作者:tzedonn

编译:深潮 TechFlow

在经历了一个疯狂的第四季度后,是时候静下心来反思了。短短三个月内,市场发生了许多重大变化。

这次的情况与以往不同。

每个人都在期待「山寨季」的到来(即蓝线超过橙线的时刻),就像 2021-2022 年那样,所有山寨的价格都呈现爆炸式增长。然而,自 2024 年 1 月比特币 ETF 推出以来,比特币 (BTC) 与 TOTAL2 指数(代表山寨总市值)的差距却在不断扩大。

在过去的山寨季中,投资者通常会将比特币的收益转移到更高风险的资产上,推动山寨市场全面上涨。这种现象形成了经典的资金流动模式。

但如今,比特币的资金流动已经与其他加密货币完全脱节,形成了一个独立的生态系统。

比特币的资金流入主要由以下三方面推动:

- ETF:目前 ETF 基金合计持有全球5.6%的比特币;

- Microstrategy:这家公司持有2.25%的比特币,是一个持续买入的机构;

- 宏观经济因素:包括利率、政治局势(例如,美国主权财富基金或其他国家可能购买比特币)。

另一方面,比特币的资金流出则主要包括:

- 美国政府:目前持有约1.0%的比特币,并表示可能不会出售;

- 比特币矿工:由于日常运营需要,矿工会定期出售部分比特币;

- 比特币巨鲸:这些持有大量比特币的投资者,自 2023 年市场低点以来,其资产价值已上涨约 5 倍。

显然,这些资金流动的驱动因素与山寨市场完全不同。

山寨市场:玩家还足够多吗?

