# I. Outlook

## 1. Macroeconomic Summary and Future Predictions

Last week, the U.S. government announced tariffs on imported goods from multiple countries, further escalating trade tensions. The market is concerned about inflationary pressures that may arise from these tariffs, which could affect future interest rate cut expectations. The Federal Reserve may only cut rates once in 2025, by 25 basis points, depending on the performance of inflation and economic data. In the future, the U.S. economy may face the dual challenges of slowing growth and persistent inflation. Investors need to closely monitor the Federal Reserve's monetary policy direction, the evolution of trade policies, and the potential impact of AI technology on the economy.

## 2. Market Movements and Warnings in the Crypto Industry

Cryptocurrencies are seen as a long-term hedge against inflation and uncertainty, but in the short term, they behave more like risk assets and may react negatively to any uncertainties surrounding the trade war. Additionally, weak Ethereum development, the retreat of meme bubbles, and a lack of fresh hotspots in the industry have also adversely affected the crypto market.

Some investors view $90,000 as a key support level for Bitcoin, while others warn that if Bitcoin significantly falls below this support level, it could lead to further deep corrections. However, the trade war has triggered a significant drop in the overall crypto industry, clearing leverage, and the likelihood of continued sharp declines in the short term is relatively low. The subsequent trend is likely to focus on oscillatory recovery, but investors still need to be vigilant about related risks.

## 3. Industry and Track Hotspots

Bluwhale, a decentralized AI customization protocol backed by investors such as Cointelegraph and DWF Labs, has raised $7 million. It helps decentralized applications acquire user insights, perform user profiling, and target potential customers across chains through its unique AI personalization network. Autonolas, a decentralized platform that has raised $13.8 million, is dedicated to creating and sharing autonomous AI agents. Through its open-source framework, Olas Stack, Autonolas promotes collaborative AI development and ensures system robustness and transparency.

Spindl, a Web3 growth platform led by Coinbase, helps developers gain insights into user behavior in decentralized applications through on-chain attribution, analysis, audience segmentation, and advertising. D3 Global, led by Paradigm and co-invested by Coinbase, aims to enhance interoperability between Web2 and Web3 identity verification. Its patented technology promises inherently secure identity verification and supports all web browsers and devices.

# II. Market Hotspot Tracks and Potential Projects of the Week

## 1. Performance of Potential Tracks

1.1. Analysis of Bluwhale, a Decentralized AI Customization Protocol Backed by Cointelegraph, DWF Labs, and Others, Raising $7 Million

Bluwhale is an AI personalization network (modular intelligence layer) designed to help decentralized applications (such as games, DeFi, protocols, etc.) acquire user insights, perform user profiling, and discover potential customers across chains. It transforms on-chain wallet data into insights through a knowledge graph structure to support real-time queries, accelerate training, and facilitate reasoning between AI models and agents.

The company utilizes AI technology to aggregate and visualize key information, promoting optimal wallet matching and social interaction between consumers and businesses through messaging (on-chain/off-chain). This will help projects rapidly expand their user base while allowing consumers to convert their digital profiles into the most profitable assets.

Consumers aggregate their digital footprints and verify their identities through Bluwhale, thus gaining sovereignty over their personal information under self-custody. They can earn passive income from their digital presence by participating in and contributing to the financial systems of the Bluwhale network and the networks built on it.

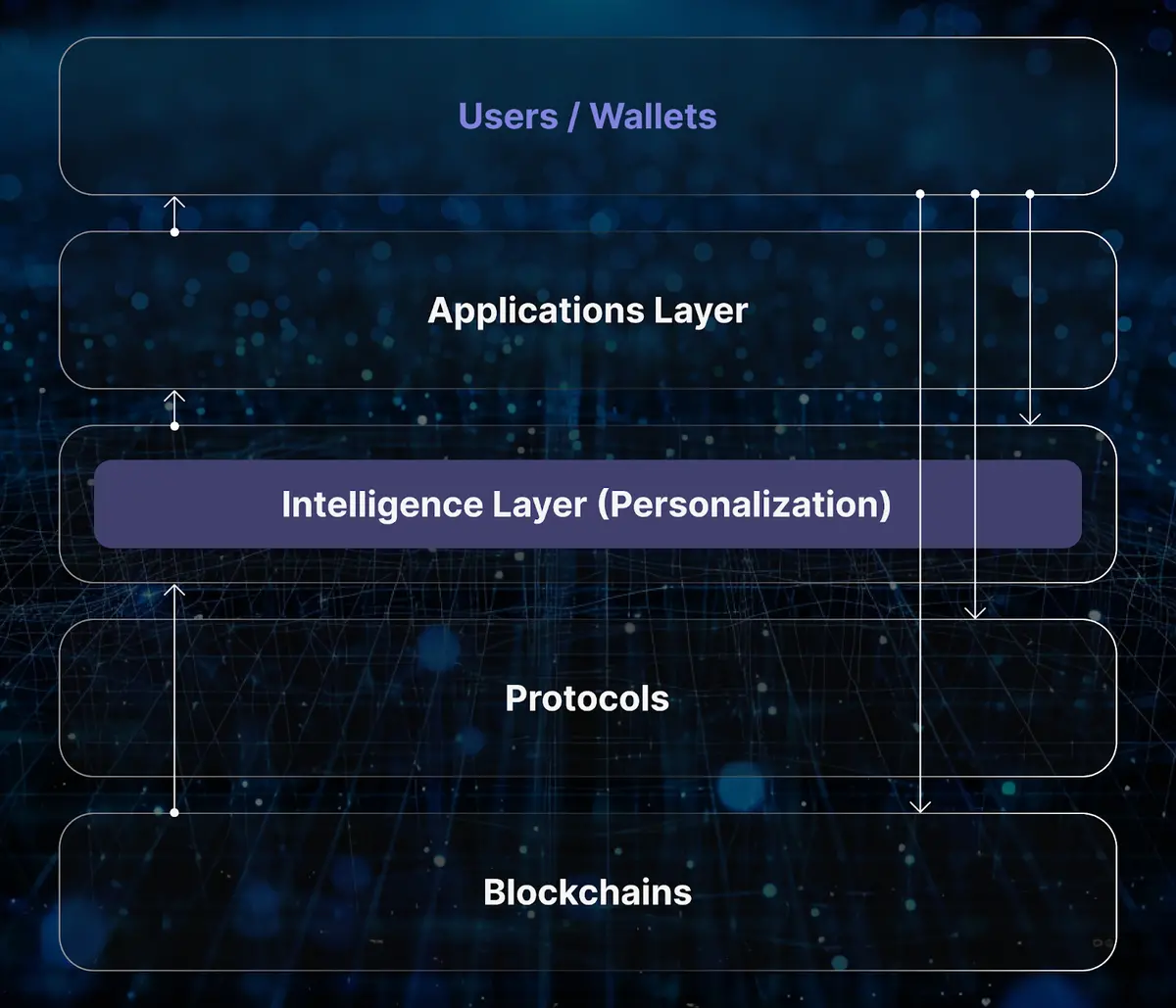

Ecosystem Analysis

The Bluwhale protocol seamlessly integrates between the application layer and protocol layer and L1/L2 chains, delivering key user insight data to decentralized applications (dApps) and individual users without requiring them to manually analyze or write technical queries.

The personalization layer can be further broken down into the following three core modules:

- Data Verification Module

This module consists of community validators, social interactions, and social circles responsible for verifying the authenticity of data to ensure the security and accuracy of the entire network. The verification content includes data contributed and identity information established within the Bluwhale AI network.

