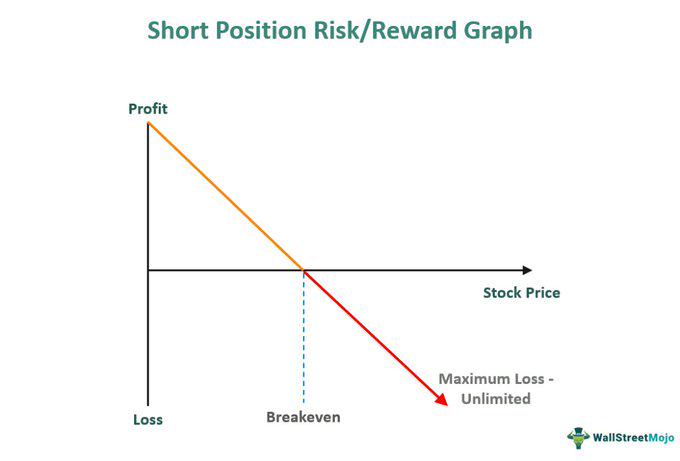

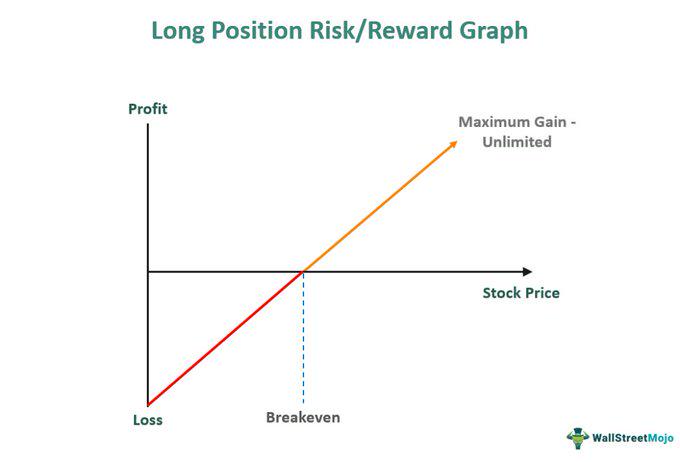

1.为什么做空性价比不高?

理论来说, 做空最多赚1倍,却可能亏正无穷;

做多最多亏1倍,却可能赚正无穷。

尽管有人反驳说,由于币圈所有山寨币都有强大的地心引力(团队出货),所以做空没有想象中那么差。

不过,我依然极少做空(套保除外),更深层的原因是:

做空会让人变得扭曲,变得开始仇恨这个行业(看到阴暗面会自我加深)

一旦仇恨上头(一定会的),失去信仰,某天一定会开始尝试空大饼,但是后果,你们懂得,很恐怖。

你需要知道:

人类永恒印钞 √

比特币永恒牛市 √

--------分割线--------

2. $Luna 暴雷空军盈利多么?

22 年我天天在推特上抨击 Luna 骗局,以至于有一段时间 Luna 的脑残粉每天追着辱骂我,所以我有发言权。

$Luna 暴雷,本质上就是:

Luna 多头的财富

↓转移到了↓

Luna 空头 + CEX。

毕竟曾是市值 TOP 10 的项目,这样的财富转移很多,所以空军大赚。

但是不能【只看贼吃肉,不看贼挨打】

在 Luna 从 0.3 美金涨到 120 美金的时候,已经有无数空头的钱进入了多头的口袋,所以做空依然不值得。

我当时为数不多得开了一次空单,我没有空 Luna ,空了 $UST (Luna的稳定币)。

我至今仍然认为这是一个相当棒的决定,UST 作为稳定币,我 0.9 几多开始空,理论上亏不到 10%,赚可以赚 90%。

不过,这种做空机会属于几年才有一次。

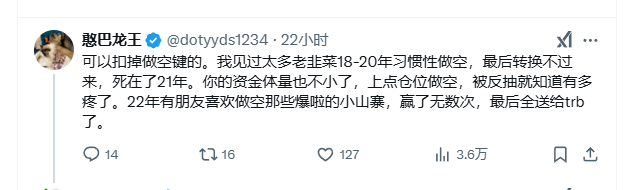

而且,每隔一段时间还会碰到 $TRB 这种,原地核爆上拉 (没有基本面,但是几个月 $10→$550),你就算有神仙级别保证金,也一下子清空空军所有弹药。

参考@dotyyds1234说的

所以结论是:

不要习惯性做空(套保除外)

有些钱宁愿别赚

熊市宁愿休息

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。