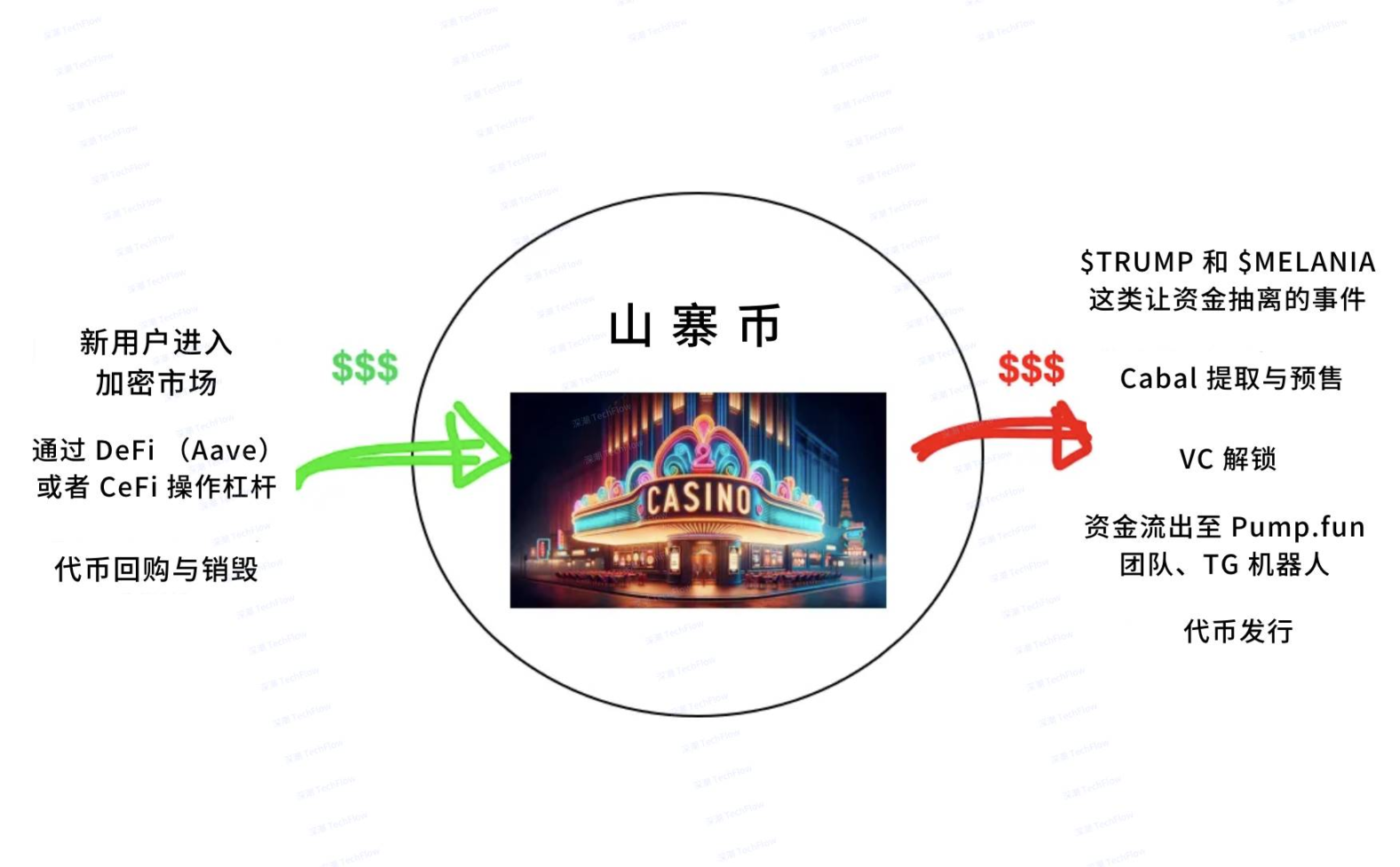

可以将山寨市场比作一个赌场。

只有当赌场中资金流动充裕时(即资金净流入较高),才是参与的好时机。而选择正确的赌桌(即投资标的)同样重要。

山寨市场的资金流入来源如下:

新资金流入

例如 2021 年,大量散户投资者进入加密市场,带来了新资金。然而,目前通过 Phantom/Moonshot 或 TRUMP 代币发行,以及 USDT/C 市值增长所带来的资金流入,似乎不足以支撑市场。

此外,某些特定资产也可能因资金轮动而受益。例如,一些投资者从不投资 Meme,但可能开始关注「AI Meme」,因为这些投资更容易被合理化。

通过去中心化金融 (DeFi) 平台(如 Aave、Maker/Sky)或中心化金融 (CeFi) 平台(如 BlockFi、Celsius)获得的杠杆资金。从机构角度来看,CeFi 市场在经历了 2021 年的崩溃后,如今已显得不再活跃。在 DeFi 领域,IPOR指数(用于跟踪 USDT/C 借款利率)显示,该利率已从 2023 年 12 月的约 20% 降至目前的约 8%。

代币回购与销毁:让玩家的筹码更有价值

加密项目中的「回购与销毁」机制类似于牌局老板利用收入提升玩家筹码的价值。

一个典型的例子是 HYPE 保险基金,该基金以每枚 $24 的价格回购了1460 万枚 HYPE,价值约 3.5 亿美元。

然而,大多数加密项目并未能实现足够的产品市场契合度 (PMF),因此难以通过收入进行足够规模的回购来显著影响代币价格(例如 JUP 的回购案例)。

赌场资金的流出:谁在兑现筹码?

大型资金提取事件

在 1 月份,市场中发生了两次「千载难逢」的大型资金提取事件:

- 特朗普事件:资金从 $0 增长到 $75B,然后迅速降至 $16B;

- 梅拉尼亚事件:资金从 $0 增长到 $14B,随后降至 $1.5B。

这两次事件保守估计从加密市场生态系统中抽走了超过 $1B 的流动性。换句话说,如果某人在一笔交易中赚取了超过 $10M,那么他们很可能会将超过 50% 的收益转移到场外市场。

工具驱动的持续资金提取

除了大型事件外,一些工具也在持续抽取市场资金:

- Pump.fun:在约 1 年内累计收入达到$520M;

- Photon:累计收入约$350M;