- Function: Ensures seamless integration of internal, external, on-chain/off-chain data through reference verification methods adopted by nodes.

- Goal: To ensure the credibility and integrity of the data.

- Identity Embedding Module

This module verifies user identities through traditional (Web2) social accounts and blockchain (Web3) social reference mechanisms, aggregating this identity information into the embedding layer. It integrates identity and data through knowledge links, weights, rankings, and other identity context models.

- Function: Contextualizes user behavior and continuously optimizes incoming reference data to create as comprehensive a user profile as possible.

- Goal: To build a complete user identity profile, providing a foundation for subsequent analysis.

- Privacy Inference Module

This module is based on Zero-Knowledge Proof (ZKP), interpreting and mapping the data disclosed by users, and allocating rewards based on the needs of businesses or individuals and the complexity of data processing and queries. Businesses can only access relevant data with user authorization, and users can receive economic returns through data sharing.

- Function: Achieves value exchange of data while protecting user privacy.

- Goal: To ensure transparency in data usage and the security of user privacy.

Comments

The advantages of Bluwhale's three modules can be summarized as:

- Data Verification Module: Ensures data credibility and seamless integration.

- Identity Embedding Module: Constructs comprehensive user profiles and optimizes data context.

- Privacy Inference Module: Achieves data value distribution while protecting privacy.

Its core value can be summarized as:

- Decentralization and Security: Achieves trust minimization (trustless) and decentralization through modular design.

- User Sovereignty: Users fully control the use of their data and earn economic returns through data sharing.

- Efficient Insights: Provides real-time, accurate user insights for businesses and individuals without complex technical operations.

1.2. What Potential Does Autonolas, a Decentralized Platform Aiming to Create and Share Autonomous AI Agents with $13.8 Million in Funding, Have?

Olas is a decentralized platform aimed at creating and co-owning autonomous AI agents, driving the entire AI-driven economy. By incentivizing developers, operators, and other participants, Olas coordinates the deployment of agents across multiple blockchains, promoting collaborative AI development. The platform offers an open-source framework—Olas Stack—that allows developers to build off-chain agents and ensures system robustness and transparency through on-chain security.

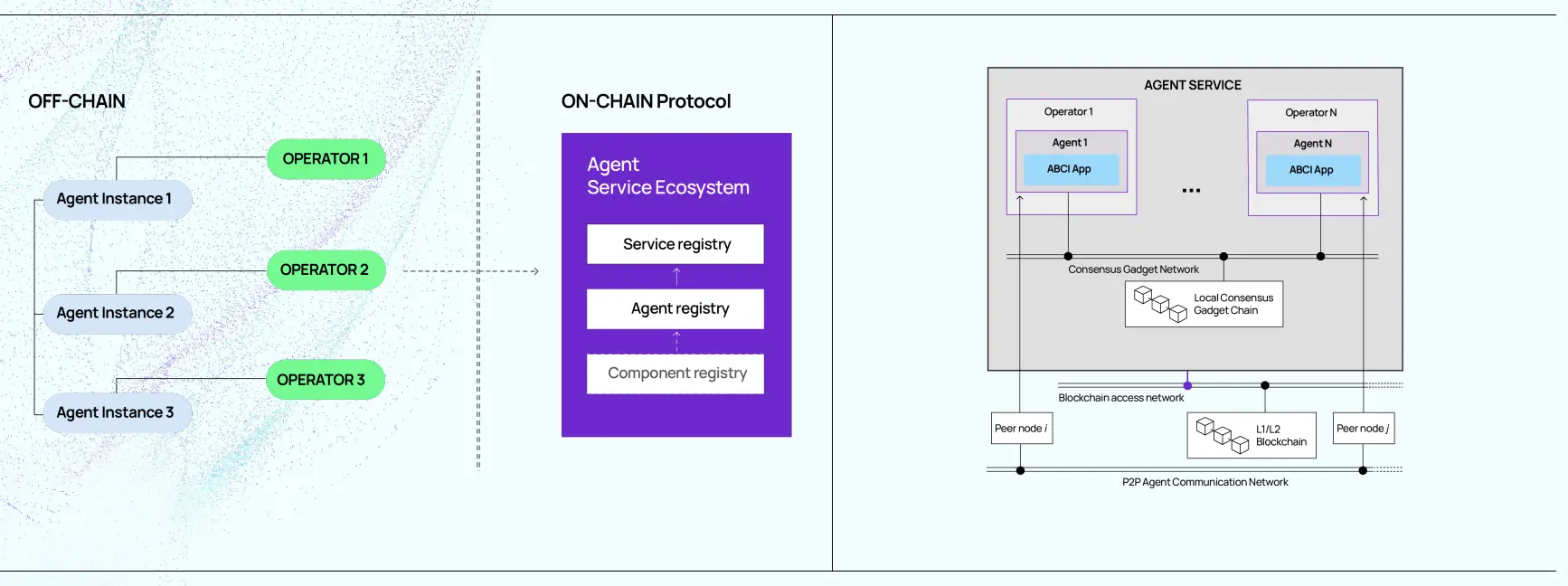

Technical Architecture Autonolas' autonomous software services are manifested in the form of agent services.

Agent services are a set of independent computer programs that interact to achieve predetermined goals. Agent services can be understood as a logically centralized application (i.e., only one application state and logic) replicated in a distributed system.

Agent services consist of code components that can be combined like Lego blocks through software. With the support and incentives of on-chain protocols, developers can publish and find code components to build and expand new services.

To this end, on-chain protocols implement a series of registries that allow code components, agents, and services to be discovered, reused, and economically rewarded.

In summary, the main elements of the Autonolas technology stack include:

- Agent Services: Maintained by service owners and operated by multiple operators, who execute independent agent instances (these instances run the same code); these instances are coordinated through so-called consensus tools.

- Composable Autonomous Applications: Built from foundational applications, easy to scale, and can be composed into higher-order applications.

- Programmable Blockchain: Used to ensure the security of agent services and incentivize developers to contribute code to the protocol.

Autonomous services make DAOs more competitive in the following ways:

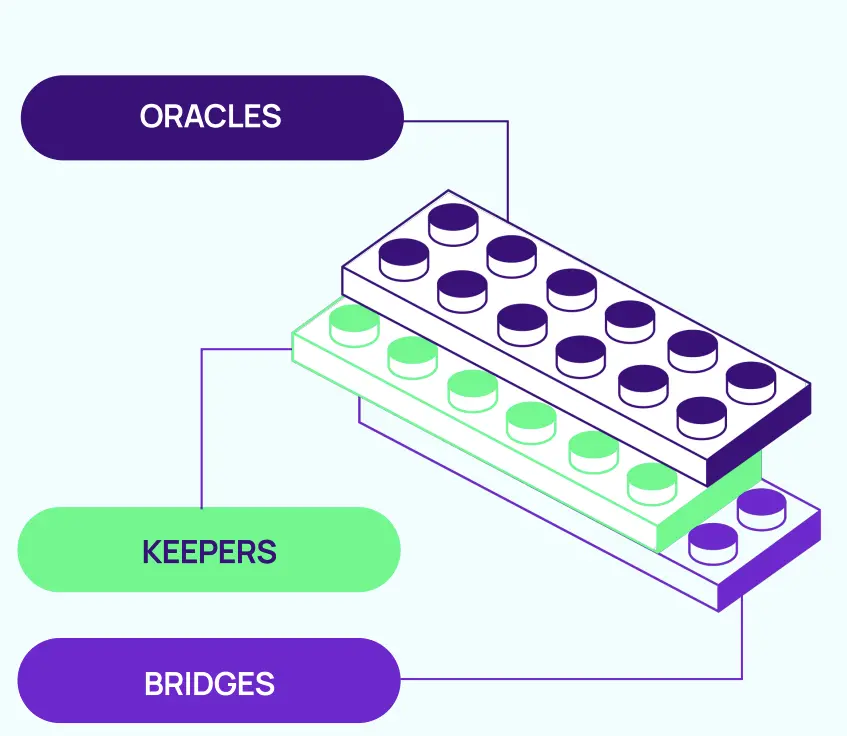

Autonomous services can consist of three basic "Lego blocks":

- Keeper – Acts on-chain based on rich conditions

- Oracle – Pulls and executes complex data operations

- Bridges – Moves value and information between blockchains

This composability leads to combinatorial expansion and unprecedented new applications.

