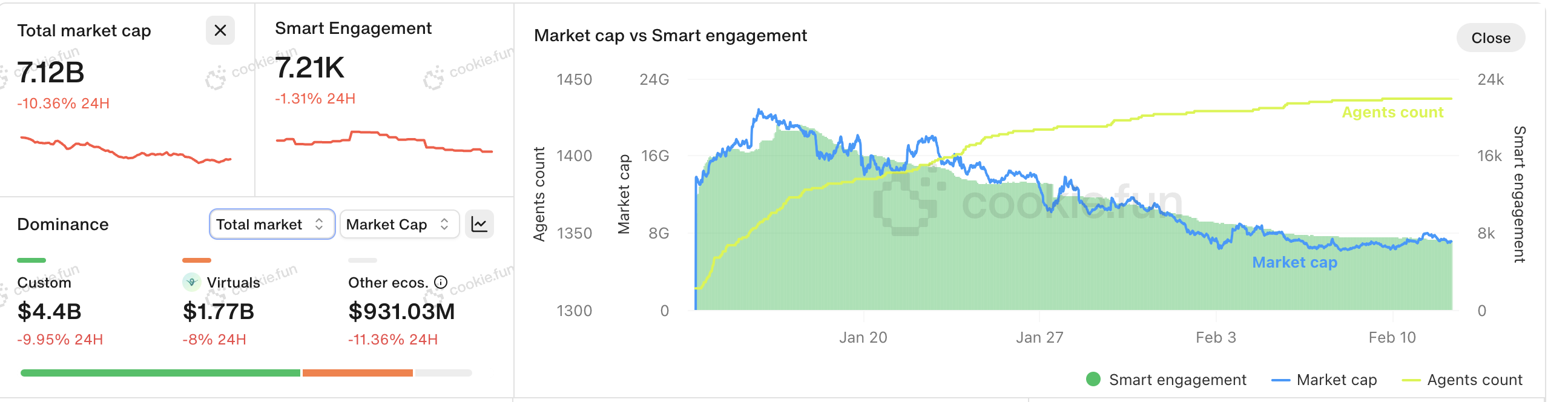

同样,Virtuals Protocol代币VIRTUAL的价格也出现显著回调。根据CoinGecko的数据,过去一个月,VIRTUAL的价格跌幅达46.3%。这一数据下滑趋势与AI Agent赛道整体遇冷有着重要关系。根据Cookie.fun的数据显示,过去一个月,AI代理市场的整体市值已经从高点缩水近65.3%。

尽管如此,Virtuals Protocol依然在AI代理市场中占据领先地位。Cookie.fun数据显示,Virtuals Protocol的生态市值达到了17.7亿美元,位居市场榜首,占据了整体市场份额的24.8%。然而,由于Virtuals Protocol在Solana上的上线时间较短,Solana上的AI Agent市场仍以ai16z为主,其市场份额接近19.2%。

由此来看,面对AI Agent市场热度的大幅下滑,Virtuals Protocol要想借助多链扩展战略重拾增长势头仍面临不小的挑战。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。