- Bonkbot、BullX 和 Trojan:每个工具的累计收入约为 $150M。

这些工具通过分散的小额提取方式,逐步从市场中移出大量资金。

Cabal 提取与预售模式

Cabal 提取与预售模式往往标志着市场周期的结束。这是因为少数人会在这个阶段提取巨额资金,并将其转移到场外市场。随着周期接近尾声,这些事件的持续时间也变得越来越短:

- Pasternak:仅持续了约 10 小时;

- Jellyjelly:持续了约 4 小时;

- Enron Pump:仅持续了 10 分钟。

这种快速的资金流出被形象地称为「安乐死过山车」,因为它让市场经历了短暂而剧烈的波动。

风投 (VC) 的资金解锁

风险投资机构通过解锁资金,将加密资产兑换成美元,以向其有限合伙人 (LPs) 返还分配的投资收益 (DPI)。例如,在 TIA 项目中,VC 通过这种方式从加密市场中抽走了大量资金。

去杠杆化

市场中还存在去杠杆化的现象,例如降低 USDT(泰达币)的借贷利率。这种行为会导致市场中的杠杆资金逐渐减少,从而进一步影响流动性。

山寨的选择:如何找到属于你的牌桌?

在加密市场中,选择正确的投资标的是成功的关键。可以将这一过程比作选择一张合适的扑克桌。

当市场活跃(即有大量玩家参与)时,你的潜在回报会更高,但前提是你选择了正确的代币。

这种投资被称为「扑克游戏」,因为它本质上是一场零和游戏。

在这个游戏中,项目要么:

- 无法产生收入或价值;

- 将所产生的价值归属于代币。

唯一可能的例外是以下两类项目:

- 经常被使用的 L1,如 SOL 和 ETH;

- 能够产生高收入的产品,如 HYPE。

需要注意的是,一些投资者基于「基本面」押注团队未来能够创造可持续的收入,但从短期来看,我对此持更为悲观的态度。

2025 年的情况:桌子太多,但玩家太少。

到了 2025 年,加密市场的竞争变得更加激烈,找到合适的投资标的比以往更加困难。这是因为市场上同时存在的「扑克桌」(即代币项目)实在太多了。

以下是一些数据:

- 每天有约5 万种新代币通过 Pump.fun 上线;

- 自 Pump.fun 推出以来,已经上线了超过 700 万种代币,其中约有 10 万种最终进入了 Raydium 平台。

显然,市场中并没有足够的投资者去支持所有这些代币项目。因此,山寨的投资回报呈现出强烈的分化趋势。

选择正确的投资标的已经成为一门艺术,通常需要考虑以下几个方面:

- 团队与产品的实力;

- 项目背后的叙事;

- 传播性与营销效果。

Kel 曾撰写了一篇精彩的文章,详细探讨了如何选择山寨投资标的。

这意味着什么?

山寨不再是「高贝塔值的比特币」。过去的投资理论认为「持有山寨而不持有比特币」可以获得更高的回报,但如今这种策略可能已经不再适用。

资产选择的重要性提升。在 Pump.fun 平台将代币发行门槛降至几乎为零的情况下,选择正确的山寨变得比以往任何时候都更为重要。市场中的资金流入不再能够平均推动所有代币价格上涨。

山寨投资更像一场扑克游戏。虽然将山寨投资比喻为扑克游戏听起来有些悲观,但这确实是目前市场的真实写照。或许未来我会撰写一篇文章,探讨加密货币真正的长期用例。

见顶了吗?目前来看,市场可能已经阶段性见顶,但未来走势仍有待观察。

下一次山寨季何时到来?

传统的「四年周期」理论可能已经失效,因为山寨币的走势正在逐渐脱离比特币 (BTC) 的影响。

未来,山寨币的行情可能会被一些意想不到的事件触发,例如类似于「GOAT」这样的现象级事件。

从长期来看,加密市场的前景依然非常值得期待,尤其在美国主权财富基金 (US Sovereign Wealth Fund, US SWF)、支持比特币的政府、稳定币相关法案的出台的影响下。

未来充满不确定性,但也充满机遇。祝好运,玩得开心!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。