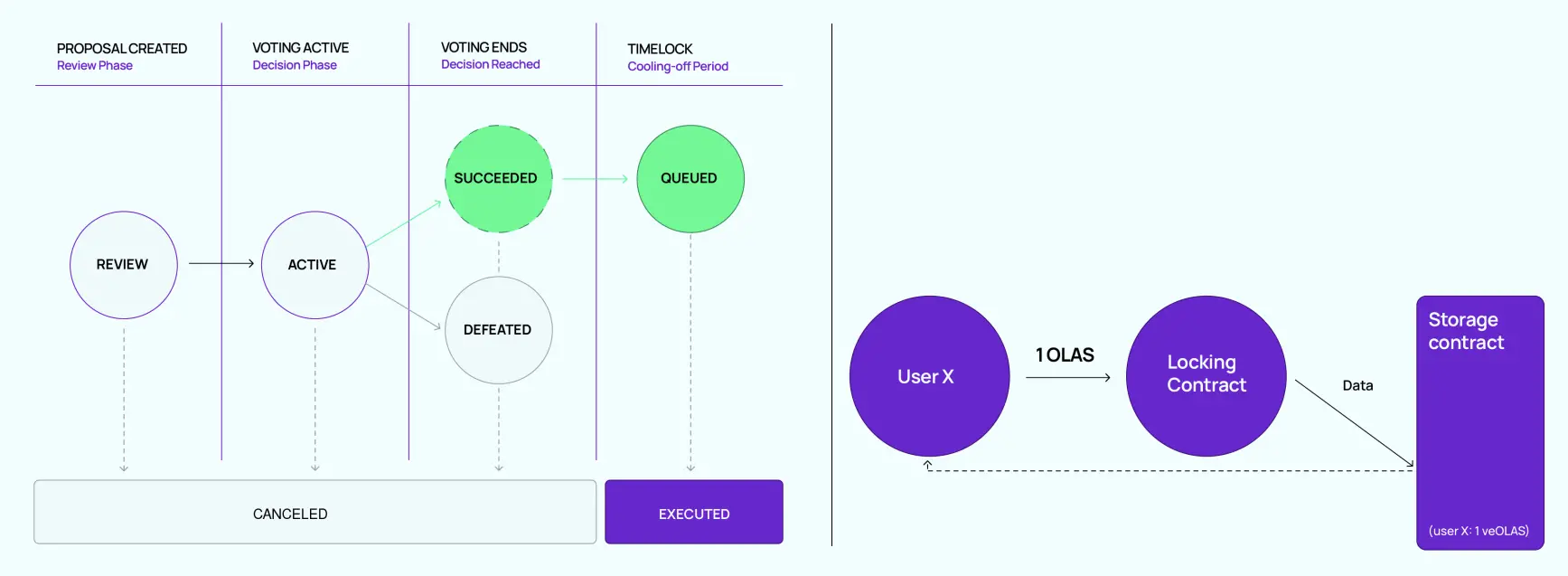

Governance

One of the key elements of Autonolas' success is having an active community and ecosystem that not only builds, develops, and promotes but also uses Autonolas technology. To this end, Autonolas is organized in the form of a DAO, where meaningful contributors and supporters participate in the decision-making process.

Initially, users holding virtualized veOLAS tokens can participate in any governance activities. veOLAS tokens are obtained by locking OLAS (the native token of Autonolas). The level of governance participation is proportional to the amount of veOLAS held and the locking duration.

Governance proposals can significantly modify system parameters, support new technological directions, or add entirely new features to the on-chain protocol. Once a governance proposal is approved, a Timelock will increase the delay in executing the proposal.

In exceptional cases, certain changes to the Autonolas on-chain protocol can be executed through a community-owned multi-signature wallet, bypassing the governance process. This allows a group of trusted participants to act beyond governance in certain aspects, such as fixing security vulnerabilities without governance discussions.

Comments

Through Autonolas' services, one can obtain:

- Continuous operation

- Autonomous action

- Interaction with the world outside the blockchain

- Running complex logic

Through Autonolas, the best AI will not be exploited by individual billionaires or large corporations. Instead, they will be collectively owned by humanity and operate as autonomous services, promoting the development of individual autonomy.

1.3. Brief Analysis of Spindl, a Measurement & Attribution Platform Focused on User Acquisition for Developers, Led by Coinbase

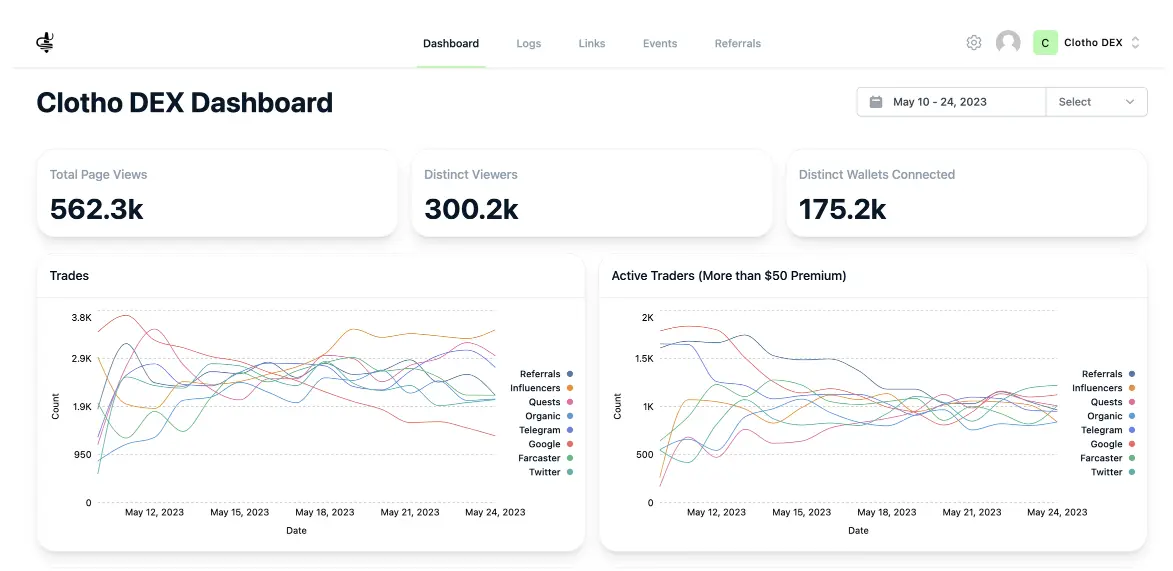

Spindl is a Web3 growth platform that provides comprehensive solutions, including on-chain attribution, analytics, audience segmentation, and advertising. It enables developers to understand the sources and behaviors of user acquisition in decentralized applications and offers customizable dashboards and reporting tools. Spindl's recommendation system allows projects to reward key opinion leaders, community members, and publishers who contribute to user growth.

This means Spindl can tell you where your users come from (Twitter? Telegram? On-chain airdrops?), as well as their on-chain behavior within your dApp. In other words, did they generate revenue? Did they stick around? Is their acquisition cost too high?

Visually, the unique view you see in Spindl is as follows: after correctly attributing Web 2 channels (like Twitter), they are displayed next to Web 3 channels (like tasks and on-chain rewards).

Attribution

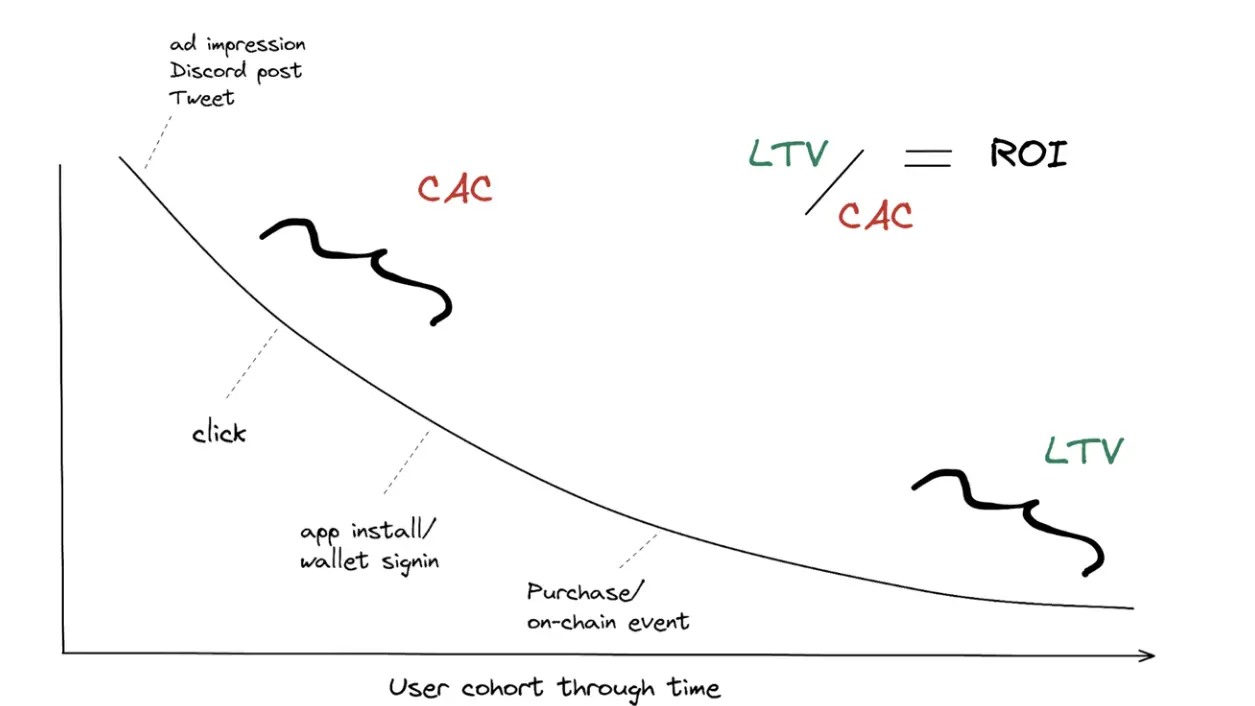

The attribution system is the capital "T" truth in the media ecosystem, determining which upstream publishers or actions—like clicking a tweet or Instagram ad—lead to certain valuable downstream user behaviors, such as installations or purchases.

In its purest and most perfect form, attribution allows you to measure the so-called marketing "funnel": a group of users gradually moving from a Discord post to clicks, to wallet logins, and then to some on-chain (or off-chain) user behavior. If you know how to monetize "downstream" in the application experience and how much it cost to bring users to that point (whether through paid media like ads or organic traffic like blog posts), then you can calculate your "ROAS" (Return on Ad Spend… there are many acronyms in marketing technology). Ideally, it looks like this:

If ROI > 1, then the business is viable. Otherwise, it is not. This is a mathematical principle that any business, whether digital or traditional, cannot escape. The difference is that in the digital world, you can almost pinpoint all data to four decimal places.

On-chain attribution faces unique challenges in achieving true attribution in Web 3. Simply put, most participants in the crypto space that claim to do this actually cannot (at least according to most definitions of "some vague terms").

In short, attribution answers the question:

Where does this user really come from?

And by extension, it also answers similar questions:

- How long did they stay?

- How much should I pay the user source as an acquisition cost?

- How much revenue did I earn from this user, and am I satisfied with this acquisition channel?

This question is difficult because it requires maintaining stateful information about users and even defining what an active user is (for example, an active user is defined as someone who has made at least one transaction in the last 7 days).

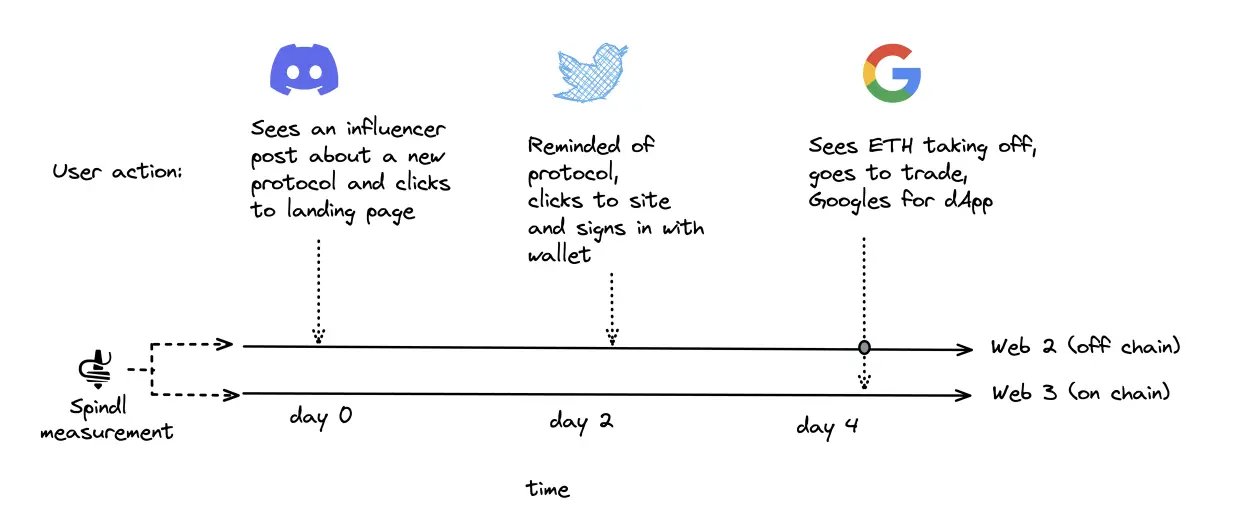

It is not just about recording which website they visited before entering your application (for example, through UTM parameters), or even recording the wallet address that conducted transactions through your protocol, which may have interacted with many other upstream smart contracts (users interact with many smart contracts). Which contract should we attribute to the new user? This is the question that "true attribution" seeks to answer.

This diagram illustrates one such scenario:

Comments

Spindl, as a unique player among all attribution providers, intelligently integrates off-chain and on-chain events to effortlessly answer these questions. Through its continuously updated identity, Spindl can interweave Web2 and Web3 funnels at will, cleverly hiding the complex transactions behind users.

Users can do almost anything in Chartbuilder. But the key to remember is that users can only attribute funnel bottom events that have been marked as "conversion events," which are typically (but not always) on-chain events, such as minting or swapping.

While Spindl makes cross-Web2/Web3 attribution both feasible and convenient, there are certain limits to what Spindl can currently abstract. As for its potential, developers may be able to acquire users more accurately and at lower costs in the future, investing more funds and energy into improving and enhancing user experience and revenue.

1.4. Can D3 Global, a Star Project Led by Paradigm and Co-Invested by Coinbase, Meet User Expectations in Enhancing Interoperability Between Web2 and Web3 Identity Verification?

D3 Global claims to possess "patent-pending technology" that promises to enhance interoperability between the Web2 and Web3 versions of the internet while improving its usability and security. D3 plans to apply for and obtain new top-level domains during ICANN's upcoming application period, aiming to provide inherently secure identity verification that supports all web browsers and devices.

Build once, integrate everywhere

Obtain traditional internet and Web3 name resolution services on a single platform, including out-of-the-box DNS and ENS support. Use a single integration without endless SDKs, APIs, or hacky solutions.

Design for future-proofing

Use the tools and languages you are already familiar with and love. Access secure and compliant infrastructure with forward and backward compatibility.

Monetize domain names

As an affiliate partner, generate revenue by selling name tokens within your application. Allow users to search, purchase, and mint name tokens while maintaining complete control over the user experience.

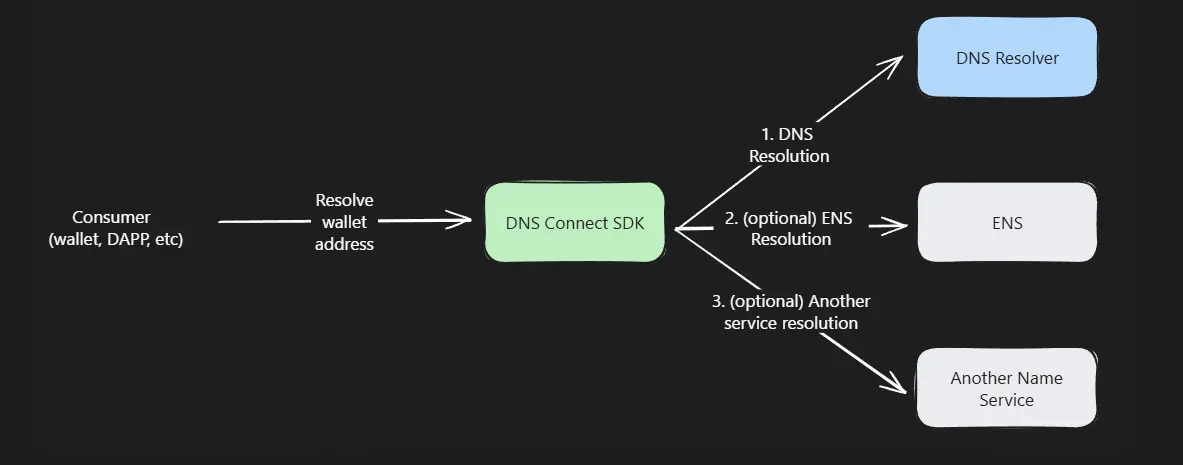

Analysis of D3 Names Built with DNS Connect SDK

Overview The DNS Connect SDK is designed to integrate different Web3 name resolution services into a single platform to simplify developers' integration work. It supports the following resolution methods, which can be applied in order of priority:

- DNS resolution

- (Optional) ENS resolution

- (Optional) Other resolution services - provided by D3 or the community.

The DNS Connect SDK offers a range of benefits, including:

- Seamless transition between existing internet (Web) and Web3 infrastructure

- Future-proof design with forward and backward compatibility

- Single integration without endless SDKs, APIs, etc.

- Accessible, compliant, and secure infrastructure

D3 offers three main integration methods to meet different development workloads and functional needs. Each option allows developers to seamlessly integrate D3's capabilities into their applications, from simple affiliate links to full API integration.

Comments

In summary, the services currently offered by D3 include:

- Selling name tokens to users within your application

- Sending/receiving cryptocurrency to/from names in the application

- Reverse resolving names within the application

More complex services that may be offered in the future:

- Partial ownership of names

- Liquidity pools for trading strategies

2. Detailed Overview of Projects to Watch This Week

2.1. Detailed Overview of Beamable, a Network Designed to Solve Web3 Gaming Issues, Backed by the Solana Foundation and Currently Raising $13.5 Million

Introduction

The Beamable network is a decentralized infrastructure network (DePIN) aimed at reducing the reliance of games on centralized hyperscale servers. It provides a cost-effective and flexible alternative for supporting real-time gaming through tokenized incentive mechanisms that decentralize computing power, storage, and bandwidth. Beamable also offers an open and scalable game server platform equipped with tools such as LiveOps, serverless backends, and Web3 integration to help developers build and scale online games.

Technical Analysis

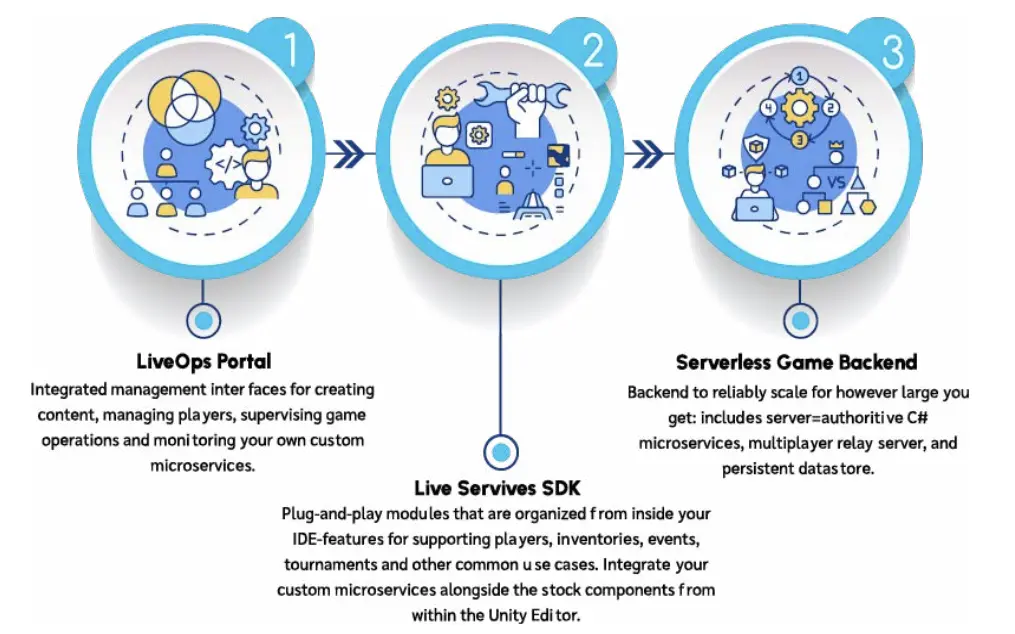

The Beamable architecture consists of three main layers: a serverless game backend that hosts microservices; a Live Services SDK that provides various ready-made features needed for your game; and a LiveOps portal for daily management, accessible to all users in the studio.

Common Workflow of Full-Stack LiveOps Integrated with Beamable:

Code Creation Use the Unity editor as the hub for writing client and server code, supporting C# and allowing full access to all the plugins and tools you are accustomed to—whether client or server-driven components.

Creating Server Workloads Execute flexible, secure, and auto-scaling workloads using cloud-based microservices. You can use any third-party services you prefer (drivers, databases, etc.).

Multiplayer Gaming Distribute and synchronize multiple game clients, providing anti-cheat deterministic multiplayer support.

Debugging Create local instances of all server-driven microservices and debug them alongside client code. You can trace code, set breakpoints, monitor variables, etc., anywhere.

Deployment Publish server-driven code without configuring or managing servers, networks, load balancers, scaling rules, monitoring/logging software, or build processes.

Monitoring Observe the performance of custom microservices through a web-based portal or within the Unity editor to identify opportunities for latency and compute consumption improvements.

Implementing Real-Time Services Provide common real-time services (events, guilds, players, inventories, etc.) through the Live Services SDK. Drag and drop and manage their configurations and data from within the Unity editor, which can be managed both inside the editor and through a web portal.

Using Persistent Data Easily store key-value pairs that cover most data storage use cases, perform powerful queries within Beamable microservices, including geospatial and time series analysis—or connect your own databases and storage services to handle more specialized use cases. Configurable datasets can be managed through integrated deployment processes to change the production environment.

Content Creation

Integrated tools allow content creators to use web-based forms, spreadsheets, or the Unity editor to create new projects, events, variable changes, and more.

Version Control

Organize all code, content, and data into comprehensive packages using your preferred standard version control tools—without the cumbersome build processes typically associated with synchronizing different real sources.

Monitoring

Observe the performance of custom microservices through a web-based portal or within the Unity editor, identifying opportunities for improvements in latency and compute consumption.

Real-Time Operations

Manage key data structures in Beamable—players, inventories, purchase histories, events, content, etc.—through web-based forms and access controls.

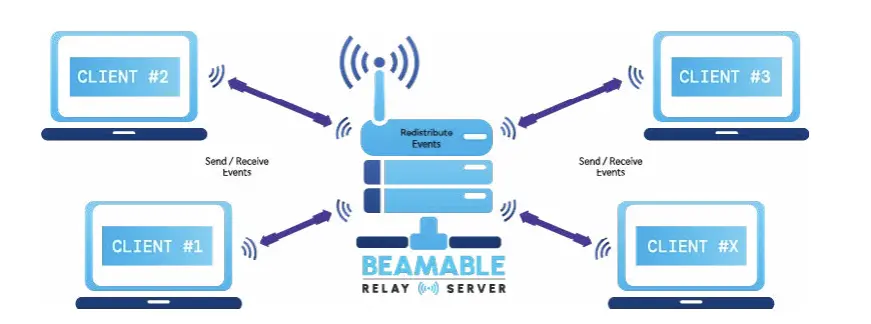

Multiplayer Relay Servers synchronize user inputs over the network and distribute changes to active sessions of each game client. Relay servers are ideal for real-time strategy, tower defense, multiplayer online battle arena (MOBA), card battles, auto chess, and other multiplayer games with deterministic progression gameplay.

Relay servers track each player's simulation frames, maintain event logs, and manage timing. When building with relay servers, you can choose to use them as a simple communication channel between games (suitable for scenarios where cheating is not a concern), or you can implement anti-cheat deterministic multiplayer gameplay, allowing game clients to securely reach consensus on game state among multiple players. In the latter case, attempts to tamper with the client will result in synchronization failures, and cheaters will be excluded from subsequent games.

Deployment of Promotional Content and Code

Since microservices are fully managed, you do not need to provide servers or engage in the usual complex work associated with scaling servers: no need to configure networks, set up load balancers, write scaling rules, install monitoring/logging software, write build scripts, etc.

Beamable automates the process of moving all interdependent client code and microservices through the various steps of continuous integration, quality assurance, and release processes.

These C# code modules are independently deployed within your microservices, separate from the front-end code (there is no backend residue in the code you publish to players), while remaining consistent with the client binaries.

Implementing Real-Time Services

Beamable comes equipped with a real-time service SDK that allows you to quickly add common social, commercial, and content features to your game. These services run within the same highly scalable microservices architecture as your custom services, giving you confidence to reliably scale to any number of players.

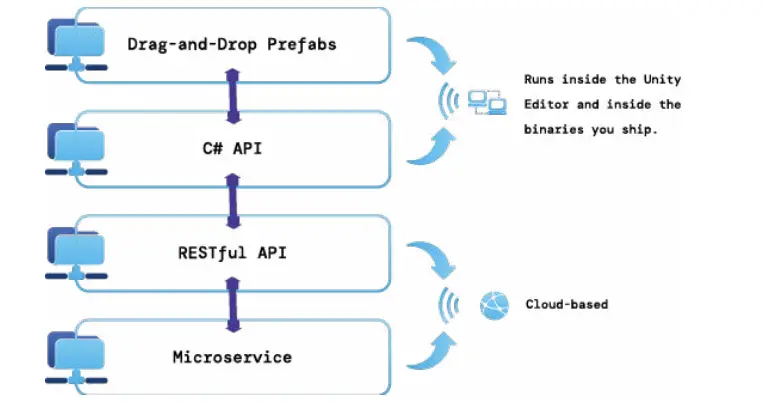

You can connect these real-time services at multiple levels to help you build your game faster:

- Many real-time services come with a Unity prefab that simplifies the game development process through drag-and-drop.

- You can call each service through the C# SDK, allowing Unity developers to operate in a locally friendly environment.

- RESTful APIs are provided for situations where you need to interact with real-time services from outside your C# project. This is often very helpful for integrating with legacy code in other languages, third-party services, websites, etc.

Summary

Beamable provides a relay server that enables clients to communicate with each other in real-time and also supports tamper-proof deterministic simulations.

Games typically rely on different systems for updates, depending on whether changes affect code, configuration, or content. Beamable allows you to publish versioned content that is atomically updated and validated according to design rules.

Beamable's relay servers address the raw issues of P2P at an affordable cost. They are compatible with client/host topologies and typically transmit data in real-time between client peers using reliable UDP protocols or (TCP) WebSockets without server-side simulation. Clients are responsible for sorting, processing, and interpolating packets to generate coherent simulations. Meanwhile, Beamable provides an application server technology that is deployed in a serverless manner and divided into microservices that can be independently scaled, versioned, debugged, and easily integrated into the Unity editor workflow.

Finally, Beamable provides complete OpenAPI/Swagger specifications for all available APIs, allowing them to be called from anywhere. For Unity, Beamable also offers a complete SDK that can be used on the server side or client side.

Therefore, if you are developing a real-time service game, Beamable's architecture can help you build your game faster.

Based on a set of real-time services, front-end, and LiveOps components, it allows you to use C# throughout the game development process. Rather than being a collection of independent components that you need to connect yourself, Beamable's services are ready to use out of the box and are compatible with the Unity editor. Development, debugging, and deployment work harmoniously together. Whether you are creating a highly interactive multiplayer game, a game with social or economic features, or even a single-player game with community features, Beamable can assist you.

### Industry Data Analysis

1. Overall Market Performance

1.1 Spot BTC & ETH ETF

Analysis

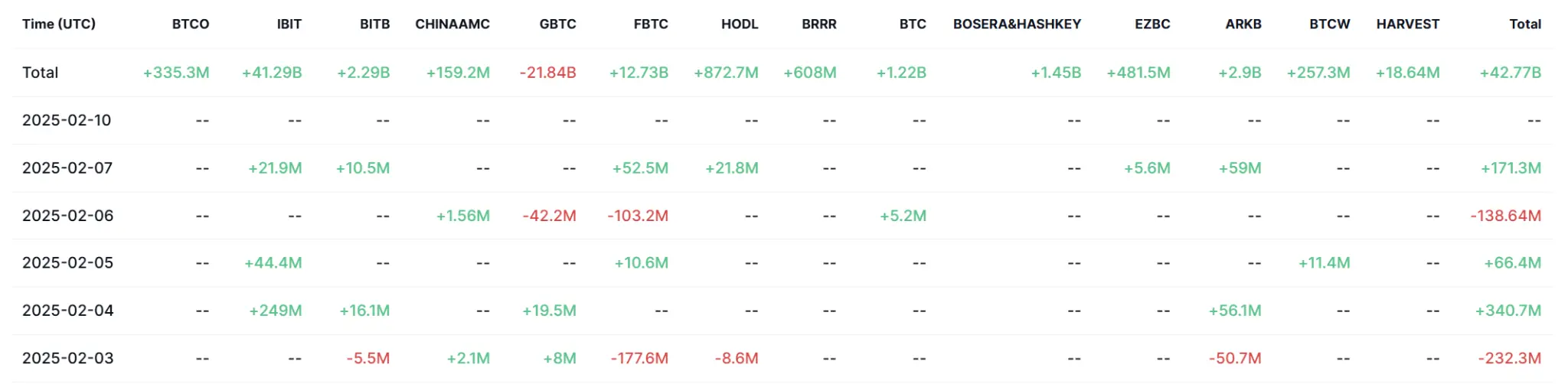

During the trading days last week (February 3 to February 7), the U.S. Bitcoin spot ETF saw a cumulative net inflow of $318.6 million, with the specific institutional buying and selling situation as follows:

Analysis

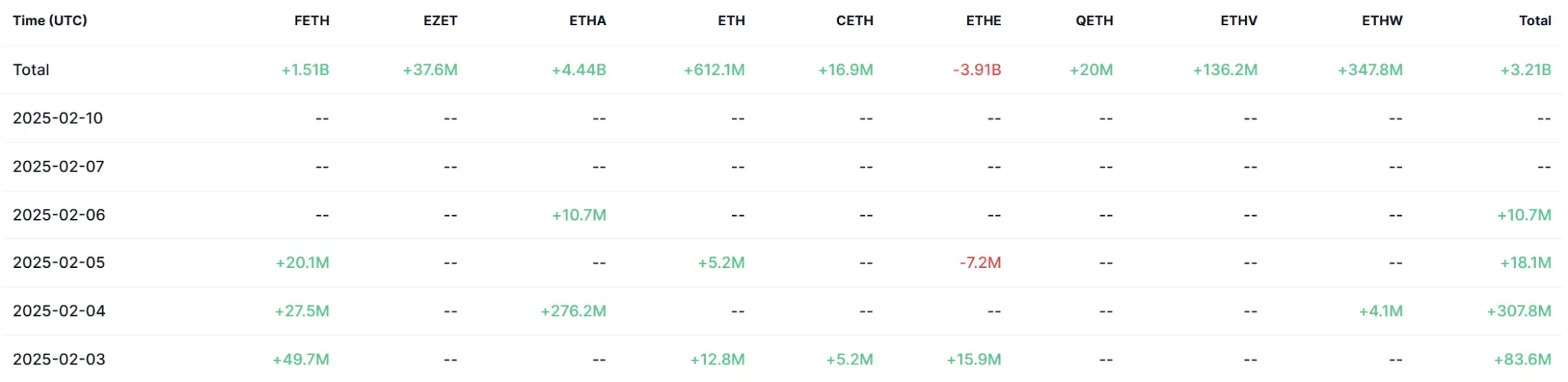

During the trading days last week (February 3 to February 7), the Ethereum spot ETF had a net inflow of $27.8 million for the week. The institutional buying and selling situation is as follows:

As of November 1, Eastern Time, the total net outflow of the Ethereum spot ETF was $10.9256 million.

1.2. Spot BTC vs ETH Price Trends

BTC

Analysis

In the past two weeks, Bitcoin has continued the trend of "strong decline accompanied by weak rebounds," appearing to be weak in performance. However, upon closer analysis, it is merely a small cycle-level decline. Once the cycle is extended to daily levels or higher, it can be seen that we are still within a wide consolidation range of $90,000 to $110,000. Therefore, until we effectively break below the $90,000 bottom, we remain in an upward consolidation phase, making it too early to mention a bear market. Thus, for spot users, it is advisable to continue holding until the aforementioned breakdown signal appears, while for contract users, it is important to focus on the key support and resistance areas marked in the chart for operations. Given that the trend at the small cycle level lacks continuity, users are reminded to minimize the frequency of holding overnight positions.

ETH

Analysis

The past two weeks have indeed been a difficult phase for Ethereum holders, as the price plummeted to around $2,160 after failing to break through the $3,500 mark, only stabilizing after significant selling. It is important to note that the $2,160 position is already the bottom of the second half of 2024, indicating that current market confidence in Ethereum's bullish outlook has dropped to a low point. Of course, Ethereum's weakness can indeed be attributed to the emergence of efficient and low-cost alternative protocols like Solana and L2.

The good news is that the large selling behavior at the beginning of February did not come from ETFs, indicating a higher probability of being led by individual whales, which suggests that ETFs currently still have a tendency to accumulate Ethereum. As the price stabilizes in the low range of $2,150 to $2,850, bottom-fishing sentiment will continue to dominate. Therefore, the probability of Ethereum breaking upward after oscillating in this range is relatively high. However, the opportunity for a breakthrough back to $3,000 must be primarily driven by continued buying from ETFs. Until then, Ethereum holders may need more patience to wait for a longer accumulation phase.

1.3. Fear & Greed Index

Analysis

Overall, these factors have collectively led to the cryptocurrency market's fear and greed index dropping from "greed" levels to "neutral," reflecting cautious investor sentiment and market uncertainty. The fear and greed index in the cryptocurrency market has recently fallen from "greed" to "neutral," and this decline can be attributed to several key factors:

- Increased market volatility: The sharp fluctuations in Bitcoin prices have heightened market uncertainty, prompting investors to adopt a more cautious attitude.

- Macroeconomic concerns: Global economic data has raised worries about future economic trajectories, suppressing investors' risk appetite.

- Changes in the regulatory environment: Countries are continuously adjusting cryptocurrency regulatory policies, raising concerns about the industry's outlook and cooling investor sentiment.

- Capital outflows: Some funds have flowed out of the cryptocurrency market into other asset classes, leading to a cooling of market sentiment.

2. Public Chain Data

2.1. BTC Layer 2 Summary

Analysis

Summary of the progress of leading Bitcoin Layer 2 projects for the week of February 8, 2025

- BOB (Build on Bitcoin): BitVM Forced Withdrawal Feature Launched

- Key Progress: On February 4, BOB officially released the "BitVM Forced Withdrawal Feature," marking the first time in the Bitcoin Layer 2 space that users can withdraw assets directly from Layer 2 to the Bitcoin main chain without relying on third parties. This feature is designed with a hybrid data availability (DA) layer and combines Ethereum and Bitcoin's dual-chain verification mechanism to ensure asset security for users in extreme situations (such as sorter failures).

- Significance: This feature fills a gap in the asset security exit mechanism for Bitcoin Layer 2 and is seen as an important milestone in enhancing decentralized censorship resistance.

- Stacks: Progress on Decentralized Bridging of sBTC

- Dynamics: Although the code development for sBTC was originally scheduled to be completed by September 2024, the community recently revealed that its testnet has entered the final optimization phase, focusing on validating the decentralized mechanism for cross-chain asset transfers. sBTC aims to allow users to bridge BTC to the Stacks network without trusting intermediaries and to interact with smart contracts.

- Future Plans: Mainnet deployment is expected to launch in the first quarter of 2025, further promoting Bitcoin's DeFi use cases.

- Merlin Chain: Ecosystem Expansion and Data Growth

- Data Performance: According to its semi-annual report, the Merlin Chain mainnet has been online for 50 days, with a TVL exceeding $3.9 billion, of which 88% consists of BTC and Ordinals native assets. The number of on-chain addresses has reached 1.9 million, and DEX liquidity exceeds $78 million.

- Collaboration Dynamics: Integration with ZK interoperability infrastructure Polyhedra Network has been completed, further enhancing its ZK security and cross-chain capabilities.

- Rootstock (RSK): Development Progress of BitVMX

- Technical Direction: The team is developing the BitVMX protocol based on BitVM technology, aiming to enhance the complexity and scalability of Bitcoin smart contracts. Meanwhile, its RBTC super application plan continues to advance, with plans to integrate DeFi tools and cross-chain liquidity.

- Bitlayer: Ecosystem Incentives and DApp Center Expansion

- Ecosystem Development: Bitlayer recently announced the addition of several applications to its DApp center, covering DeFi, NFTs, and cross-chain protocols. The previously launched $50 million incentive program has attracted over 30 projects, including attempts to collaborate with the Move ecosystem.

2.2. EVM & Non-EVM Layer 1 Summary

Analysis

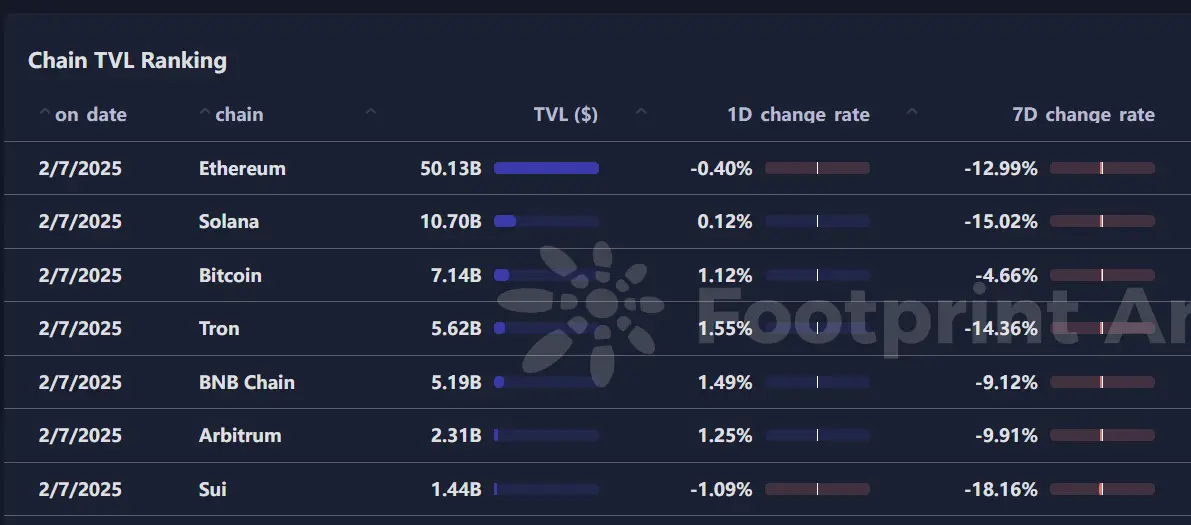

This week, the total value locked (TVL) in EVM (Ethereum Virtual Machine) and non-EVM Layer 1 public chains saw a significant decline, likely due to the following reasons:

- Overall Market Downturn: The overall downturn in the cryptocurrency market may have led to a decline in investor confidence and capital outflows, subsequently affecting the TVL of public chains.

Macroeconomic Factors: The U.S. stock market has performed poorly due to rising inflation expectations and delays in the Federal Reserve's interest rate cuts, leading to depressed investor sentiment, which may impact capital inflows into the cryptocurrency market. - Increased Competition: The rise of Layer 2 solutions (such as zkSync) offering higher scalability and lower transaction costs may have led to some capital flowing out of Layer 1 public chains, affecting their TVL.

- Market Sentiment Volatility: The sharp fluctuations in Bitcoin prices may trigger panic in the market, leading to capital withdrawals and subsequently affecting the TVL of public chains.

2.3. EVM Layer 2 Summary

Analysis

This week, EVM (Ethereum Virtual Machine) Layer 2 solutions made significant progress in several areas, mainly reflected in the following aspects:

- Technological Innovations and Upgrades:

- Rise of Parallel EVM: Multiple projects have begun exploring parallel EVM architectures to enhance transaction processing speed and network throughput. This architecture allows multiple transactions to be processed in parallel, reducing transaction delays and improving user experience.

- Advancement of Decentralized Sorters: Layer 2 networks are working on the development of decentralized sorters to enhance the decentralization and security of the network. For example, the Metis network has been running a decentralized POS sorter on the Holesky testnet, with plans for further promotion in the future.

- Ecosystem Development:

- Expansion of DeFi and NFT Projects: The number of DeFi and NFT projects on Layer 2 networks such as Arbitrum and Optimism continues to grow, attracting a large number of users and capital. For instance, the GMX protocol on Arbitrum has performed outstandingly in terms of trading volume and user activity.

- Rise of Gaming and Metaverse Applications: The application of Layer 2 networks in gaming and the metaverse is gradually increasing, providing higher transaction speeds and lower costs, attracting more developers and users to participate.

- Market Dynamics:

- Fluctuations in TVL (Total Value Locked): Some Layer 2 networks have experienced fluctuations in TVL, mainly influenced by market sentiment and capital flows. For example, the TVL of Arbitrum and Optimism has recently declined, possibly related to the overall market downturn and capital outflows.

### Macroeconomic Data Review and Key Data Release Nodes for Next Week

In January, the U.S. added 143,000 non-farm jobs, below the market expectation of 170,000. However, the job additions for November and December 2024 were revised up by 49,000 and 51,000, respectively, with December's revised non-farm additions reaching a 23-month high of 307,000.

The U.S. unemployment rate fell for the second consecutive month in January, dropping to 4.01%, down 0.08 percentage points from 4.09% in December last year, and below the Federal Reserve's latest forecast for December 2024 (4.2% for Q4 2024 and 4.3% for Q4 2025).

Important macroeconomic data release nodes for this week (February 10 to February 14) include:

February 12: U.S. January unadjusted CPI year-on-year

February 13: U.S. initial jobless claims for the week ending February 8

February 14: U.S. January retail sales month-on-month

### Regulatory Policies

Although Trump expressed support for establishing a Bitcoin reserve in the U.S., the Federal Reserve's continuous statements have made the timeline for this plan uncertain. As the cryptocurrency market continues to fluctuate downwards, the clarity of policies will become a key factor influencing market direction.

United States

On February 5, David Sacks, the White House's AI and cryptocurrency director, held the first press conference on digital assets with several U.S. congressional legislators on Capitol Hill, detailing the latest plans for the U.S. to develop digital assets. David Sacks stated that the proposal for a Bitcoin reserve is under evaluation, although it is still in the early stages. However, he also revealed that NFTs and Memecoins are viewed as "collectibles" rather than securities or commodities.

India

According to Reuters, India's Economic Affairs Minister Ajay Seth stated in an interview that India is re-evaluating its stance on cryptocurrencies due to changing attitudes towards crypto assets in other countries. This review comes after U.S. President Trump's announcement of a friendly policy towards cryptocurrencies and may further delay the release of the cryptocurrency discussion document originally scheduled for September 2024.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。